Sell the pop in USDCNH and buy the dip in EURUSD

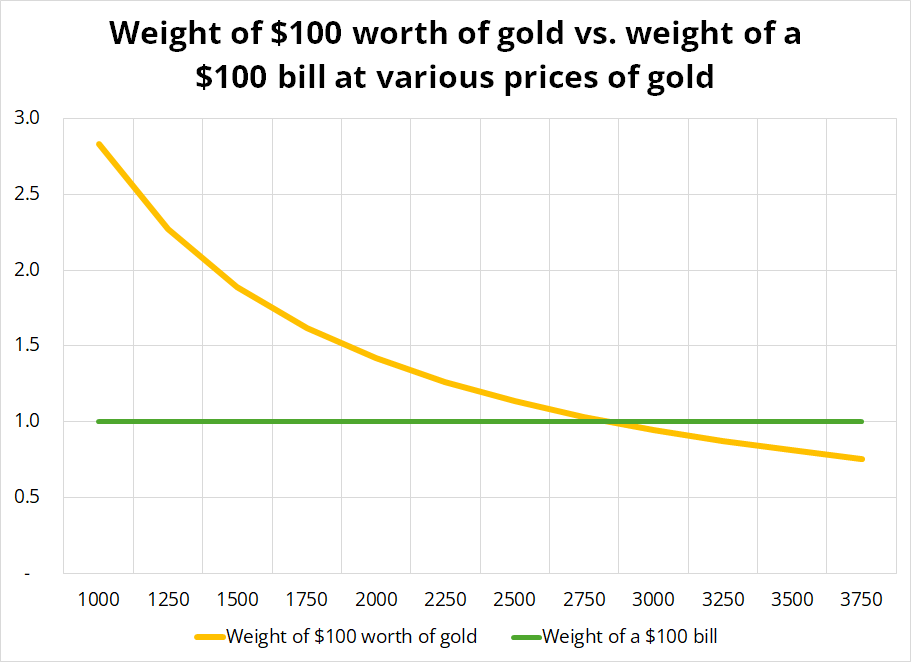

$100 worth of gold now weighs less than a $100 bill

Sell the pop in USDCNH and buy the dip in EURUSD

$100 worth of gold now weighs less than a $100 bill

Long 11MAY 168/163 put spread in CHFJPY

~31bps off 175.25

Long 05JUN USDCNH 7.40/7.60 call spread

29bps off 7.2955 spot

Covering today

Buy EURUSD 1.1257/77

Stop loss 1.1084

I am taking profit on the USDCNH call spread. It’s not a huge win, but to me the idea is stale for three reasons:

