Lots going on, most of it logical.

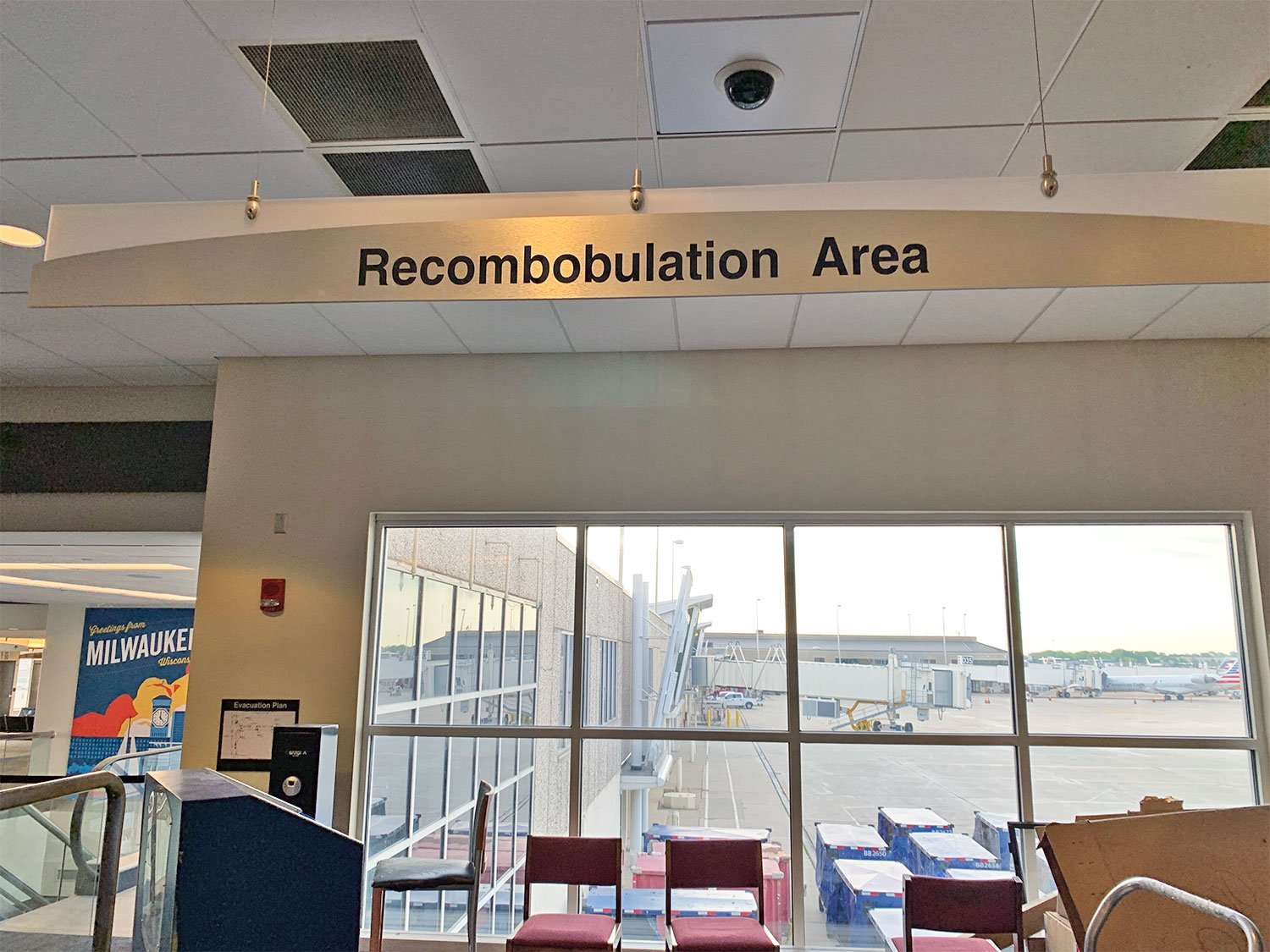

If you get discombobulated while going through security at MKE (Milwaukee Airport) you can spend a little time in the recombobulation area.

Lots going on, most of it logical.

If you get discombobulated while going through security at MKE (Milwaukee Airport) you can spend a little time in the recombobulation area.

Short EURUSD @ 1.0490

Stop loss 1.0616

Take profit 1.0306

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC 7:30 a.m.

Short EURSEK @ 11.52

Stop loss 11.7110

Cover 31DEC 7:30 a.m.

