So many events in just five days.

Sea cucumber skin under a microscope

So many events in just five days.

Sea cucumber skin under a microscope

Long 12MAY 168/163 put spread in CHFJPY

~31bps off 175.25

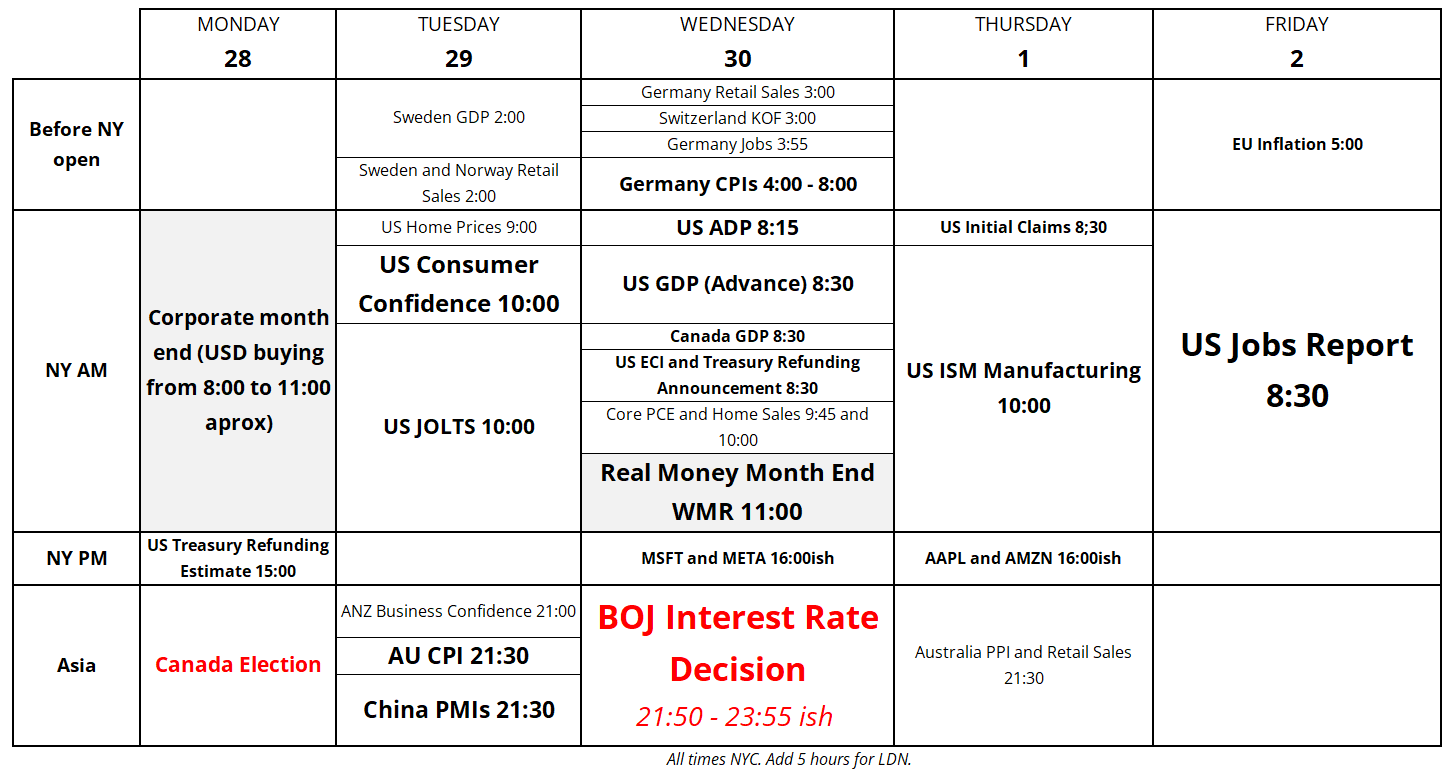

This week’s calendar offers plenty of food for thought, so let’s go through some of the biggies. Today is corporate month end, a day when US corporates generally buy USD vs. EUR, AUD, GBP, and JPY. The JPY is exempt today because its month-end value date was Friday due to the Shōwa Day holiday. Here’s the performance of GBPUSD on corporate month end, for reference.

