EM should be safe unless upward yield velocity increases. Policy is inherently mean reverting.

EM and The Trump Strangle

Current Views

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

EM

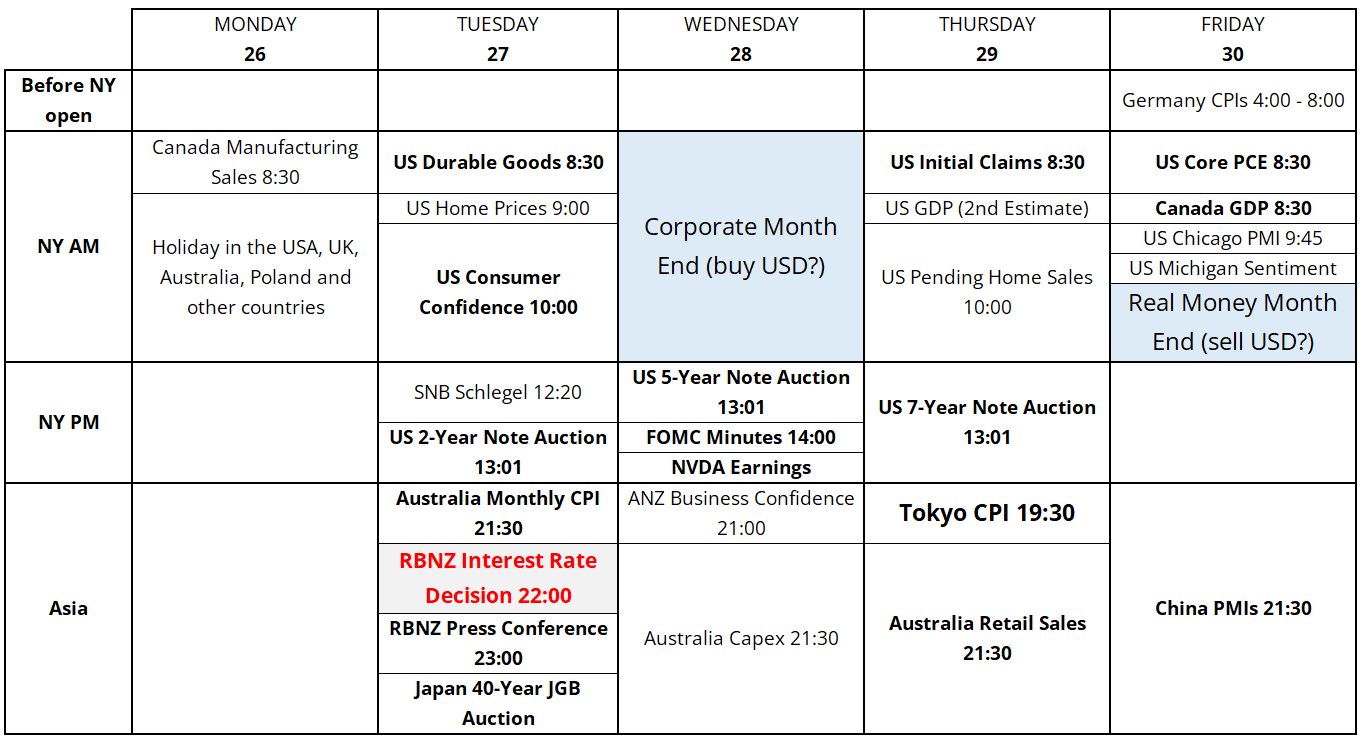

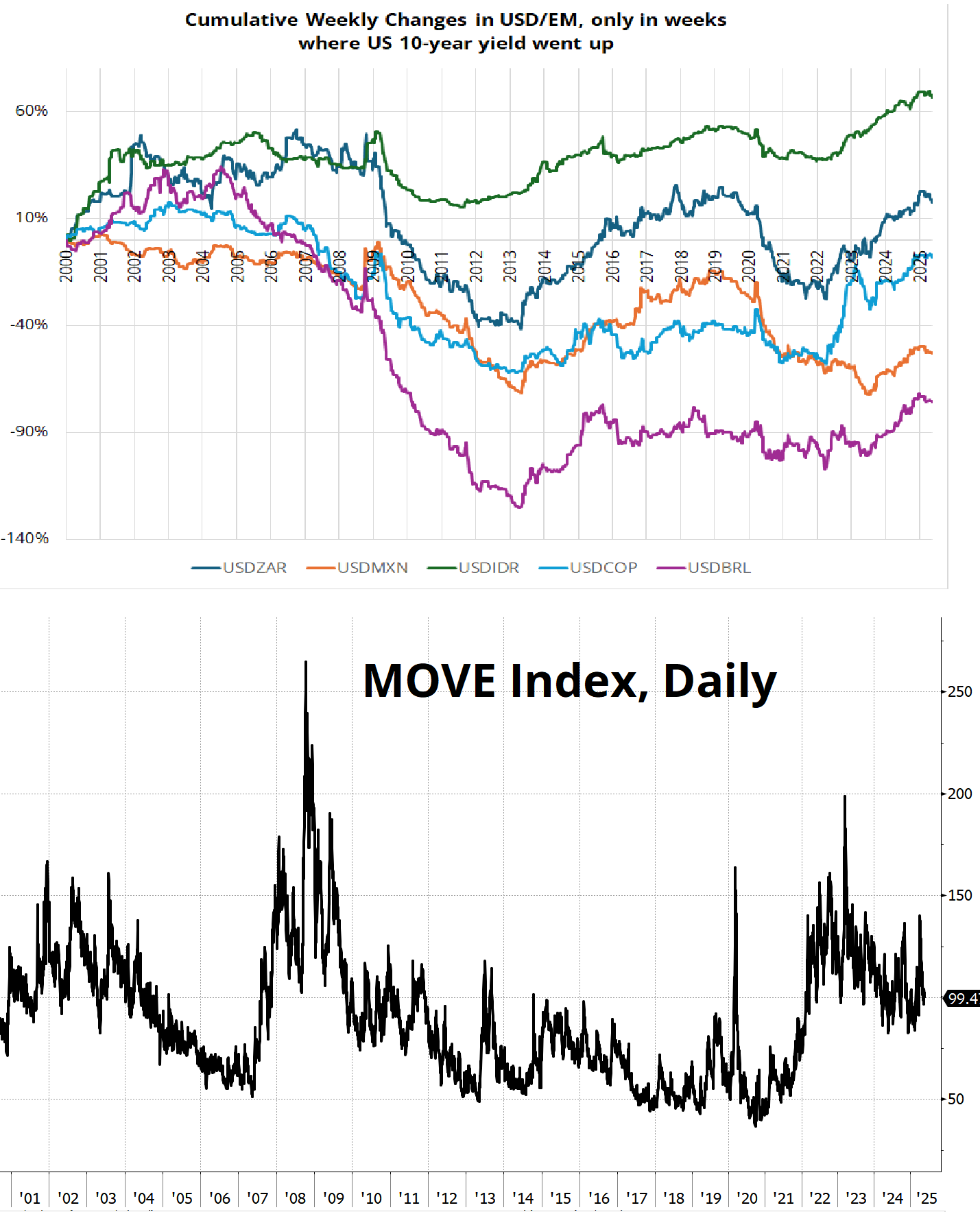

A question that keeps arising throughout this cycle and particularly yesterday is: “Why doesn’t EM ever sell off, even when US yields are higher?” First, let me examine the premise of the question. Does EM generally sell off when US yields go up? Not really. Here is the cumulative performance of five EM currency pairs, filtering only for weeks where US yields went up. You can see that it’s highly nuanced and the very broad ebbs and flows have to do with bond market volatility. The panel below my colorful EM performance lines, in black, is the MOVE Index, a measure of bond market volatility.

This is consistent with how I would describe the relationship between equities and bond yields (generally): US yields up fast = bad for stocks. US yields grinding/trending higher = OK for stocks. Of course, the most important consideration is why yields are going up in the first place. If it’s because of inflation, that’s probably bad for emerging markets. If it’s because of spicy US growth or US fiscal concerns, it’s less obvious it should be a sell EM event.

