This event is too complicated to game.

@mattsurely

This event is too complicated to game.

@mattsurely

Taking profit on short USDJPY @ 150.40

Stop loss 151.66

Take profit 148.26

Buy EURUSD 1.0711

(Limit order)

Stop loss 1.0484

First up, I am taking profit on the USDJPY short. I don’t feel like I have any edge on the tariff announcement. It was a good trade with not much pain, and I don’t want to flip a coin here. I am leaving my bid in EURUSD as my base case for tonight is that it’s confusing and choppy, not a directional all clear for bears or bulls. I continue to believe that the USD is headed lower. I know it’s consensus, but I don’t think it’s at all crowded.

The theme in every inbox is the exodus from US assets and while my first instinct when my inbox fills up with a theme is to fade it, that is probably not the right play here. The world has been buying US assets for 10 years on the back of the belief in TINA and now that has turned on a dime. There isn’t much of a policy mix that will change that now as the bridges have all been burned and pension funds, SWFs, and most of the herd is heading for the exits. This is an epic turn in narrative, and it will take weeks or months for it all to play out.

The stream of headlines overnight continues the comedy as WSJ, FT, and Bloomberg put out unsourced piece after unsourced piece saying everything from 20% universal tariff to “everything is still on the table” even as we are 8 hours away from announcement time. One would hope that such an important policy would be decided and clearly written up well in advance by a group of competent professionals. Let’s see. :]

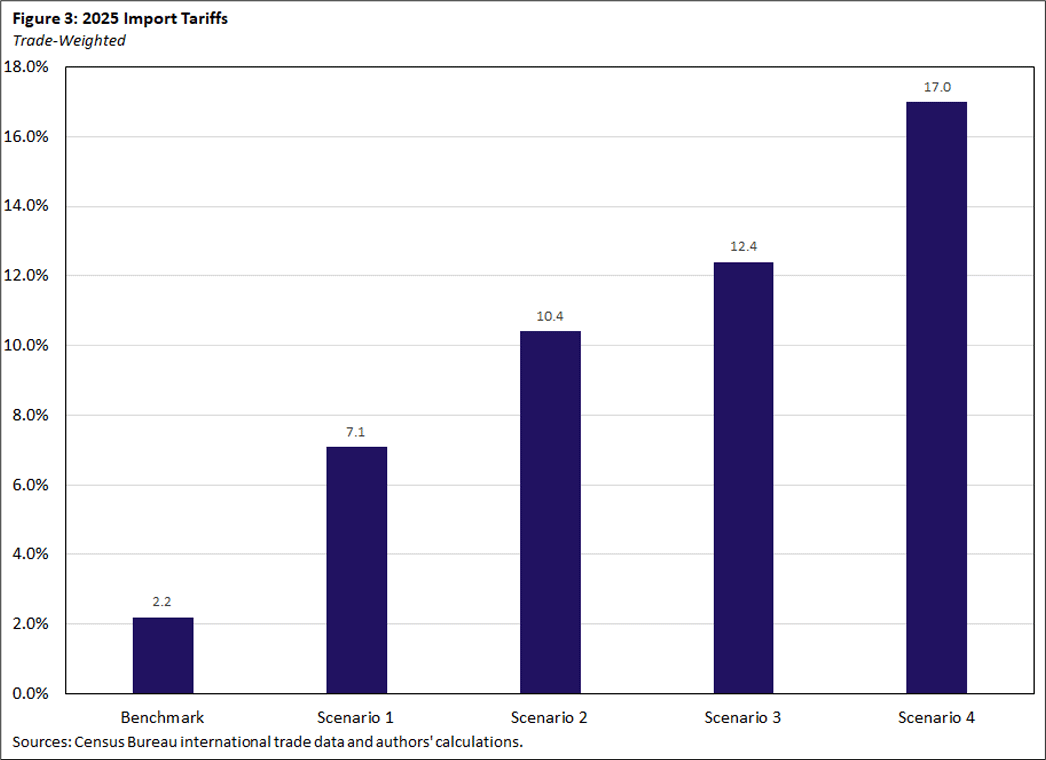

In terms of what is expected from the Rose Garden today, this GS chart is a good starting point. I heard Valerie Tytel sum it up nicely on Bloomberg 1130 this morning. To paraphrase here: Anything that sounds like close to 10% is bullish. 20% across-the-board is bearish. That’s probably a good starting point for your reaction function.

Good, timely writeup on tariffs here from the Richmond Fed. Scroll down for their 4 tariff scenarios. Their takeaways match the GS expectations pretty closely.

In a tiny but countertrend twist, Sweden announced yesterday that they will be increasing their holdings of US dollars. The key quote:

Until further notice, the foreign reserves will contain assets in the US dollar at 70% (previously 62%), the euro at 17.5% (previously 22%), the pound sterling unchanged at 5%, the Australian dollar unchanged at 5% and the Norwegian krone at 2.5% (previously 3%). At present, the Danish krone and Canadian dollar are not included in the foreign exchange reserves.

Ok.

Good tweet from Kris Sidial:

Some thoughts on “Liberation Day”:

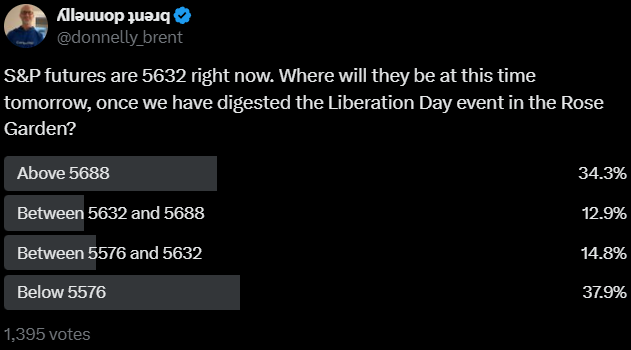

It’s starting to feel like the consensus bear case is a blanket 20% tariff across the board, while the bull case leans more toward a targeted 12–20% on specific sectors and countries. Regardless of what’s read off the podium at the White House, the market seems poised to interpret the news positively.

Right now, derivatives pricing isn’t showing much fear. Absolute vol levels remain subdued. Vol is flat on the day, and equities are up for a second session in a row — largely because most believe Trump is bluffing, given the substantial GDP hit broad tariffs would inflict.

This feels like a reverse “sell the news” setup — where equities get aggressively bid and vol is suppressed by yield-focused and opportunistic/tactical vol players. But in the coming weeks, that bounce will likely fade sharply as we grind lower.

Because while the market might want to fade Trump, the real story is the next frontier: deteriorating economic data. Rapid shifts in federal employment, immigration policy, international trade, proposed fiscal changes, and ongoing pressure on monetary policy all introduce significant variance into the data. That’s what ultimately matters. Outside of the little wiggles that take place on a day-to-day basis, there is a bigger picture in play here.

Good luck tonight.

@mattsurely