Lots going on this week and a bias to keep buying dollars

So, he’s doing the moonwalk?

Lots going on this week and a bias to keep buying dollars

So, he’s doing the moonwalk?

Flat

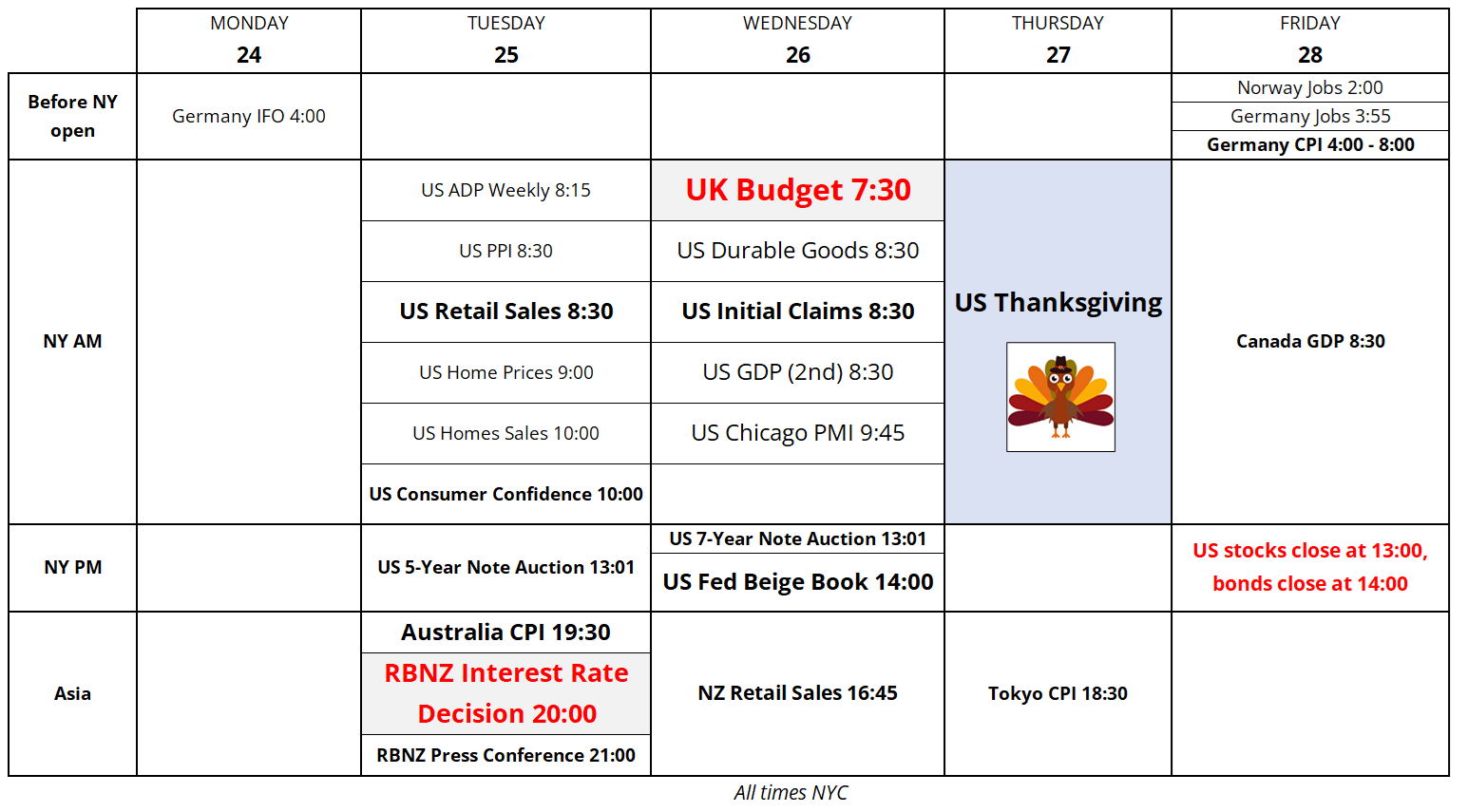

Let’s start with the calendar as it’s jam packed because the end of the U.S. government shutdown brings a flood of U.S. data before Thanksgiving. We also get the RBNZ, the UK Budget and corporate month end.

