You still can’t buy USD on tariffs.

Koalas have fingerprints that are super similar to those of humans.

They are the only non-primate with fingerprints.

You still can’t buy USD on tariffs.

Koalas have fingerprints that are super similar to those of humans.

They are the only non-primate with fingerprints.

Buy EURUSD 1.0711

(Limit order)

Stop loss 1.0484

Last night’s price action could be a harbinger of the post-Liberation Day price action in EURUSD as we got bad news / good price after the 25% auto tariffs. This is consistent with the price action after the tariffs on Canada and Mexico and paints a pretty clear picture that buying USD on tariff news is (still) not a thing.

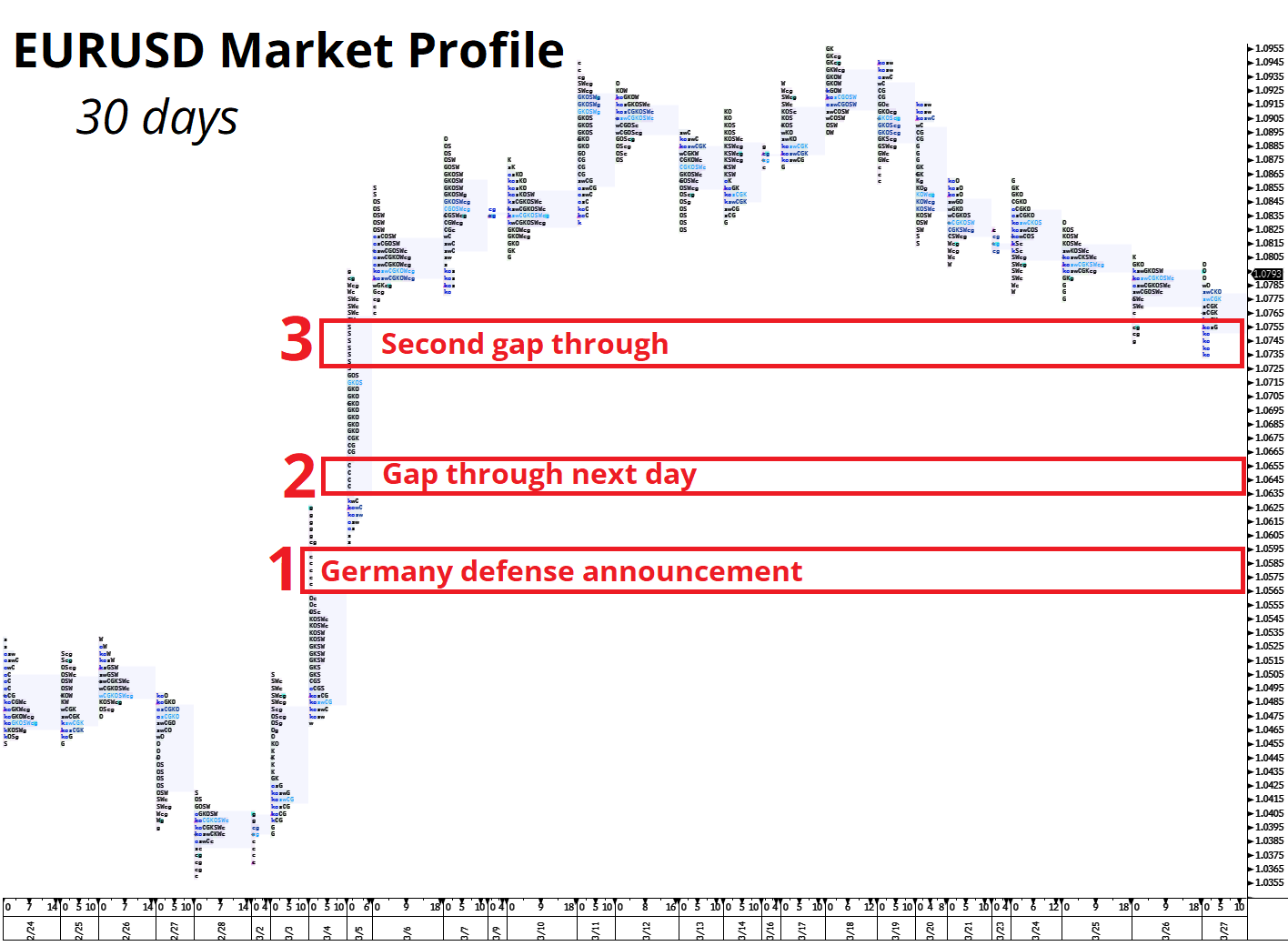

A few weeks ago, I posted the Market Profile for EURUSD, and it shows a series of single prints at 1.0720/40 and again at 1.0640/60. Here it is:

It’s amazing to see rate differentials at the lows, new auto tariffs, and corporate month end today and EURUSD is higher. Weird. This probably tells you that the strong hands are showing up on the bid down here and will be layered buyers from 1.0740 down to 1.0600. The best strategy for USD bears is to ignore the headlines and find levels to buy.