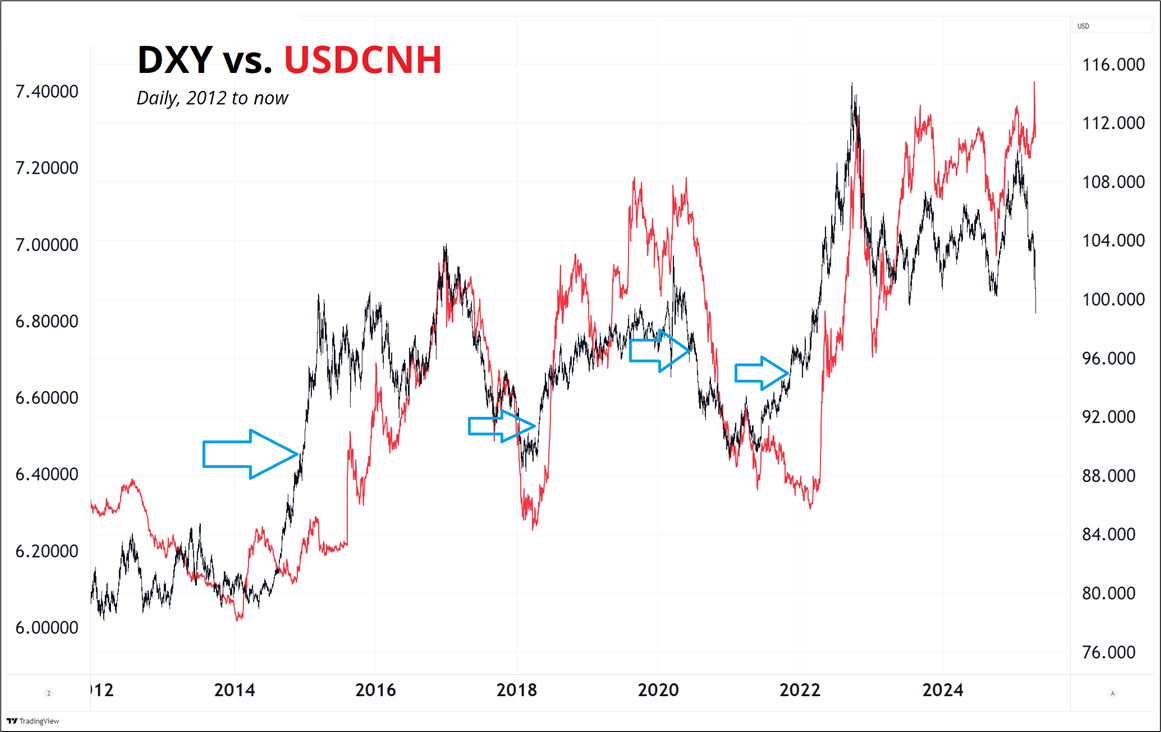

1. I am bearish USD more broadly and a structural USD bear move is not a good environment for long USDCNH. The first chart today shows the DXY vs. USDCNH, with blue arrows marking the moments when the DXY showed the way for a delayed move in USDCNH. The lags can be months and months.

For example, the DXY started ripping higher in late 2021 and USDCNH didn’t release to the topside until April 2022. The huge rally in the dollar in early 2015 didn’t matter until China devalued in August 2015. And the rip higher in the dollar in April 2018 saw a spike in USDCNH in June. But the risk/reward of long USDCNH after such a large move lower in the DXY is not amazing, and it will get worse if I’m correct that the USD has further to fall in the coming weeks.

The CNY is obviously weakening dramatically against the basket right now, but it’s going to be hard for USDCNH to go up.

2. We have what is essentially a trade embargo with China here, and USDCNH doesn’t care. Good news, bad price for USDCNH.

3. False break of 7.3750 in USDCNH is bearish.

This false break happened a few days ago, but I wanted to see how it played before bailing. Now, I am ready to bail. There is every macro reason in the world for USDCNH to go higher, but in the end, USDCNH is mostly a G10 USD proxy with a side order of China policy. The policy seems to be very gradual weakness, and they might get enough CNY weakness via the basket that USDCNH ends up stable. I want to use this pop in the USD to get out while vols are still high.

USDJPY has been incredibly choppy as it decouples from US yields. The Liz Trussification of the USD, as foreign investors flee US assets in response to cacophonous and disorderly policy chaos looks like a real theme to me. Furthermore, the excitement around some sort of Plaza Accord type deal with Japan should build as the April 17 meeting date nears. The US would appreciate a stronger yen, and most of the noise out of Japan supports that, too. See this weekend article from Reuters, for example:

https://www.reuters.com/markets/currencies/japan-ruling-party-chief-calls-stronger-yen-2025-04-13/

There’s a bit of confusion as to whether Japanese officials will meet Wednesday or Thursday this week, but the consensus seems to be that Thursday, April 17 is the day. From Reuters:

Tokyo’s top trade negotiator Ryosei Akazawa, the minister for economic revitalisation, will meet Treasury Secretary Scott Bessent on Thursday, two people familiar with the negotiations told Reuters.

