Trades update

The AUDUSD was stopped out pre-CPI, and that was a good thing as Australian inflation came in far above expectations. EURUSD is doing nothing and I plan to cover it between 10 a.m. and noon today as the main idea behind these trades was a resurgence in the dollar culminating with corporate USD buying today. Instead, nothing has really happened. Oddly, the USDJPY long was pretty much never OTM and the EURUSD short was never ITM.

On USDJPY, I am tempted to hold on because:

1. Bessent and recent moves in pricing have created enough uncertainty around the BOJ that you could actually get a dovish result at this point. The Takaichi plan isn’t quite clear yet, but her dreams seem to include more fiscal stimulus, a snail’s pace BOJ, and a weak (but not weaker) yen.

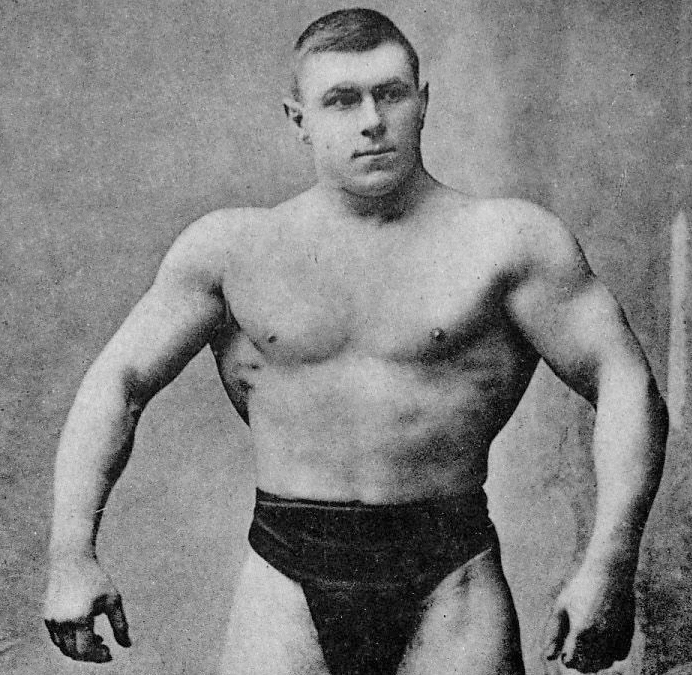

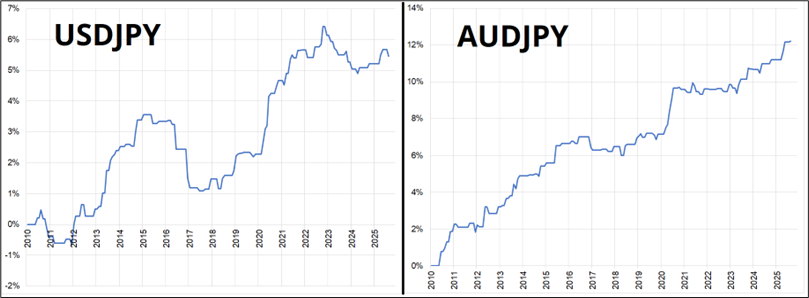

2. Corporate month end should be buy USDJPY, while actual month end (Friday) should also be RHS cross/JPY. These two charts show how USDJPY and AUDJPY perform in the four hours leading up to the month-end fix (4 p.m. London) in months where the S&P and NASDAQ are up a combined 5% or more.

P&L from noon to 4 p.m. LDN on last day of month if (SPX+NDX return >5%)

3. The chart has four solid bottoms at 151.50 now, which means I can move the stop up to 151.19 and get pretty good risk/reward if I survive.

4. The hourly cloud is nearby here at 152.26/50. Ideally we get a close above 152.50 today to relieve some of the technical pressure.