I would also note that the April ECB meeting is priced for a 75% chance of a cut, while the rhetoric from the ECB has not been dovish enough to fully ensure this is correct. In other words, a lot is priced for the April ECB meeting given the flurry of deficit spending coming from Germany and extreme uncertainty from trade policy.

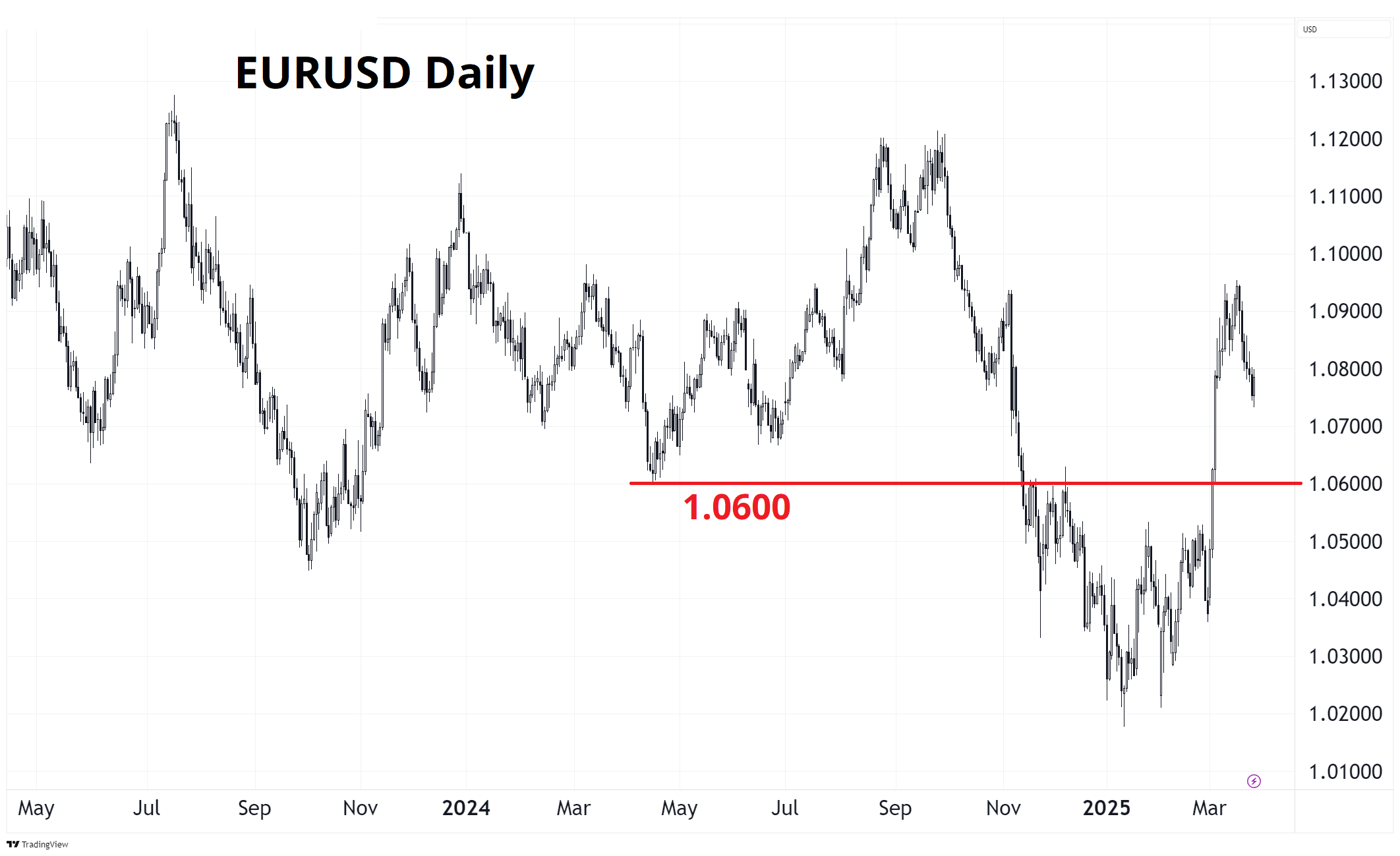

Looking at the daily chart, the major 1.0600 low in Q2 2024 became important resistance in November and December before the final blowoff sub-1.02 and should now be major support once again.

