Commodity currencies have divorced from commodity prices as the transmission mechanisms that used to drive correlation have abated. This has implications for FX trading and Canadian inflation.

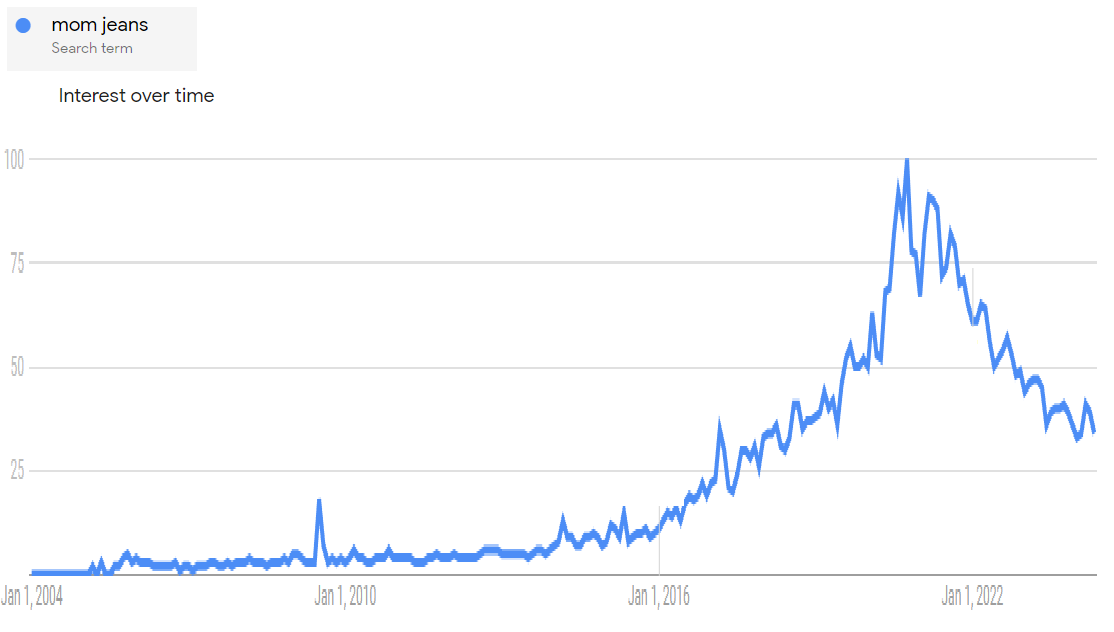

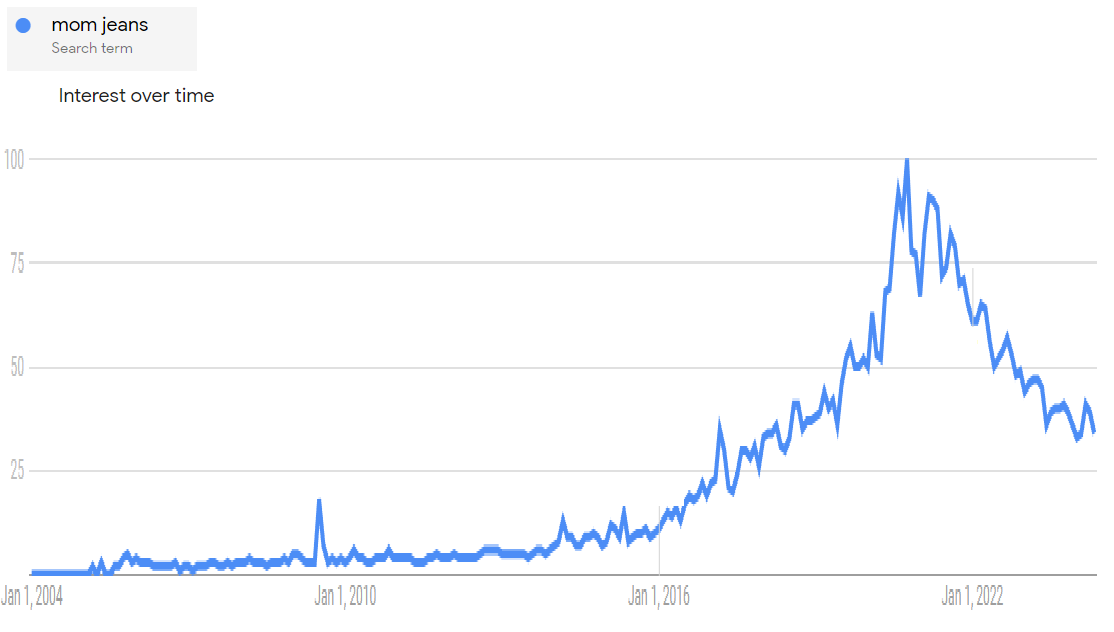

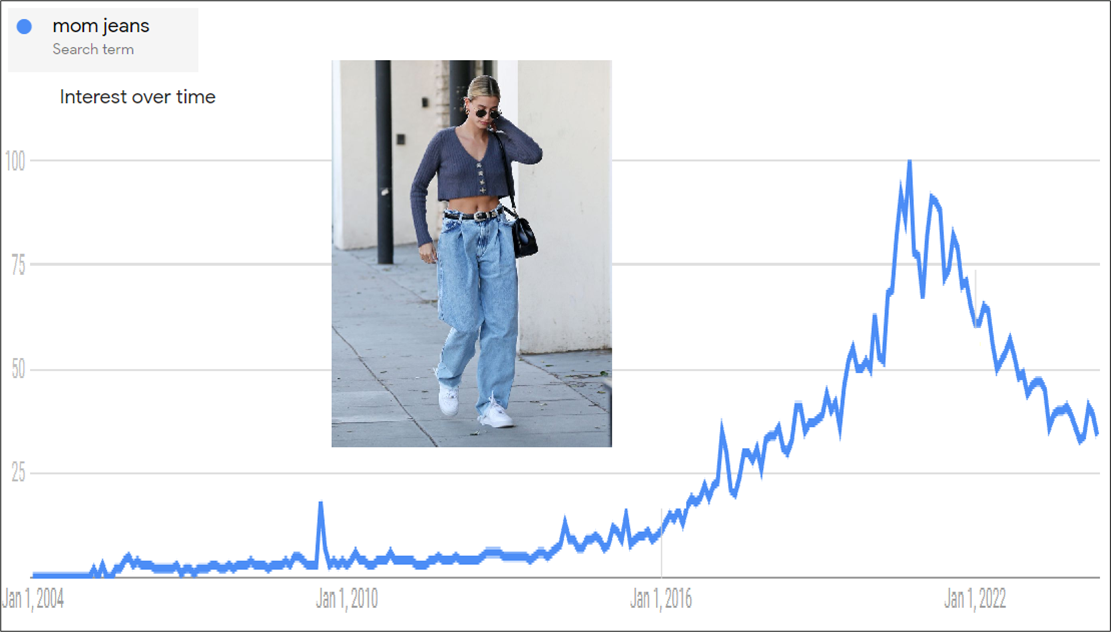

Google searches for “Mom Jeans” 2004 to now

Commodity currencies have divorced from commodity prices as the transmission mechanisms that used to drive correlation have abated. This has implications for FX trading and Canadian inflation.

Google searches for “Mom Jeans” 2004 to now

Long EURUSD @ 1.0785

Stop loss 1.0694

One of the most striking aspects of the FX landscape over the past 7 years or so has been the death of the commodity FX to commodity price correlation. Part of this has been driven by the US as it has moved from net importer to net exporter of crude oil, and part has been driven by the internal dynamics of the commodity production that happens in Australia, Canada, and other countries.

I have written extensively about this issue and the challenges it brings to FX trading. For example:

am/FX: One Less Vulnerability – Why the USD is no longer correlated to oil

am/FX: Blown Transmission – Why the AUD does not respond to positive terms of trade shocks anymore

And while many of the concepts apply to Canada, I have never written on the specifics there. Fortunately, ex-colleague, Canada expert, and Alberta resident Charles St.-Arnaud has done it for me! With his permission, I want to excerpt some of the most important takeaways to explain why USDCAD, which used to basically be an oil proxy, no longer trades with any connection to crude.

You can read Charles’ piece here, or start with the excerpts I will provide now.

