We are in the intermission between Act 1 and Act 2 of the Trade War

Harvard bought what they thought was a copy of the Magna Carta for $27 in 1946, but it turns out it’s real

Interesting timing if you know what the Magna Carta is all about!

We are in the intermission between Act 1 and Act 2 of the Trade War

Harvard bought what they thought was a copy of the Magna Carta for $27 in 1946, but it turns out it’s real

Interesting timing if you know what the Magna Carta is all about!

Flat

First, a correction. I posted some incorrect information in am/FX on Tuesday. Here is the correct info on gold (thanks Alf).

https://www.lbma.org.uk/articles/gold-and-hqla-correcting-misleading-online-information

We are in a weird intermission between Act 1 and Act 2 of the show here as one batch of tariffs is on hold until July 8/9 and China is excused from the gigantic tariffs until August 12. Meanwhile, the economic data is meaningless as it covers either pre-Liberation Day impacts, the initial reaction to gigantic tariffs which have subsequently been removed, or front running of tariffs that were subsequently paused, reduced, or eliminated. The resulting rallies in the USD and stocks have left positioning close to flat and most traders are fairly agnostic.

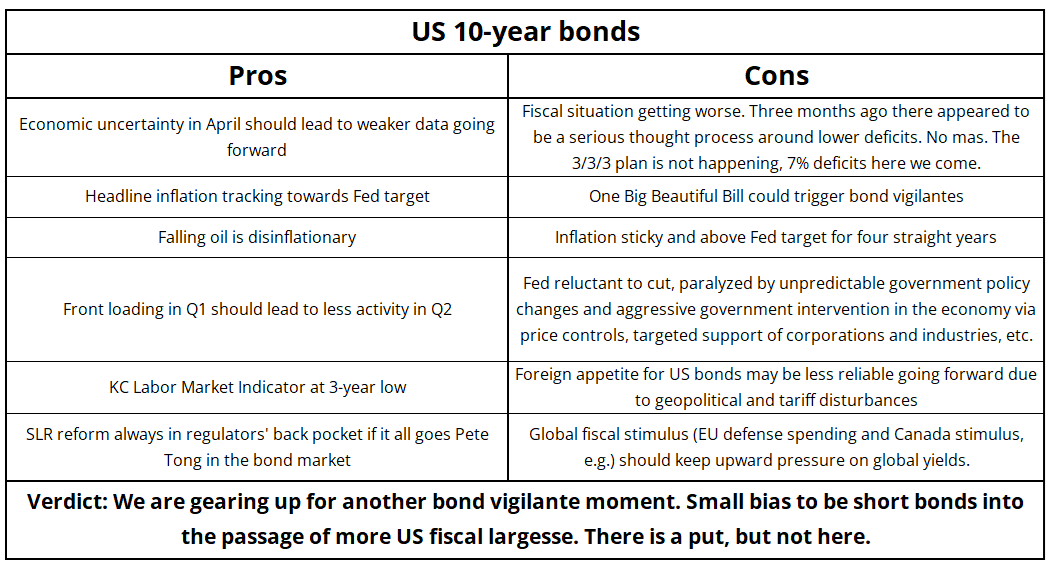

When I was a kid and I couldn’t make up my mind on something, my Mom would tell me to do a pros and cons list. Given my confusion here on all things macro, I will try that. This might help at least frame where we are so that I can start to make some forward-looking statements again soon. I prefer to make forecasts and forward-looking statements in am/FX most of the time, because they are more interesting than “where we at?” summaries like this one, but sometimes you feel a bit lost so you need to whip out a map before you drive on.

Most of the bond cons are similar. The path of least resistance is a creep higher in yields as bonds again shrugged off weak data today. 4.60% in US 10-year yields is the level to watch. Now let’s do pros and cons for the US dollar.

