What about Bob?

The reported nomination of Robert Lighthizer (according to the FT) has sent a chill down the spine of USD shorts as this early announcement potentially shows that of the four main pillars of Trump 2.0, trade is Job One. Then again, Reuters came out with a denial shortly after, but nobody is paying attention to that.

Honestly, I am a bit confused by this, as the market seems to be assuming the FT story is true, or maybe it doesn’t matter if the FT story is true, because if it’s not, maybe Lighthizer gets the Secretary of Commerce role or some sort of “trade czar” tag anyway.

https://www.reuters.com/world/us/trump-asks-lighthizer-be-us-trade-chief-financial-times-reports-2024-11-08/

Tom Homan was appointed to border czar. He recently said:

“Wait until 2025,” he said, adding that, while he thinks the government needed to prioritize national security threats, “no one’s off the table. If you’re here illegally, you better be looking over your shoulder. You’ve got my word. Trump comes back in January, I’ll be in his heels coming back, and I will run the biggest deportation operation this country’s ever seen.”

Mass deportation is incredibly difficult logistically, and was promised and did not happen in Trump’s first term. See here and here. Then again, it’s a much higher priority this time.

My bet is we see some high-profile deportations of convicted criminals and then the logistical nightmare of locating and deporting illegal immigrants becomes the reality. Note that the first Trump administration removed far fewer immigrants and also arrested fewer immigrants than the Obama administration. Anyway, let’s see.

I strongly doubt deportation is relevant to the economic or markets story because it is too difficult to execute quickly. Some have pointed out deportation as a massive wage inflation risk, but I don’t buy it.

With trade and immigration names floated, that leaves taxes and government restructuring as the two remaining Big Four objectives without a figurehead. Note that last time Lighthizer was only nominated January 3, 2017, so this is a lightning-fast move that probably shows that Trump 2.0 is going to operate much faster than Trump 1.0. It is a consensus view that Trump regrets his slow movements in his first term, as he focused on a failed health care reform effort before pivoting to easier, more winnable battles like trade and taxes.