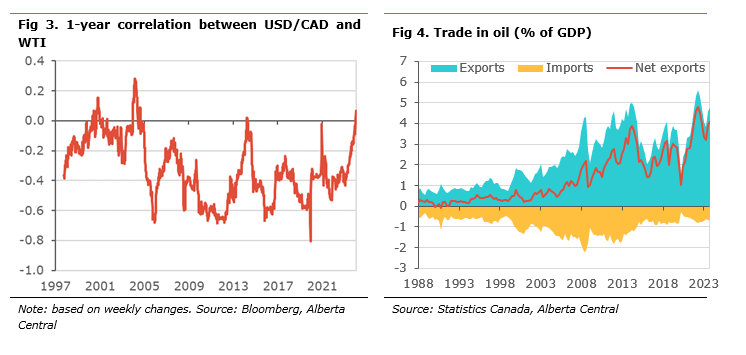

Most of the piece can be boiled down to the key charts. First, the what. You can see the correlation of weekly changes in USDCAD and WTI has gone to zero, despite no change in Canada’s net energy exports.

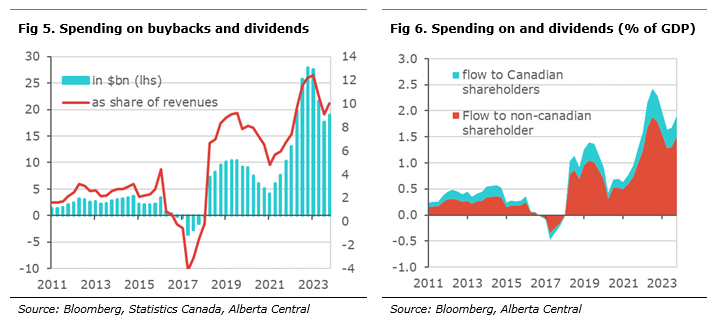

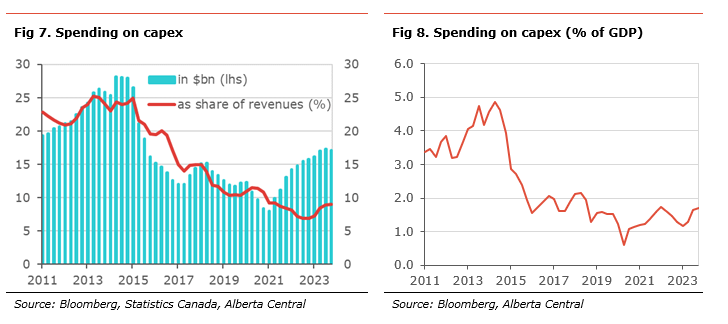

During the commodity supercycle, rising commodity prices led to a boom in capex in Australia and Canada and this flowed through to the real economy, jobs, and monetary policy. Therefore, higher commodity prices meant tighter monetary policy in the commodity exporting nations. Now, you’ve got a different regime where higher commodity prices mostly lead to larger dividends for foreign investors in domestic commodity exporters. Here’s how Charles describes it:

We estimate that about 10% of revenues (almost $20bn over the past year) are returned to shareholders through share buybacks and dividends. In comparison, that proportion was about 3% of revenues ($3.7bn) in 2014. Moreover, it is estimated that about 78% of these shareholders are non-Canadian, compared to 62% in 2014. This means that most of the flows back to shareholders is not an inflow into Canada. Adjusting for foreign ownership, we estimate that the payment to foreign shareholders is currently equivalent to about $11bn, or 1.5% of GDP, compared to about $3bn or 0.4% of GDP in 2014; almost four times bigger.

The money that now goes out as dividends used to go to capex.

And here are the implications (again from Charles’ piece):

Implications of a weaker link between CAD and oil prices

The lack of a relationship between oil prices and CAD will have broader implications for the Canadian economy. These include:

In general, higher oil prices remain a net benefit to the Canadian economy. However, their impact is less positive than it was a decade ago.

This could have some potential implications for monetary policy, as higher oil prices will be more of a negative supply shock to the economy than they were previously. This implies that higher oil prices will be, in general, more inflationary and could lead to the BoC being more sensitive to energy prices when setting monetary policy. This is also important as the second-round effect from higher energy prices on other prices can be important in the Canadian context (see The current energy shock is more inflationary and stickier than the 1970s oil shocks).

So there you go. The days of trading USDCAD on the DoE numbers or OPEC meetings are over.

