I think so, but the price action isn’t exactly panicky

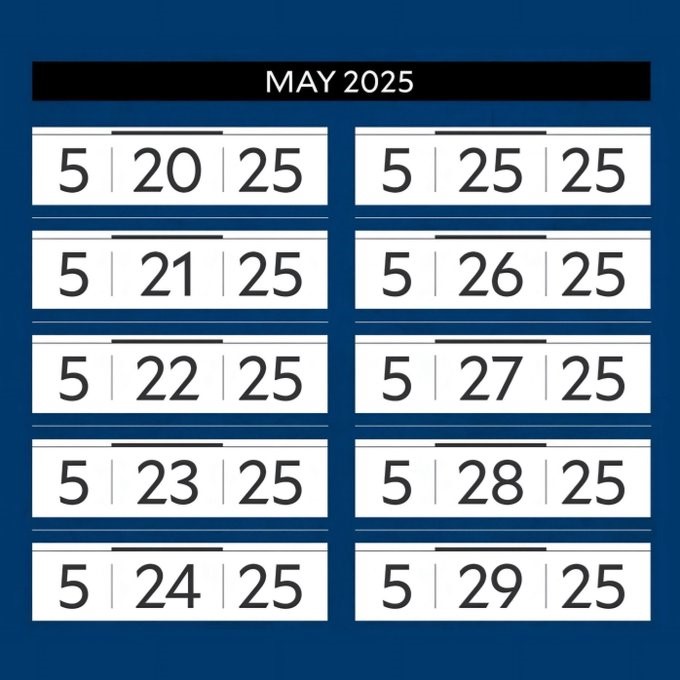

We’re in a nice run of palindrome dates!

I think so, but the price action isn’t exactly panicky

We’re in a nice run of palindrome dates!

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

One thing I am finding surprising and intriguing here is just how slowwwwwwly we are moving towards a potential crisis in US debt markets. Everyone can see it and Saravelos and others have been talking about it for at least a week as the Big Beautiful Bill gains momentum and the smaller deficits promised by Bessent’s 3/3/3 or Musk and Vivek’s much-overhyped passion project are now clearly not a thing. Deficits in the US will continue to explode until the bond market says otherwise.

But bonds are just creeping lower. The USD is barely selling off. Stocks are stable. So, either I am wrong that we are heading towards an UH OH moment, or the market is just moving incredibly slow. One time when I was 13 and my brother was 16, we went out for a drive in his 1972 Dodge Dart. There was a red light up ahead, and he was going kind of fast and he hit the brakes, but the road was wet. We started to slide, in slow motion, at maybe 20 mph. Time dilated as my brother yelled “We’re gonna hit this guyyyyyyy…”

BAM! We smacked into the stopped car. I feel like we are in that moment right now where everyone can see we are about to hit the car in front of us, but we haven’t hit it yet. I suppose the fundamental question is: Has the US crossed the Rubicon? If yes, the base case is that yields will go higher as the market rejects the current fiscal acceleration and they will keep going higher until the government intervenes, changes some rules, or changes policy. If we have not crossed the Rubicon, deficits are bullish, the soft landing continues, AI stocks go to all-time highs and life is good.

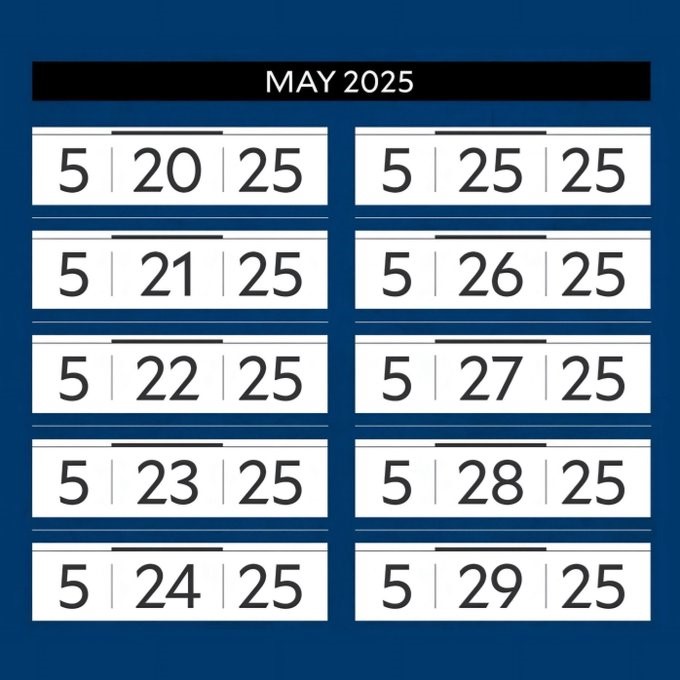

I am more of the view that we have crossed the Rubicon. But we know the bill is going to pass in some shape or form similar to its current look and yet the market is not exactly in crisis mode here. I will keep an open mind. The 2025 P&L of vol-weighted short bonds + short USD is right at resistance.