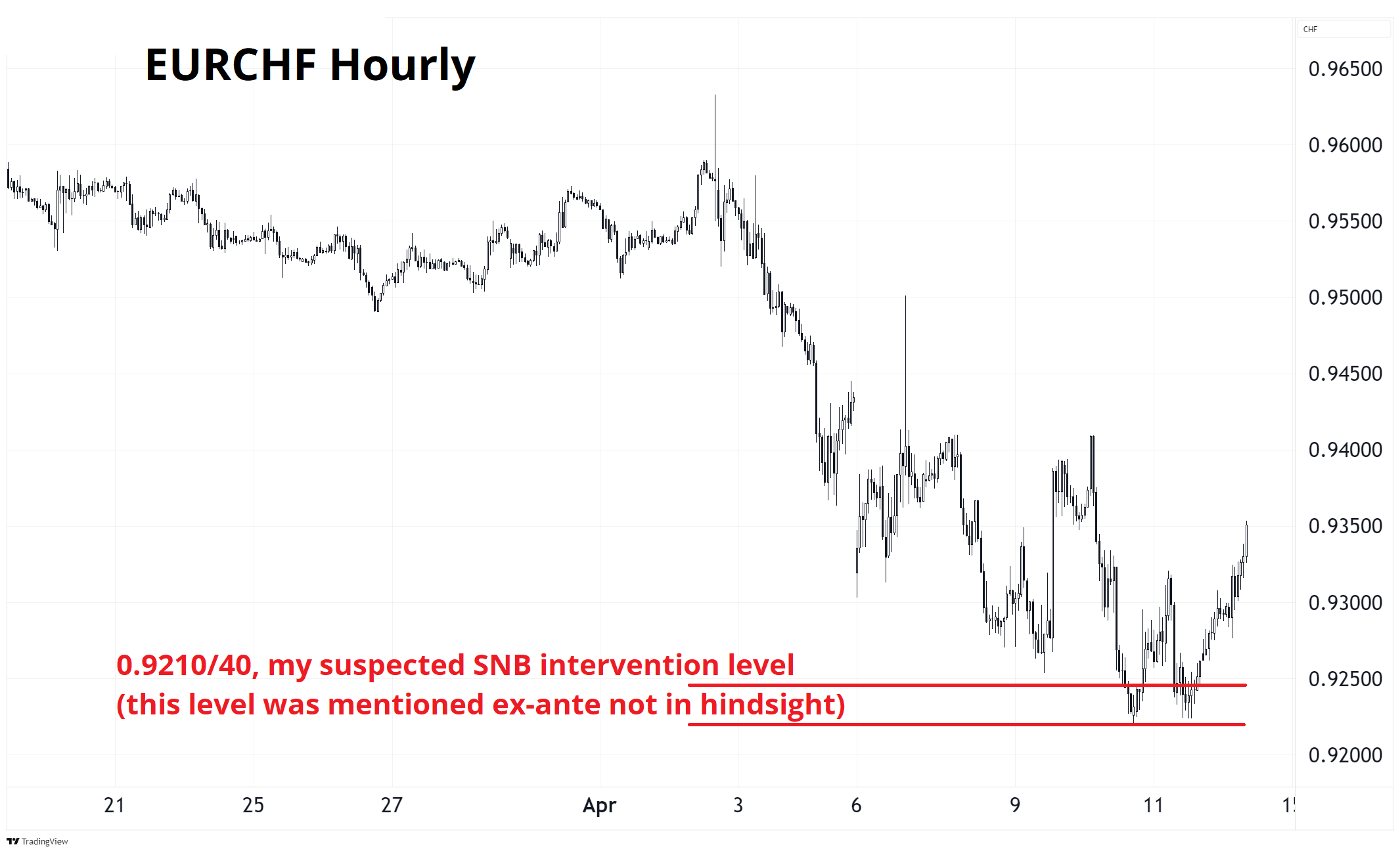

CHFJPY is moving a bit lower since my bearish rec Friday, but it’s flying around so one big fig is pretty meaningless. I am encouraged by the fact that EURCHF held exactly where it should have held and that probably means that my suspicion that the SNB would intervene at 0.9210/40 was correct. See here for the full writeup on the importance of the 0.9210/40 level and why I went short CHFJPY Friday.

EURUSD has found a new happy place, as it zig zags wildly between 1.1250 and 1.1500. That should be the short-term range ‘til we get a breakout to the topside.

