TINA is hard to resist

The view from the terrace at Saga NYC

TINA is hard to resist

The view from the terrace at Saga NYC

Long 12SEP 1.3850 USDCAD call

~12.8bps off 1.3807 spot

I presented my thoughts on FX and then had dinner last night with a crew of FX managers from European pension funds (thanks to Jakob Sørensen). Other presenters from the Danish Mafia, like Torsten Sløk and Jens Nordvig, put forward concrete forward-looking views, while I took a bit of a different approach and talked about how many of the frameworks that once worked in FX have stopped working. While I am not a huge fan of listing problems without solutions, that’s what I did in this case because I don’t yet know the solutions to the current conundrum called FX.

Before I get to the takeaways from dinner and my presentation, let’s talk about PPI because it’s more urgent. As discussed last week, it’s unusual for PPI to come out before CPI and that can create an opportunity because the misses in PPI are predictive of miss direction in CPI. So, what you get is a market staring with mouth agape at PPI, thinking “who cares?”, because PPI is normally a bore. But in months when it comes out before CPI, it’s useful. Here you can see that PPI used to always come out first, then they switched to CPI first (mostly) in 2019.

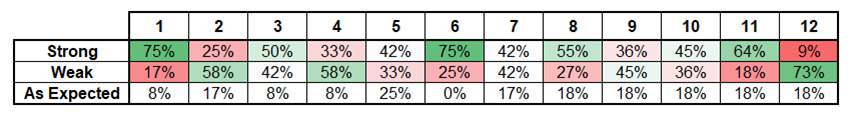

To get a good signal from PPI, you need both of them to miss in the same direction. Then, there is a strong lean for CPI. Data below. The PPI data in Bloomberg starts in 2014, which is 139 months, and the sample size here is the 96 months where both PPIs were either weak or strong. I was surprised the sample was so large, but it turns out it’s rare for PPI to come in exactly as expected, and it’s rare for core and headline to miss in opposite ways. 96 out of 139 months, both PPIs missed in the same direction.

Here’s the output. So you can see that CPI still comes in as expected a lot, but if it doesn’t, the direction predicted by PPI is good. For example, when both PPIs are weak, CPI has only been strong 16% of the time.

Not a ton of seasonality in August, but it leans strong as you can see in the next table. The top row (1 through 12) is the month of the year. Look at that turn of the year effect in December and January ha.

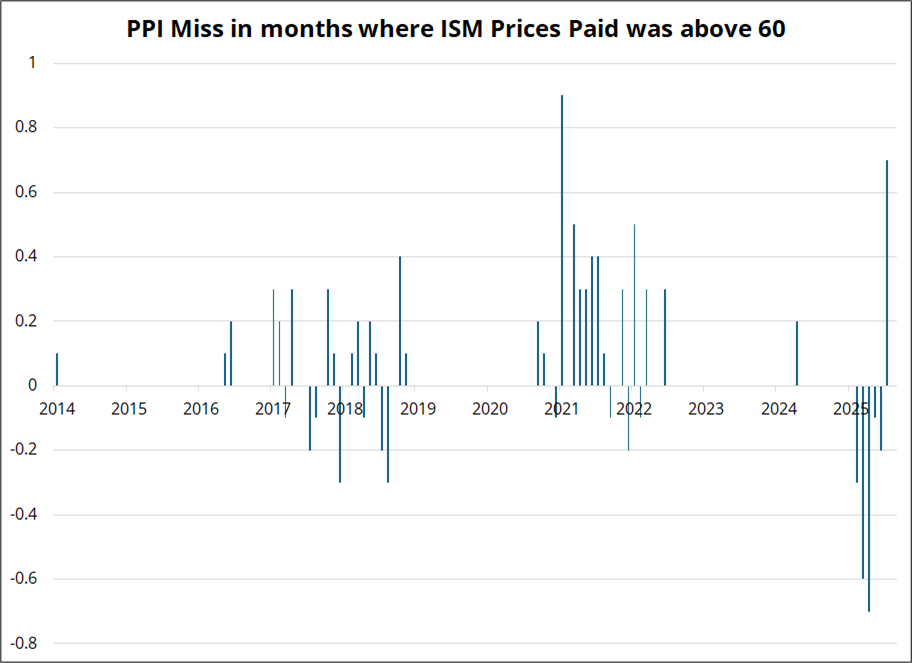

Finally, I was curious about what PPI does in months where ISM Prices Paid is above 60. Prices Paid is currently 63.7. The results are interesting only in that they seem to show a setup where recently Prices Paid was high, even as PPI kept missing early in the year, probably reflecting front-loading of imports creating an expectations vs. reality mismatch. If the snapback has begun, this would be a decent reason to lean towards a strong number tomorrow.

