A bit of a sentiment frenzy in CAD. ETH is interesting for the first time in ages.

Jobs are not plentiful

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

A bit of a sentiment frenzy in CAD. ETH is interesting for the first time in ages.

Flat

The logic of higher USDCAD is compelling as President Trump has been relentless in his negative commentary about Canada, the country is often referenced by various members of the administration as a tariff candidate, February 1 has been touted as the latest tariff “deadline”, and The Bank of Canada is wargaming tariff risks more loudly than any other central bank. But it all feels like a bit of a frenzy. Yesterday, these headlines all crossed the wires.

Traders See Much Weaker Loonie in Coming Week, Month: FX Options

Long Canada Bonds, Short Loonie Is ‘Home Run’ Trade: Rosenberg

Goldman Recommends Long FX Vol Trades as Hedge Against Tariffs

Canada Braces for Trump’s Tariffs

And this one: Canadian Dollar, Mexican Peso Options Disagree on Tariff Risk

“The stark contrast between implied volatility charts for the Canadian dollar and Mexican peso shows traders seemingly have widely differing assessments when it comes to the impact of US tariffs on each country that could come as soon as this weekend. Options in the Canadian dollar clearly show rising concern. Hedging against swings in the currency against its US counterpart is notably more expensive now than it was before the US presidential election.”

It is extremely difficult to know what is priced in, but I can say there has been rapacious demand for USDCAD topside for weeks now, and a tariff on Canada is not exactly a surprise when it happens. Then again, people (including me) have been trying to position for the tariffs for a while and some have given up either out of frustration, or because their options expired, and they don’t want to spend more on this same idea. It’s one of those ultimate FOMO trades because any macro trader worth her salt is going to be ashamed to miss such a juicy, asymmetric, and obvious macro trade.

The purpose of tariffs on Canada to control fentanyl is hard to fully understand.

Those are the stats from last year. Given the reality, one would think that Mexico is much more threatened by tariffs, but the market is pricing the opposite.

In fact, the market consensus is now that short CAD and long MXN is a good trade based on the fact that Canada is much more likely to be tariffed than Mexico. And then, to confuse things even more, Lutnick yesterday sounded quite conciliatory as if Canada sending some videos of a few border reinforcement efforts might do the trick.

I am not saying that Canada won’t get tariffed, but it’s certainly not going to be a huge surprise if it happens. It’s impossible to be short USDCAD here due to the gap risk over the weekend, but my bet is that if tariffs are applied, the tail risk instantly flips to LOWER USDCAD because then you have USDCAD at 1.47 or 1.48, billions of USDCAD to sell up there for corporates and hedge fund option longs, and all the headline risk suddenly the other way. In the meantime, we are trapped in this range with the latest deadline, 01FEB, now looming. Also, once the tariff hits and USDCAD reprices up there, vol will probably spike then collapse and USDCAD option skew will quickly go from 1.75 in favor of USDCAD calls down to something closer to zero. There is nothing to do here on this, but these are dynamics to be aware of if we get tariffs this weekend.

Adding further confusion to the whole tariff picture are the myriad goals of the administration, some of which work in harmony and some of which conflict, e.g.:

All these preferences have been expressed at various times and so when you’re trying to figure out what the real plan is, it’s hard to know what target might be relevant. And sometimes, they just say stuff.

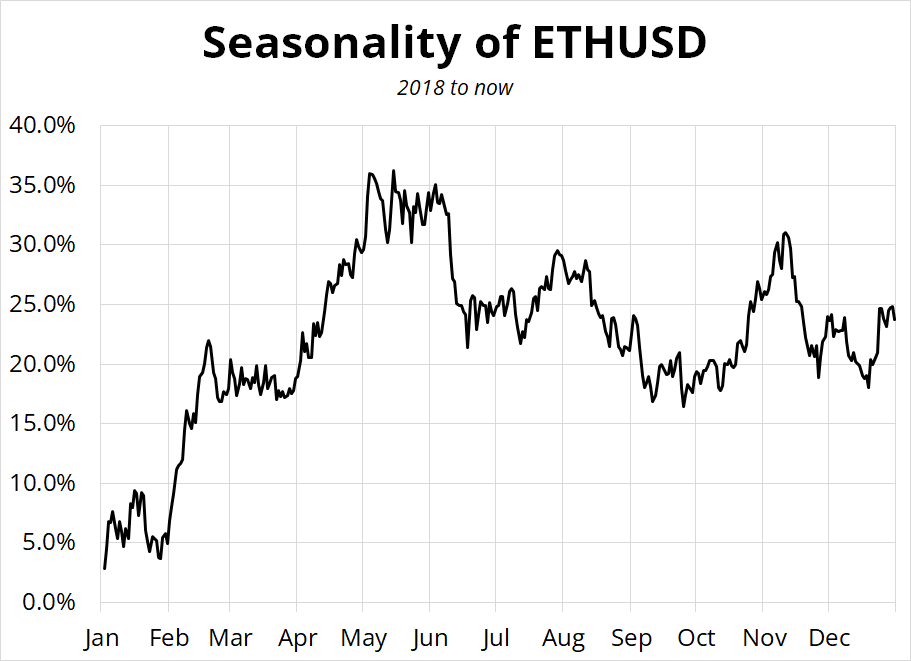

You can make a decent argument for higher ETH here as it is the most hated cryptocurrency and has been mired in a horrible narrative for eons but now agents affiliated with the US government are buying it in huge quantities, it’s making a nice base around 3000, and positive seasonality starts now.

The bearish narrative (ETH has too many competitors and SOL is the better long in a memecoin cycle) has made sense for eons but maybe that story is getting a bit long in the tooth.

Have an effectively immortal day.

Dried specimen of glass sponge

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

There is too much bad news for the market to keep ignoring Canada

Comments relevant to backtesters and confusion over an early UK meme