The Fed is on track to cut at the December meeting, I think, as they appear to have the votes. In the grid here, the biggest uncertainty is around Cook (she has been quiet lately as her oral arguments at the Supreme Court begin January 21), Barr, and of course Powell. My bet is that Powell is in the 70% area, and several of the near 50/50 voters are conditional on Powell.

If he wants a cut, Barr, Cook, and maybe Goolsbee and Musalem will comply. Retail Sales (tomorrow) isn’t going to move the needle. As much as I wish this was not true, the remaining U.S. data points are unlikely to matter much either.

The more likely scenario is that we enter the Fed blackout with pricing around 70% for a cut, and Nick Timiraos confirms the cut via a leak from the Fed as the coddling of the American markets requires all rate moves to be fully priced. The Fed blackout runs 29NOV to 11DEC with the FOMC meeting on December 10.

The RBNZ has been wildly dovish for ages, and I keep waiting for the end of the rate cut cycle pronouncement. This meeting has a couple of idiosyncratic quirks as it’s the last meeting headed by Christian Hawkesby (Anna Breman takes the helm of the RBNZ on December 1) and it’s the one meeting per year with a multi-month gap afterwards. The next RBNZ meeting is not until February 2026! See chart.

You could argue that Hawkesby would like to clear the decks by cutting 50bps to put the economy in the best state possible, or you could argue that he avoids anything radical and lets Breman make the call in February as rates are already close to neutral and inflation is not super low.

Market pricing is a shade above 25bps as the 50bps cut is a lotto ticket play. The market has the terminal rate around 2.0% with some banks as low as 1.75%, but with rates down here, I don’t think the RBNZ will see the urgency to go 50bps. I expect a 25bp cut and a non-committal statement as the polite thing for Hawkesby to do would be no forward guidance and a clean baton pass to Anna Breman.

Normally I put out a sell AUDNZD recommendation around this time each year because there is mega bearish AUDNZD seasonality now ‘til year end. I am not doing it this year because seasonality has simply not worked in 2025 and I cannot explain why or whether or not that will continue. As such, I’m off any seasonality trades until the end of the year and then I’ll be open minded again in 2026.

In the last 25 years, AUDNZD has been down 19 times and up just 6 times between 24NOV and 31DEC. The standard explanation for the AUDNZD move lower is that tourism to New Zealand skyrockets in December. It also increases in Australia, but the relative magnitude is different as 500k overseas visitors come to NZ in December (9.7% of NZ population) while 1 million visit Australia (3.7% of Australian population). So, the relative impact of the inflow spike is larger in NZ. But like I said, I’m nervous about seasonality in general as it has been a horrible indicator in 2025.

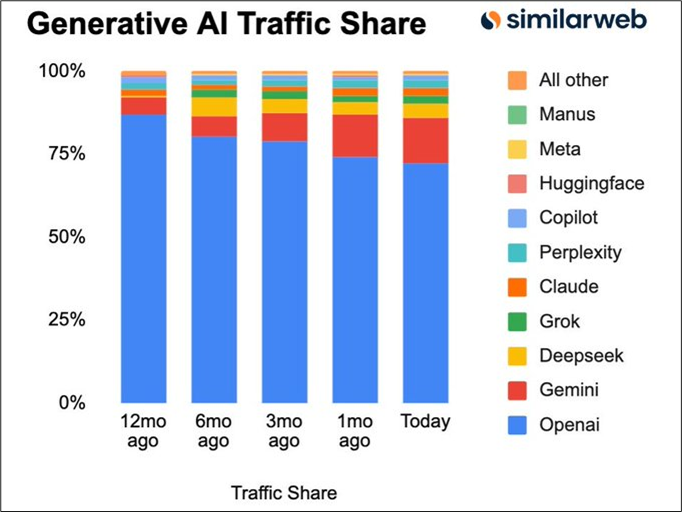

There has been an incredible surge in positive narrative momentum around Google in the past two weeks as Buffett invests and Gemini 3.0 has generated an enormous and unanimous positive response. If you would like to catch up on this, here are a few good articles:

https://substack.com/home/post/p-179701197

https://www.nexteconomy.co/p/the-one-company-economy

And one more article on AI: https://ceodinner.substack.com/p/the-ai-wildfire-is-coming-its-going