To summarize:

Overall, I lean 65/35 towards a strong PPI tomorrow and this will offer a good read through to strong CPI. Long USDCAD is the best expression to me, but I suppose USDJPY could bottom here again for the umpteenth time and so that would work too.

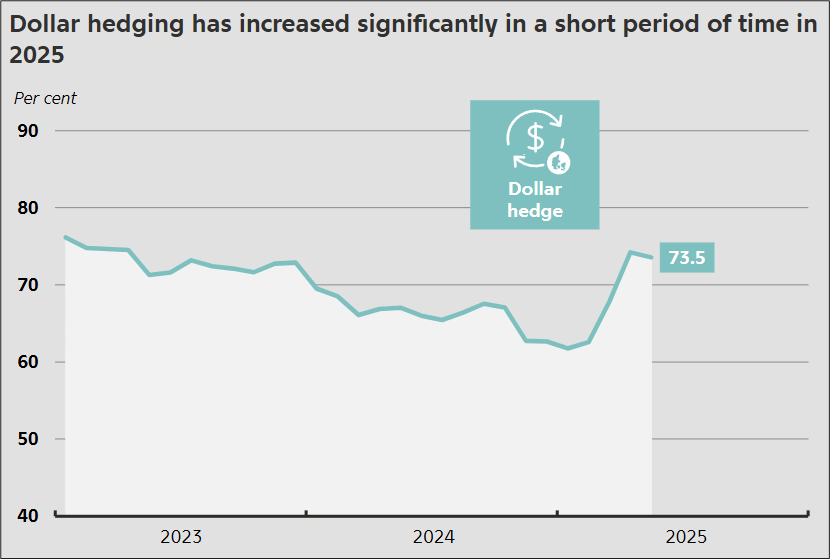

The vibe from the EU pension fund dinner last night is that they ramped up hedging either in January (lucky!) or April (less lucky!) and have now stopped adding to hedges. This chart of Danish pension fund hedging is representative.

Source: Danish Central Bank

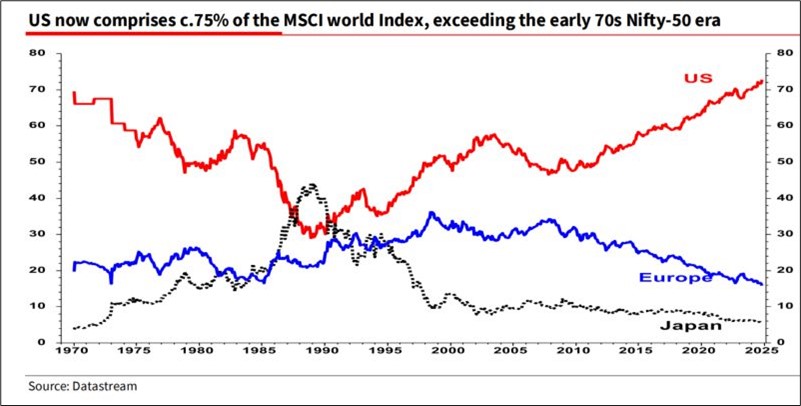

Most EU pension funds follow MSCI World for their equity allocations and there’s considerable reputational/career risk for anyone daring to go underweight USA. There was some discussion about how it’s kind of absurd that MSCI World is now 72% USA, but benchmarkers need to benchmark! Several European pension funds used to run GDP-weighted equity allocations, but after underperforming for so many years, they have all been stopped out and forced to run the MSCI World sized allocations. This forced herding is a big deal. It means 72% of all new money must go into US indexes. Sure, the US companies are super profitable, but they “only” represented 38% of global profits in 2024.

