Today I clarify my thinking on the new relationship between energy prices and the US dollar.

Degrossed

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Today I clarify my thinking on the new relationship between energy prices and the US dollar.

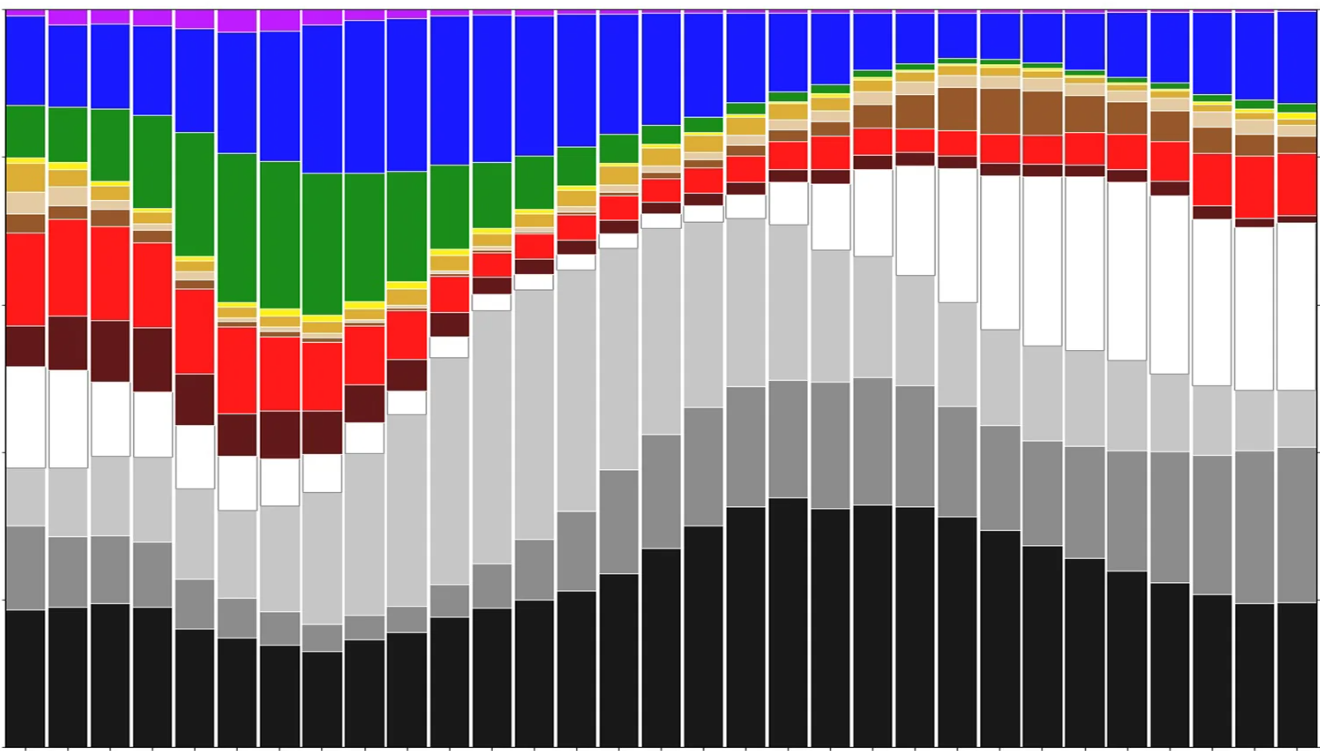

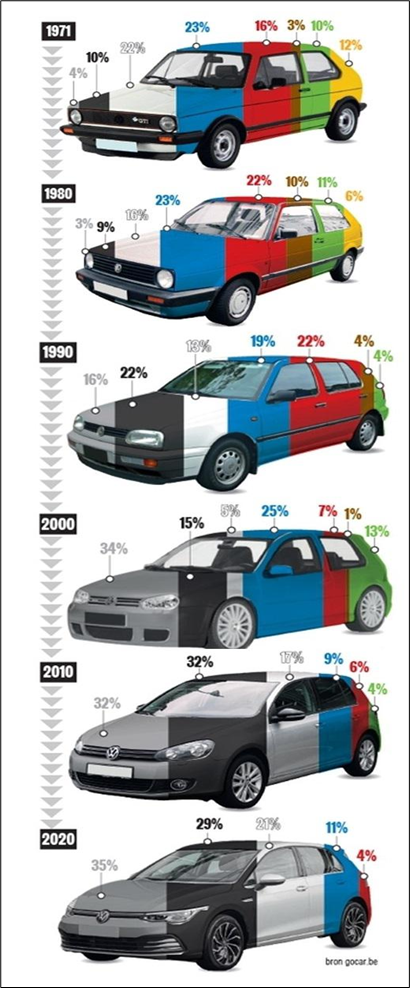

More matte paint jobs, less color variety

Friday 0.6380 AUD puts

for ~14 USD pips off 0.6420 spot

September 28, 2023