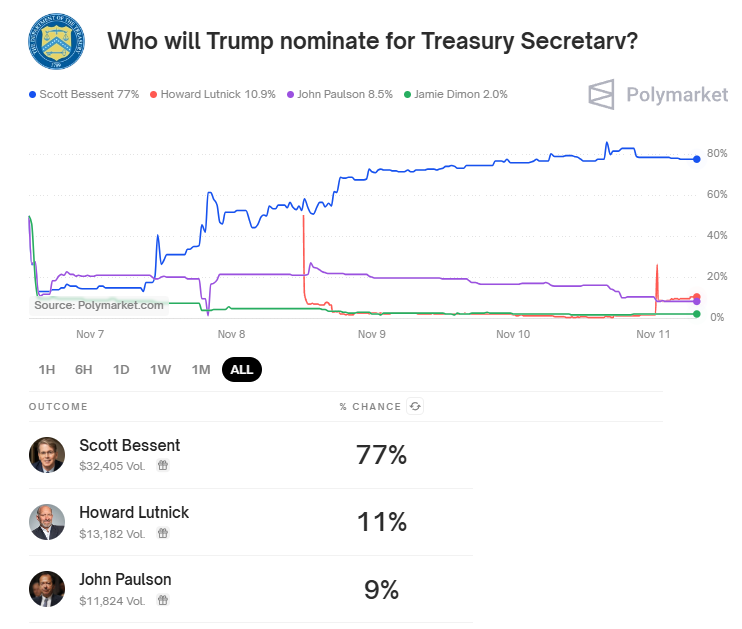

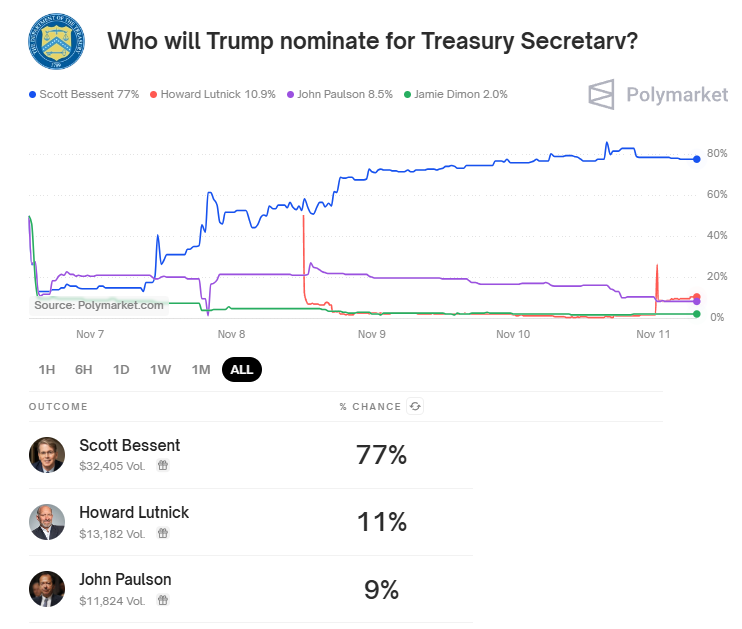

Here is how the battle for Treasury Secretary is shaping up. Note that in 2016, the market accurately converged on Steve Mnuchin as the likely pick for treasury by November 14.

The big question for markets is how the contradiction in policy objectives will be resolved. Bessent’s platform is 3% growth, 3% deficits, and 3 million new barrels of oil. How do you achieve that with huge tax cuts and current levels of spending? You don’t. Therefore, the recipe has to be some kind of pie-in-the-sky government spending reductions via job cuts or restructuring. Like if Javier Milei bought Twitter.

For a nice summary of up to date odds on all the possible Trump nominations, see WSL ELECTION {GO} on Bloomberg.

