Quite an amazing shift in narrative and price over the last 30 days.

Greek Freak: Freethrow airball

You may want to add: “Is the team hungover?” to your sports betting algorithm.

Quite an amazing shift in narrative and price over the last 30 days.

Greek Freak: Freethrow airball

You may want to add: “Is the team hungover?” to your sports betting algorithm.

Long a 1-month 1.4600 USDCAD call

for 33bps off 1.44 spot

We have gone from euphoria and everyone max bullish stocks to a frightened environment here as rising yields, sticky inflation, UK dislocations, EM melting (see USDINR, wow), LA fires, quantum computerz bubble burst, priced-for-perfection tech, good news/bad price on NVDA, and a dump in crypto have all conspired to flip sentiment from raging bull to rather scared.

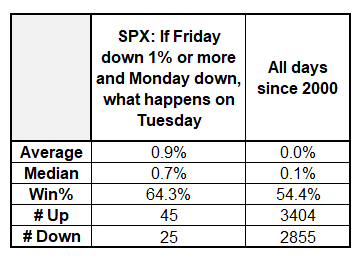

We can’t do the normal Turnaround Tuesday analysis today because the stock market was closed Thursday, but if you just look at episodes where stocks fell 1% or more on Friday and fell again Monday, here’s what the returns look like on Tuesday.

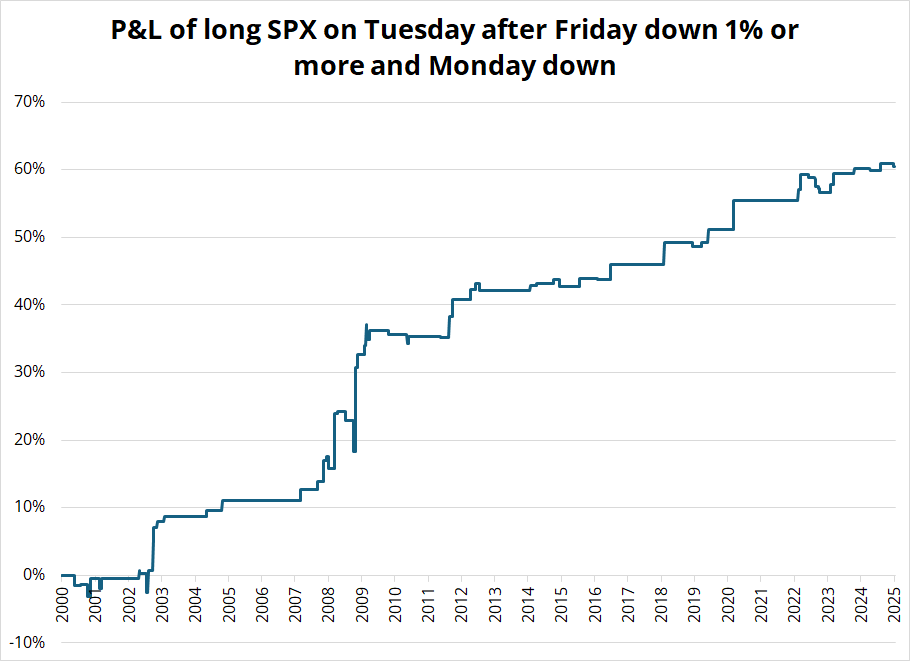

And for greater granularity, here’s the cumulative P&L of going long those Tuesdays.