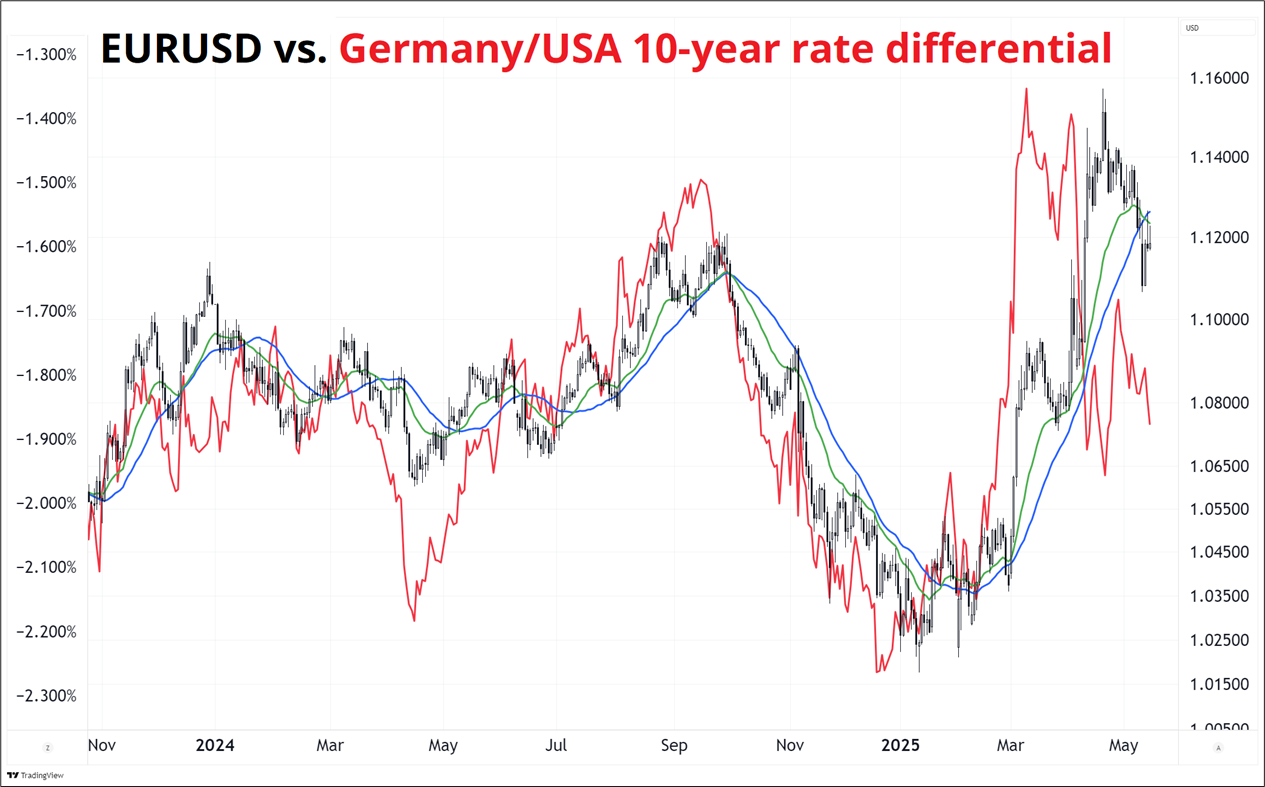

As is the case with treasuries, the risk of a bond vigilante moment looms large but is not happening right now. The USD trades very weak relative to interest rate differentials, but there is no fiscal crisis going on in markets right now. As we approach the passage of a new fiscal stimulus and bigger tax cuts, we may see the SELL AMERICA theme return, but for now it feels we remain in between themes.

“The Rust Belt’s manufacturing decline isn’t primarily about jobs going to Mexico. It’s about jobs going to Alabama, South Carolina, Georgia and Tennessee…In 1970, the Rust Belt was responsible for nearly half of all manufacturing exports while the South produced less than a quarter. Today, the roles are reversed, it is the Rust Belt that hosts less than one-fourth of all manufactured exports and the South that exports twice what the Rust Belt does.”

Have a foundational day.

Testing the Magna Carta to see if it’s real

Harvard bought what they thought was a copy of the Magna Carta for $27 in 1946, but it turns out it’s real

Interesting timing if you know what the Magna Carta is all about!

True Canadians will notice that the color scheme in the image above looks a lot like the color scheme on the cover of “Trouble at the Henhouse”.