If I zoom in on the same colorful chart, you can see that the USD rallied hard against EM when yields went up in 2022 (US inflation scare and high bond market volatility and bull market for USD vs. G10) while it has sold off modestly vs. EM when yields went higher in 2025. Lower USD, lower bond market volatility, OK equity performance, and a theme of SELL AMERICA AND BUY ANYTHING GLOBAL have all kept EM buyers happy.

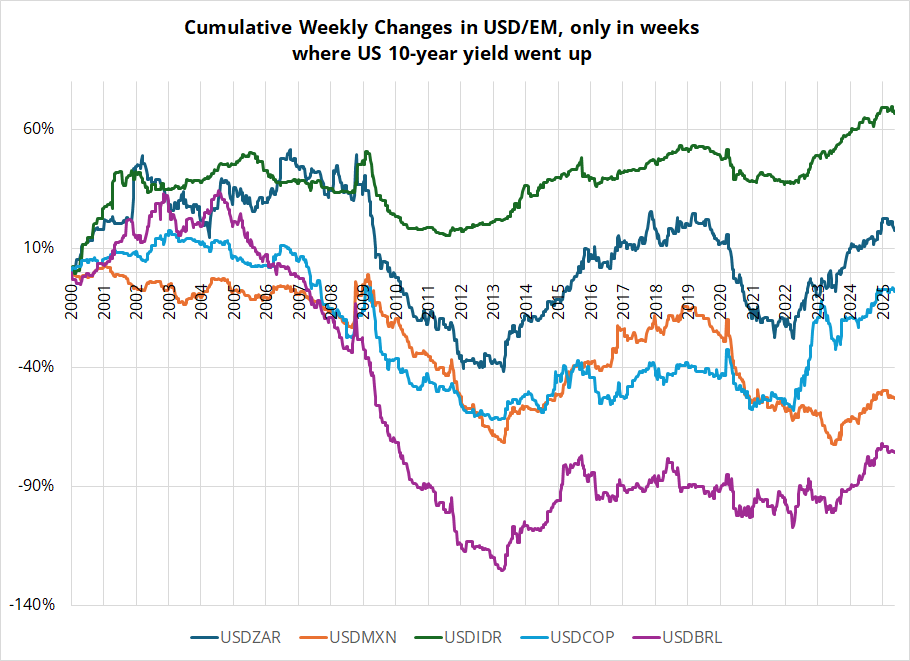

And finally, consistent with the theme of lower bond market volatility, US yields have been in a range for two years. So sure, yields have gone up from 3.90% to 4.60%, but the fear factor is still low because we are in a familiar range. As much as the narrative is about US fiscal implosion, the price action has hardly been furious.

So, if you’re long EM, the things to fear are:

- Rising yields + rising bond volatility at same time.

- Break of multi-year range in 10-year yields (above 5%).

- A move away from the SELL AMERICA theme back towards US exceptionalism.

- Higher inflation in the USA (or globally)

Until then, the most popular portfolio is working. That being: Short US bonds, short USDJPY, and long carry (via selling USD calls vs. EM, etc.)

Buy bad news sell good news

Nick Timaraos with a friendly reminder: “In 2019, when the market would recover, he’d escalate again. We are on the ‘market has recovered’ part of the fly wheel.” There is implicit mean reversion when government policy pivots based on the level of the S&P 500. In a normal regime you have the Fed put, but now we must contend with the Trump Strangle.