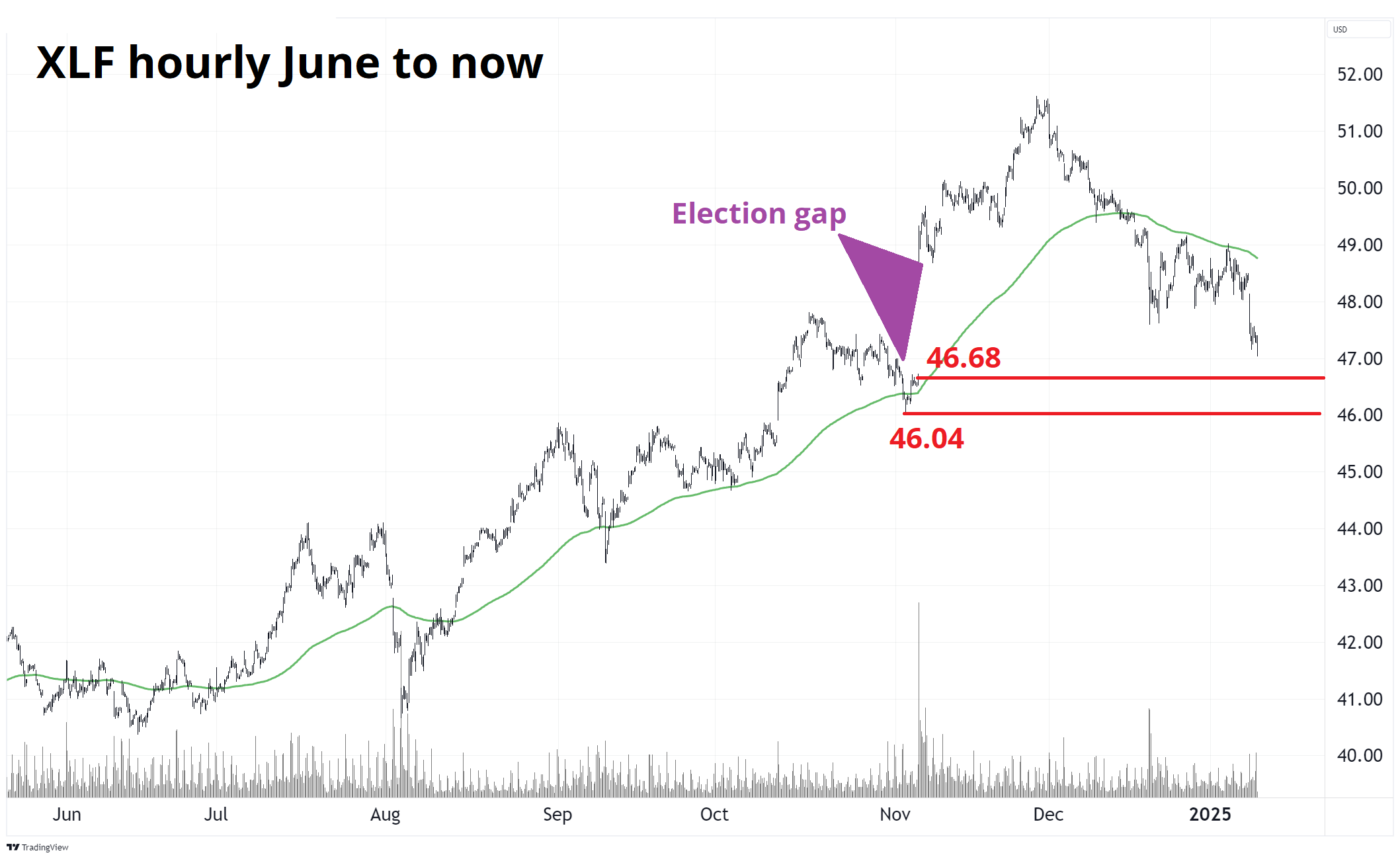

It’s hard to craft much of a bullish equity narrative right now, but it was also hard to craft a bearish one in mid-December and SPX was 6075 and now it’s 5775. I suppose if you really wanted to be bullish you could say that Fed pricing is getting extreme (hard to price in hikes) and the froth in AI, quantum stocks, crypto, and financials (the four post-election favorites) has been reduced significantly.

Interestingly, XLF just filled the election gap and we get Citi, JPM, BLK, GS, and WFC Wednesday. So, it’s a potentially interesting entry point there.