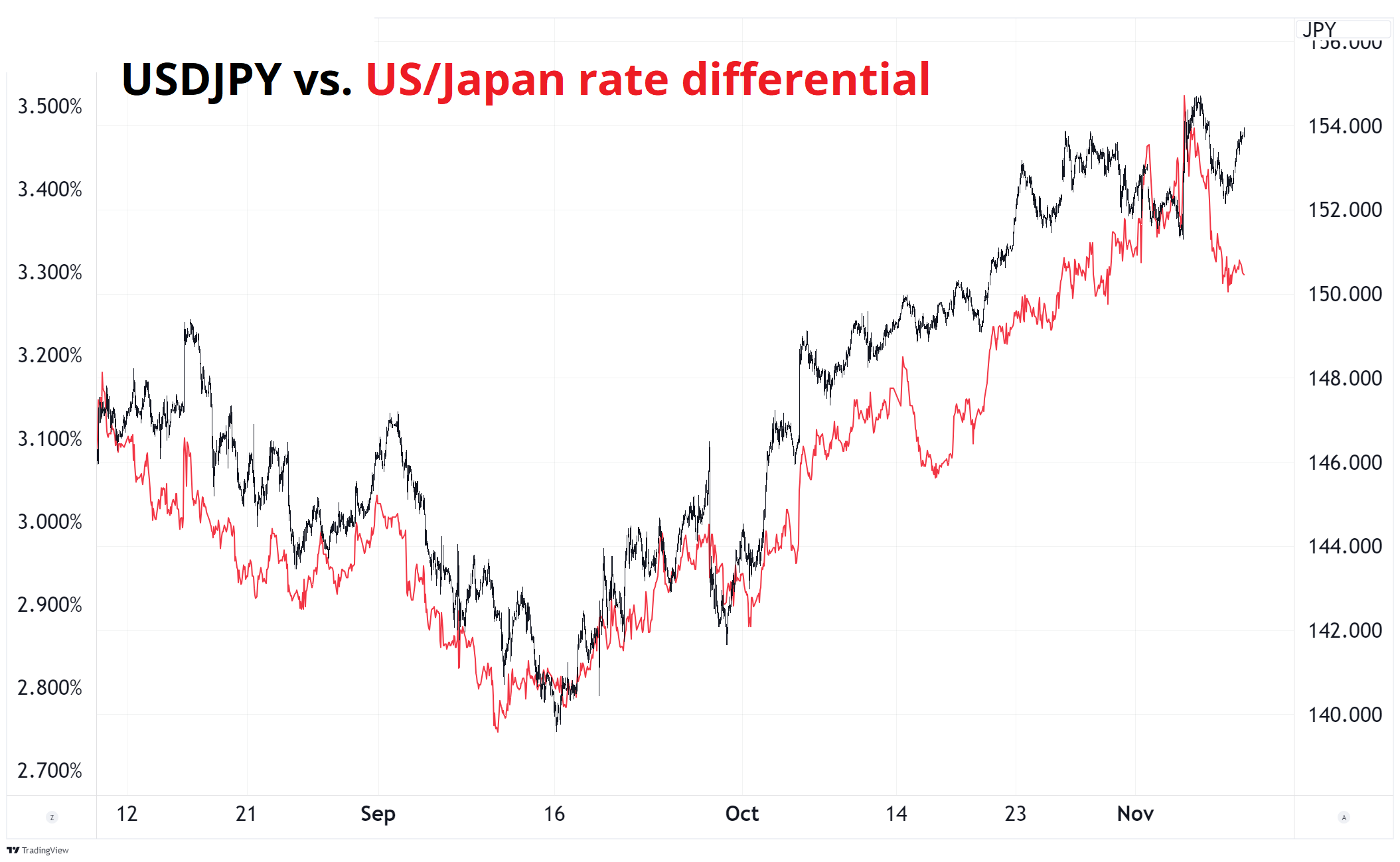

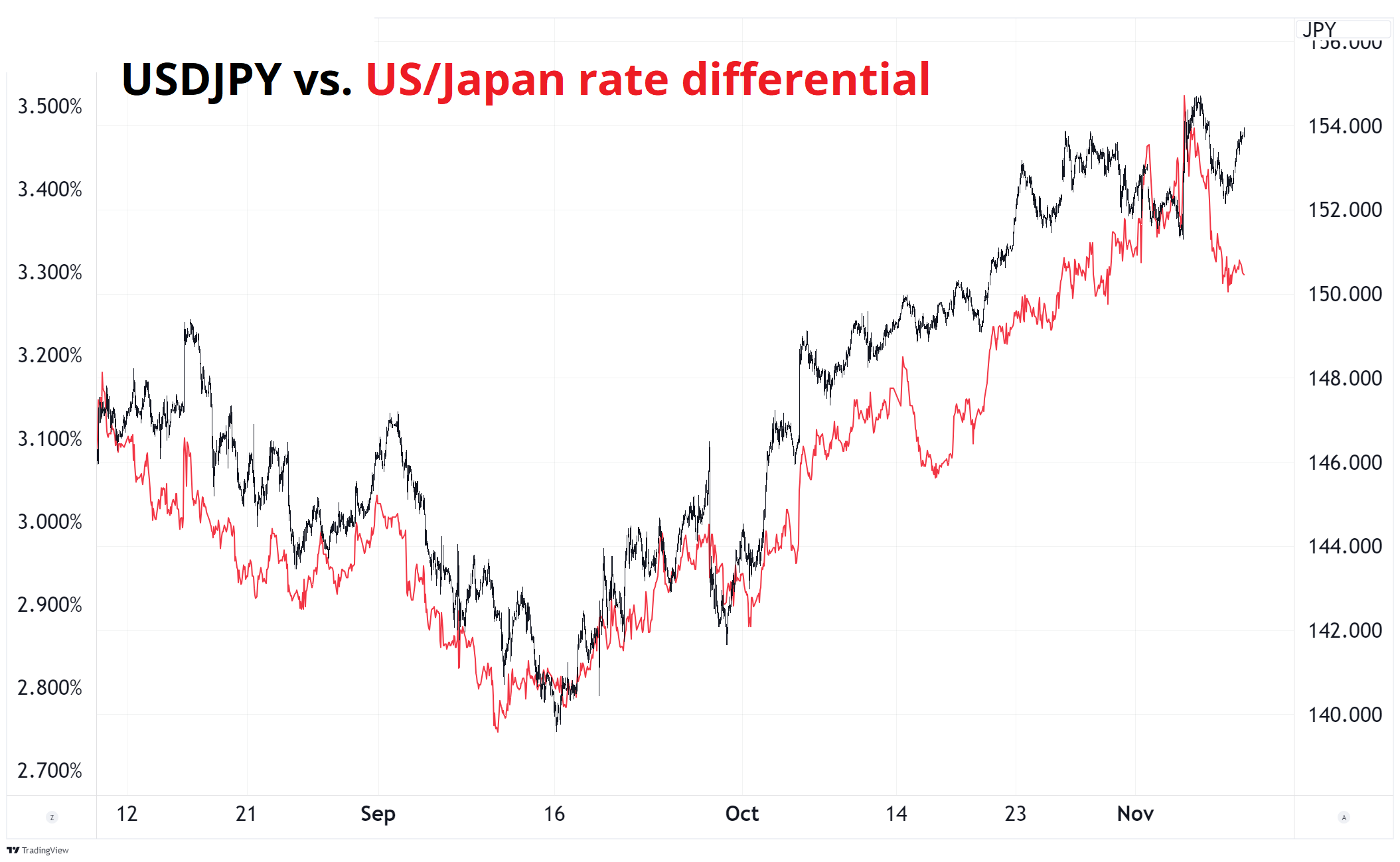

Anyway, for now, the USD is ripping, yields are unchanged, and commodities are lower—this is exactly what would make sense if you got huge across-the-board tariffs that threaten global growth, are mildly inflationary, and drive USDCNH higher EURUSD, AUDUSD, etc. lower. That’s a decent ex-post explanation for why USDJPY and yields have decoupled, I suppose. Explaining weekend game results on Monday is easier than forecasting them on Friday.

