EURUSD is still sell rallies. So are stocks. Need to let some of the froth out.

A series of typographical symbols used to replace profanity is called a “grawlix”

EURUSD is still sell rallies. So are stocks. Need to let some of the froth out.

A series of typographical symbols used to replace profanity is called a “grawlix”

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

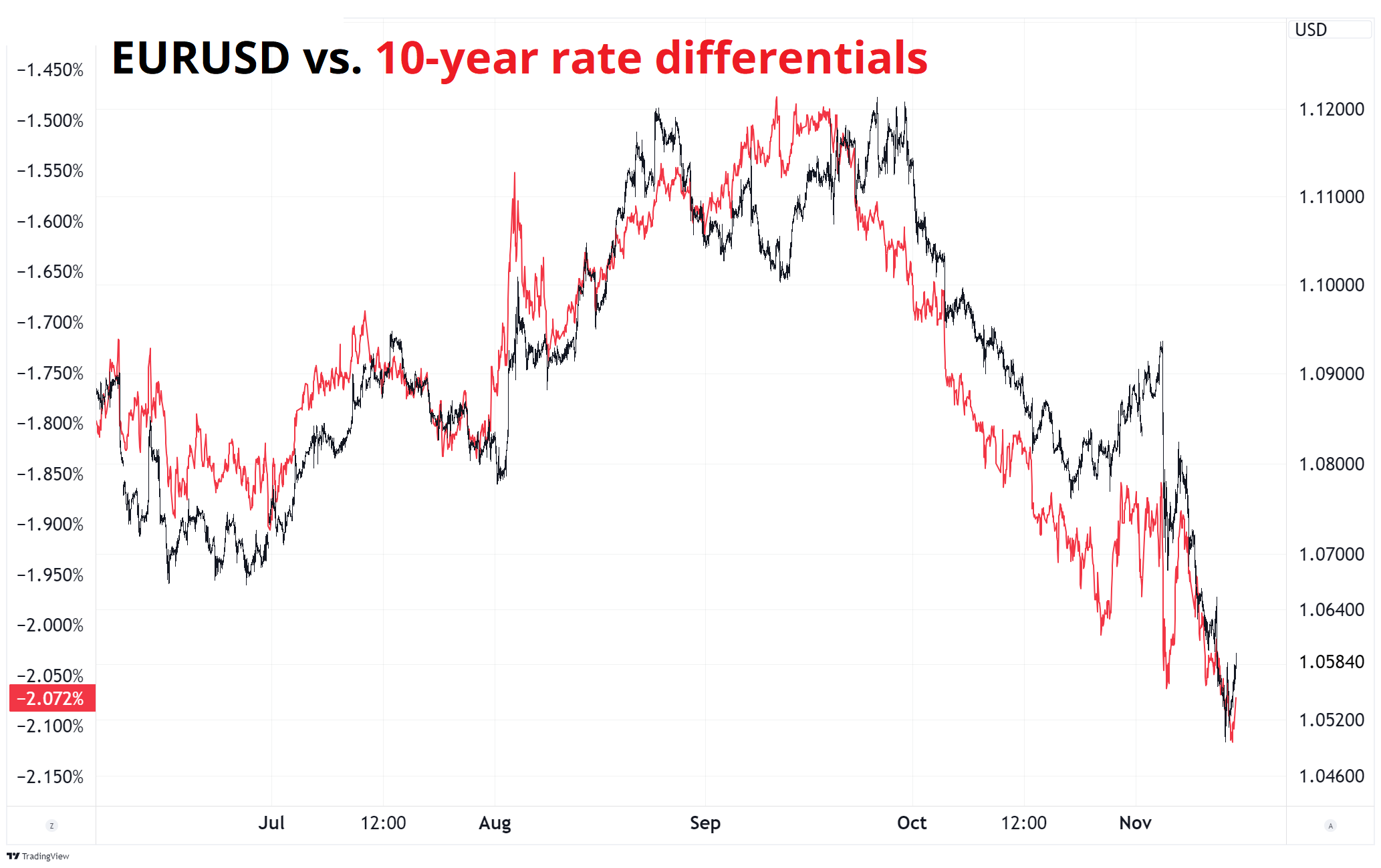

EURUSD is consolidating as momentum wanes, US yields stabilize despite some hawkish words from Chairman Powell, and the PBoC staunches upside USDCNH momentum. We have now completely reversed the move in yields that started in early August and culminated in late September. The 4.40% level has become an important level in 2’s.