The market profile chart shows that we have made a decent equilibrium zone with strong support now 1.1250/80, so if you are looking to buy a dip, that’s your entry point.

Below 1.1100 is extremely problematic for longs, so a stop loss at 1.1084 is good. I am adding this buy the dip trade idea to the sidebar trade ideas.

My writing has been way more political than usual lately. It’s difficult to avoid politics when it’s so inextricably linked to markets, and as a Canadian it’s hard not to be biased. I don’t want that bias to ruin this newsletter or make me trade like an angry depressed permabear, so I am going to make a conscious effort to at least attempt to stay rational. I don’t want to end up like The Atlantic, just pumping out end of the world nervous breakdowns week after week.

In the interest of balance, below I republish some April 7 notes from John Thomas, a Republican strategist who did an interview with the fine folks at Speevr. I am a Speevr subscriber, and they said it’s OK for me to send out these notes.

John Thomas, GOP Strategist, Nestpoint Associates Co-Founder & MD

Date: April 7, 2025

1. Trump’s Overall Intent and Negotiation Approach

Trump genuinely views the current situation as an opportunity to fundamentally rebalance global trade, using tariffs strategically as negotiation leverage. He is not bluffing; tariffs may be reduced through negotiations but will not be eliminated entirely. Trump’s negotiation style involves aggressive initial positions (anchoring), symbolized by the “my button is bigger than yours” approach, signaling significant tariff hikes initially before moderating slightly. He aims to quickly finalize key trade agreements within weeks.

2. Trump’s Long-Term Political Perspective and Base Support

Trump is uniquely positioned as the first U.S. president genuinely driven by a long-term strategic outlook, enabled by the fact that this will be his second and final presidential term (no “third term”), despite rhetoric suggesting otherwise. This affords him greater freedom from immediate political pressures. He remains unwaveringly committed to a tough stance, particularly towards China and the EU, and believes strongly he holds more leverage. Trump is determined to “stare into the whites of the eyes” of China and Europe longer than most observers anticipate, demonstrating his insistence on projecting strength and resolve. He remains indifferent to Wall Street’s short-term reactions, instead explicitly prioritizing Main Street interests. With robust and steady support from his political base (around 93%), Trump sees no reason to shift his aggressive approach or soften his stance in the near future. While mindful of maintaining control of the House politically, Trump believes he can endure political pressures far more effectively than his predecessors.

3. Trump’s Stance toward Wall Street vs. Main Street

Trump has shifted his focus decisively away from Wall Street, explicitly prioritizing Main Street by pushing policies aimed at reshoring manufacturing jobs, particularly to electorally significant states like Ohio and Michigan. While he previously touted stock market performance as a key achievement, it is now clearly secondary in his policy considerations. He may again begin to emphasize Wall Street performance later on, but it is explicitly not a priority at present.

Scott Bessent made a pact with Trump to stand by him through thick and thin—this was a precondition before accepting the role of U.S. Treasury Secretary.

4. Country-Specific Negotiations (Chile)

Countries viewed unfavorably due to political alignment, such as Chile—whose socialist government openly supported Kamala Harris—will experience notably tougher negotiations. Chile, in particular, is highly anxious about these unfavorable prospects. Businesses within these politically disadvantaged nations are strongly encouraged to bypass their own governments and directly engage with the Trump administration. Such direct negotiations have previously allowed corporate clients to secure beneficial tariff waivers, providing them with significant competitive advantages lasting potentially up to a year or the remainder of Trump’s term.

5. Tariff Pause Scenarios (recall this was published 07APR, before the 90-day pause—good call)

The administration is considering temporary tariff pauses during ongoing trade negotiations, and White House denials on Monday morning are not entirely accurate. Two primary scenarios have emerged: a 90-day pause (30–35% probability) and a shorter 30-day pause (around 40% probability). Additionally, limited pauses might be granted individually to one or two countries actively negotiating. Given the substantial number of countries seeking agreements, there’s also roughly a 50% chance Trump might prefer consolidating these negotiations into one large-scale, comprehensive negotiation to simplify and expedite the process.