I suggested that the hedging from Canadians and Europeans might be a one off, but most of the Europeans at the dinner suggested that more hedging is absolutely possible but would require a new catalyst. Given the political catalysts can’t get any more obvious, the catalyst now would have to be a cyclical slowing in US inflation and a big drop in 2-year yields.

With fairly large hedges already in place, and no ability to reduce equity exposure to the USA due to its high weighting in MSCI World, there was not much urgency to do anything aggressive right now. Another huge round of hedging is possible if the US economy decisively rolls over, but right now it’s not obvious whether USA is in stagflation, cooldown, or a cyclical turn.

Like I said, my presentation was about how so much has changed in FX as the monetary, fiscal, and geopolitical regimes have all shifted since 2020. Here are a few super quick takeaways with some charts.

FX has been hard because:

Commodities don’t matter anymore:

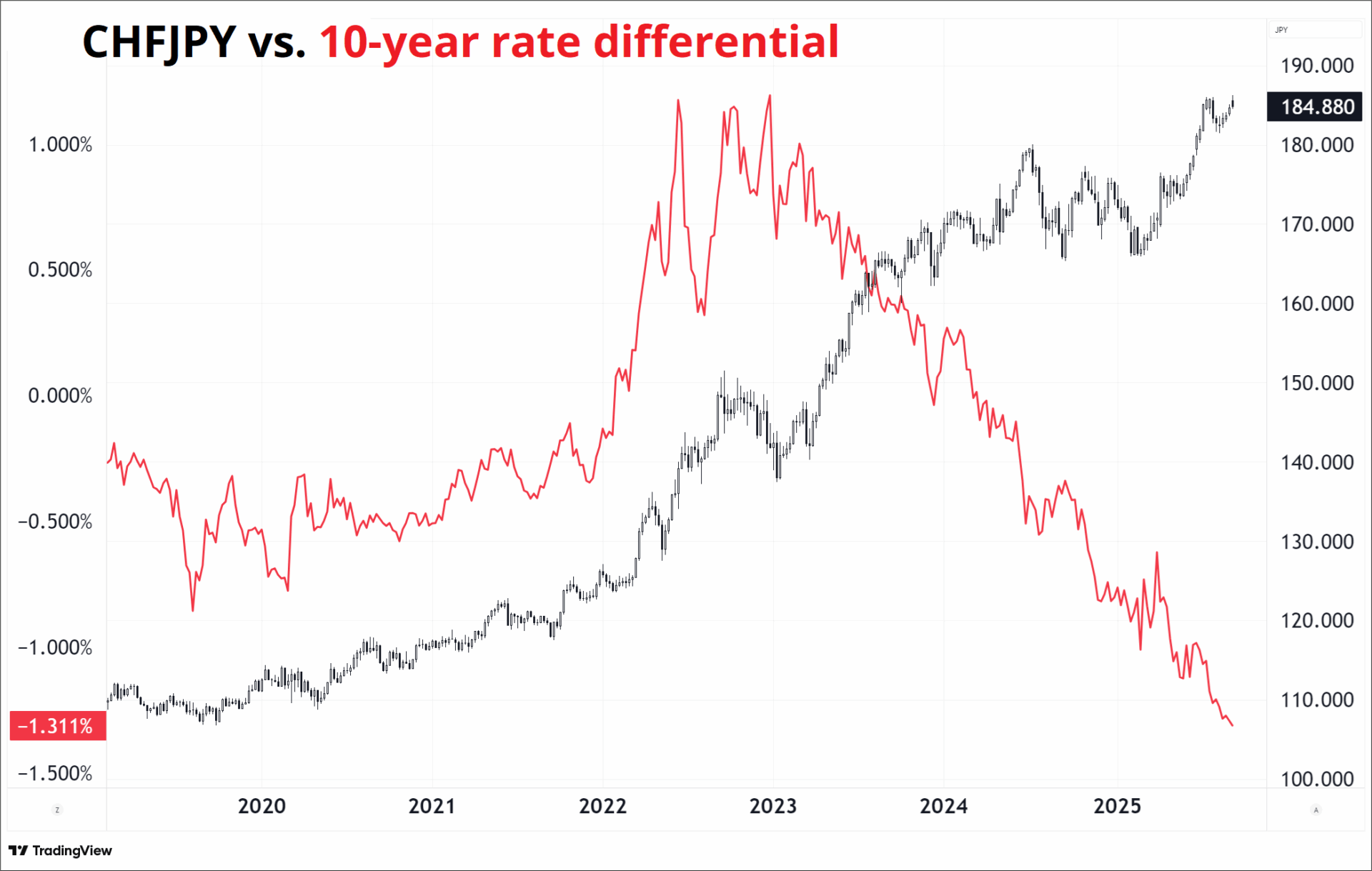

Rate diffs are not as reliable:

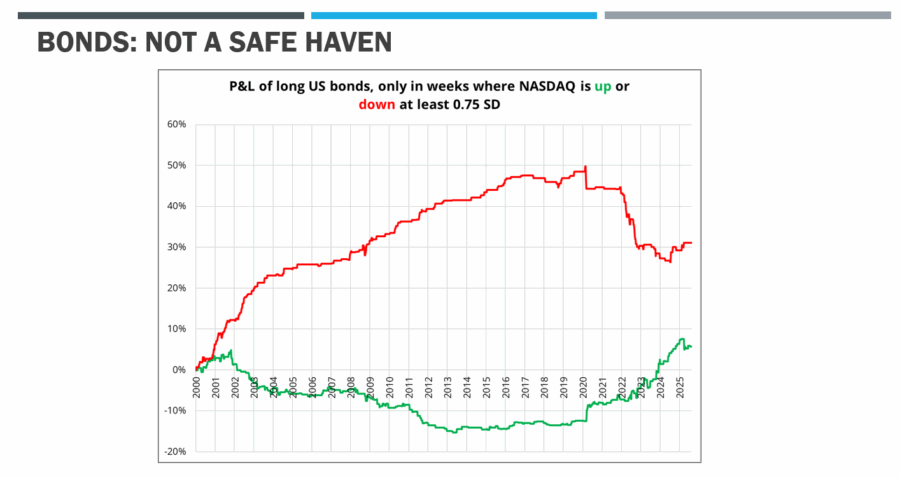

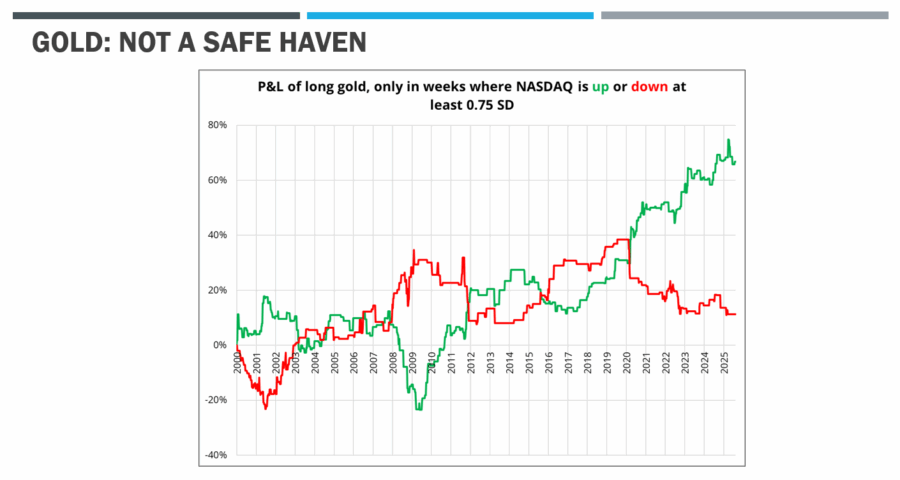

And there is a shortage of safe havens:

In a world where commodity prices don’t drive commodity currencies, Japan pension funds are not rotating into JGBs despite rocketing yields in Japan, China is not a tradable theme, interest rate differentials work and then don’t work, there are no good safe haven currencies, idiosyncratic non-US themes don’t matter as much, structural USD selling was a one-off, US jobs are weak but inflation is sticky, and everything seems to come down to the USA, TINA, and AI Capex… FX is hard!

