As we await the details on reciprocal tariffs, BABA steals the spotlight

This graphic is from a kinda-ludicrous, 174-page document written in 1921 called:

The paper’s worth a quick skim!

As we await the details on reciprocal tariffs, BABA steals the spotlight

This graphic is from a kinda-ludicrous, 174-page document written in 1921 called:

The paper’s worth a quick skim!

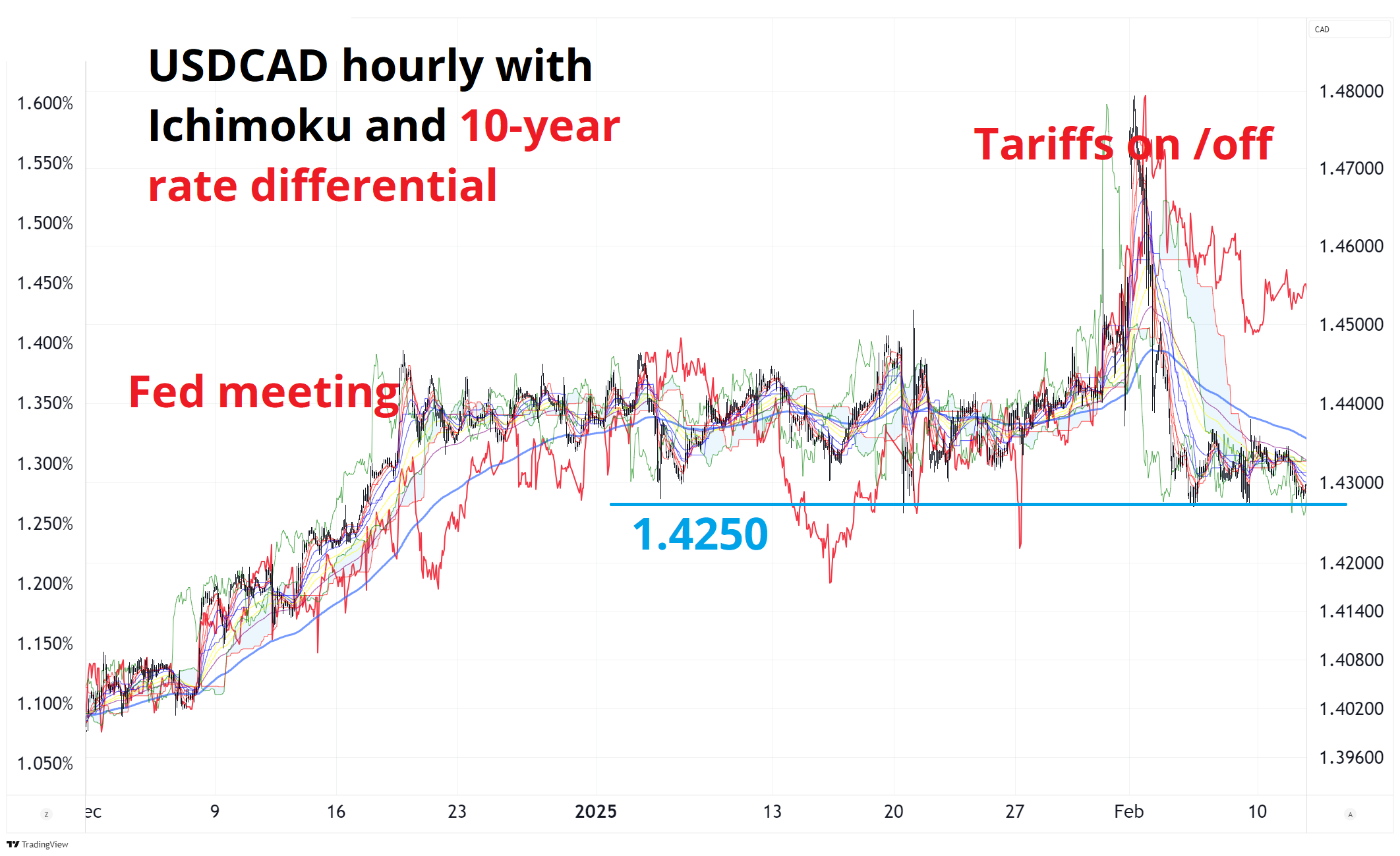

Long USDCAD @ 1.4333

Stop loss 1.4224

Take profit TBD

I was a bit euphoric yesterday with my statement that a strong CPI was obvious, and the market gods replied with a double 70-pip downdraft in USDCAD minutes after I went long at 1.4333. Hubris is typically rewarded with a punch in the face like that. I do still stand by my statement, though, that economists are particularly bad at factoring in fairly clear seasonality in US economic data.

The USDCAD trade obviously starts on the wrong foot, though the double test of 1.4255 at least encourages me to believe that the stop loss is in the right place. It’s mind-blowing how constrained USDCAD has been over the past few months.

That chart shows a few things. First, 1.4250 has been the bottom of the range pre- and post- December Fed meeting and pre- and post- the tariff bluff. Second, the cloud is currently capping USDCAD at 1.4325/1.4350 and we need to get above there to really get excited about a resumption of the uptrend. So, 1.4250/1.4350 are the levels to watch in the short run with 1.4680/1.4700 still key above after the false break of that epic level on the 25% tariff fakeout.