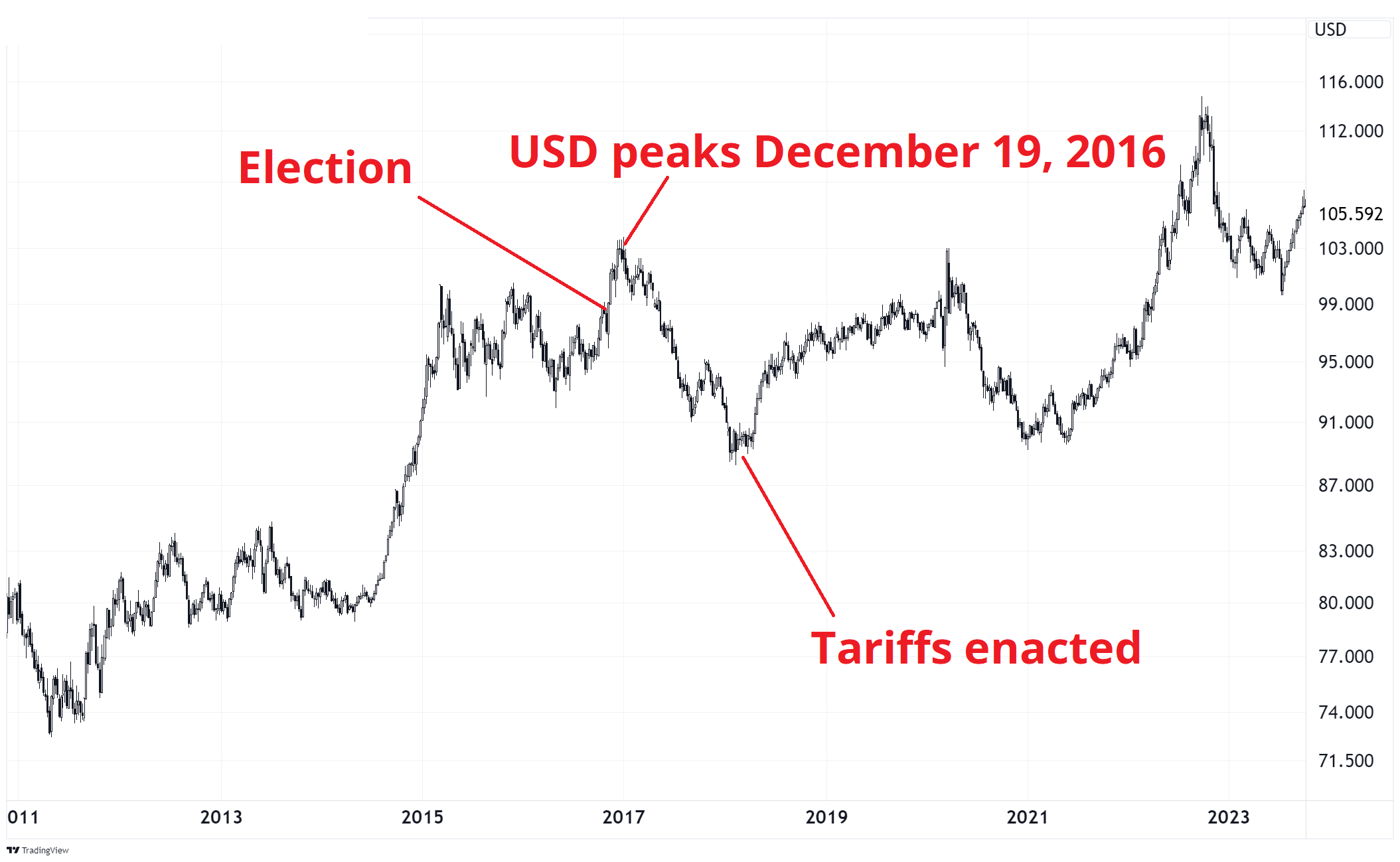

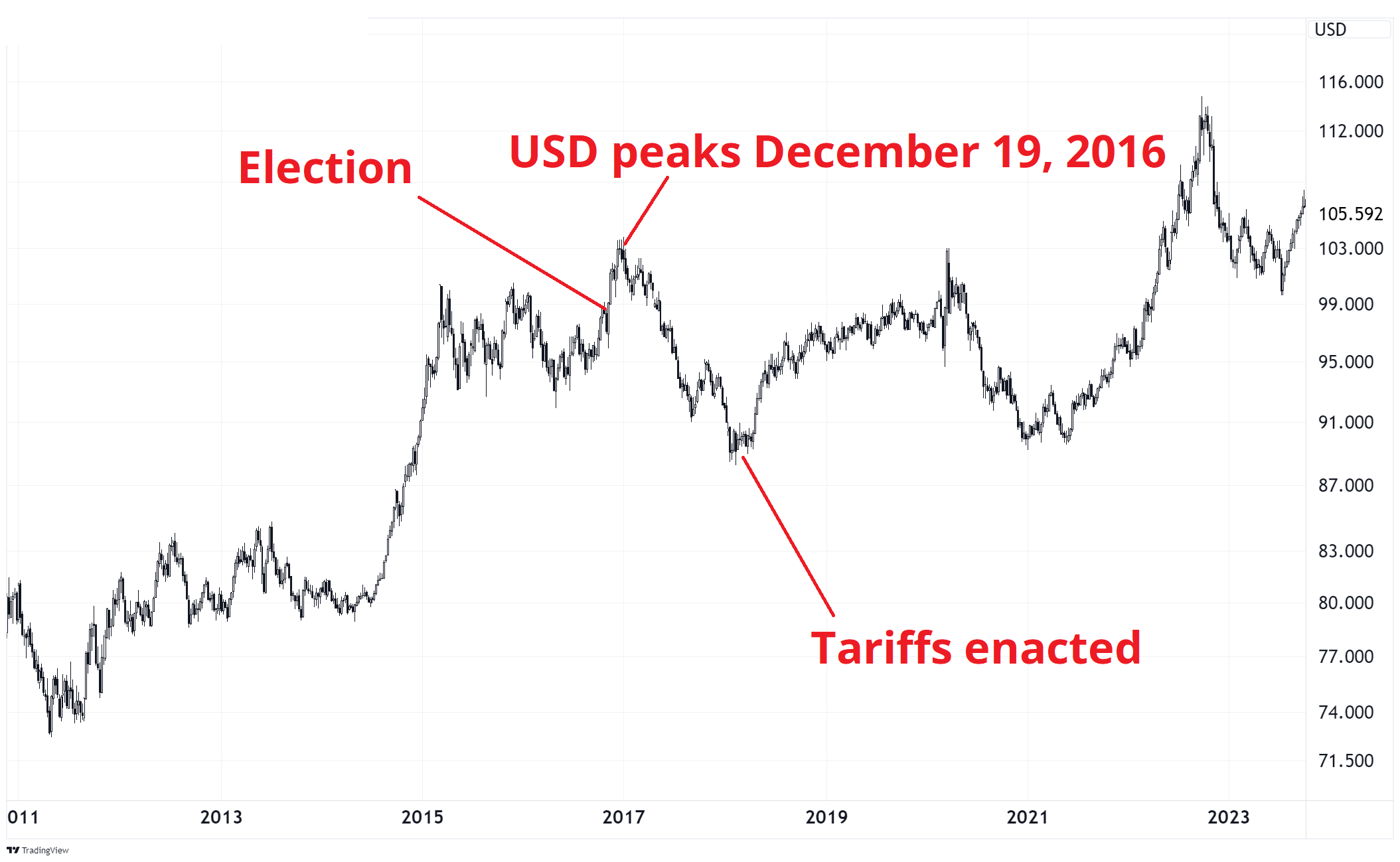

The dollar is a bit of an enigma for me here—it’s not completely obvious it needs to rip higher from this point as yields are stable, the tariffs story is still unknown, the deficit reduction vibes are palpable, and our prior experience with Trump initially saw a weaker, not strong dollar. Then again, global growth was strong in 2017/2018, the Fed was hiking, and tariffs took forever to enact. So, it’s pretty easy to argue this time is different.

