A series of short bursts of prose each discussing a separate topic

Cook, PCE, BLS, etc.

Current Views

Long EURGBP @ 0.8674

Stop loss 0.8589

Defenestration

Today a federal judge will hold a hearing on Lisa Cook’s firing at 10 a.m. Cook is asking for a temporary restraining order (TRO) and will probably get one as the judge (which is randomly selected) is a Biden appointee who has already ruled against Trump on another matter. The case will almost certainly go to the Supreme Court so today’s ruling isn’t a major deal but might trigger a kneejerk. The hearing starts at 10 a.m. and a ruling on the TRO could come today.

I would expect a TRO headline will yield a 15 or 20 pip rally in USDJPY as the market initially interprets this as a win for the checks and balances and then the move will revert because people will realize that this thing is going to the DC Circuit Court of Appeals and then the Supreme Court.

Politico: Meet the judge who will decide the Lisa Cook case

Core PCE

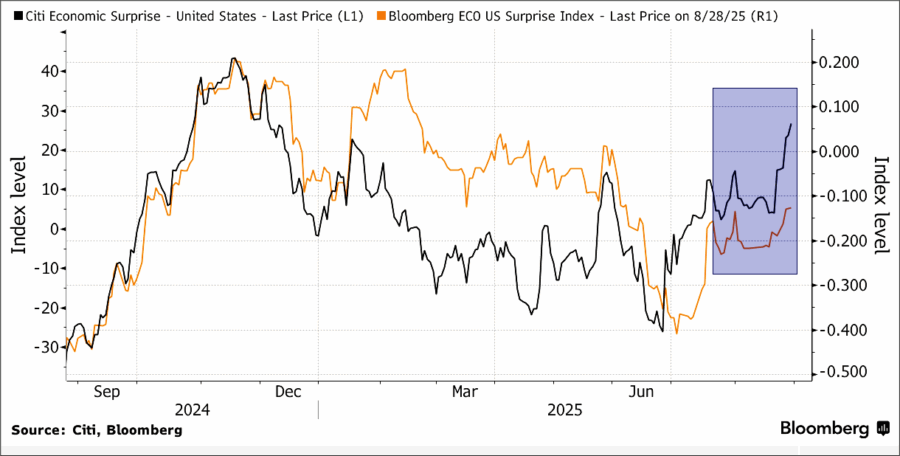

Core PCE and Personal Income and Spending all came in on the screws this morning, as PCE is fairly easy to model given the inputs from CPI and PPI. Overall US economic data remains firmly in the soft landing zone as the soft patch we experienced post Liberation Day starts to unwind. There was much fear and loathing going on in markets and the real world in April, May, and June, but cooler heads have prevailed and that is boosting economic confidence back to baseline.

The BLS isn’t to blame

Chris Waller fired off another dovish speech last night, repeating his main talking points on the labor market, but the more interesting part of the speech discussed the BLS. Even some smart people have said to me recently something like: “Well, yeah, I mean the BLS is pretty bad. Why are the revisions so big??” But revisions have nothing to do with the BLS being bad. Waller explains it clearly in his speech:

Before I move on from the labor market, let me address a question of some public debate recently, which is the quality of the payroll data. As should be obvious from these remarks and others I have delivered, I consider the monthly jobs report, including its estimate of payroll employment, an absolutely indispensable tool in evaluating the economy and setting monetary policy, and that view is close to unanimous among economic forecasters and policymakers. Considering how important this data is in getting an accurate and reliable read on the state of the labor market, it is entirely appropriate to examine the quality of the jobs numbers and the process by which they are collected. There is always room for improvement in data collection and analysis. In fact, the Bureau of Labor Statistics (BLS) and other agencies that collect economic data have benefited from expert committees of outside advisers who have provided advice on ways to improve data quality.