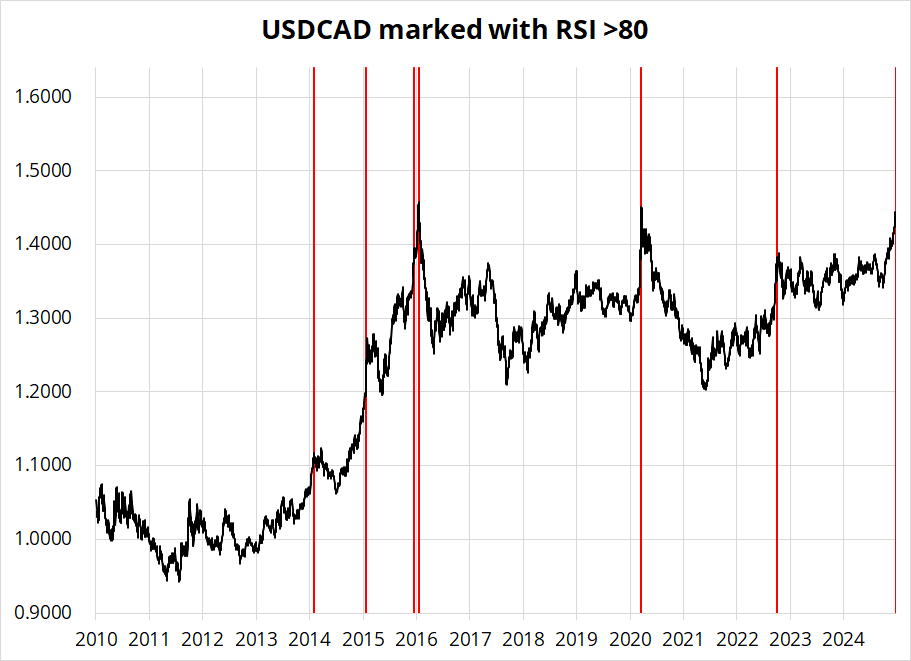

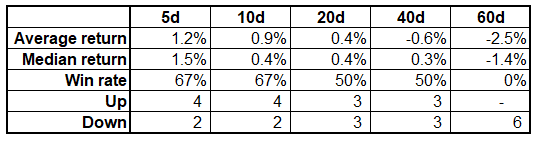

Positioning has not mattered all that much of late as the market has been comfortably long USD for over a month. That said, things are getting quite overextended momentum-wise now, as (for example) USDCAD’s RSI broke above 80 yesterday, an event that has only happened six times in the last 14 years.

While the initial visual scan of that chart makes it look like a scary time to be long USDCAD, the first touch of the 80 level in RSI is more like an early warning than an immediate “uh oh”. Here are the stats. The sample size is admittedly small, and there are obviously the not-small matters of a possibly cataclysmic tariff on Canadian goods plus some political weirdness going on up North.

The Daily Sentiment Index, which mirrors RSI very closely, is below 10 (out of 100) for AUD, NZD, and CAD right now. Another warning that the commodity currencies are rather extended right now. These are not tradeable short-term signals, but they are yellow lights for shorts in those currencies.

The hawkish Fed outcome yesterday confirms that the Fed no longer has the back of equity longs, and I think that more turbulence is forthcoming even as stocks have rebounded somewhat after yesterday’s wipeout. Every measure of exposure and sentiment is pinned to the red line so it’s a nervy setup for the stock market.