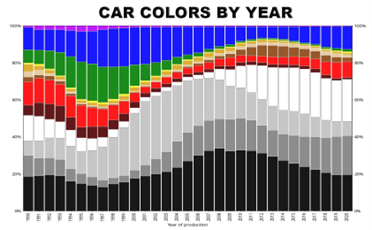

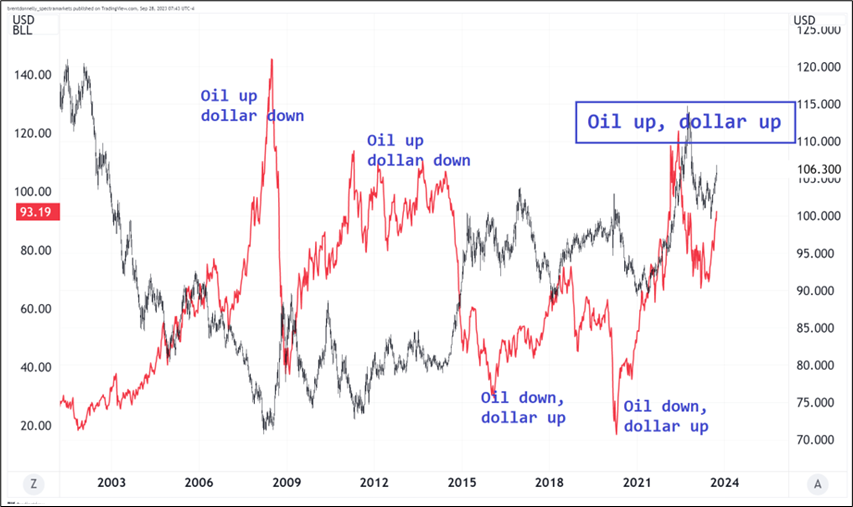

One of America’s key vulnerabilities from 1970 to 2019 was its reliance on foreign energy. This meant that the up/down cycles in the price of oil triggered aggressive down/up cycles in the USD.

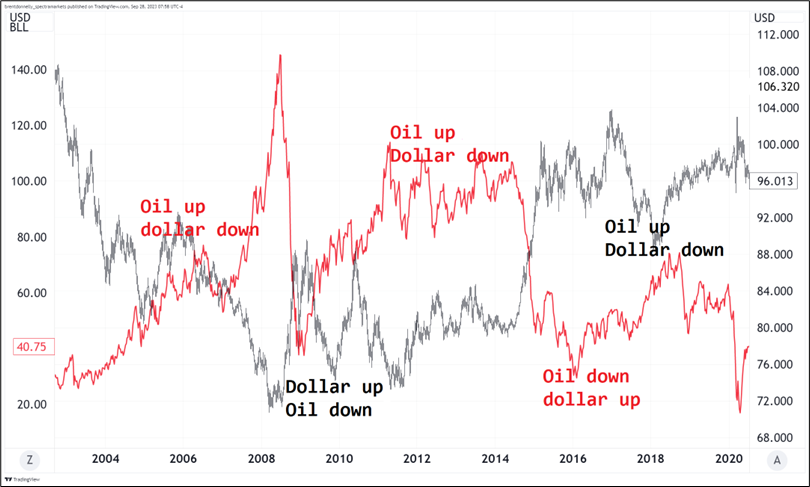

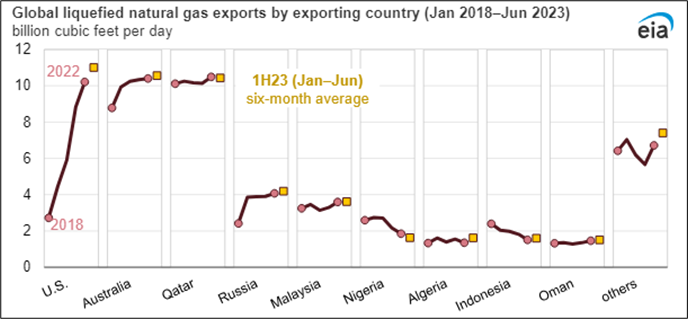

But as Taylor and Ed once sang together in sweet harmony: Everything has changed. Here’s a blurb from the US Energy Administration.

