I don’t think that either French politics or Lisa Cook’s firing are tradable.

The evolution of the World Cup soccer ball

I don’t think that either French politics or Lisa Cook’s firing are tradable.

The evolution of the World Cup soccer ball

Long EURGBP @ 0.8674

Stop loss 0.8589

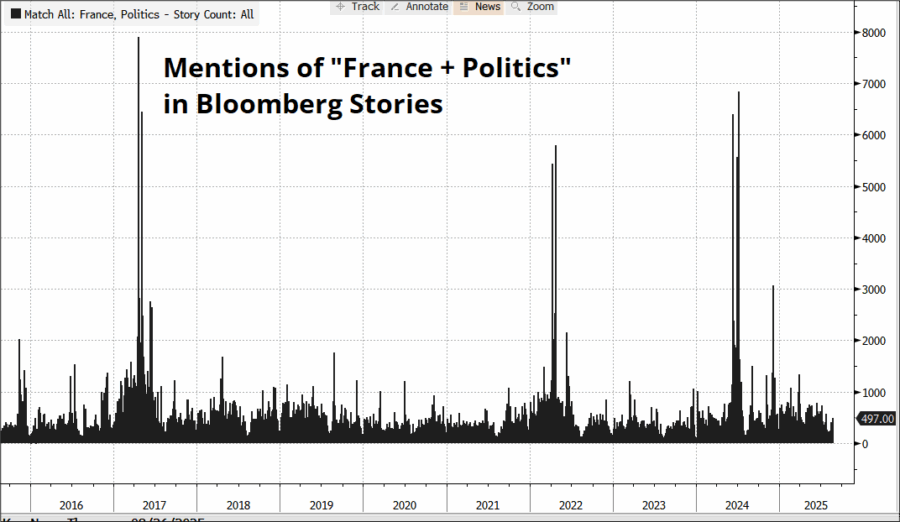

While there is real-time correlation between French yields and the euro, the effect of French politics tends to be short-lived and mean reverting. This chart shows the frequency of mentions of French politics in Bloomberg stories since 2016. You can see these flare ups don’t generally last. I am not including 2011 to 2013, of course because that was a completely different regime (Eurozone Crisis). This is not a crisis.

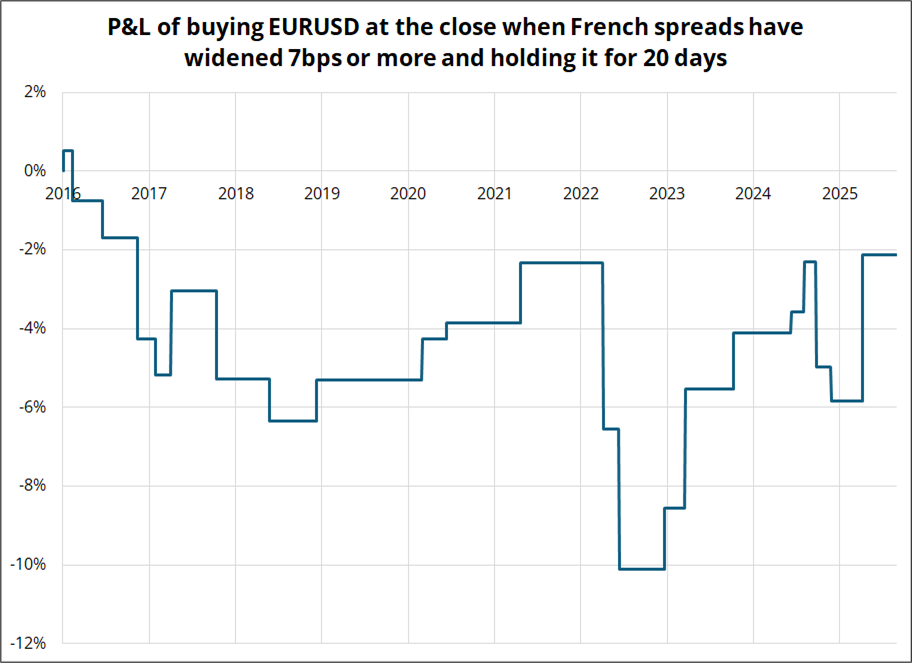

You can see the same thing if you look at spreads.

France/Germany has widened about 7bps in the past five days. Here’s the P&L of going long EURUSD after that happens and holding for 20 days.

So, if you sold EURUSD at 1.1700 as the CAC tumbled 3%, that’s great, but going forward I am not sure there is much to get excited about here. Sure, tighter fiscal in France could lead to higher corporate taxes, or less spending, or outflows from French assets. But things are just as likely to mean revert as people quickly get bored and people remember that France is maybe 15% of Eurozone GDP and 7bps is pretty meaningless in the bigger picture for a spread that has been 20bps-90bps for 10 years. If we widen beyond 90bps, that would be new wides and then maybe it’s worth getting a bit more concerned.

Meanwhile, Lisa Cook has been fired but refuses to go quietly as she channels her inner Zach de la Rocha. It is extremely difficult to judge whether this matters as the Turkification of the Fed should be sending shivers down the spine of the bond market-but isn’t. When there are troops walking around DC after another government emergency announcement and the US president is calling people LOSERS and MORONS in ALL CAPS, it’s easy to become blasé or overwhelmed as the zone is flooded. It can be hard to know what matters for markets and what is just more blustery noise.

For now, the matter of Lisa Cook seems to be another important legal battle with little impact on markets, but at some point, a completely neutered Fed will matter if inflation doesn’t cooperate. Central bank independence is a spectrum, not a binary question, and the US is clearly moving to the right on that independent vs. captured spectrum. If inflation falls and growth cools, it’s all fine, but if prices remain sticky, the bond market is going to freak out at some point.

All this brings me back to my core view on how to look at markets right now: Ignore politics and rhetoric as much as humanly possible and focus on the US data. This is the fourth time we have sold USD on Lisa Cook headlines and it might not be the last.

https://ethanding.substack.com/p/ai-subscriptions-get-short-squeezed

Have a top corner day.

The evolution of the World Cup soccer ball