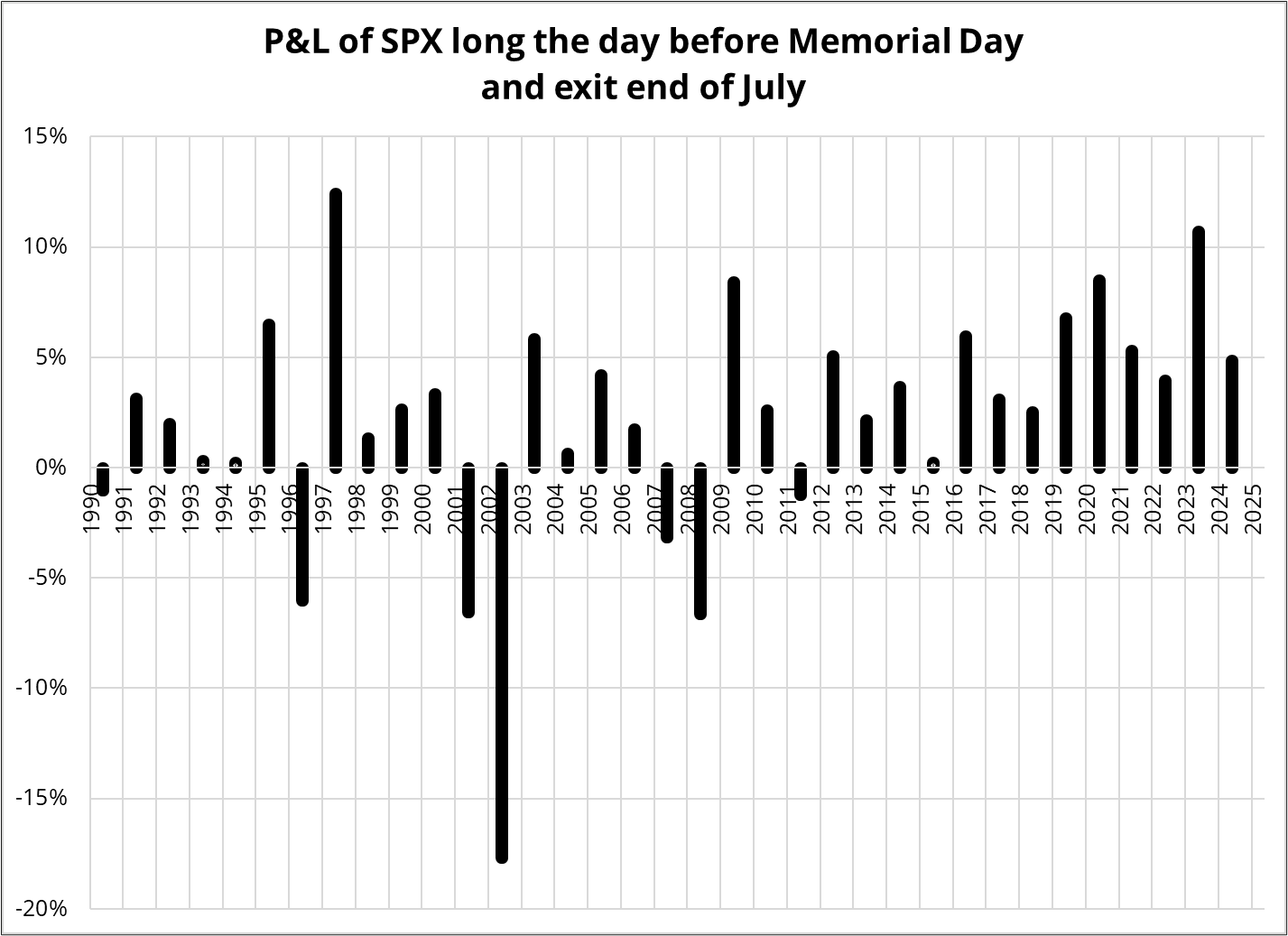

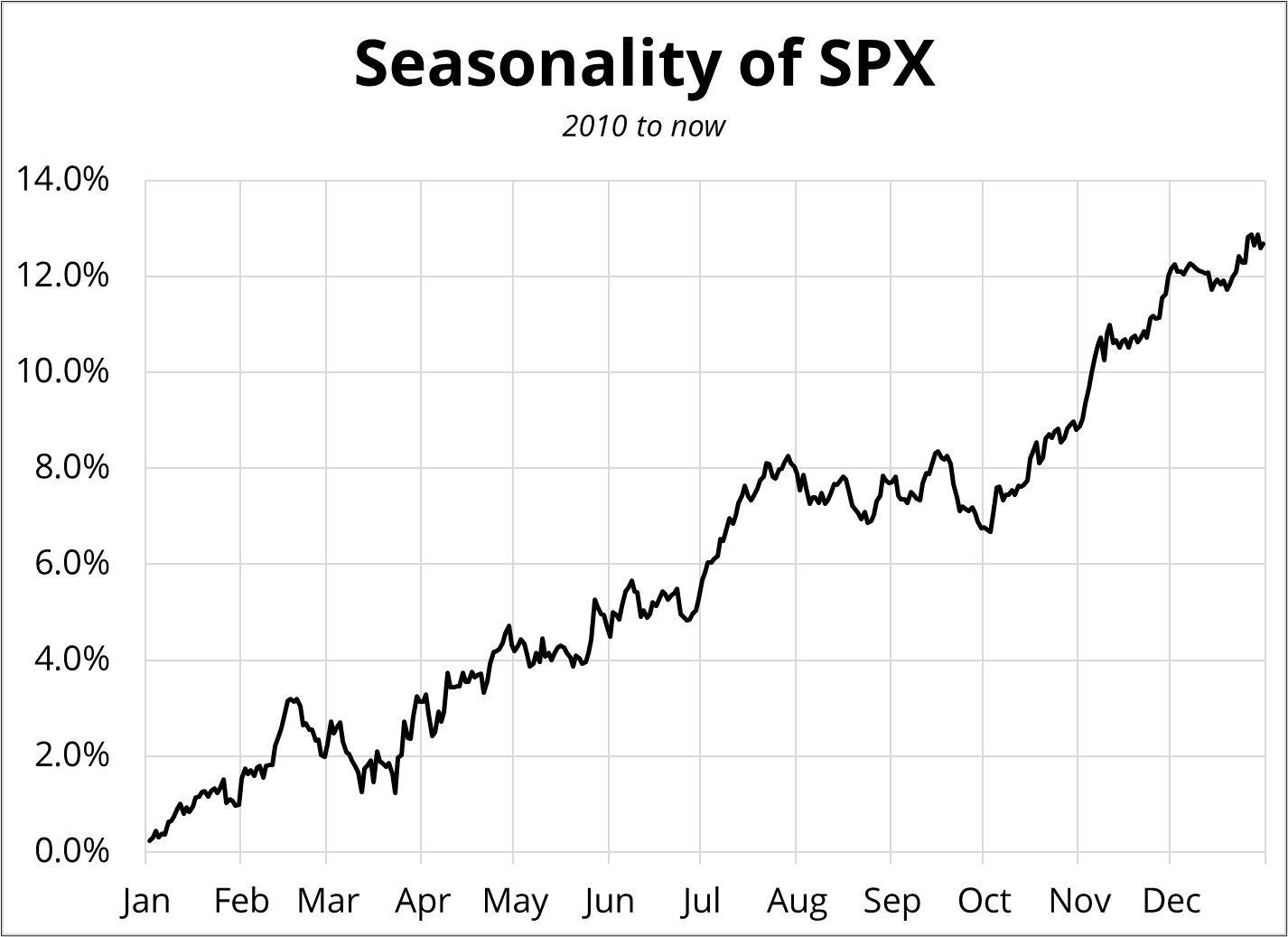

If you are courageous, this entry point for stocks is attractive because Habibi just pointed out to me that we are about to enter a generally pleasant 70-day period of springlike weather for stocks.

You can see in the next chart that a good chunk of those returns were earned in July, but a decent piece also accrued in the May trading days following Memorial Day. The only negative returns were during recessions and the Summer of 1996.

Final Thoughts

The five G10 currency pairs with the highest correlation to SPX over the past 100 days are: AUDJPY NZDJPY CADCHF AUDNZD and GBPCHF. Against the USD (including EM) it’s USDILS, AUDUSD, USDBRL, USDMXN, and USDCHF.