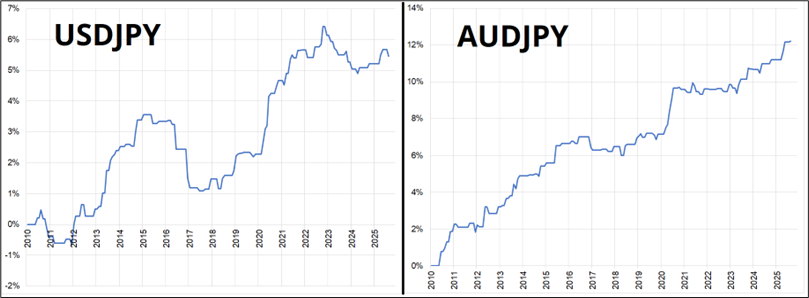

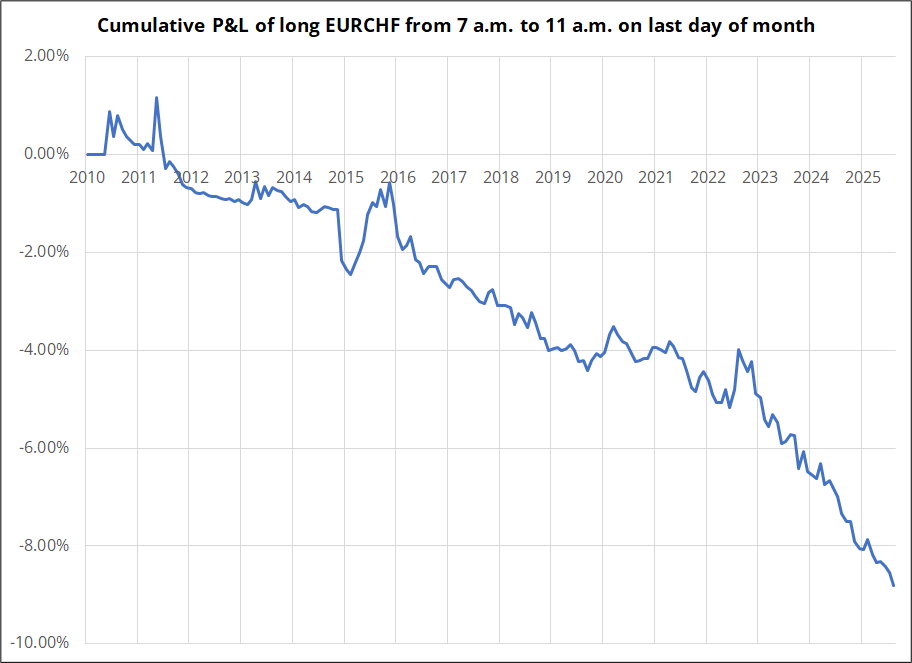

The EURCHF short is a few pips from getting stopped out, so I will leave that and presume I am about to get dinged. For your reference, here is the performance of EURCHF, 7 a.m. to 11 a.m. on the last day of every month. These results show all final days, with no filter for S&P or NASDAQ performance.

Note that WMR is at noon NY time this week.

FOMC and market halitosis

I like to get excited about things but have a bit of trouble getting excited about the FOMC right now because they are on autopilot. Even if they were data dependent, there is no data to depend on! With the inflation target jettisoned, labor market data scarce, and most other data collection on hold, it’s going to be a while before anything meaningful comes out of the Federal Reserve. They are cutting and they are ending QT and there is zero mystery around any of it. The Fed is cutting into some of the loosest financial conditions in world history and stocks and credit are behaving appropriately.

