Answer: Yes. Today’s headline violates Betteridge’s Law.

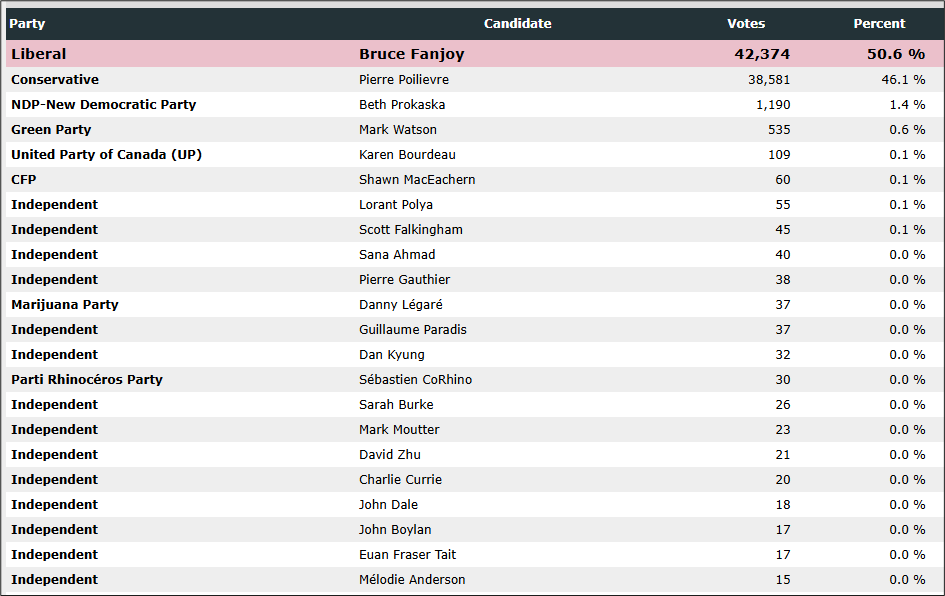

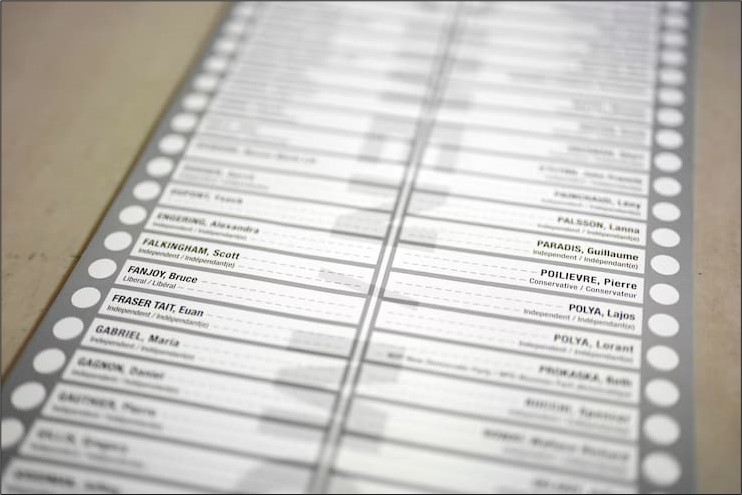

Canadian Liberal leader Pierre Poilievre lost his Carleton riding seat to Bruce Fanjoy after holding it for 21 straight years.

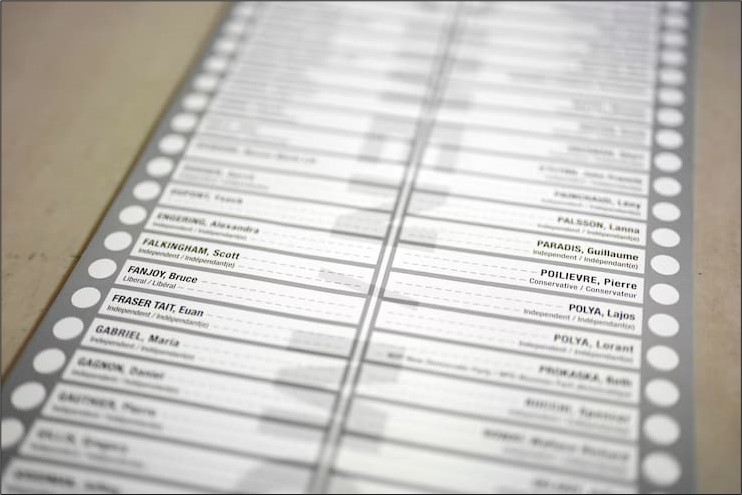

There were 91 candidates on the ballot in that riding.

Answer: Yes. Today’s headline violates Betteridge’s Law.

Canadian Liberal leader Pierre Poilievre lost his Carleton riding seat to Bruce Fanjoy after holding it for 21 straight years.

There were 91 candidates on the ballot in that riding.