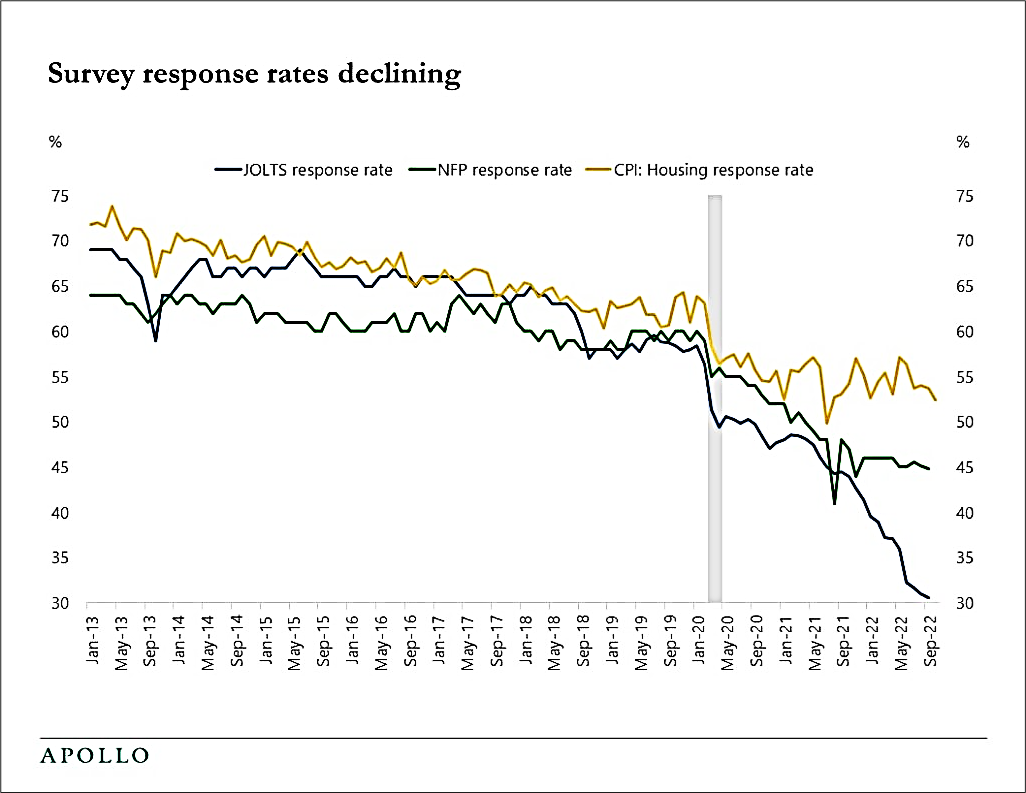

There has been substantial commentary since the last jobs report regarding the declining response rate of establishments and individuals in the employment survey and the outsized revisions of the data. This commentary has raised questions about the quality of the employment survey data. So I want to address this issue and clarify some facts about the survey response and the revisions. When the BLS sends out the establishment survey for a given month, it gives firms three months to return the survey—they can return it in the first month, the second month, or the third month. Some firms do not respond at all. Firms that submit their responses in the first month are the basis for the initial, or preliminary, payroll estimate. Those firms that respond in the second month get added to the first-month responders to get an updated number, which yields the first revision that is published a month later. Then the firms that respond in the final month provide the BLS with the final numbers for the original month. This is the second revision and is the official payroll estimate for that month.

A decade ago, the response rate for the first month was 75 percent, meaning three-fourths of the firms surveyed responded immediately. But the initial response rate has fallen to 60 percent recently. Does that imply that the overall response rate for the entire three-month period has fallen? No, response rates by the final estimate have not fallen—about 95 percent of firms responded a decade ago, and that is how many are responding now. What has happened is that U.S. firms are slower in returning the survey. Ten years ago, if the survey had been sent to 100 firms, 75 would respond in the first month, and 20 firms would respond in the next two months. But now only 60 firms respond in the first month, and 35 firms respond in the second and third months. But in both cases, 95 out of 100 firms surveyed responded.6

What are the implications of this delayed response pattern? First, if more data come in later in the survey period, then the initial estimate is less likely to accurately represent the final estimate, which means you are more likely to get significant revisions in the second and third months. The revisions do not mean the quality of the data has declined; it simply reflects the fact that more data is coming in late in the survey period.