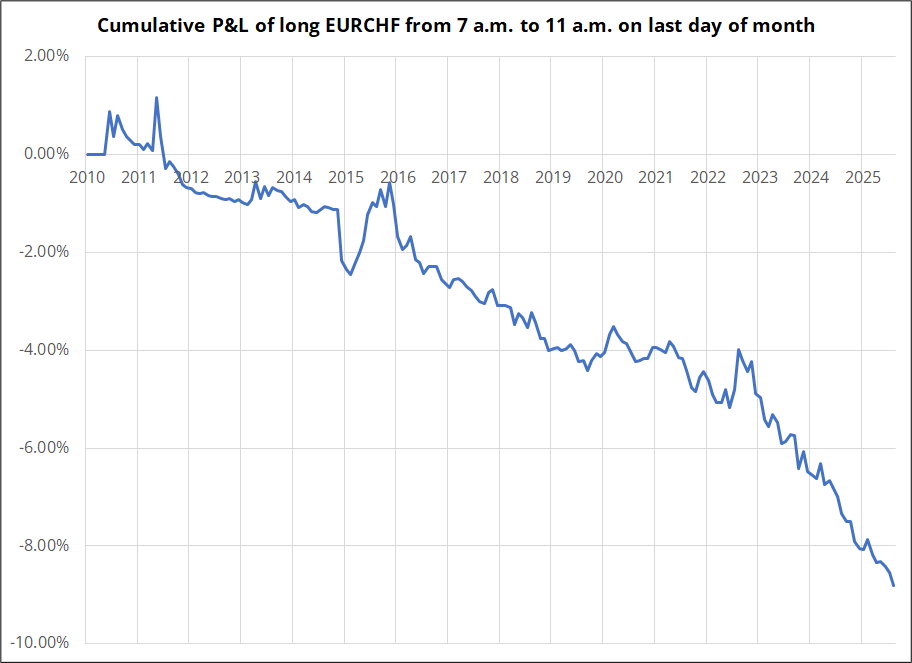

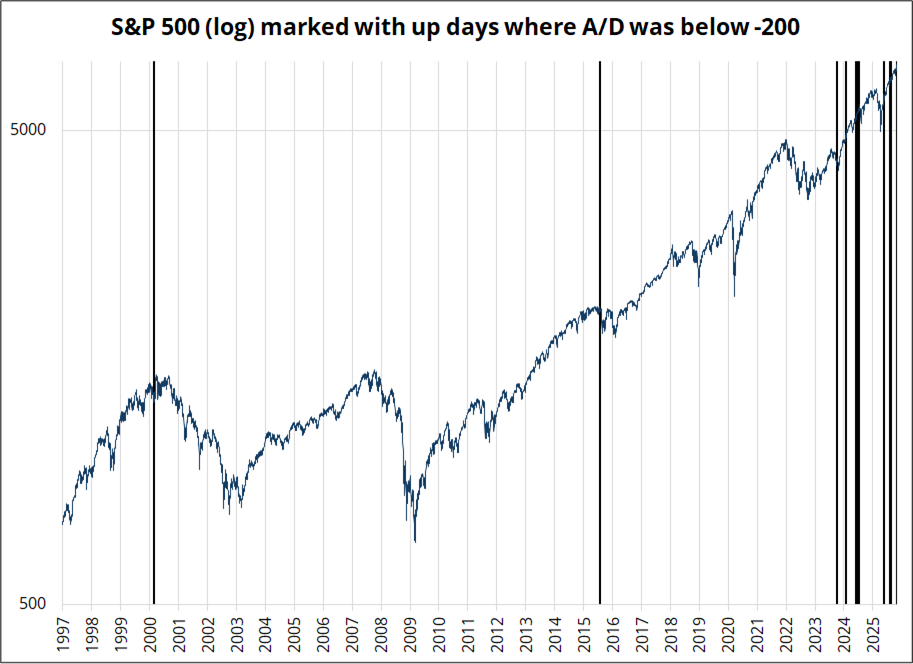

Speaking of stocks: Bespoke noted yesterday that it was the worst breadth ever for an up day in the S&P 500 as you had 398 decliners and only 104 advancers on a day when the S&P 500 closed up 0.23%. Weird! Well, not that weird. The fact is that as concentration builds and a few ginormous stocks like NVDA become the dominant drivers of the equity market, you will see this more and more often. If NVDA is adding $350B of market cap in one day, the rest of the stocks can do whatever they want! BTW, NVDA is trading above $5T market cap pre-market as $205.76 = $5T.

The advance/decline (A/D) line yesterday was -294. To give you a sense of the breadth situation, here are all the times you had a positive SPX day with A/D below -200.

Sadly for the bears, bad breadth is not a useful bearish indicator. It’s a coincident indicator that reveals current levels of concentration but does not predict anything about the future. Sort of like how the inverted yield curve can tell you that maybe a recession might be coming one day, and that will tempt you into all sorts of bad trades that never work out… Extreme concentration makes you nervous but gives you no actionable signal. These things work in hindsight but not ex-ante.

Final Thoughts

- In celebration of this week’s BOJ meeting, and its unknowable timing, I have reactivated the Spectra Markets merch store for a few days.

- The 2026 Spectra Markets Trader Handbook and Almanac live on Amazon!

- From FiatElpis on Twitter (via Chuck):

PX/EST EBITDA z-scores (richness vs history):

SX5E 2.5σ, NKY 2.4σ, CAC 2.3σ, HSI 2.3σ, DAX 2.2σ, UKX 2.0σ, SPX 1.9σ, NDX 1.8σ, RTY 1.1σ.

- Imagine growing up watching the Blue Jays and then watching them win a world series in 1992 and 1993 while in university and then getting ready to go to Game 6 in Toronto on Friday. Childhood dreams coming true!

- Brazil election odds. Bolsonaro down, Lula up in recent weeks. The market doesn’t care, though.

*ELEIÇÕES 2026*

LULA 40,5/43,5

TARCÍSIO 31,5/34,5

RATINHO 9/12

HADDAD 3,5/5

MICHELLE 1,5/3

BOLSO 1,25/2,75

Have a record-setting day.