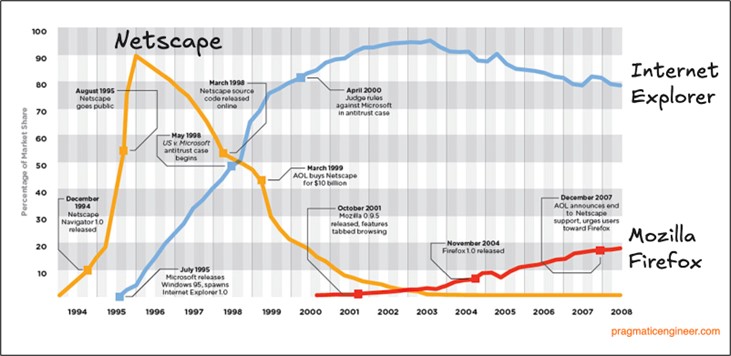

I have been bullish Google for a while, for many of the reasons explained in these articles and I am bearish OpenAI as it reminds me so much of AltaVista and Lycos. In 1996, Netscape was dominant in browser space:

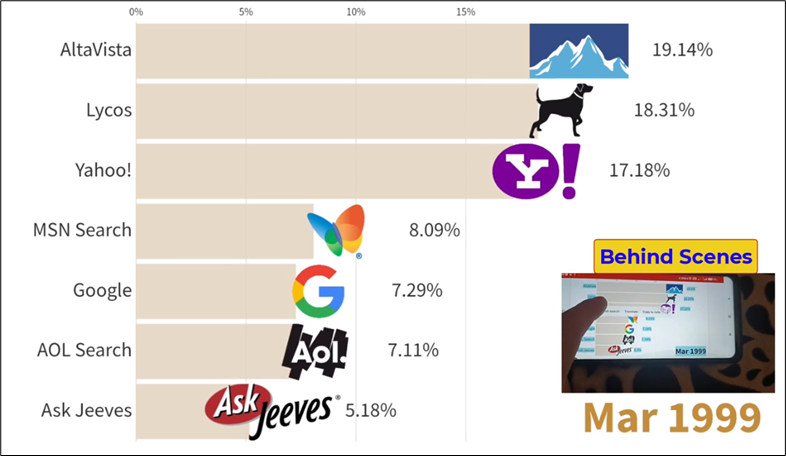

In 1999, Alta Vista was the lead search engine, with Lycos, Yahoo, MSN, Google, AOL, and Ask Jeeves all close behind.

In 2025, OpenAI is the leading LLM, with Gemini, DeepSeek, Perplexity, and Claude well behind but catching up.

As an avid user of four LLMs, I find they are more similar than different. OpenAI has no moat. The free version of Gemini is as good as the $20/month version of ChatGPT. And the corporate governance shenanigans at OpenAI have put Sam Altman under the microscope (in a bad way).

I thought the NASDAQ selloff was more about rotation out of the debt-heavy names like ORCL and into safer names like GOOG and NFLX, but last week showed no stock was safe from the purge of retail length. Retail spent all summer, plus most of September and October buying the unprofitable, no revenue, no cash flow things like RGTI, OKLO, and crypto and then spent the last 3 weeks dumping. There are many signs of a possible bottom, like the record volume day in the bitcoin ETF on Friday (via TK). See chart here.

The NASDAQ chart is a mess as we breached the 24300/24400 zone aggressively, but have now recaptured it. Again, this is moderately bullish. Friday’s high was 24600 and an hourly close above there is another box ticked for the bulls. At some point, the market is going to start looking ahead to 2026 and with the U.S. economy OK and liquidity returning, I presume most equity forecasts for the new year will be bullish. The question is whether retail has finally stopped out of all their longs, or there is more to sell. My feeling is the bears are losing control.

For what it’s worth, the bullish GOOG view has become incredibly consensus now post-Buffett and post-Gemini-3.0, so I would look for an overshoot if you’re a short-term trader looking to take some profits. Using the deviation from the 100-hour moving average as an overshoot indicator, the 319/326 zone is good place to exit longs, or sell some 2-week calls against those longs.

Wednesday is corporate month end, so expect USD buying tomorrow and Wednesday as real money may also participate given the drop in US equities. USDJPY still looks primed for a move to test the Takaichi government as they attempt to defy the trilemma as they broadcast loose fiscal, negative real rates (loose monetary) and a desire for a stable or stronger yen.

