Silver and MAG7 are the riskiest bets for 2026

Silver and MAG7 are the riskiest bets for 2026

02JAN26 EURSEK 10.87 put

25bps off 10.92 spot

Medium-term

03FEB25 USDCNH

Put Fly 6.98/6.88/6.78

1X2X1 for 15bps (7.0565 s/r)

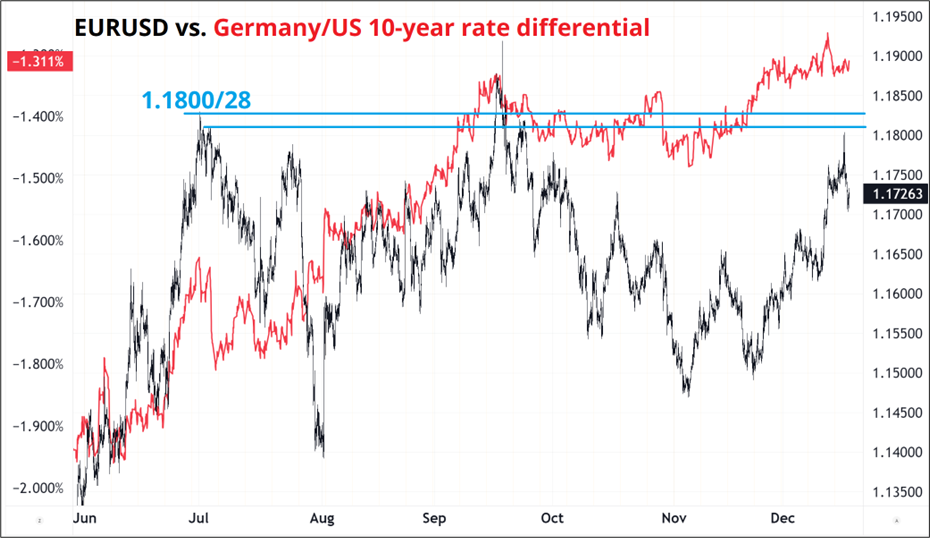

The dollar has reversed on some Trump tariff threats against Europe and a rejection of the brief peak above 1.1800 in EURUSD. The majority of H2 2025 has been spent in the 1.15/1.18 range and the currency got vertigo up there. If we are tracing out a huge Head and Shoulders pattern, the 1.1800/28 zone is key.

I left the rate differential (red line) in there to show that all hope is not lost for EURUSD bulls. As long as that remains wide or widening, demand for EURUSD should continue and the pullback should not go below 1.1620/50.

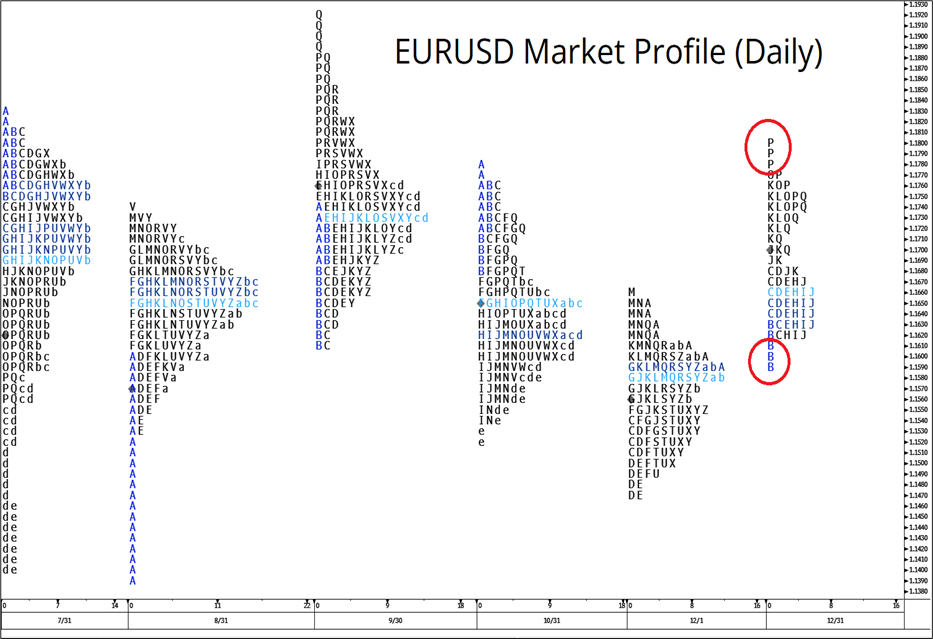

Looking at the daily market profile, you can see that December features a clear rejection of probes above 1.1780 and below 1.1620.