Today, we get the reciprocal tariff announcement, and the key variable is likely to be whether these include a consideration of the European VAT. Hassett and Trump seem to frame the VAT as tariff on US consumers, but let’s see. If the reciprocal tariffs do not account for the VAT, that will be seen as soft. HT NJ on this.

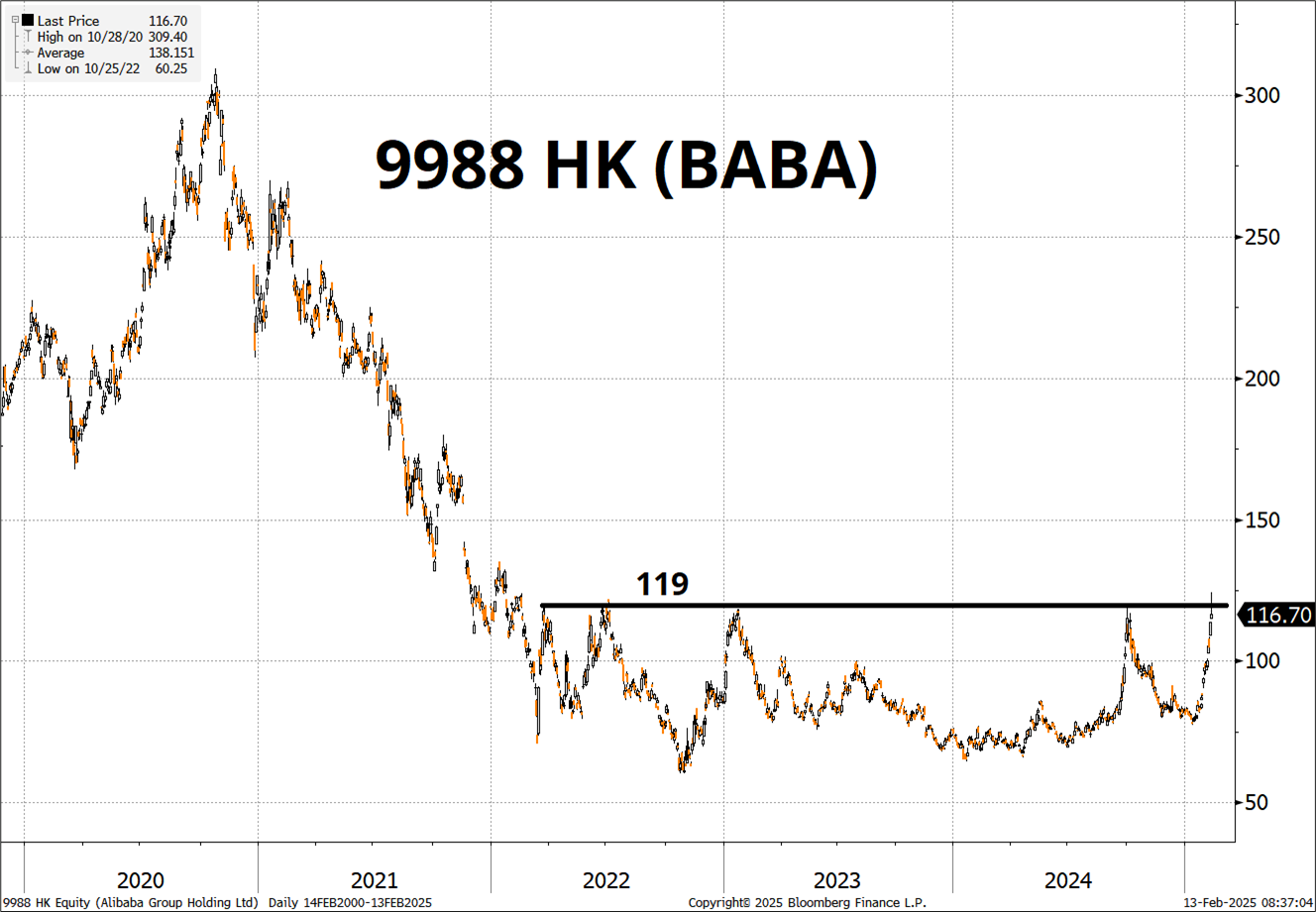

The price action in BABA overnight has caught the attention of many, many traders as David Tepper recently did another flex on TV regarding his China longs and they signed a deal with Apple on AI. Here is the chart:

That horizontal line at 119 was breached as the stock touched 124.30 overnight then crashed back to flat. This is kind of alarming if you’re long BABA. It will be interesting to see how NY trades this setup. Can BABA hold on or is this the start of a capitulation back to $100? I would think it’s another major top, but let’s see.

We have gone from euphoria to less euphoria quickly on the Russia / Ukraine situation. Things are moving quickly there but the jury is still out as to whether a) things can actually get done quickly enough to satisfy the EURCHF and PLN longs and b) whether a deal that is viewed as a capitulation to Russia will actually be good for Europe. The rebuild and terms of trade aspects are likely positive, but the timing and structure of the deal remains to be seen and there is plenty of room for disappointment out of the Munich meetings.

One of the great cartoons of all time, Phineas and Ferb, gets a reboot this summer.

And if you are into animation, the Latvian movie Flow is incredible. Suitable for both kids and adults.

Have a wEIRrdly-shaPED day.

The USD is bid, FOMC could surprise hawkish, and crypto proxy supply explodes

Most of the pillars of the big USD down trade have crumbled