The USD rally in 2018 appeared to coincide with the launch of tariffs after Trump spent a year trying to negotiate and finagle with various trade investigations, etc. This time, you can argue tariffs on China are coming on Day 1 and so the USD should just rip straight through to inauguration day.

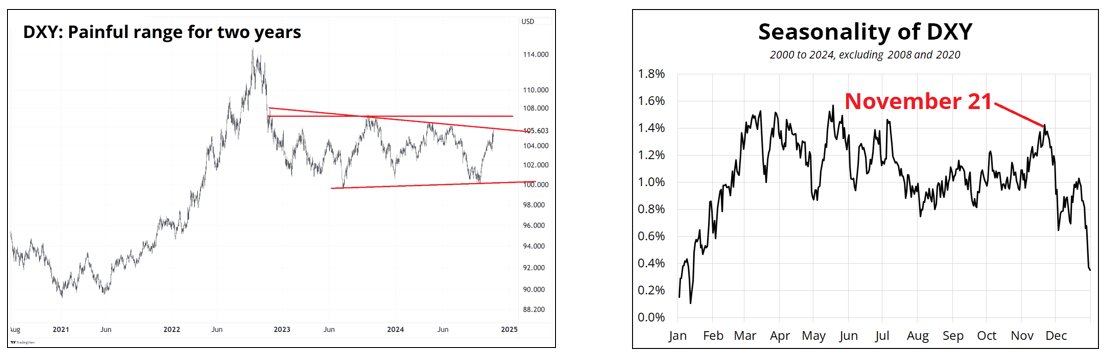

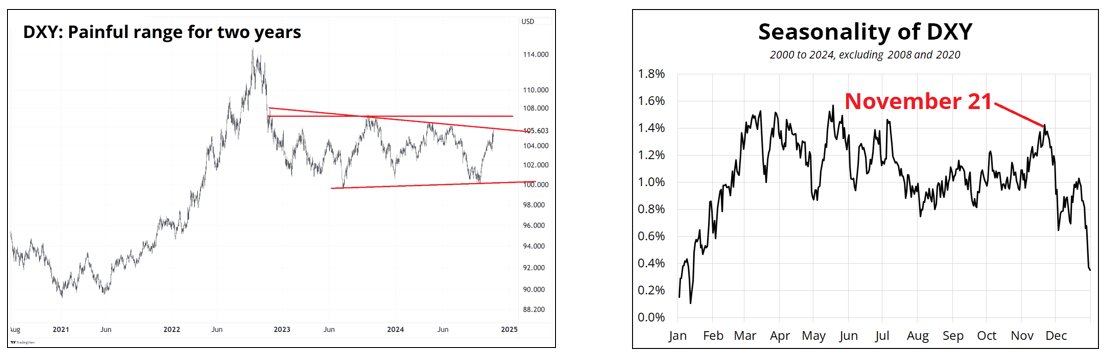

Again, I think it’s complicated. The DXY range has been a P&L destroyer for two years and we are now at the top of the range just before bearish USD seasonality kicks in. That makes it a really confusing situation for me, and I cannot commit to a dollar direction given the heavy crosswinds.