A second point is that revisions have been, on average, negative for the past couple of years, and while the recent revisions were large, revisions have not been getting bigger, on average, based on an analysis recently issued by economists at J.P. Morgan.7 They did find that large revisions are often associated with major turning points in the labor market. One possibility is that the recent large revisions in the payroll data for May and June indicate the labor market is at an inflection point and may worsen in coming months.

Overall, the delay in responses does mean that we can expect initial reports to be noisier and more prone to revision. One month of data has never constituted a trend, but it is going to be especially important to take near-month payroll data with a grain of salt and form a picture of the labor market based on several months of results and a range of other labor market indicators. I hope my analysis of the labor market shows you that I do exactly that.

There is a simple fix for this: Legislate timely responses from companies. If accurate and timely economic data is what we want, then we need to require companies to respond in a timely manner. Survey fatigue is real.

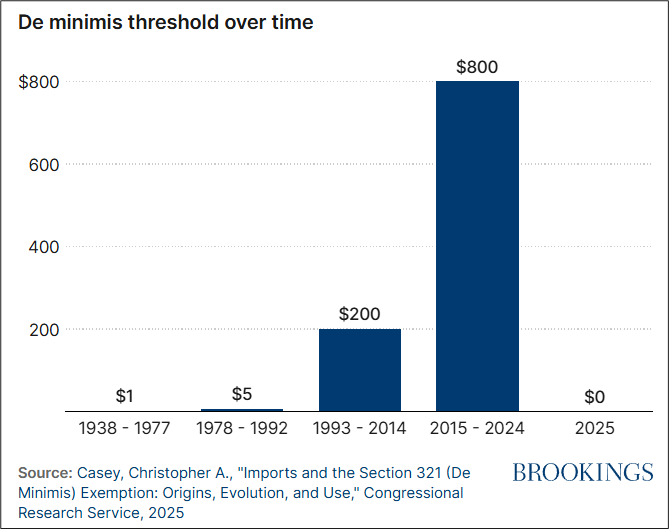

De Minimis

Etsy and eBay have been selling off as Trump moved the De Minimis exemption for inbound packages to zero and that goes into effect today. Many foreign shipping and postal companies have simply decided to stop low-value shipments to the USA. This is worth watching as it could bleed through to other companies like AMZN and SHOP and become relevant to the broader market. Read the Brookings Institute’s analysis here.

Watch for a possible backtracking on this policy if it becomes too chaotic (similar to the backtracking on China once the reality of rare earths hit home).

Final Thoughts

1. Don’t forget that we will get a federal appeals court ruling soon on whether the “reciprocal” Liberation Day tariffs, ostensibly justified by a fentanyl emergency, are unlawful. Bloomberg Litigation Analyst Holly Froum gives the ruling a 60/40 slant with a ruling of illegality slightly more likely. This will set up another Supreme Court clash as Trump has smashed the Overton window on presidential power by normalizing actions and claims of authority that were once seen as extreme or unconstitutional.