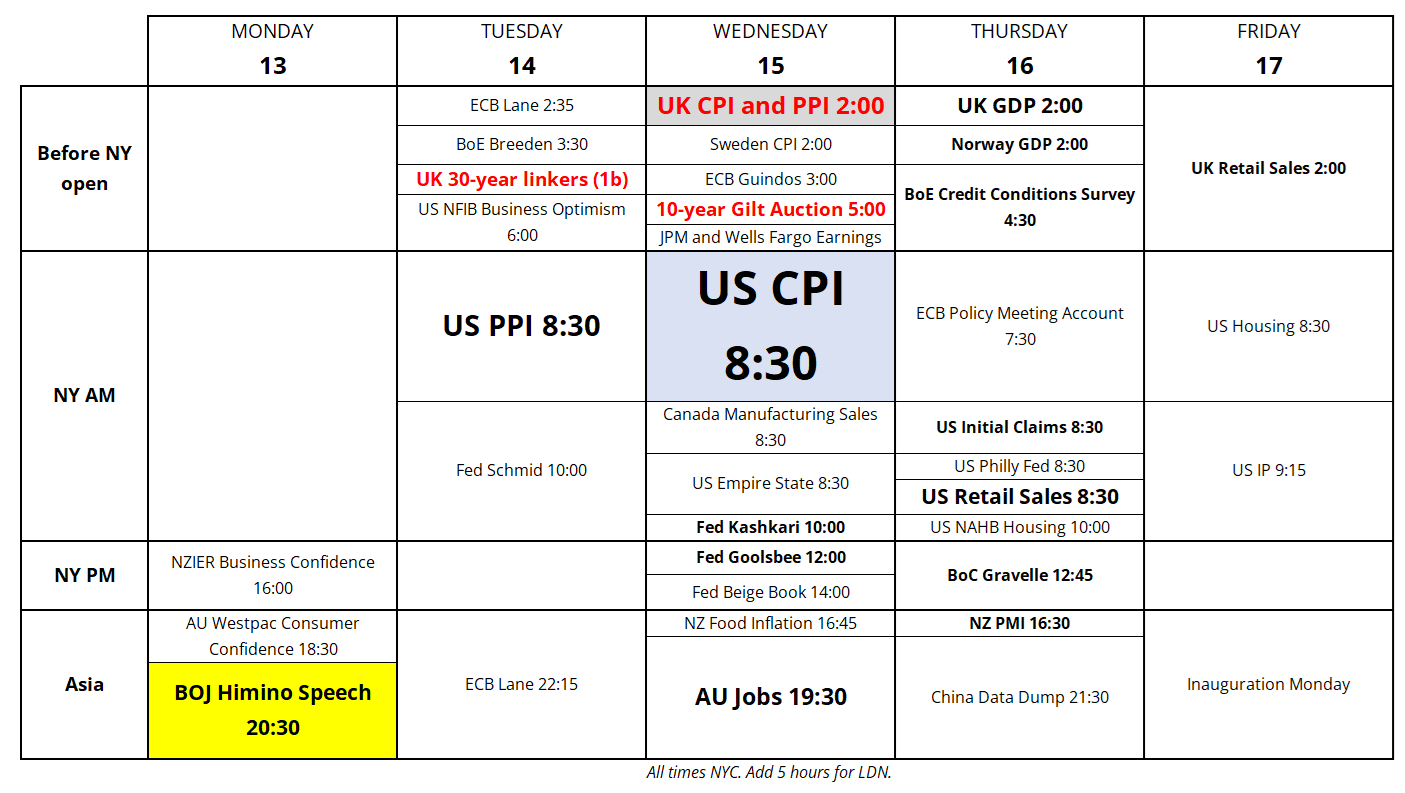

Updated calendar below.