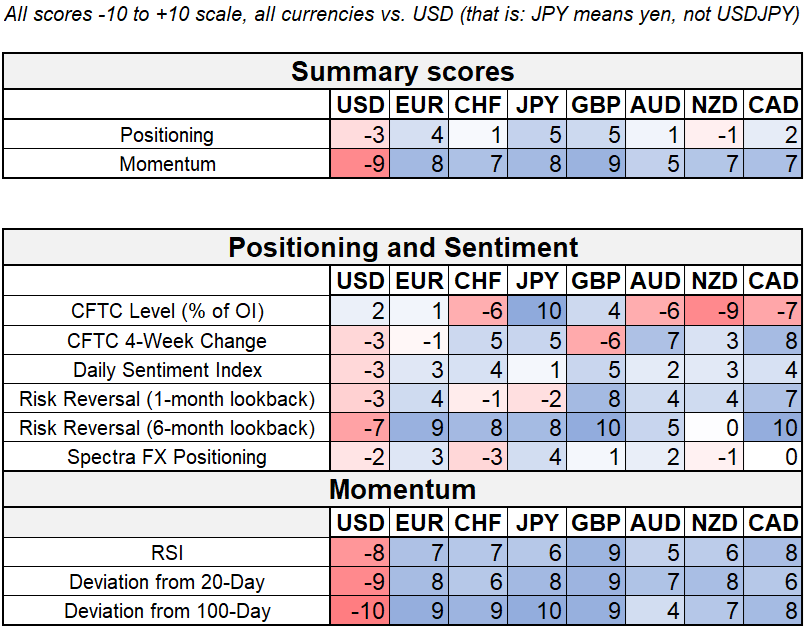

Long 12MAY 168/163 put spread in CHFJPY

~31bps off 175.25

The USD continues to struggle even as US equities rebound. The asymmetry to the correlation is glaring.

And while the EUR trades somewhat like a safe haven of late on equity selloffs, it doesn’t sell off much when equities rally. Even EURAUD, which has historically (and recently) served as an excellent proxy for risky assets, remains a tad firm on this last leg of the equity rally.

You may have noticed I said, “EUR trades somewhat like a safe haven of late” and that is a new property for the European single currency. Historically, it mostly traded more as a low-beta risky asset, not a safe haven.

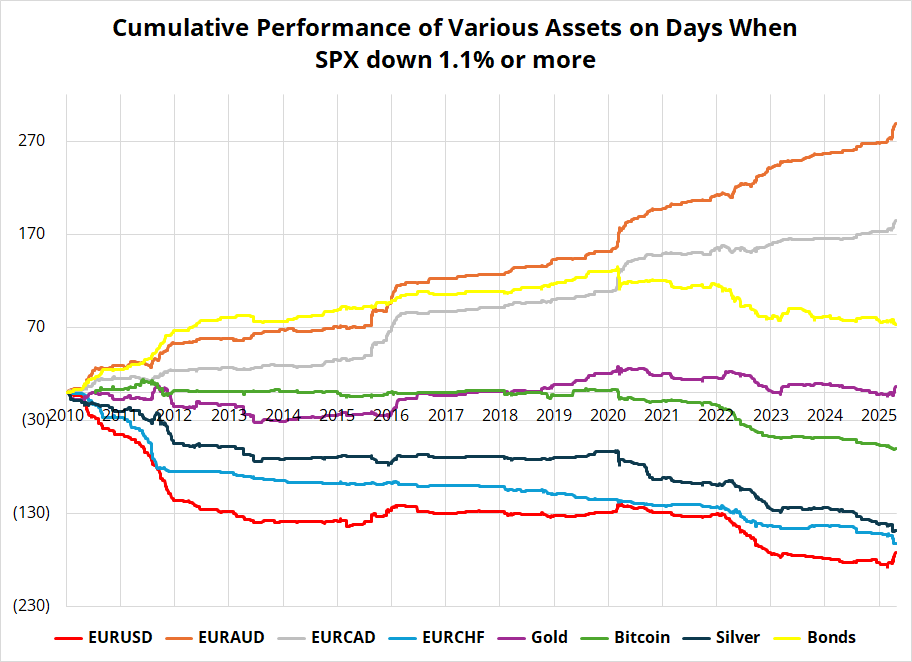

In other words, in the past, when the S&P 500 sold off aggressively, EUR went down a bit, AUD went down a lot, and EURAUD shot higher. Post Liberation Day, large S&P selloffs have been the result of foreign exits from US assets, and EURUSD has gone up. Here is the history of some safe havens and purported safe haven trades over the past 15 years. I screened for the worst days for the S&P 500, finding the 10% of days that were the worst. This means I screened for all S&P 500 down moves of 1.1% or more, because that’s how you get to 10% of all days. Here are the results, showing the cumulative standard deviation moves over time.

Takeaways:

This is not immediately actionable, but good forecasts first require good explanations of how and why markets move.