I keep getting questions as to why I haven’t been putting the trades in the sidebar as I have been bearish bonds via TMF for a while and bearish the USDJPY/TY package as well into the passage of the Big Beautiful Bill. I also am bullish platinum. I generally only put FX trades in the sidebar, but I will try to put others in there going forward. That said, sometimes I have views that are too flexible to be set in stone and I don’t want to make things confusing by jumping in and out. You know my thoughts, and you can trade whatever you like, regardless of the sidebar ofc.

Anyway, the platinum trade is in the sidebar, though as I said in yesterday’s piece, I am personally long PLTM and PLG, not platinum futures. I have never wanted am/FX to be too much of a trade copying service; the idea with the sidebar is just to maintain a record and stay accountable. Please trade your own view and incorporate whatever analysis of mine that resonates. And ignore the rest.

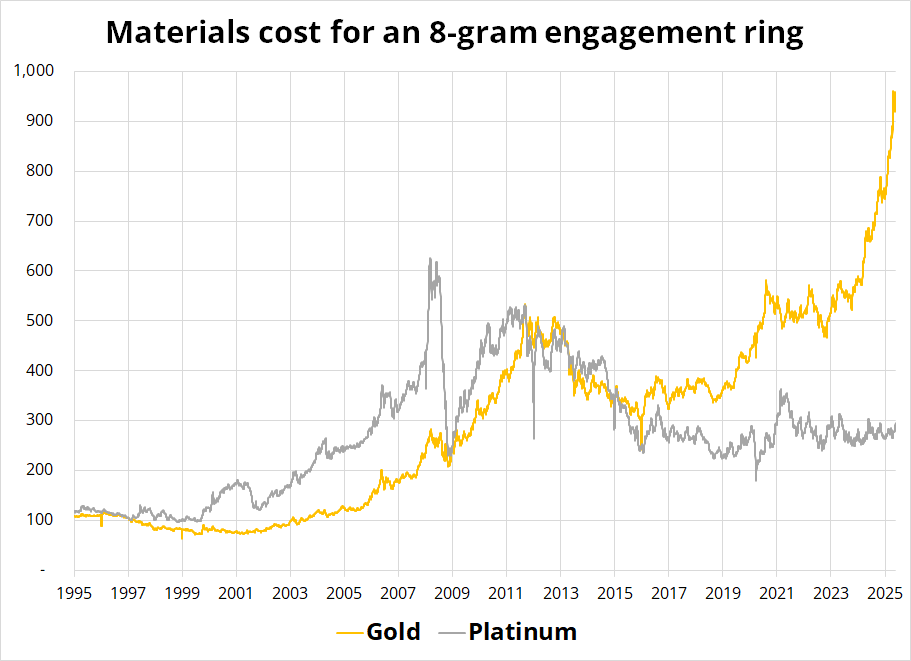

The platinum story looks super compelling to me as we have a technical break combined with a pretty good (and new) narrative. And that narrative (China substituting platinum vs. gold as the price of XAU rises to the stratosphere) looks sensible and true. Platinum Guild International disclosed at London Platinum Week that Chinese platinum jewelry demand rose by 50% in Q1 (thanks NvR).

The switch from gold to platinum is driven by 4 factors according to Platinum Guild International:

Here’s the just-released quarterly report from the World Platinum Investment Council, if you want some further reading. This organization is biased bullish, obviously, so keep that in mind.

https://platinuminvestment.com/files/873451/WPIC_Platinum_Quarterly_Q1_2025.pdf

Out of curiosity, I plotted a comparison of the input cost for engagement rings made of gold and platinum. The chart goes back to when I started my “career” working on the spot desk at Citibank Toronto. When economic research and newsletters like this were hand delivered in a paper packet format each morning. Me old.

We are not hearing much from Stephanie Kelton these days.

The Rubicon is not an intimidating river.

Holy bitcoin.

Yo, Banana Boy! Step on no pets.

We’re in a nice run of palindrome dates!