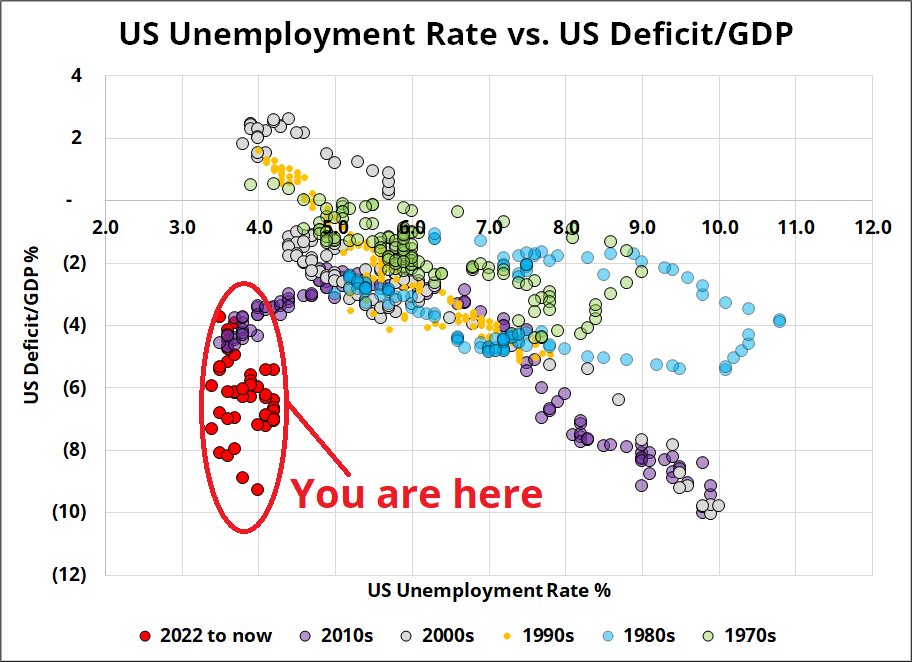

A chart I’ll never get bored of.

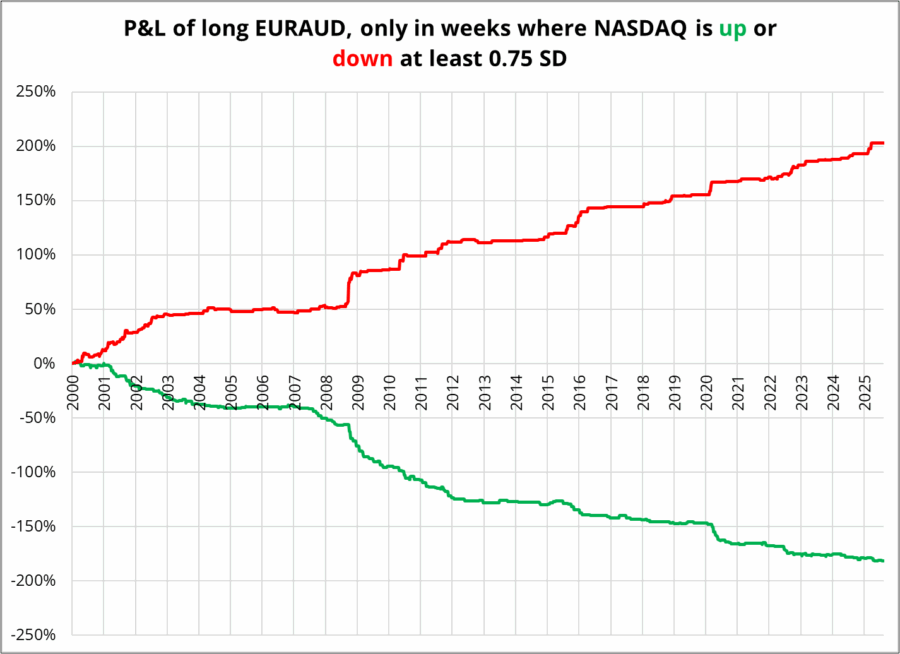

At least EURAUD is still a safe haven!

The view from the terrace at Saga NYC