6. Negotiations and Concessions with China

Trump intends to remain uncompromising in negotiations with China, convinced that the U.S. possesses superior leverage. He has explicitly identified three crucial demands necessary for meaningful progress: the successful conclusion of the TikTok deal, a firm crackdown by China on fentanyl precursor exports, and explicit commitments by major Chinese industries to relocate (“onshore”) their production into the United States.

7. Symbolic Deals with Allies (Japan, Korea)

Trump seeks symbolic yet politically significant concessions from key allies, particularly Japan and Korea. Specifically, he is fixated on concessions involving autos and rice tariffs—items that, despite their relatively small monetary value, carry substantial symbolic importance. These concessions serve primarily as political victories to demonstrate fairness and strength rather than as measures designed to achieve significant economic impact.

8. Economic Impact and Tariffs as Revenue

Trump explicitly frames tariffs as a type of consumption tax aimed at raising significant revenue for the U.S. government. This tariff revenue is strategically intended for reducing national debt, strengthening domestic manufacturing sectors, and explicitly improving economic conditions and quality of life in Trump’s core electoral base states, notably Ohio and Michigan.

9. Forced Divestment of Chinese-Owned Assets

The administration is actively exploring or moving towards forced divestments of Chinese-owned companies operating in broadly defined strategic sectors, including technology, energy, batteries, and critical infrastructure. A prominent example specifically identified is ZPMC, a Chinese state-owned enterprise that controls roughly 80% of cranes at U.S. ports, making it a notable candidate for potential divestment.

10. Chips Act and Capital Gains Tax

Trump strongly opposes the Chips Act, preferring tax incentives, tariff waivers, and joint ventures over direct subsidies. He is also considering eliminating capital gains taxes entirely and has expressed interest in eliminating carried interest, although this particular change will not appear in the current legislative package.

11. Geopolitical Strategy

Trump views international geopolitical conflicts largely as proxy struggles against China. He explicitly seeks increased U.S. military presence in Greenland and identifies Africa as a critical battleground due to growing Chinese influence, especially concerning China’s Belt and Road Initiative and CCP-related debt issues. In the Middle East, Trump supports decisive action against the Houthis in Yemen—including possible Saudi-led ground operations—as Iran distances itself from the group, and he maintains unwavering support for Israel while desiring an end to hostilities in Gaza.

12. Ukraine-Russia Negotiations

Trump aims for concrete diplomatic progress on Ukraine by May, explicitly timed to precede a possible Russian spring offensive. He firmly opposes any U.S. ground troop deployments overseas. Reintegration of Russia into the SWIFT payment system is being considered as leverage in negotiations, alongside the possibility of a ceasefire as a precondition for Russian cooperation. Trump’s previous experience with Zelensky left him skeptical, as he felt “backstabbed” after an earlier tentative agreement collapsed. Additionally, there remains skepticism regarding whether Ukraine’s upcoming elections will proceed as planned.

13. Federal Reserve Independence

Trump expects and strongly desires the Federal Reserve to significantly cut interest rates and is currently refraining from public conflict. However, if cuts do not materialize soon, he may escalate pressure and criticism, particularly against Fed Chair Powell, whom he dislikes. Meanwhile, Trump is actively reorganizing banking and financial regulators, merging the OCC and FDIC, effectively dismantling the CFPB, and accelerating bank merger processes.

14. EU Retaliation and Parity

The Trump administration remains highly focused on achieving tariff parity with the EU and is prepared to aggressively counter any retaliatory actions from the EU.

15. Capital Controls or Depreciation of Dollar

There remains uncertainty about whether the administration may consider implementing capital controls or actively seek depreciation of the U.S. dollar as part of its broader economic strategy.

16. Tariff Floor (10%)

Once all trade negotiations stabilize, the Trump administration expects a minimum long-term baseline tariff rate of approximately 10% to remain in place. This figure is viewed as the new normal.