The United States has been an annual net total energy exporter since 2019

Up to the early 1950s, the United States produced most of the energy it consumed. U.S. energy consumption was higher than U.S. energy production in every year from 1958–2018. The difference between consumption and production was met by imports, particularly crude oil and petroleum products such as motor gasoline and distillate fuel oil. Total energy imports (based on heat content) peaked in 2007 and subsequently declined in nearly every year since then.

Increases in U.S. crude oil and natural gas production reduced the need for crude oil and natural gas imports and contributed to increases in crude oil and natural gas exports. The United States has been a net total energy exporter—total energy exports have been higher than total energy imports—since 2019.

And here is a chart:

And here is another chart.

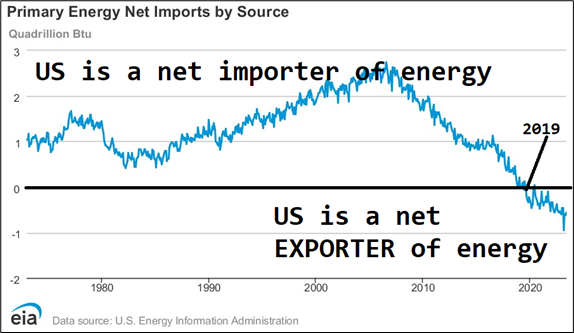

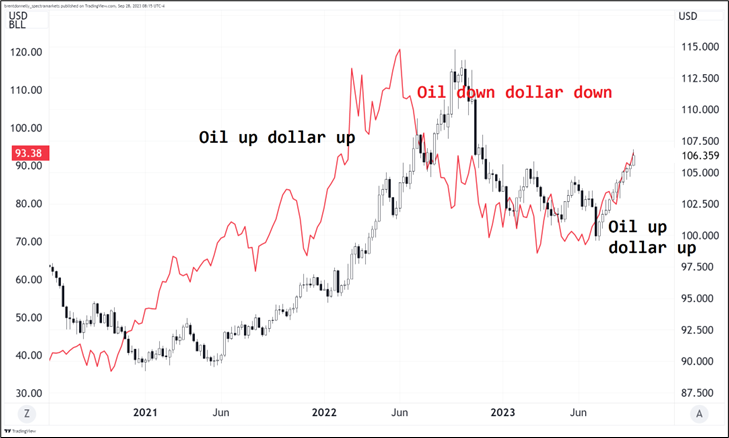

This move to net energy independence has had a major impact on FX markets and global cashflows as a rise in energy prices no longer leads to massive selling of dollars. So now, that first chart looks like this:

By removing one of its key vulnerabilities, the US has transformed its currency into an all-weather behemoth where good economic news and tech innovation are bullish USD, fear and safe haven demand are bullish dollar, and now oil rallies are bullish dollar. The most violent USD-negative regime (oil ripping higher) has been crossed off the menu.

Yes, the US deficit story presents a scary structural headwind for the dollar at some point, but that point could be the Great Recession of 2026. This newfound resilience to energy shocks does not mean the dollar will go up every day or every month. There is still that middle part of the dollar smile where China and Europe do better than expected. With expectations very low for those two spluttering engines of the global economy, we could see better-than-expected performance at any moment.

Anyway, bringing the two main charts together you get this:

This is not a dollar bullish piece. It’s just a thought exercise as I think more and more about all the changes in correlation and transmission to FX that have happened over the past couple of years. Many of the relationships we have come to know and love (oil vs. USDCAD, Aussie vs. Terms of Trade) have broken down as transmission mechanisms have changed. You could also make the argument that transmission from US monetary policy to the US economy is also broken (for now) as most major economic actors have locked in at low rates.

As discussed a few times of late, I think the market is heavily short equities and the June CPI gap (4230/4240), the JPM collar (4210) and major technical support (4200/4250) will be a major bottom as we transition from the worst seasonal period of the year (16SEP – early OCT) into the most extreme bullish seasonal period (early OCT to yearend). Yesterday, the SPX hit the target like a perfectly-tossed 180 in darts; the low was 4238.60. Now, I think we will enter a choppy bottoming process as we oscillate 4240/4300 for a bit and digest the new levels. P.S.: Normally I talk about levels in S&P futures, but the gap in cash is relevant and that’s why I’m using cash levels lately.

Don’t forget to Buy 50 Trades in 50 Weeks right here.

—

If you are into hip hop, or UK grime, or just cool music in general: This track is great.

The song contains bad words and adult themes, but also: it taught me the word “mandem”.

Mandem: (UK slang) is a collective noun for a bunch of boys or men, particularly your own group of mates.

Have a black and white day.

—

Prescient article from 2018

https://www.gq-magazine.co.uk/article/dave-interview-2018

https://dailyinfographic.com/most-popular-car-colors

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.