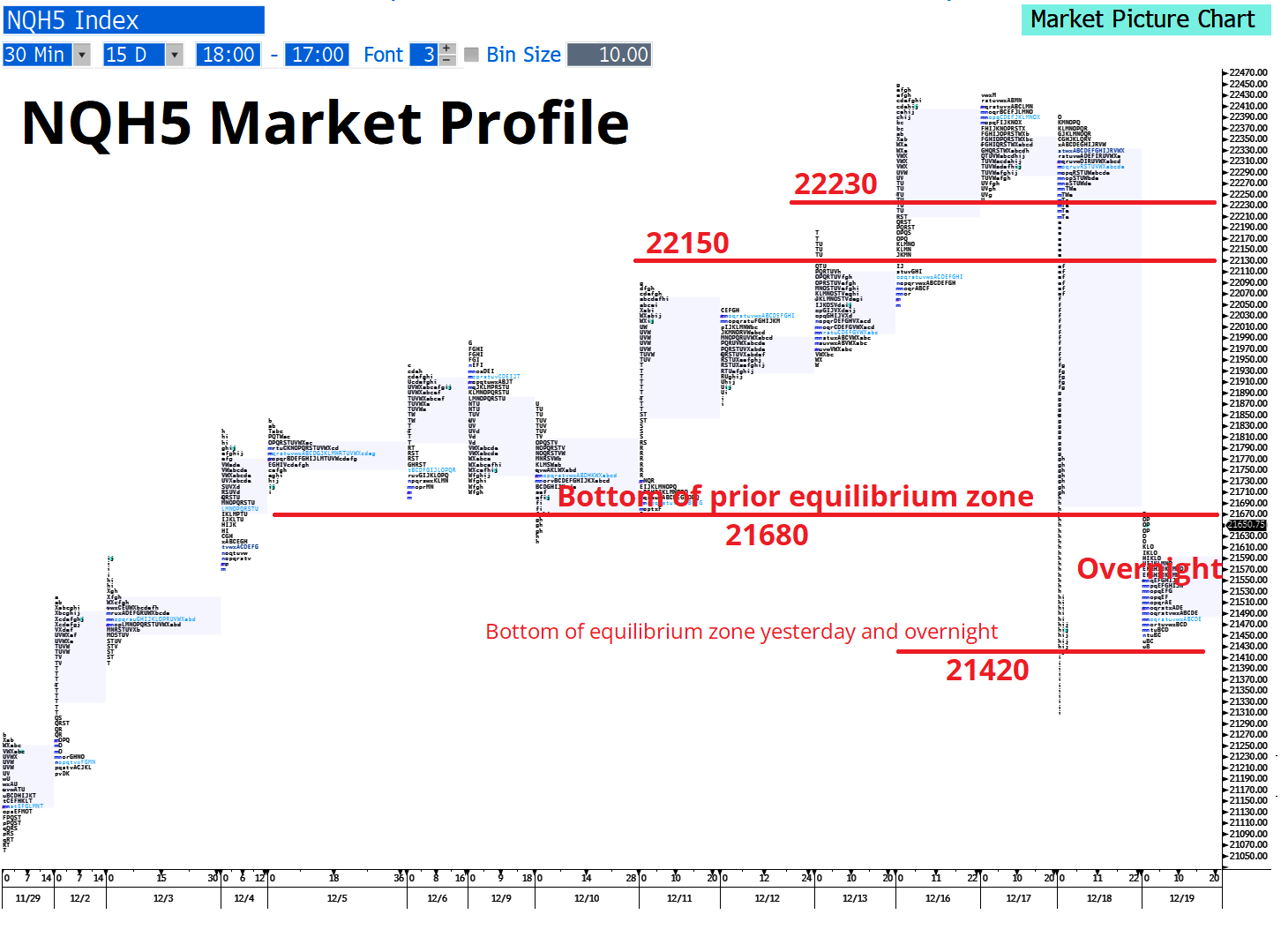

Looking at the Market Profile for NASDAQ futures (NQZ4), you can see the bottom of the old equilibrium zone was 21680 and we are currently trading around 21650. I think there will be a big layer of sellers around here and if we can recapture 21700, there’s quite a lot of open air until 22150. To the downside, there is significant support now at 21420, which was the bottom of the equilibrium zone yesterday and overnight. We flashed as low as 21311, but that was quickly rejected.