While the risk is now that we have missed the opportunity to buy the dip, there is still month end and Liberation Day to get through so perhaps EURUSD buyers get another shot. I like buying at 1.0711 (regardless of the newsflow) and stop loss 1.0484. That puts you below all the major supports and below the 1.0545 level that was trading when the German defense announcement came out. I am putting that in the sidebar and if I were to get filled, I might consider optionalizing it at some point to get more leverage.

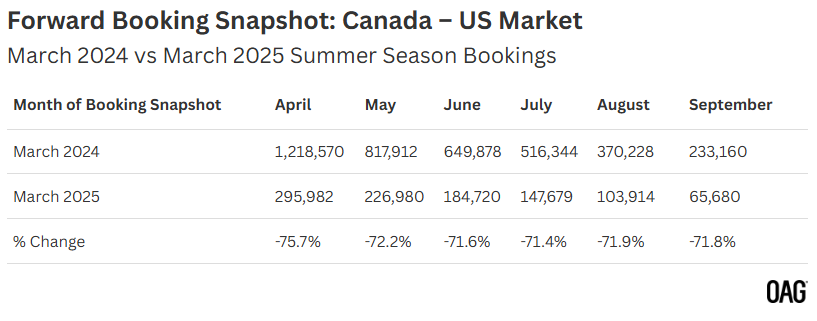

Some pretty insane statistics here from OAG on air travel bookings by Canadians. HT SZ.

Canada to the US: Forward Bookings Collapse

Despite airline schedule changes and capacity being redirected to other markets, a more troubling trend emerges from forward demand data: future flight bookings between Canada and the US have collapsed.

Using forward booking data from a major GDS supplier, we’ve compared the total bookings held at this point last year with those recorded this week for the upcoming summer season. The decline is striking — bookings are down by over 70% in every month through to the end of September. This sharp drop suggests that travelers are holding off on making reservations, likely due to ongoing uncertainty surrounding the broader trade dispute.

https://www.oag.com/blog/canada-us-airline-capacity-aviation-market

I had never heard of OAG before, but after some investigation, they appear to be a highly-credible organization (founded in 1929) that is the gold standard for aviation data. Not tradable in any way, but just something to watch in case it’s representative of a global turn against travelling to the US as aggressive border incidents, the strong USD, tariffs, and politics discourage foreign tourism.

CRWV: I am not an expert on IPOs, but this Coreweave IPO looks like it’s going to be an absolute turd. The company has 7.5B of debt payments on the near-term horizon, it derived 62% of its 2024 revenue from Microsoft, and MSFT are cutting their AI expenditures. Ed Zitron tends to be hysterically bearish on all things AI, so I take his writings with a few cubes of salt, but if you want the bear case, you can read it here:

https://www.wheresyoured.at/core-incompetency/

It will probably be tough to find a borrow and get short CRWV (it starts trading tomorrow), but I would bet that the underwriters are already smelling the stink and that’s part of why NVDA trades so poorly this week. If CRWV tanks, it will reflect poorly on AI spend and NVDA, AVGO, et al. Again, I’m not an expert on the nuts and bolts of the offering, but much as you could smell the ugly Venture Global (VG) IPO well before it crashed onto the public markets, you can usually smell out the big stinkers before they start trading.