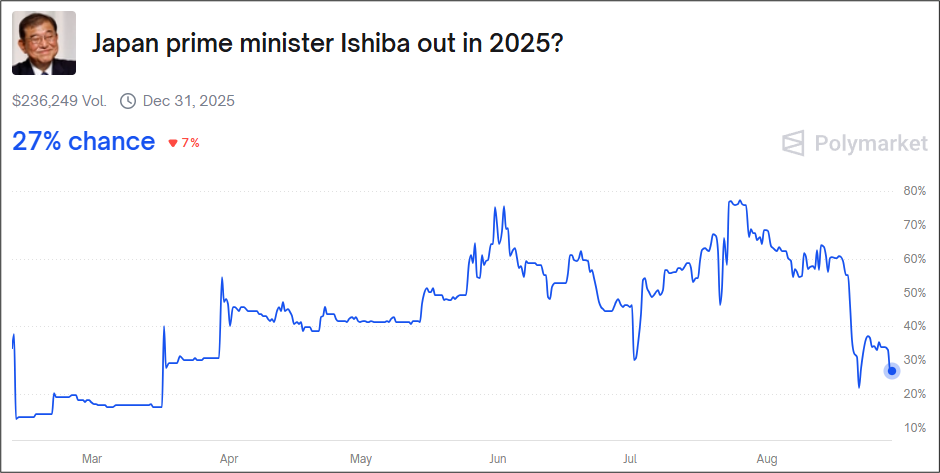

2. We were told that Ishiba was a lame duck, but he keeps on hanging on.

a. https://www.asahi.com/ajw/articles/15995920

b. https://www.nippon.com/en/news/yjj2025082900362/

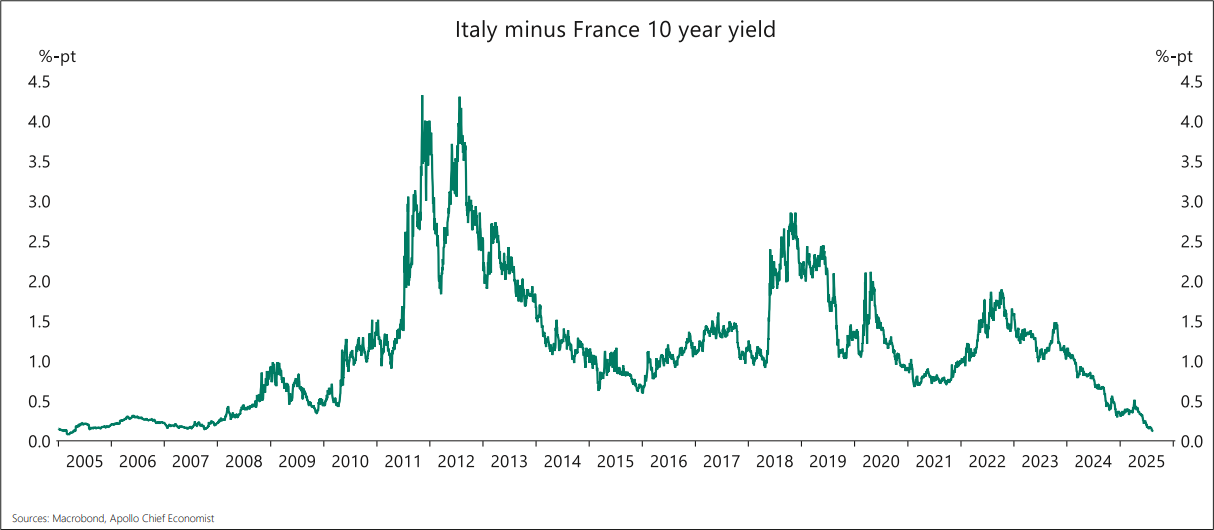

3. Crazy chart from Apollo:

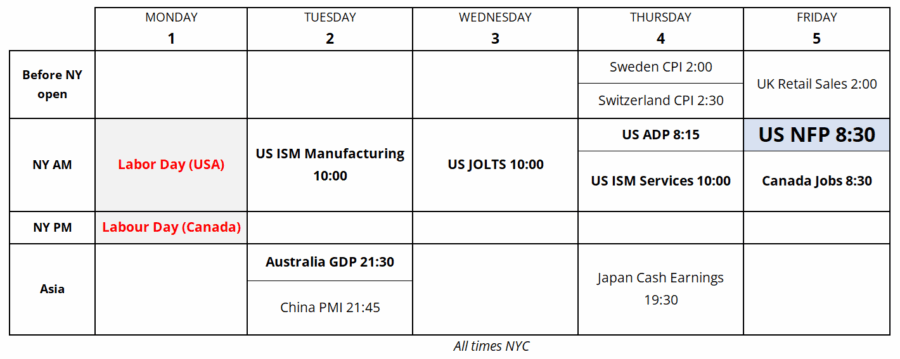

Next week’s calendar is weirdly US-centric. See next page. Have a purrfect weekend.

Trading Calendar for the Week of September 1, 2025