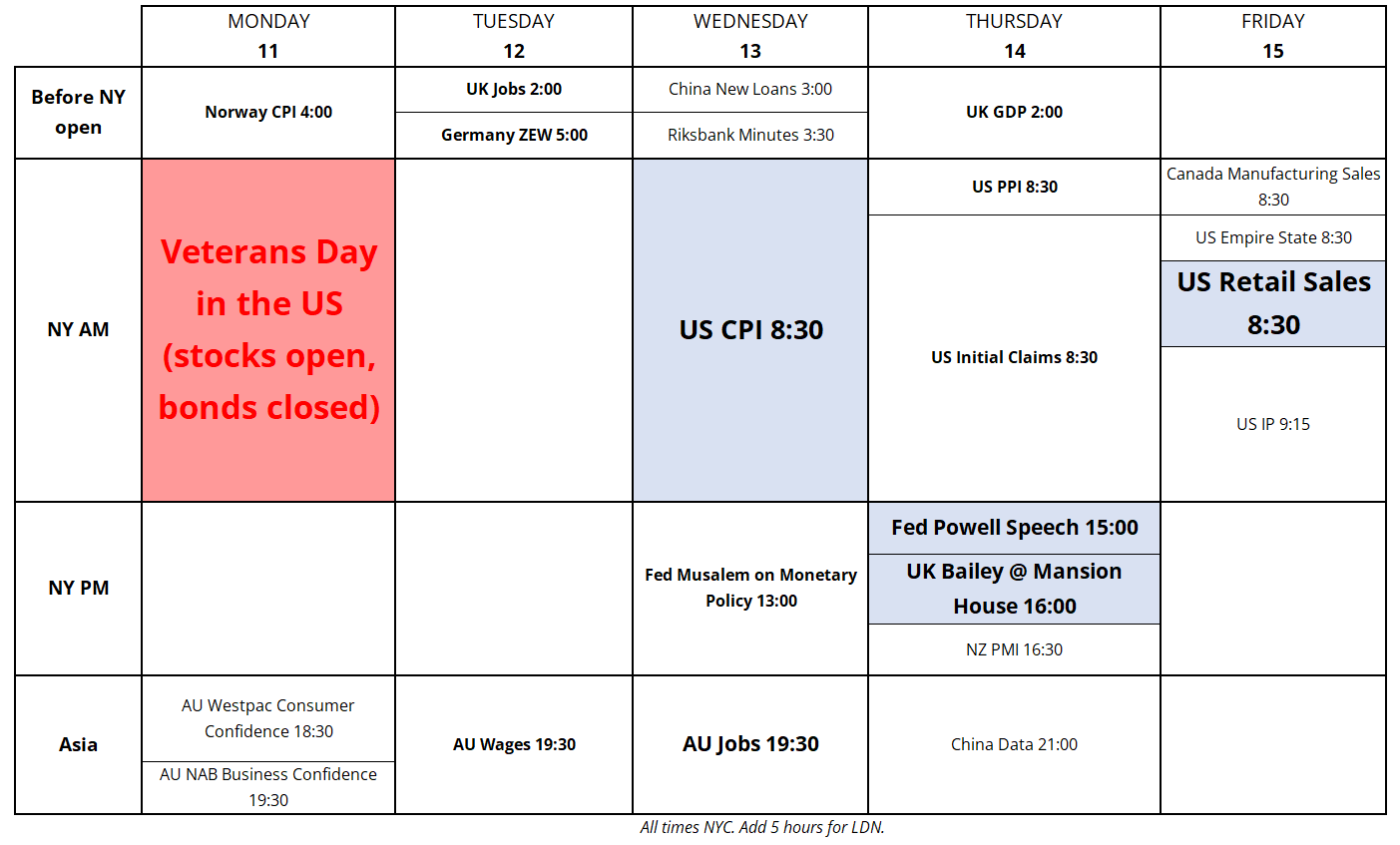

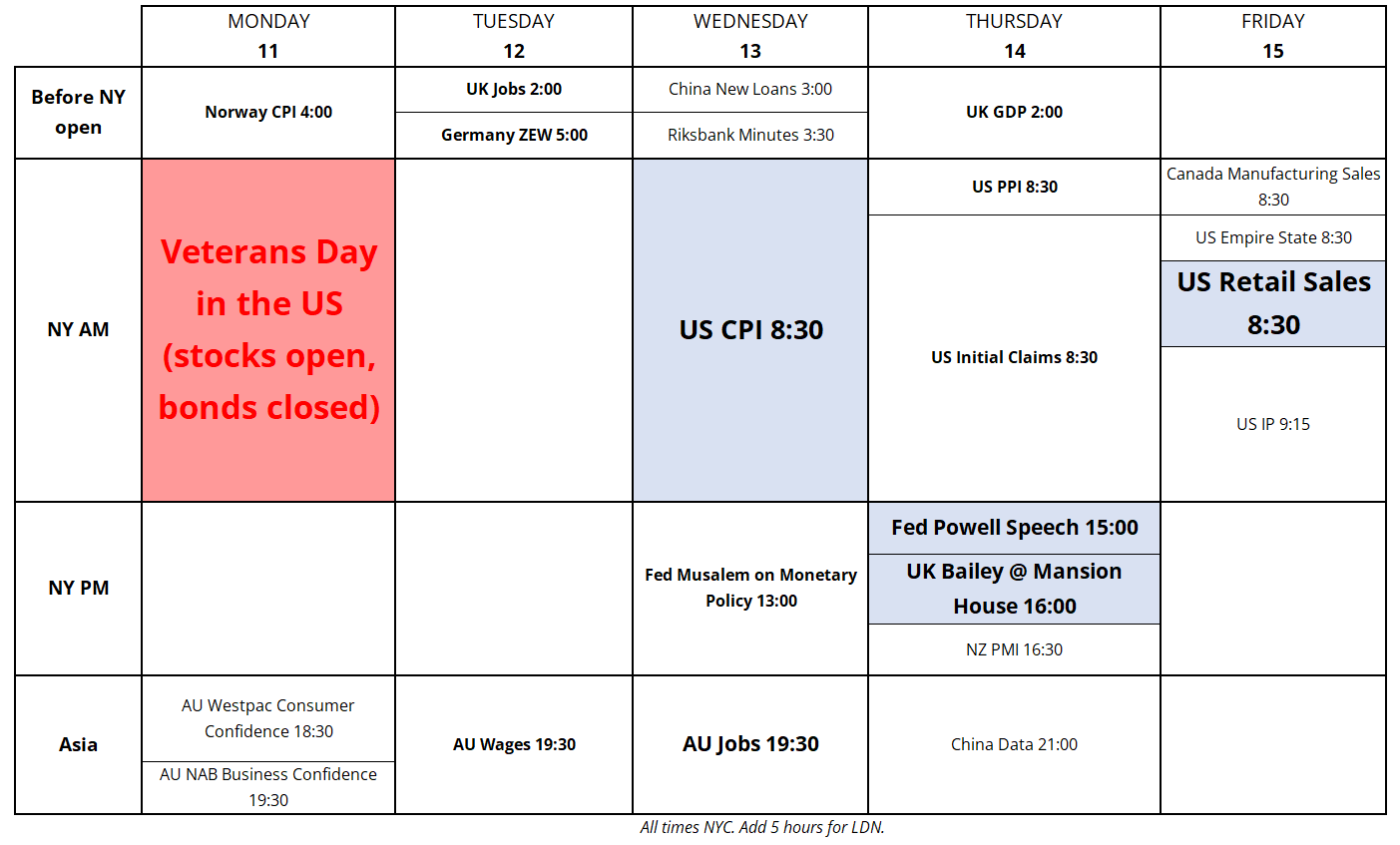

Calendar

The policy breadcrumbs matter more than backward-looking US data, but you still can’t ignore CPI on Wednesday. ZEW could be moderately interesting too if we are to believe the uptick in the Citi Surprise Index for Europe. Overall, policy leaks and announcements are the driver this week, though, not data.

Final Thoughts

With yields flat, commodities dumping, and global trade potentially under threat from Day One Tariffs… I still like the 1-month CADJPY lower view, even as it has gone the wrong way a bit since inception. The issue in the short-term is that USDJPY is higher beta than USDCAD and so a USD rally doesn’t help me, nor does the equity rally.

The froth in crypto and equities is now neck deep, so let’s see what happens. Not too late to put on CADJPY or CADCHF downside.

Have a high-flying day.