It’s important to note here that corporates have become more discretionary in their hedging activities over the past year and seem to focus more on levels than on the t-2 date. You can see the returns of going short GBPUSD on t-2, for example, have turned positive. AUDUSD looks the same. This used to be a reliable trade, but like real money month end, once hedgers’ behaviors start to incorporate the fact that everybody knows that everybody knows about the effect, EMH kicks in.

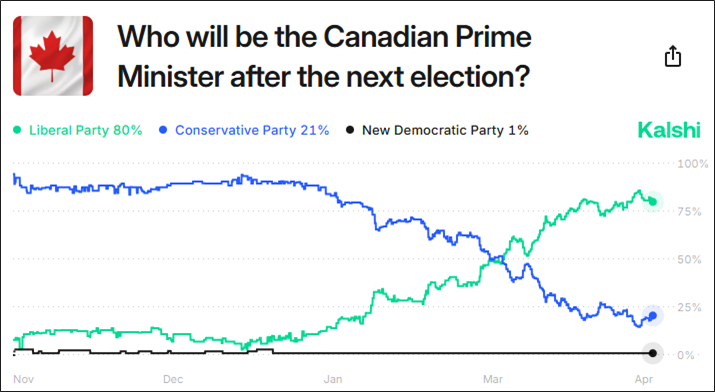

Next on the calendar comes the Canadian election (results tonight). I don’t see this as a market-moving event, unless Pierre Poilievre manages an upset. In that case, you might see a 50 point drop in USDCAD, at most. Carney goes off as a ~80% favorite with Pierre Poilievre trading at 20% on Kalshi and Polymarket.

Tuesday, we get Consumer Confidence, which is close to irrelevant as we have about 1,415 soft sentiment releases telling us that the mood is dour, and we don’t really need #1,416. Then we get JOLTS, which is also pretty meaningless because it’s for March. What we want here is data that shows a potential shift in the US economy post Liberation Day. Aussie CPI and China PMIs might have a small influence on the AUD. I liked AUDNZD on a 1.06 handle but whiffed and maybe missed my chance.

Wednesday is so full I could barely fit it all on the spreadsheet!

Wednesday Highlights:

For reference, here’s the USDJPY chart. I had noted that JPY longs would get tricky at 140 due to mega gamma and a huge technical level (see here). Now the chart looks like a top of the range sell. You can see the April 8 support was 144.25 and that has now become important resistance at 144.00/25. And the cloud comes in just above 144.00, too. Getting short USDJPY into 144 for the BOJ meeting is nice.

Thursday’s ISM looks irrelevant, because as mentioned we know what sentiment is doing. AAPL and AMZN after the close and again their outlooks are what matters. Huge beat + bad outlook = stock goes lower.

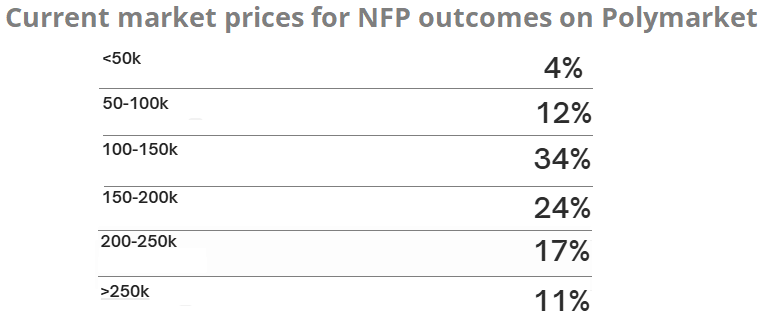

We end the week with Friday’s US jobs report. Here is the forecast distribution from Polymarket.

Economists are at 130k and Kalshi is at 155k. We keep waiting for the US jobs market to roll over and we keep waiting and keep waiting… Still waiting.

Have a cool, green day.

Megacap Earnings Next Week

These images are all polarized images of sea cucumber skin under a microscope

Pretty insane!

Resembling a boat’s anchor, these are the minuscule projections from the skin of a sea cucumber, known as spicules. These needle-sharp structures are composed of a transparent, brittle mineral formed from calcium carbonate. The microscopic spines, called anchors, are embedded into the thin, transparent body wall and help the sea cucumber burrow through the sand.