It makes sense that USDT and BTC inflows would benefit the USD, but the evidence is difficult to parse and inconclusive. Big rejection in EURUSD.

Special Japanese-designed plate allows the last noodle to be collected more easily

It makes sense that USDT and BTC inflows would benefit the USD, but the evidence is difficult to parse and inconclusive. Big rejection in EURUSD.

Special Japanese-designed plate allows the last noodle to be collected more easily

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

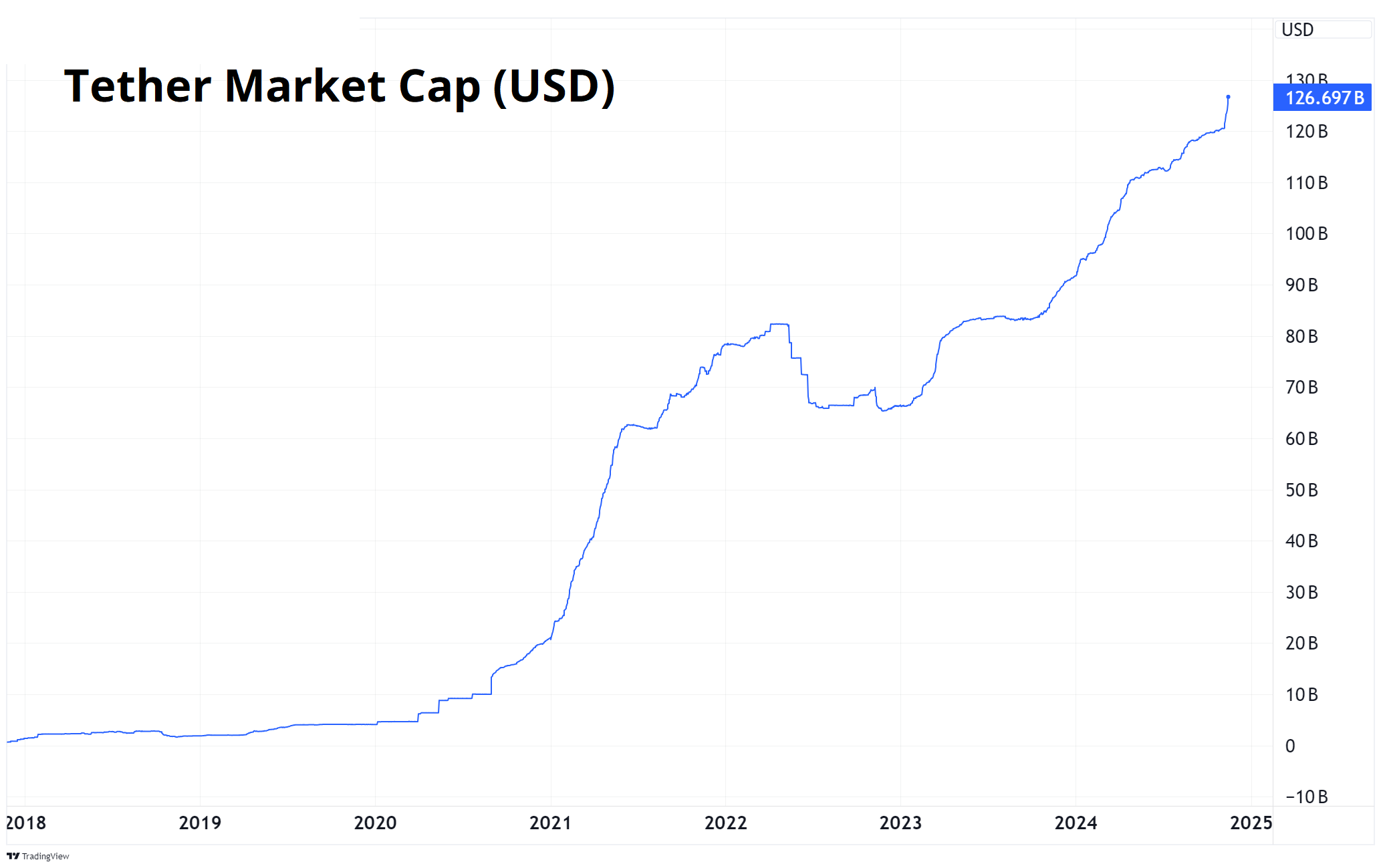

An old idea that did not end up being true was that blockchain and crypto would threaten the USD’s hegemony and its role as the central unit for global transactions. In fact, crypto has increased USD hegemony as crypto transactions flow through a stablecoin ecosystem built entirely on the USD. 99% of stablecoins are USD-based, with only a tiny remainder in EUR and other currencies.

As such, when non-US residents want to buy crypto, they most often do it by selling their home currency and buying USDT or USDC. While the USD critics have been worried about oil trading against non-USD currencies and the end of the petrodollar since 2005 or 2012 or whenever, they missed the emergence of a massive new commodity ecosystem built entirely on top of the USD.

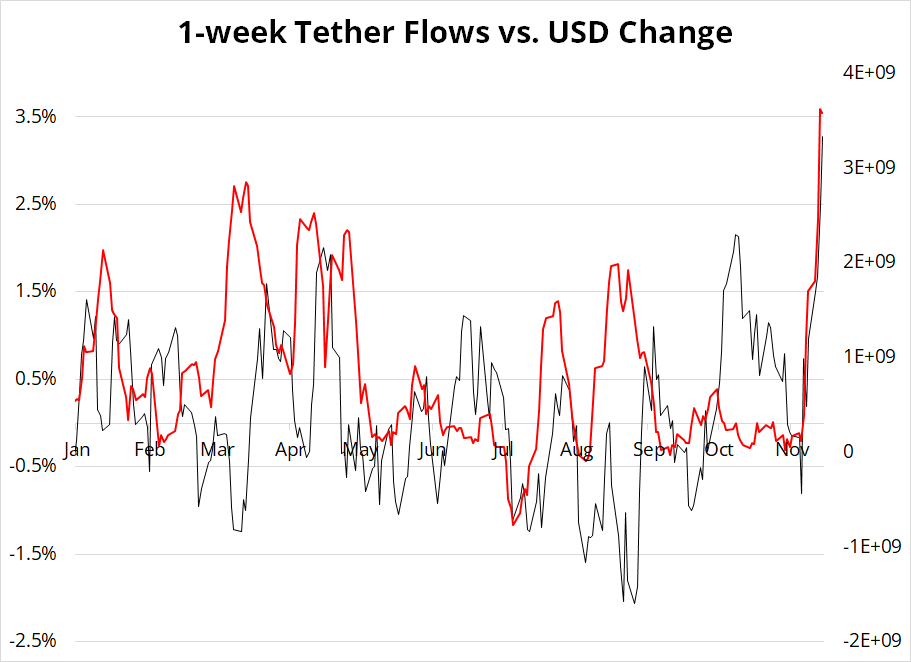

So, my question is: Are the recent flows into crypto part of the strong dollar story that we’re seeing right now? It’s hard to answer. The challenge with analyzing something like this is that there are so many other, more important drivers of the USD than crypto flows. Interest rates, obviously, but also tech stock performance, US energy independence, and much, much more. If we look at the weekly change in the DXY vs. the weekly flows in Tether in 2024, we get this:

It’s messy. If you stare hard enough at that chart, maybe you can see something. I’m not sure.

The reaction to Trump has been a massive repricing of crypto and the USD at the same time, but the cause effect is probably more about Trump and less about Tether flows creating USD demand. That is, even if it looks like a correlation, the causation is a third driver: The Trump dummy variable.

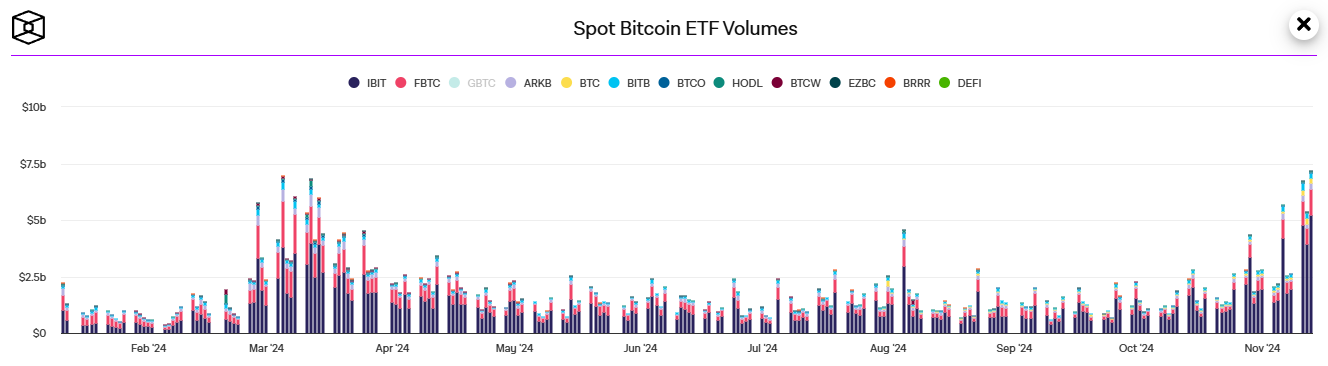

Also, 4 billion USD of FX selling (buying USD) in a week is not that huge. Then again, a decent amount of the spot BTC ETF buying on the NYSE could also be foreigners, so in aggregate, rapacious crypto demand could create enough marginal USD demand to move markets when crypto volumes are extreme.

There is too much cross-contamination from yields to make any strong conclusions here. Yes, the DXY ripped in the periods where BTC and USDT flows were largest, but so did yields. Overall, I just bring all this up for three reasons:

Let me know your thoughts. Thanks.

Quite an aggressive rejection of the 1.05 level in EURUSD today as the mega options interest down there managed to hold. We took out all the barriers (the low was 1.0497) and now we have spiked pretty aggressively. Taking a look at the chart, I think there is reason to expect a frustrating consolidation from here. I outlined a bunch of reasons yesterday (am/FX: EURUSD shorts will be less fun), so today let me just show you the chart.

This is the inverse of the DXY chart, of course, and you can see that the majority of the tortuous and torturous range that has dominated since January 2023 is bounded by 1.0480 and 1.1205.

The price action in EURUSD today should add another bullet point to my reasons from yesterday as it now looks like a blowoff bottom in EURUSD. I suppose 1.0480/1.0780 is a fair expectation for a consolidation now that we have a tradeable low down there.

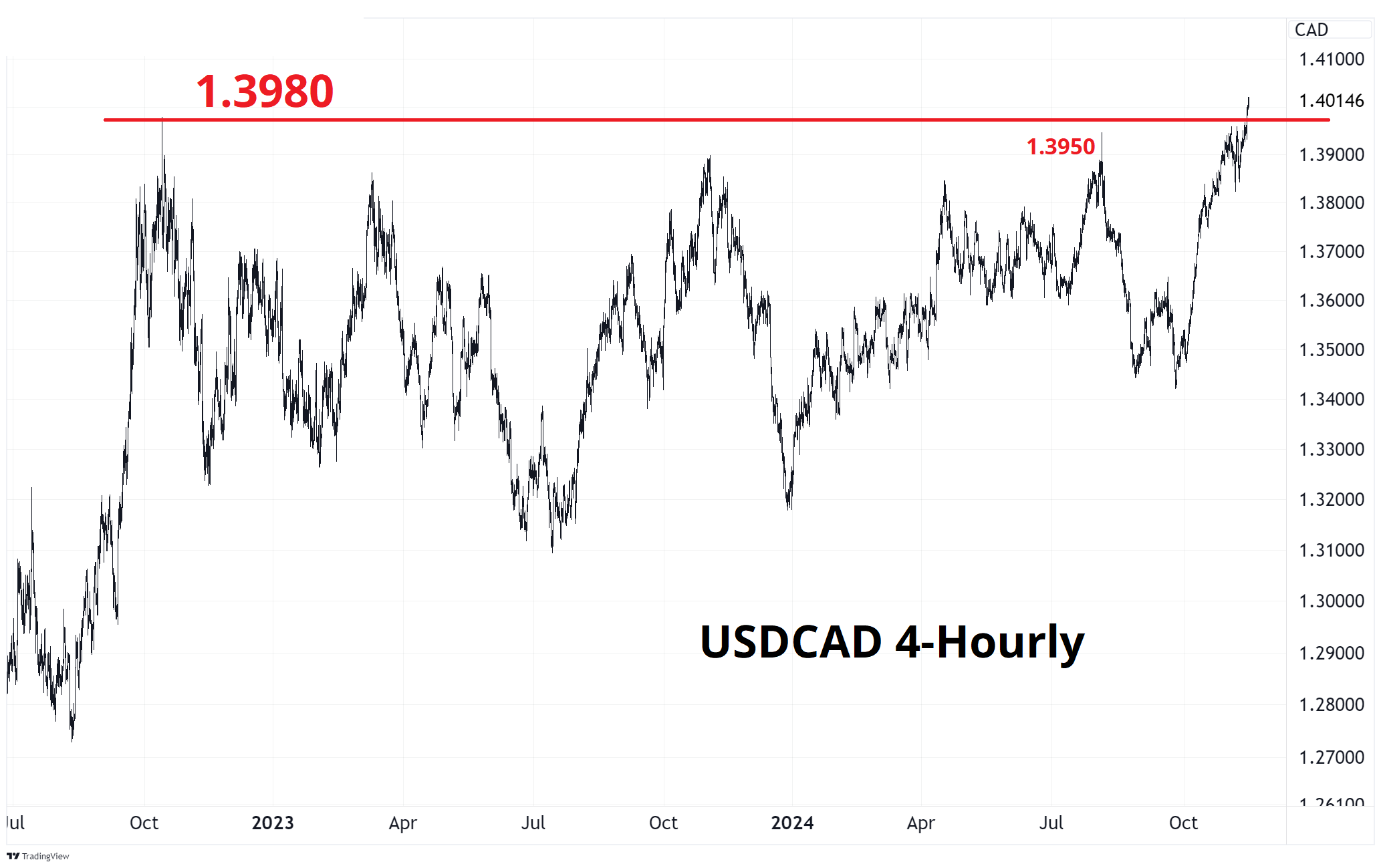

This may lead to some angst in other pairs like USDCAD if they reject their range extensions.

USDCAD took out the major post-COVID high at 1.3980 yesterday, trading to levels not seen since May 2020, so if we get back below there, watch out. The market is significantly short CAD but obviously having a great time so far and USDCAD continues to trade well, even with the zippy reversal in EUR.

An hourly close below 1.3980 in USDCAD would trigger a Slingshot Reversal formation. I would not pre-empt that pattern by selling USDCAD here, but I would be very concerned about long USDCAD if the Slingshot triggers.

It’s hard for specs to maintain mega conviction in the face of tech reversals when the timing and substance of Trump policy is still up in the air.

Have a groovy day.