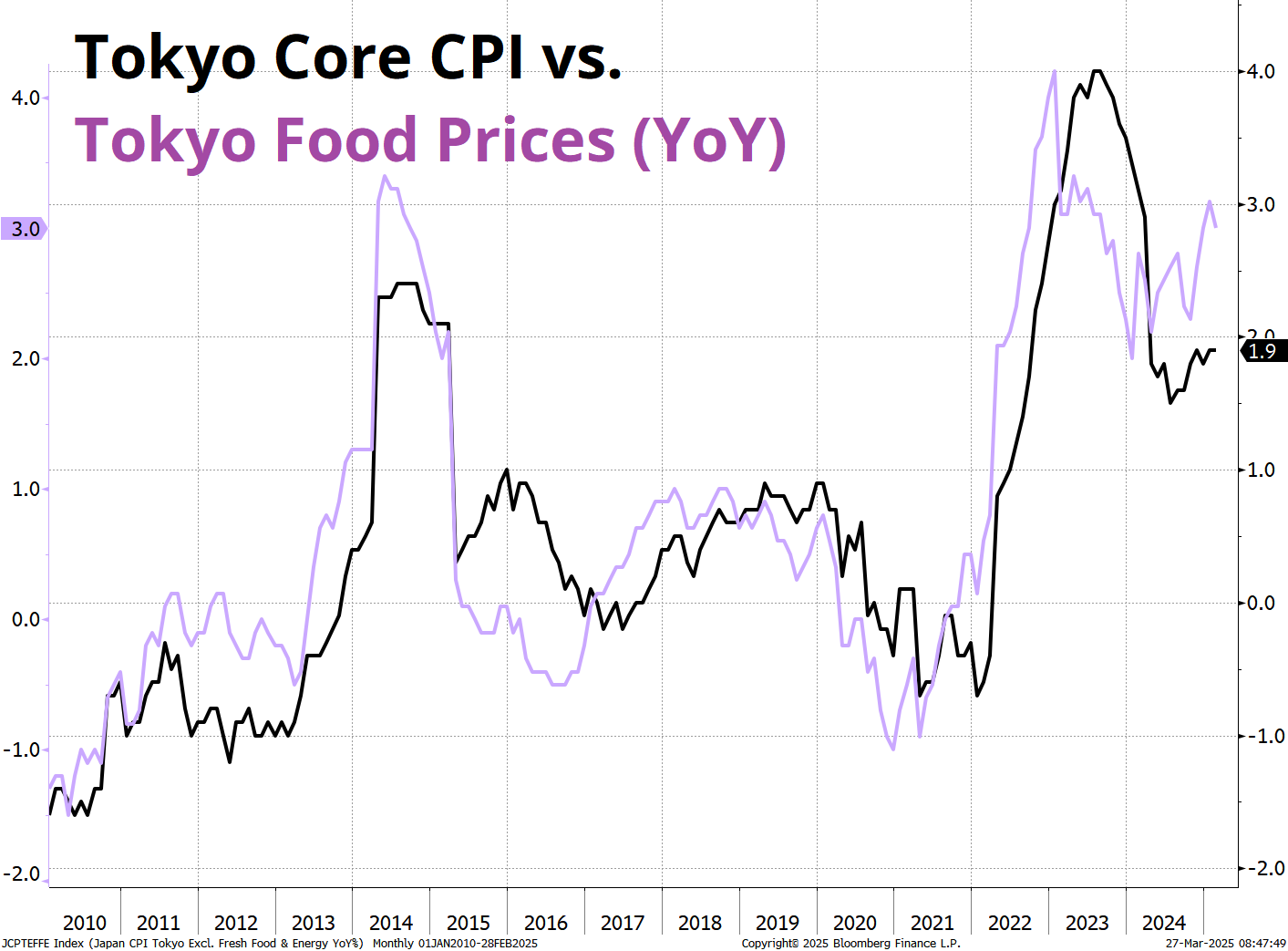

JPY: Tokyo inflation tonight is worth a gander (18:30 NY time). Tokyo CPI comes out a few weeks before the national figure (Japan CPI) and is pretty much 100% correlated to it. Furthermore, food prices tend to feed into core CPI with a lag, and food prices have popped in recent months. Note the purple line (food prices) moved higher a few months before Core CPI in 2011, 2013, 2016, and 2021. The median survey is 1.9%, and I think the risk is heavily skewed to the strong side (2.0% or maybe 2.1%).

GME, ha. $21.50/$21.80 is a good TP zone if you’re short (and patient). Have a whorled day.

Koalas have fingerprints that are super similar to those of humans.

They are the only non-primate with fingerprints.

Fingerprints help filter out the tactile equivalent of white noise.

When a finger sweeps over a finely textured surface, such as a cotton sleeve or a wooden coffee table, the interaction sends a large range of vibrations into the skin. Specialized sensors called Pacinian fibers, the tips of nerve fibers, detect only a select few of the vibrations — those right around 250 hertz — before sending the signal to the brain, where the touch sensation is processed. But since Pacinian fibers are located relatively deep—about 2 millimeters—under the skin, researchers guessed that fingerprints help magnify the vibrations.