Incompatible policy mixes like this tend to be tested. Intervention risk rises substantially into 159/160 as the government has already started making noise about the weak JPY, but the question is whether it will work, or it will just drive USDJPY temporarily to 154/155 before a rapid retest of 160. Interventions almost always yield a short-term move of around 3.5% in USDJPY, but it’s what happens after that matters.

Intervention or no intervention, 158.40/75 is a major top to watch as that is where we peaked during the euphoria around the inauguration of Donald Trump. At that time, tariffs were bullish USD and fiscal stimulus was going to drive an economic renaissance.

There is a bit of a premium in GBP vols for the Reeves budget this week, but the market has become fairly blasé overall. 1-week EURGBP vol got to 20% pre-Brexit and 40% immediately thereafter and you can see that Liberation Day took it above 12% and we are currently trading 7.2% or so. This is much higher than realized volatility, which has been oscillating in the 3.5% / 6.0% range. My guess is the budget comes and goes with some chop in EURGBP but no real direction as there have been so many leaks and preparatory trial balloons, etc.

The market seems to have come to the conclusion that austerity is bad (lower growth) and spending is bad (debt crisis!) and that usually means that the bearish result is well flagged by this point. There is no real thesis for long GBP, but the bear trade feels well known and well-subscribed for now. Maybe an austere budget will lead to a big sell GBP trade in 2026 as the BoE can finally cut and GBP’s high-yield flavor disappears.

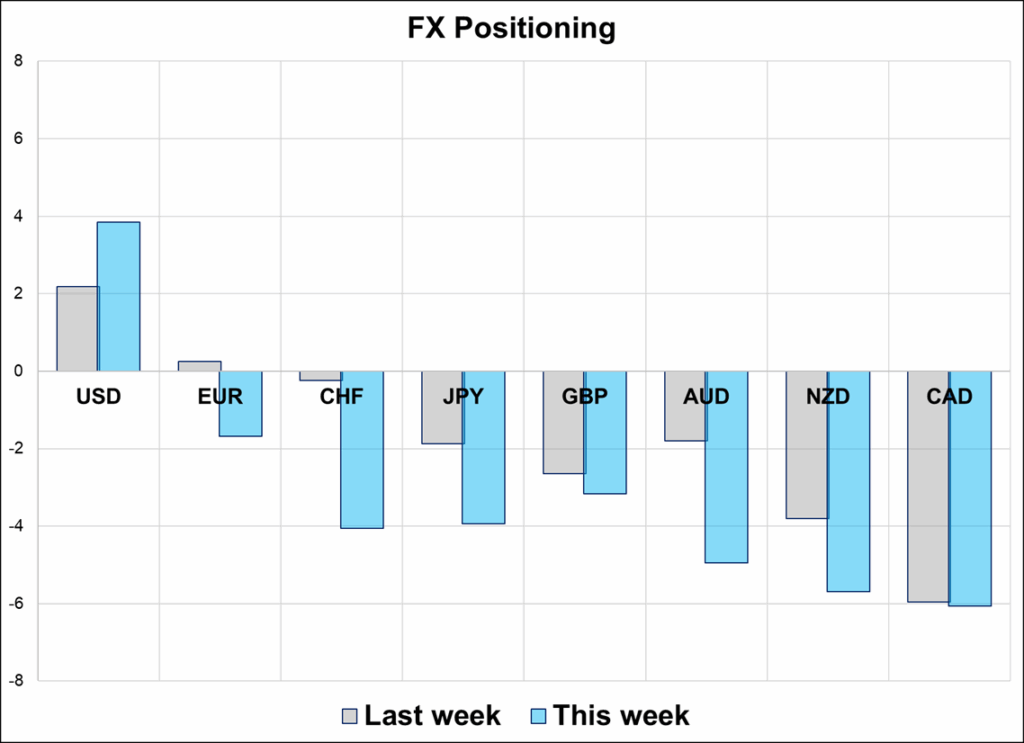

Hello new subscribers! Thanks for coming on board. Don’t worry, am/FX is not always seven pages long. Sometimes it’s one page. Sometimes it’s seven. Just depends what’s going on. Each Monday, we feature the FX Positioning Report (see next section). The market is sneakily getting more and more long dollars, though we have to take the data with some caution as the CFTC data is slow to update post shutdown.

Have a beautifully-designed week.

Note CFTC data is as of October 7. We are still waiting for it to fully update post-shutdown.