There is an argument to be made that Day One Tariffs should be neutral for yields and bullish for the USD, so I am not 100% confident that interest rate differentials will work perfectly going forward, but for now, FX and yields are mostly tracking. Cross/JPY is high vs. yields, but the USD is not.

If you believe that tariffs are coming on Day One, you should be looking for places to buy USD. While tariffs are inflationary, in theory, their impact on inflation was nearly invisible in 2018/2019 and their impact on the stock market and the economy could be negative enough to create a situation where you want to be long bonds and long USD in early 2025. For now, I think the place to sell EURUSD if you are not already short is between 1.0600 and 1.0660 (impatient) or 1.0700/40 (patient). Any short squeeze is likely to be short lived as long as the prospect of huge tariffs on January 20 remains the base case.

I outlined the reasons I think stocks are a bad bet and why I am selling stocks and raising cash earlier this week. A garden variety correction in SPX would take us down to major support in the 5680/5720 area.

The flurry of ERP charts doing the rounds also make me wonder about stocks. For example, this one from Dave Rosenberg:

If you go further back, there is perhaps a counterargument that the greatest bull market of all time happened with negative ERP.

But the two regimes are not comparable. That 1980 crossover to negative ERP was the start of the greatest bond bull market in history as yields went from 15% to 0% over the next 35 years, This time, we are probably normalizing away from the secular stagnation ZLB stuff and finding a new, higher equilibrium.

So, you are not going to get a structural move lower in yields like we saw 1980 to 2019. And if you do, it’s very possibly not good news. Anyway, just something to think about. Again, I’m selling stocks to raise cash (see here).

ERP is one more thing that makes you go hmmm. The 1980 bull market started from low valuations and high yields. Now the setup is high valuations and historically normalish yields.

Also, AI Capex is still capex. And capex is always cyclical.