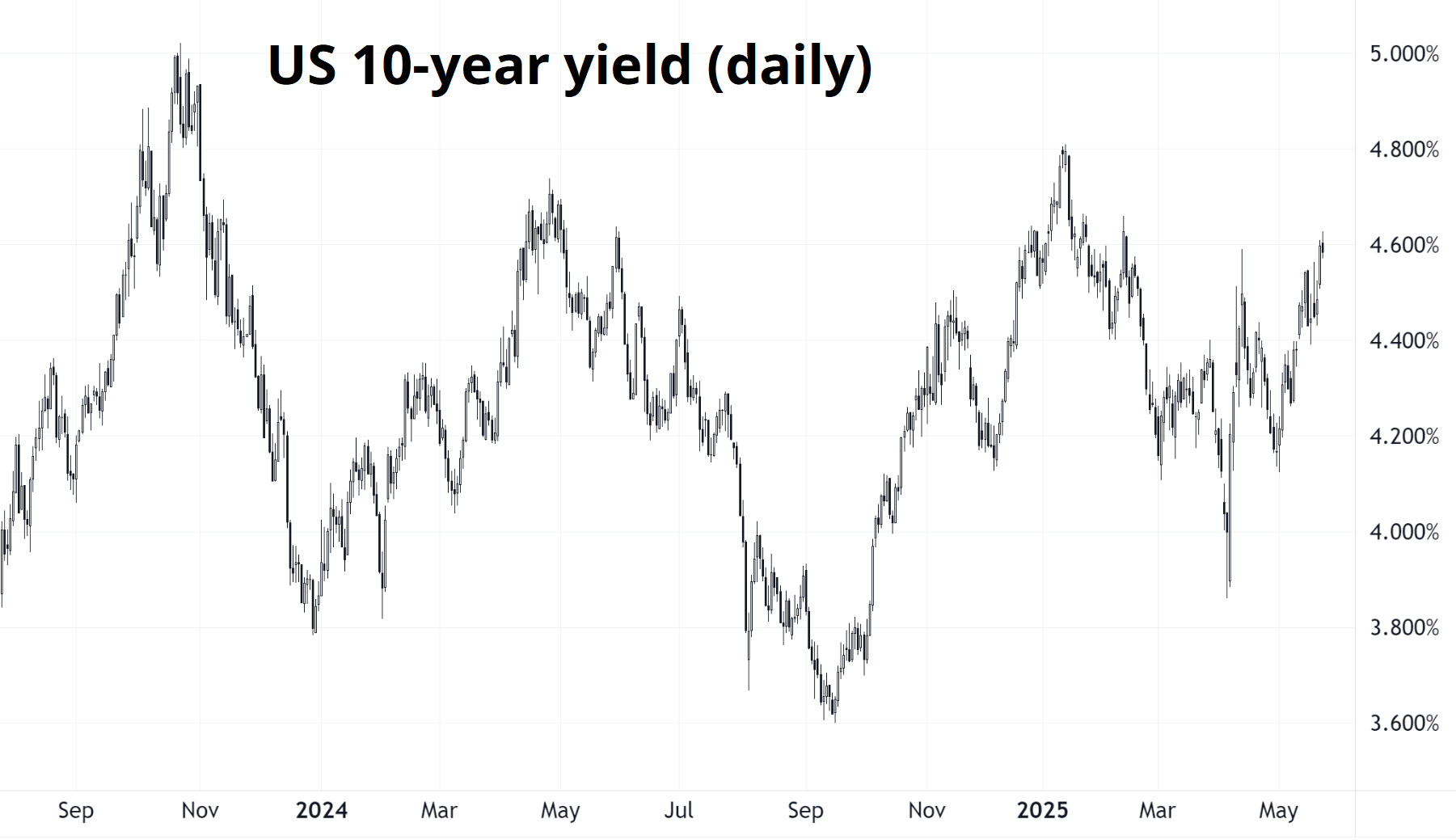

Next week’s calendar is below.

Have a glow-in-the-dark weekend.

Calendar for the week of May 26, 2025