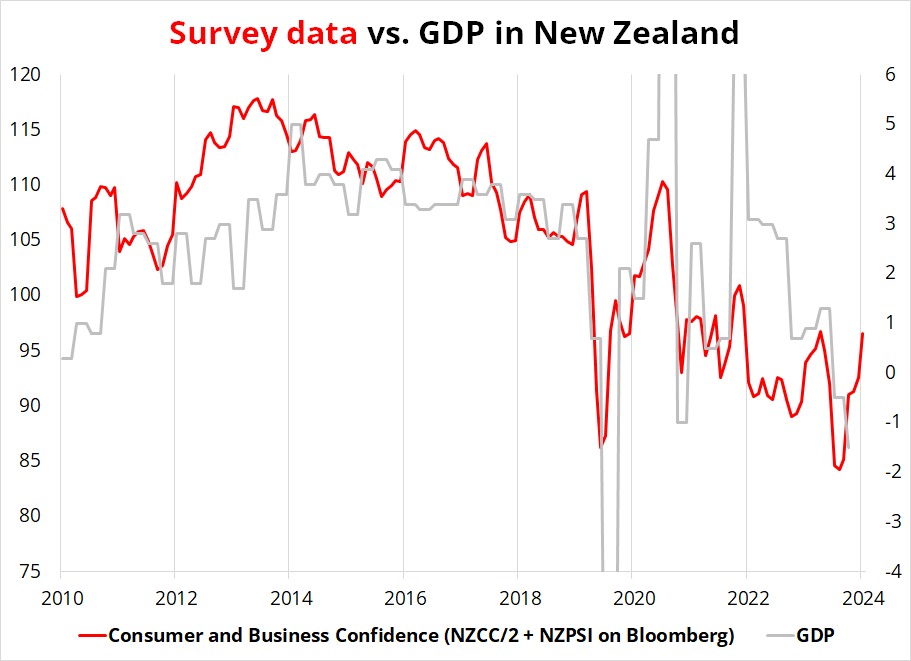

The EURUSD short is working and the EURSEK short survived the Riksbank. The AUDNZD short has been buffeted by an extremely weak GDP report out of New Zealand. It’s always tough to figure out how much weight to assign to data that’s months and months old, but the epic miss and sizeable revisions to Q2 are definitely not good news for New Zealand!

GDP is obviously rather lagging as we are looking at June to September data and if you want to be more optimistic, you can look at more timely Business and Consumer Sentiment data. They have both flipped a fair bit higher as you can see in this chart which overlays GDP with the sum of the two sentiment figures.

This is irrelevant to my AUDNZD short because that trade ends on December 31, but I am simply pointing it out to give you some perspective on the NZ recession. It happened and it’s probably over.

USDJPY has gone Barry as US yields and a non-committal Ueda take us 350 pips higher in about 12 hours. The 10 yen in one month level is currently 158.50, so that would be the first place you might start to think that the MOF might start to think about intervention. 160.00 is most definitely a fade as intervention risk will skyrocket there.

The daily chart also features 160.00 as a key level because we rejected it in Q2, then held above for a bit before collapsing on intervention in July and the carry unwind in early August. 160 feels far away, but you never know. We just went 350 in 12 hours, why not another 350 in a few days?

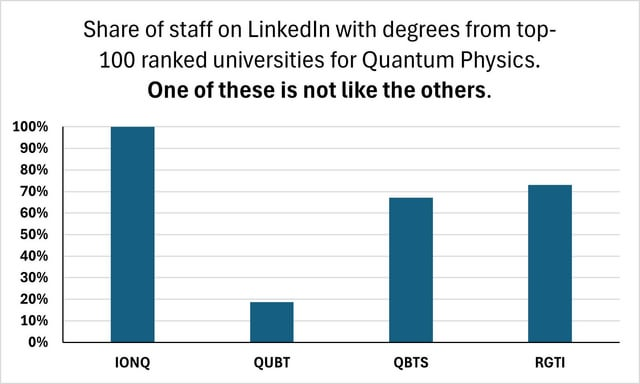

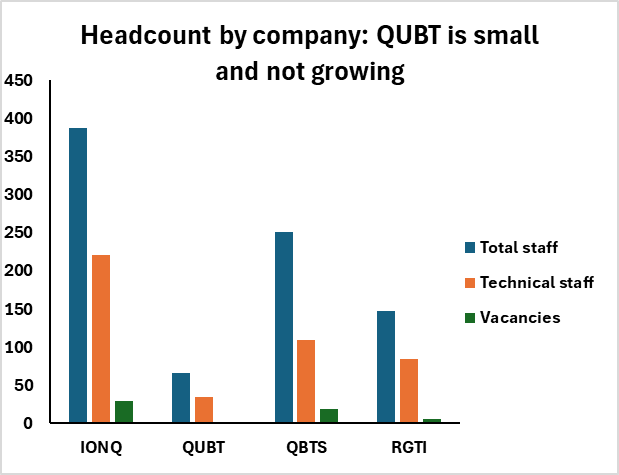

Finally: If you are watching the madness in quantum computing and looking for winners or maybe shorts to fight this GME-style wildness, these two charts might be of interest. Note I cannot vouch for the accuracy of the charts, I got them from WSB on Reddit. There is great research on WSB sometimes, but it’s not guaranteed to be accurate so please do your own research. Selling QUBT call spreads might have some appeal as the IV is 300+. Two fun facts:

https://www.reddit.com/r/wallstreetbets/comments/1hadjii/quantum_computing_inc_is_going_to_crash/

At a glance, it reminds me of HWIN and LTEA combined. Have a minimally-discombobulated day.

If you get discombobulated while passing through security at MKE (Milwaukee Airport) you can spend a little time in the recombobulation area.