I think the switch from US dollar to EUR as the global safe haven currency of choice is real. As trust in US deficit credibility and confidence in US economic policy evaporates, the big down days in stocks will be rotation out of US assets and US dollars and into other large, stable capital markets like Europe. In 2011, it was popular to describe EURUSD as two garbage trucks colliding. The European garbage truck is now a bit spiffier than the American one. Europe will issue cartloads of new debt, which can be good for the currency given the low starting point of debts in Germany. And then maybe you get Joint EU Defense bonds one day and that further cements the EUR as a place to park sovereign wealth.

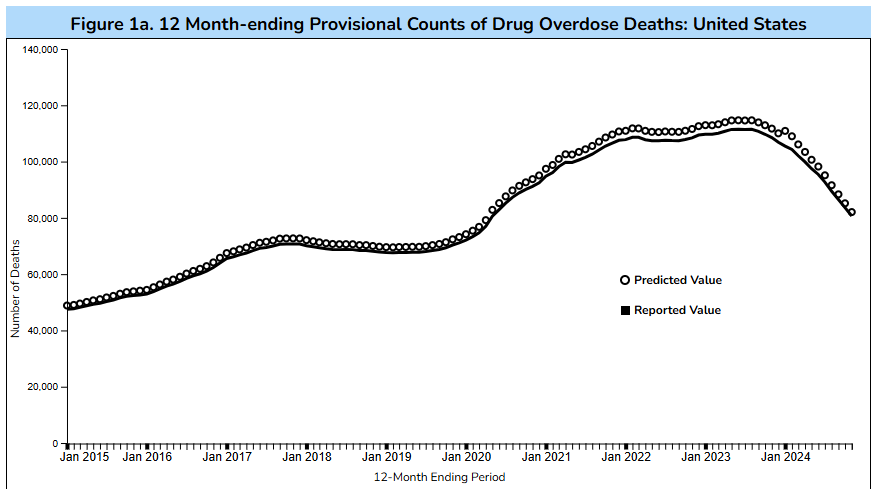

https://www.cdc.gov/nchs/nvss/vsrr/drug-overdose-data.htm

Have a fanatically joyful day.

Consolidation

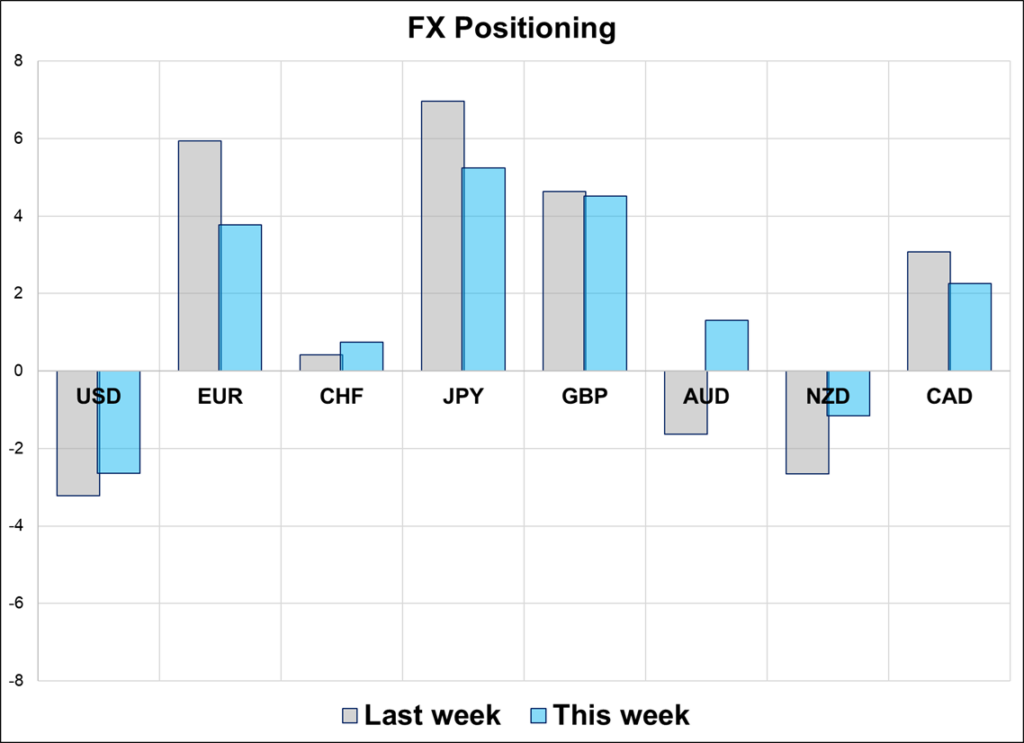

Hi. Welcome to this week’s report. Positioning has come off the boil a bit as time passes, price consolidates, and options decay.

Canadian Liberal leader Pierre Poilievre lost his Carleton riding seat to Bruce Fanjoy after holding it for 21 straight years.

There were 91 candidates on the ballot in that riding. Most of the candidates got less than 50 votes. Here are the top 22 finishers: