As the zone becomes more and more flooded, the market becomes desensitized

You can’t whistle in a spacesuit.

As the zone becomes more and more flooded, the market becomes desensitized

You can’t whistle in a spacesuit.

Flat

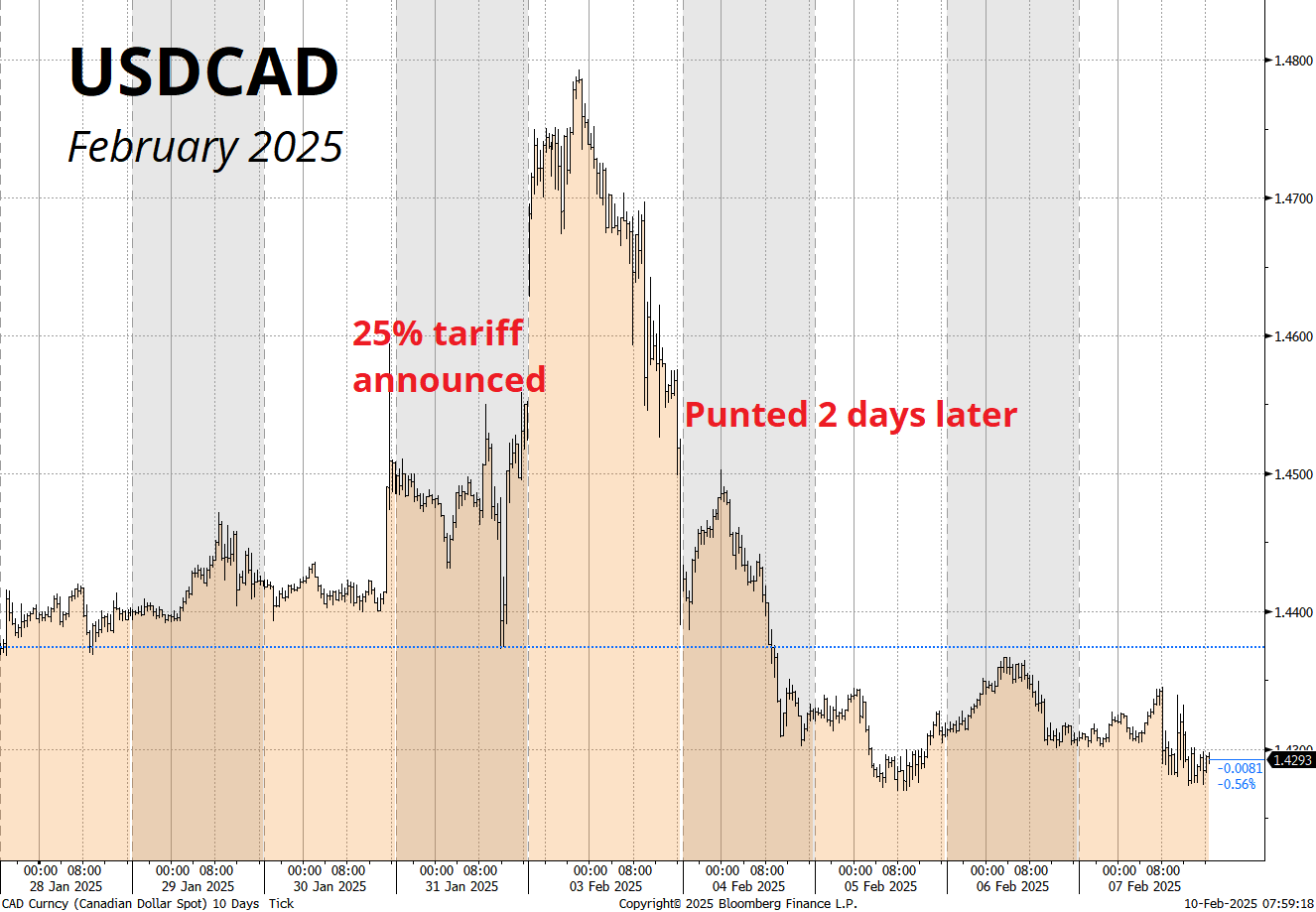

Before I left for a week off, we were talking about the fake tariffs on Mexico in 2019, which caused USDMXN to do this:

And then last week, we got this:

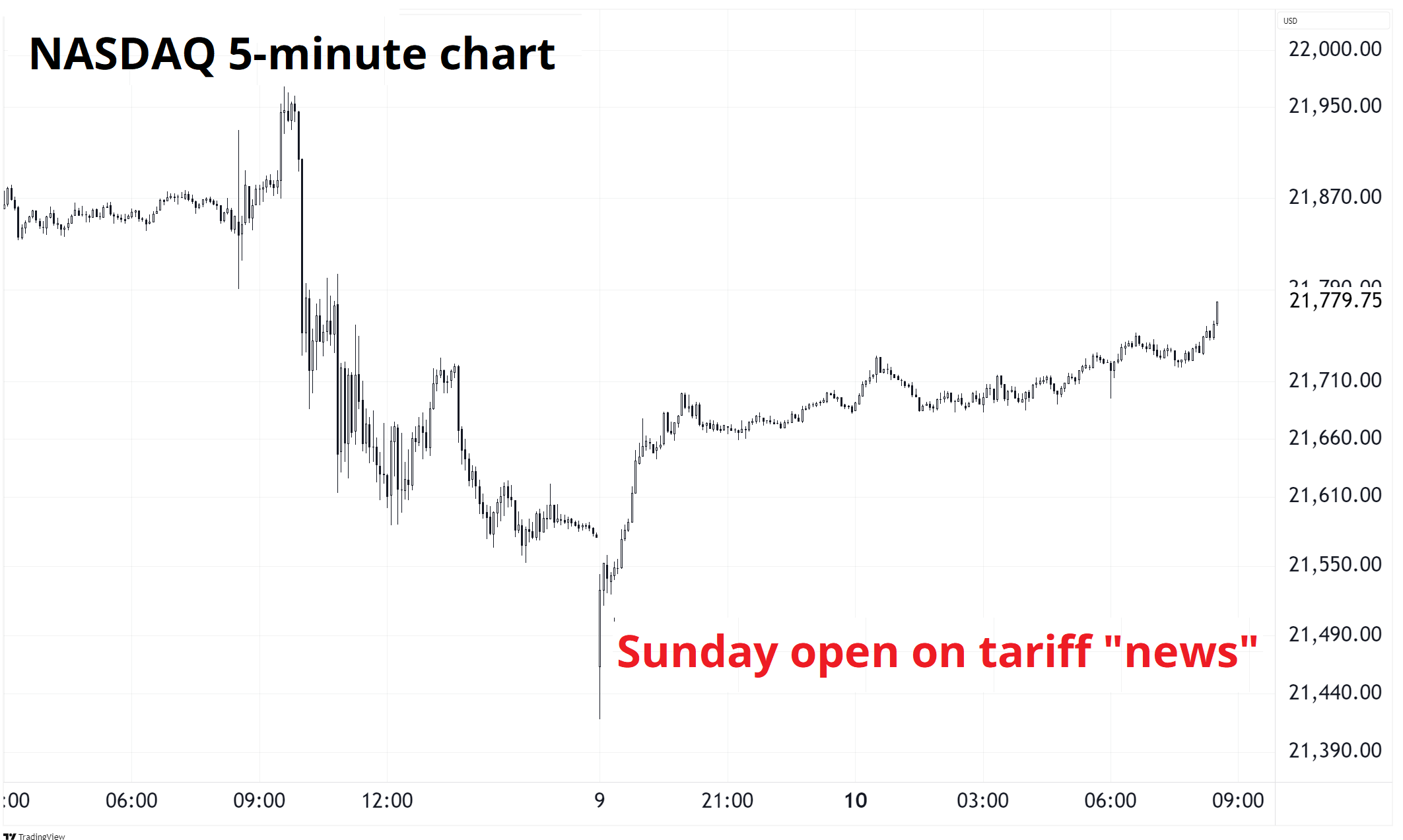

Now this weekend we have more tariff threats on Europe, along with the suggestion that some aluminum or steel tariffs might drop today. And stocks shrugged it off immediately (see chart).

The market is clearly becoming desensitized to the threat of tariffs as the credibility of the threats is mixed. Yes, the tariffs on China are real, but for every utterance there is only X probability of it being true and it’s close to impossible to assess the value of X for each individual threat. We need to go back to the overriding framework of Trump’s communications, as outlined by Steve Bannon in 2019:

Steve Bannon: The opposition party is the media. And the media can only, because they’re dumb and they’re lazy, they can only focus on one thing at a time… All we have to do is flood the zone with shit. Every day we hit them with three things. They’ll bite on one, and we’ll get all of our stuff done. Bang, bang, bang. These guys will never — will never be able to recover. But we’ve got to start with muzzle velocity.

And there has been plenty of muzzle velocity so far. This excellent weekend email ramble from Eric Peters of One River Asset Management captures the incoherence of the zeitgeist perfectly:

Did stocks puke this Monday? Or last? Maybe both? And I seem to remember that Crypto tanked too because of a trade war with Mexico and Canada that lasted hours. Makes no sense the more I think about it. But maybe I’m conflating that sell off with the DeepSeek air-pocket that happened a month or two ago. Or was that two weeks back? Big tech ramped up AI spending plans anyway. Why did Bessent wait so long to launch a sovereign wealth fund? And where did Mexico find 10,000 troops to seal off its northern border? Didn’t know they even had an army. And did we impose new tariffs on China? We might have. Or maybe that was Europe, and the Chinese trade war comes later? Saw some clip on X where Japan’s Prime Minister Ishiba pledged to invest $1trln in the US. Does that include existing investments? Oh crap, I might be confusing Ishiba and Mayoshi Son. Oh well. And did USAID really pay Politico $8mm last year? BBC and NYT too? Mexico’s President Sheinbaum applauded the dismantling of USAID, saying that if the US wants to help with development, it should be done in a transparent way. Rwanda’s President Kagame voiced his agreement, saying Africa must wean itself off aid, “I think by being hurt, we may learn some lessons.” Like all matters of substance, the closer you examine them, the more ignorant of their complexities you discover you are. And Hegseth committed to a full audit of the Department of Defense and its $850bln budget. Did Panama just kick the Chinese out and grant our warships free passage? Why did we have to pay in the first place? Elon’s going after Medicare and Medicaid fraud, with his band of nerds ripping through Adderall and antiquated databases. And apparently, we’re going to shut down the Department of Education and let our states figure out how to improve upon its disgraceful results. Which will free up resources to buy Greenland, invade Canada, and build our new Gaza resort. Which all left the S&P 500 -0.2% on the week, 1.5% below its record.

Ha! Amazing and true.

So do we just ignore everything Trump says? No, we can’t. We just have to take everything and multiply it by some probability and then see what actually happens. Right now, I think the risk of actual tariffs on Canada remains high because the power vacuum in Canada creates weakness while Sheinbaum looks strong in Mexico and therefore there is probably a greater chance of an agreement or another punt when it comes to Mexican tariffs.

The issue that further complicates all this is that whether tariffs are enacted on Canada or not (for example) there is an impact anyway. Canadian investment is surely at a standstill right now. Canadian tourists are cancelling trips to the United States. Europe might cut its auto tariffs on US cars. All sorts of unintended or intended consequences are echoing around the world.

While the political landscape remains flooded, the economic story percolates on as the soft landing continues, but inflation looks increasingly problematic in the short run. Even as market implied rents fall, there is some awkward seasonality to deal with first because December tends to be weak (and it was) while January and February inflation figures tend to come in strong.

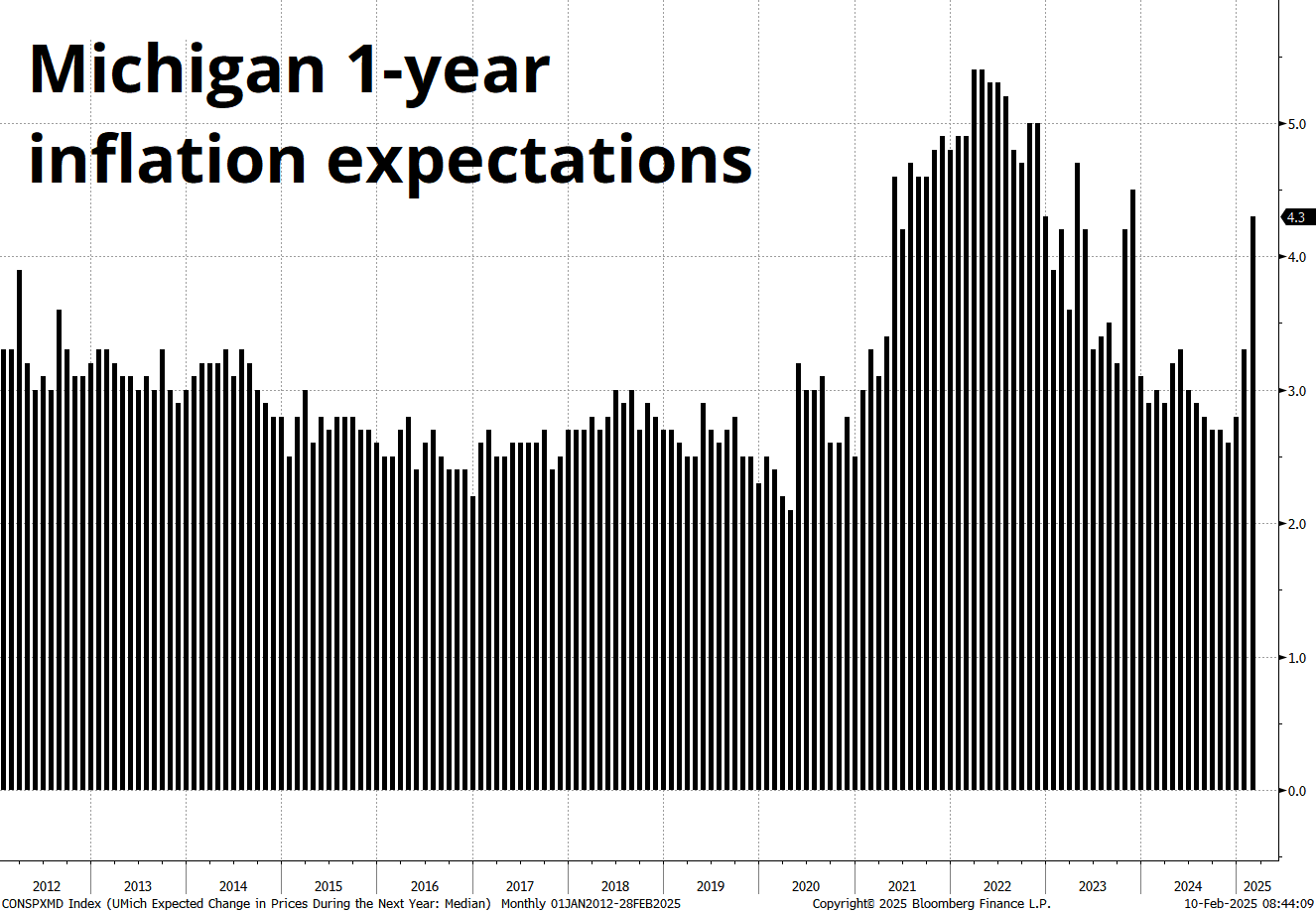

The market knows this, and so I would expect bonds to trade heavy into and through Wednesday. I will get into the details on CPI seasonality in a sec, but note the (admittedly volatile) Michigan expectations number skyrocketed this month, many commodity prices are ripping (coffee, copper, gold, etc.) and China CPI is finally ticking higher.

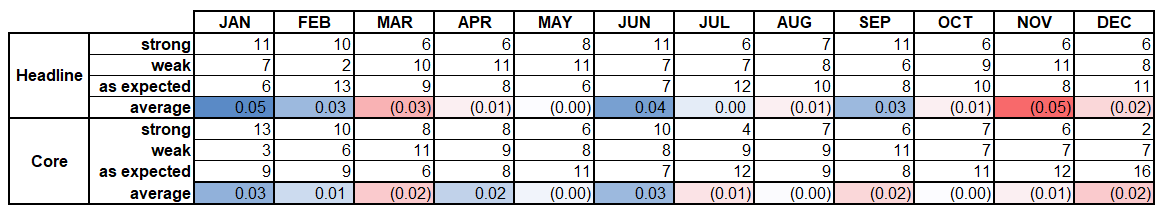

Going micro on the January data, it tends to be strong (same with February). Here are the results, by month, for CPI (Headline and Core) from 2000 to now.

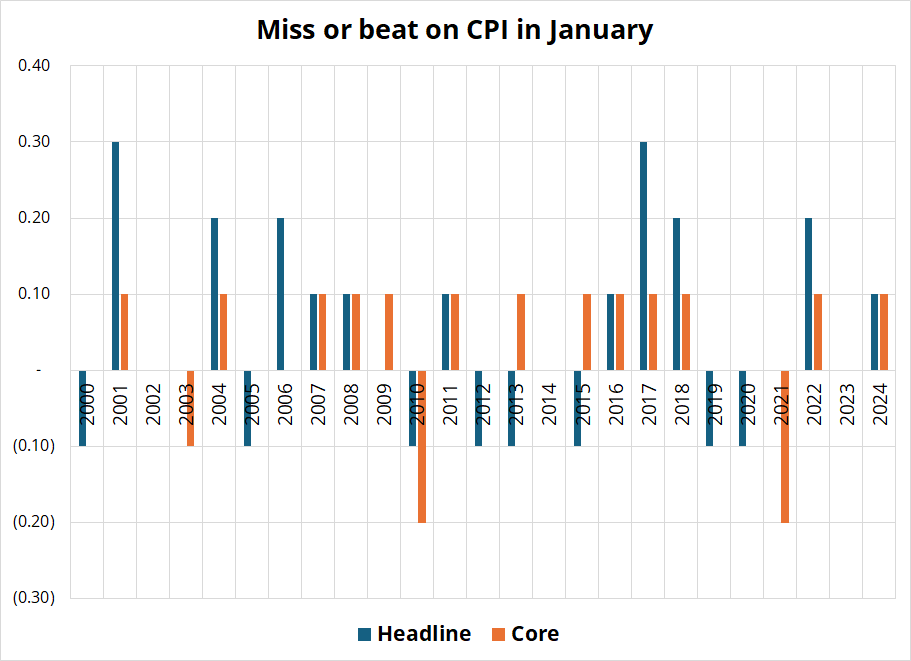

And here’s the detailed miss or beat for both CPI readings in January.

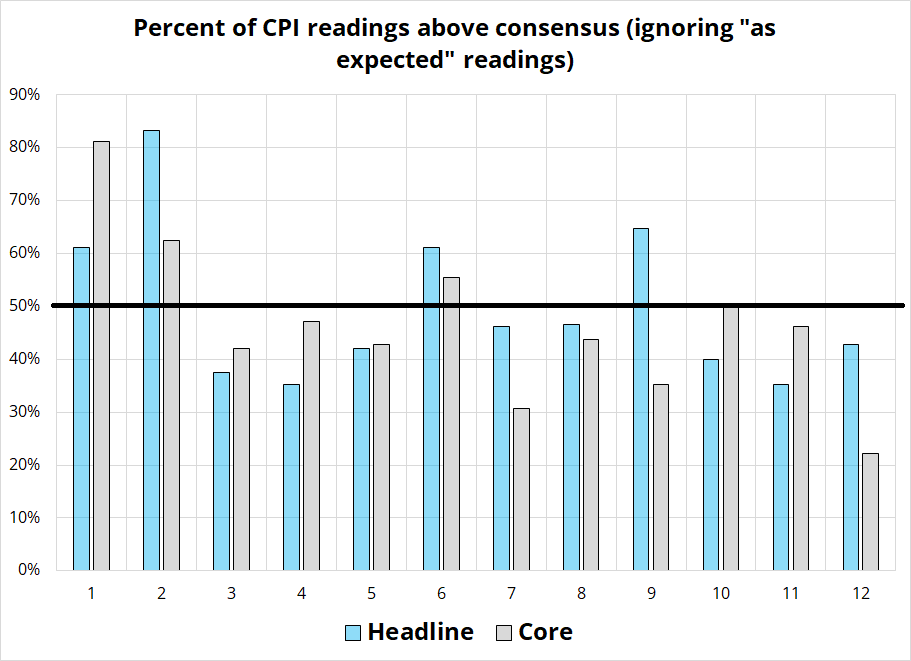

And one last chart showing the percentage of the beats and misses (ignoring “as expected”) that were strong.

So my lean is for a strong CPI release on Wednesday, though it’s also worth keeping in mind that a lot of what the Trump administration is doing right now looks likely to create drags on growth as policy uncertainty, tariff risks, government cuts and lower immigration hit just as the economy could already be vulnerable given the buoyant starting point. And then there is the explicit government targeting of lower 10-year yields to consider as well. Still, in the short run, yields should be well-supported, even if the bigger picture risk is lower yields as policy mayhem and trade war fear destroys animal spirits like it did in 2018.

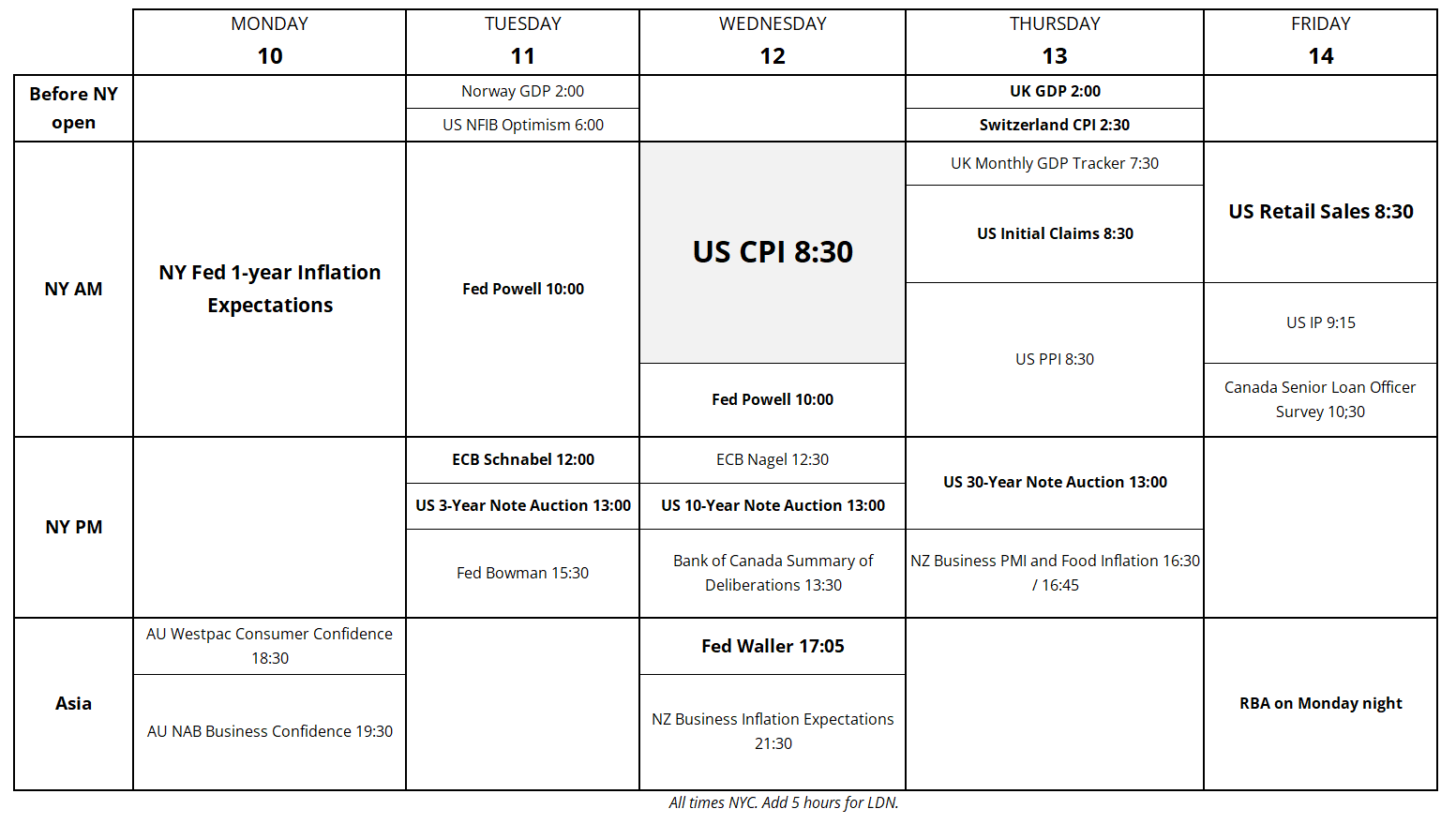

As mentioned, CPI is the biggie, with Powell, bond auctions, FedSpeak, and second-tier data sprinkled throughout.

The MAG7 have been much-hated and most crowded off and on for seven years, but the risk now is that sentiment is finally shifting for real. Capex is off the charts, it’s starting to hurt earnings, and the chart looks a bit ominous. A clear break of that triangle could signal that the sentiment turn is meaningful.

Have a musical week.

The air pressure inside a spacesuit is 4.3 psi, vs. normal atmospheric pressure of 14.7 psi and therefore there are not enough air molecules blowing past your lips to make a sound. You also can’t whistle on the moon without a spacesuit because there is no air, and you would be dead.

https://web.archive.org/web/20220809150351/https://abcnews.go.com/Technology/story?id=2894799

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

There is too much bad news for the market to keep ignoring Canada