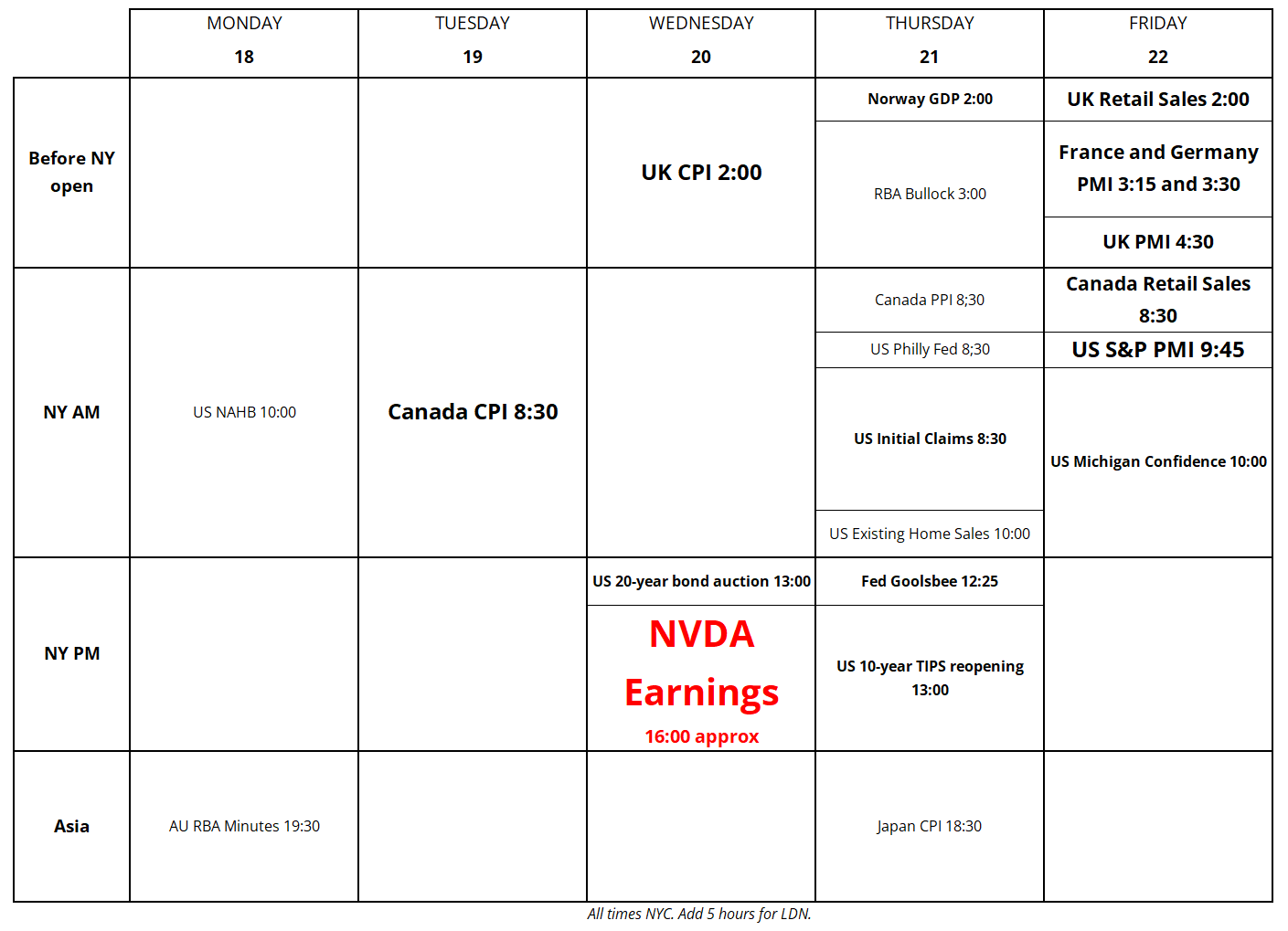

A pathetic calendar next week, despite some nice highlights. If you were thinking of doing your annual physical before the end of the year, Monday might be a good day to take off.

A random question that popped into my head last night: What’s the over/under on Musk staying with this D.O.G.E. project? That is, will Trump fire Musk, or will Musk quit before, say mid-2025? The idea of bringing in two outside consultants to reduce government spending by $2T when discretionary spending is $1.7T is super fun but might run into a few real-life roadblocks as reality hits. Just something to think about as “Musk Fired” would probably be a 30% one-day hit for TSLA stock and DOGE. Much as mass deportation had populist appeal but never happened in the first Trump administration due to its near logistical impossibility, this consulting effort will face similar implementation hurdles.

While I am in favor of reducing the size of government, this does not seem like a serious initiative to me and my bet would be Musk gets bored of Trump or Trump gets bored of Musk as their battle to out-shenanigan each other wears thin sooner rather than later. I don’t doubt Musk’s genius, but I do doubt this particular initiative will amount to anything other than some funny memes.

Big ideas are a dime a dozen. Execution is hard. Prepare for splashy headlines and minimal progress. That said: I hope I’m wrong! Good summary here, which politely describes the effort as “nascent and amorphous”. :]

https://www.wsj.com/politics/policy/doge-musk-ramaswamy-trump-c62291be

For context, the current odds of Musk out by July 2025 are around 21%.

https://polymarket.com/event/elon-musk-out-as-head-of-doge-before-july

Have a &$(#ing awesome weekend.

Face with Symbols on Mouth

An angry-red face with a black bar and white grawlixes covering its mouth, indicating it’s swearing or being vulgar. Grawlixes are typographical symbols (e.g., @#$%&!) representing swear words or obscenities. Often used to convey an outburst of anger, frustration, or rage.

Most platforms feature the same eyes as on their 😠 Angry Face and 😡 Enraged Face.

Face with Symbols on Mouth was approved as part of Unicode 10.0 in 2017 under the name “Serious Face with Symbols Covering Mouth” and added to Emoji 5.0 in 2017.