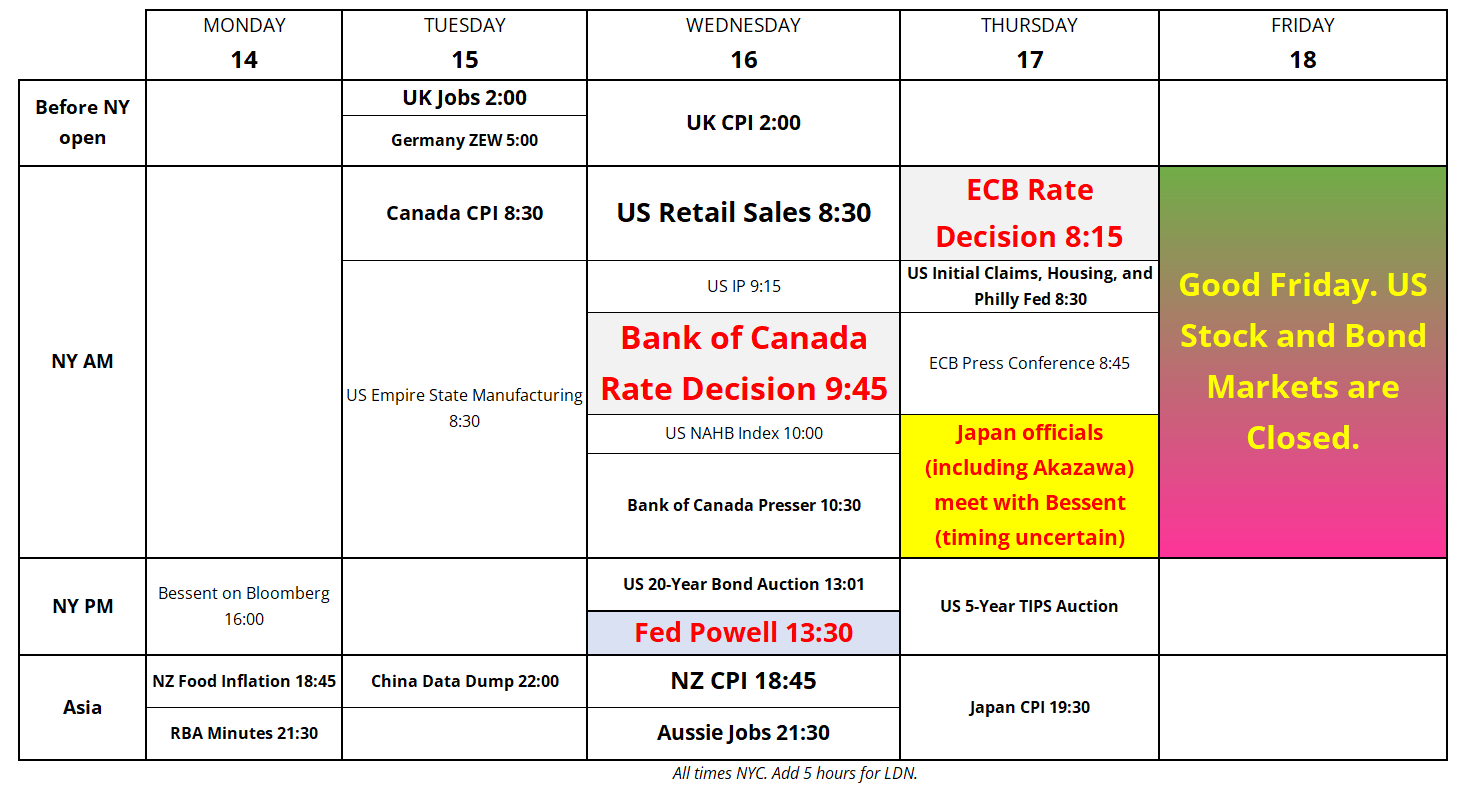

Note I added Bessent at 4 p.m. today on Bloomberg and Powell in Chicago on Wednesday to the calendar.

Calendar for the week of April 14, 2025

I hope your day is as cool as a $100 bill.

$100 of gold now weighs less than a $100 bill