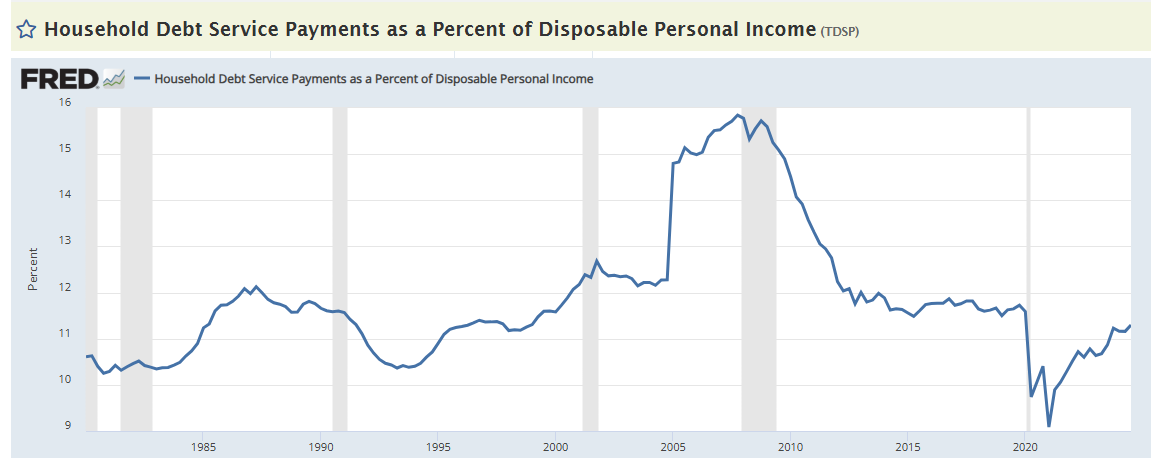

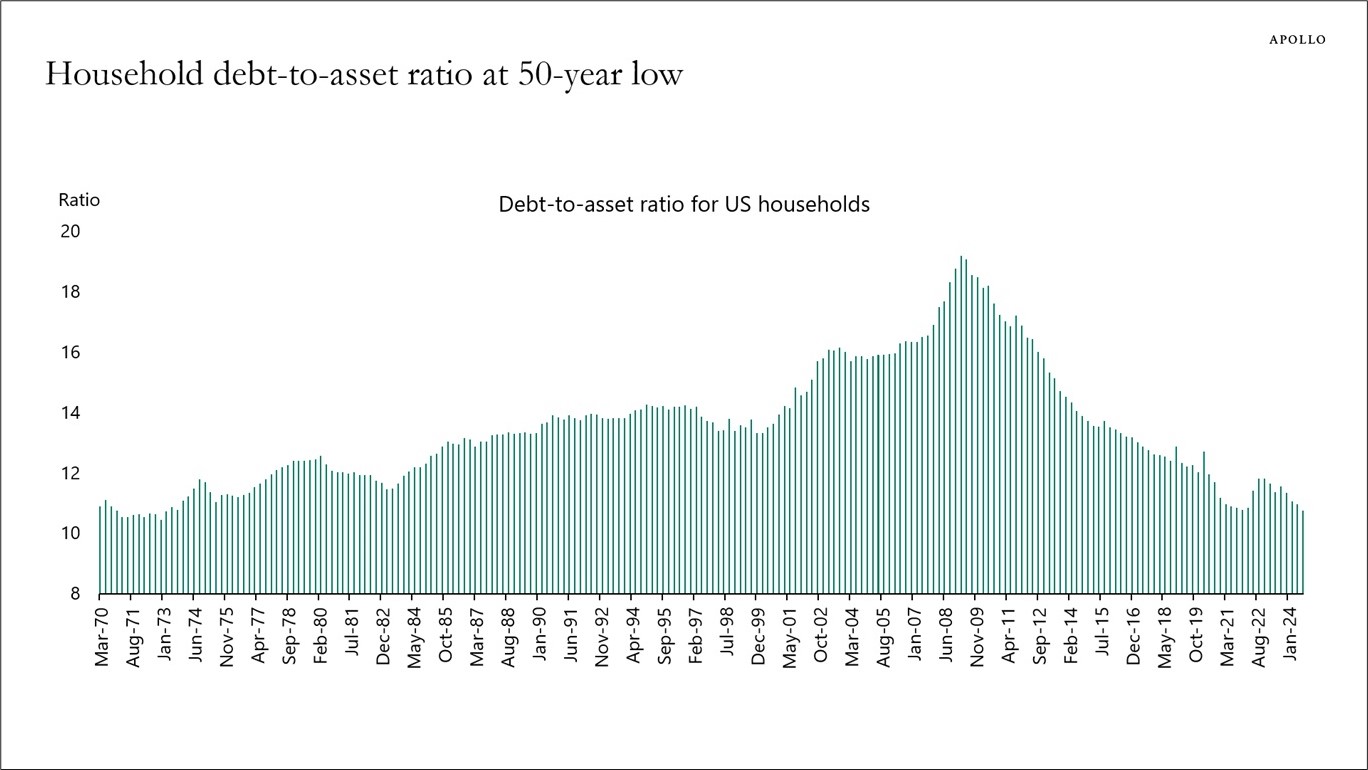

Good perspective on the current state of US households via Fred and Apollo.

Have a well-hydrated day.

DeAndre Jordan free throw airball

Causal Hangover Effects by Andreas Santucci and Eric Lax

ABSTRACT:

It’s not unreasonable to think that in-game sporting performance can be affected partly by what takes place off the court. We can’t observe what happens between games directly. Instead, we proxy for the possibility of athletes partying by looking at play following games in party cities. We are interested to see if teams exhibit a decline in performance the day following a game in a city with active nightlife; we call this a “hangover effect”. Part of the question is determining a reasonable way to measure levels of nightlife, and correspondingly which cities are notorious for it; we colloquially refer to such cities as “party cities”. To carry out this study, we exploit data on bookmaker spreads: the expected score differential between two teams after conditioning on observable performance in past games and expectations about the upcoming game.

We expect a team to meet the spread half the time, since this is one of the easiest ways for bookmakers to guarantee a profit. We construct a model which attempts to estimate the causal effect of visiting a “party city” on subsequent day performance as measured by the odds of beating the spread. In particular, we only consider the hangover effect on games played back-to-back within 24 hours of each other. To the extent that odds of beating the spread against next day opponent is uncorrelated with playing in a party city the day before, which should be the case under an efficient betting market, we have identification in our variable of interest. We find that visiting a city with active nightlife the day prior to a game does have a statistically significant negative effect on a team’s likelihood of meeting bookmakers’ expectations for both NBA and MLB.