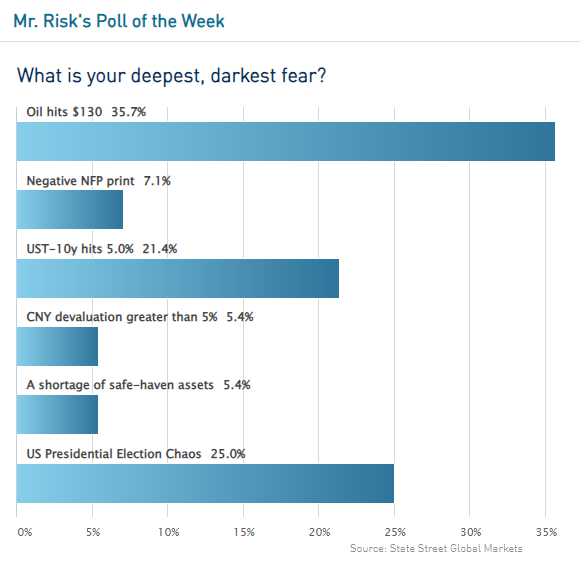

Since today’s piece has been an exercise in plagiarism so far, let’s continue that theme with Fred Goodwin’s Poll of the Week, via State Street. My vote would be “Negative NFP print”.

I find it surprising that people voted for “Oil hits $130”. Haven’t we seen enough evidence at this point to show that oil doesn’t want to go up, even on important geopolitical shocks like Russia and Iran?

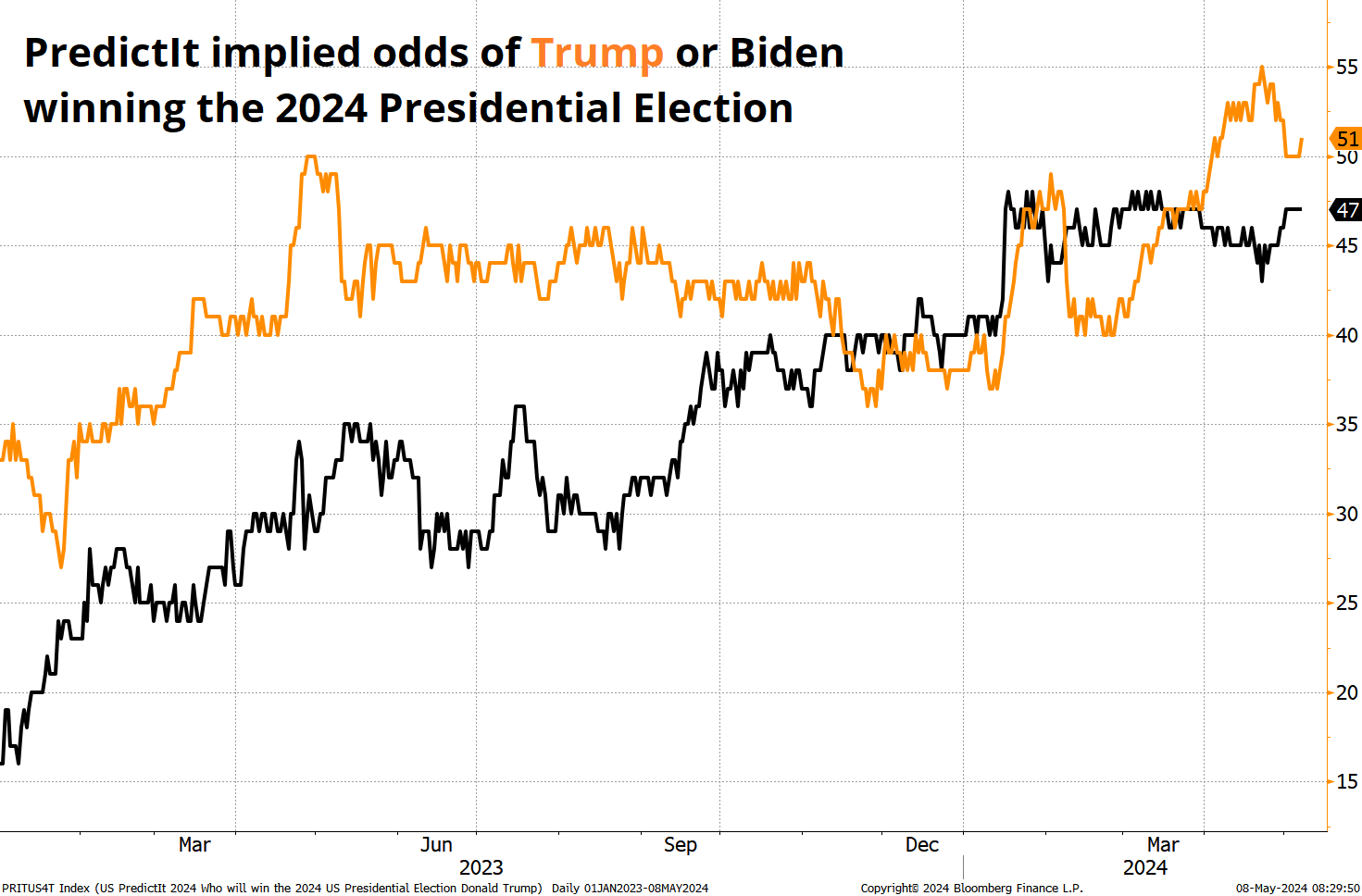

The election has become a weird one to handicap as the old assumption was that Trump is bullish USD due to tariffs but now he (maybe) wants to bring The Fed under his wing, Erdogan-style and this could be viewed as extremely USD-negative.

Our client base has concluded that there is no Trump trade in MXN because the USMCA was his idea and therefore he is unlikely to want to go after Mexico this time. That said, he could target Chinese exports that flow through Mexico, and this could have implications for the peso. But there is too much time before the election and too many questions around Trump’s potential Mexico policies for this to be relevant right now.

In contrast, there could be trades to do around CNH because China-bashing is bipartisan. Trades that benefit if USDCNH goes nowhere or up continue to make sense as the PBoC appears to be targeting stability and the tail risk is more, larger tariffs on China.

My ongoing desire to be long JPY has been a mess. I am stopped out of the short USDJPY, and I will give it a rest for a while. The carry is too attractive with vols in the toilet, and the USD is too strong despite some softening of US data. I am sticking with the EURUSD as the DAX makes new all-time highs and Germany/US rate differentials are neither here nor there at the moment.

Have a fashionable day.

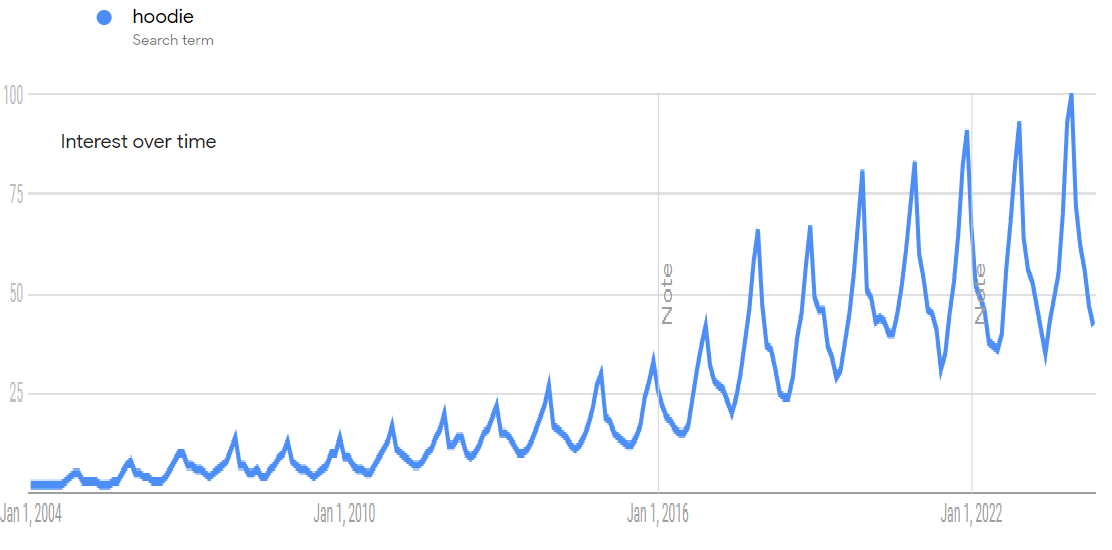

The first chart is self-explanatory. The second chart establishes both the seasonality of hoodie purchases (peaks in December every year) and the rise of online shopping since 2004.