Those are the red circles indicating single prints. As long as EURUSD is above 1.1600, the cautious up trend is in force, and the USD weaker seasonal into year end is valid. Below 1.1600 is a big problem for EUR bulls and USD bears. Let’s see.

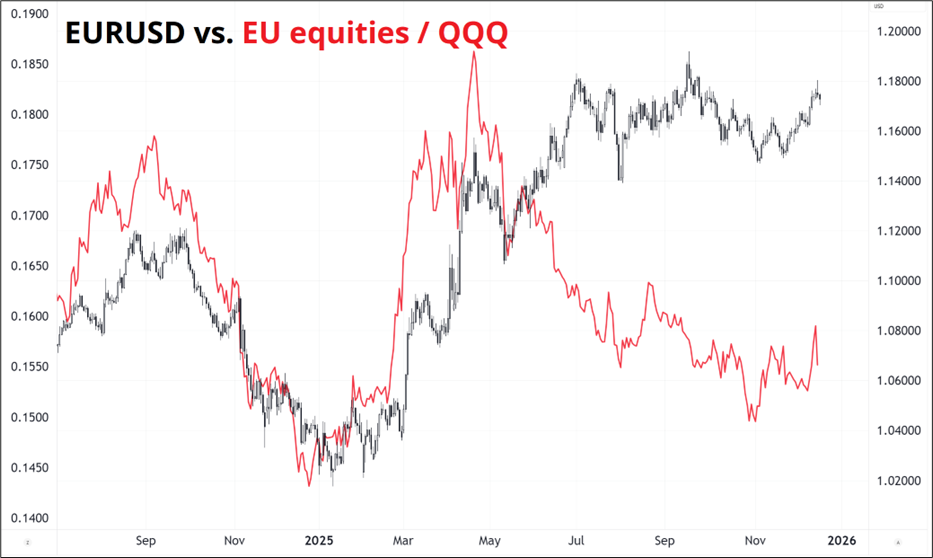

While interest rate differentials have supported EURUSD somewhat, it is important to note that the big trade was supposed to be out of MAG7 and into European equities and yet…

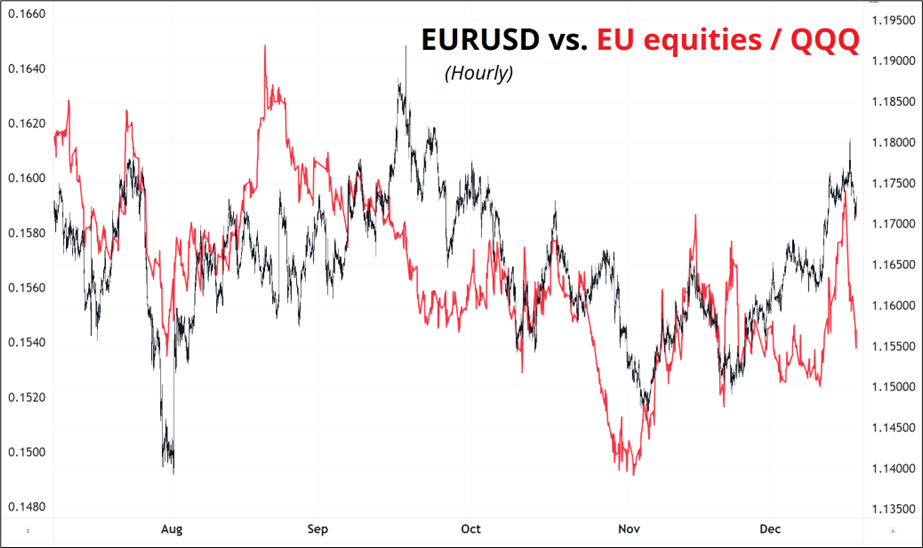

Zooming in, last night’s dump in EU stocks showed the way.

The hardest thing about trading FX in 2025 has been knowing what matters and what doesn’t. We were talking about NIIP and EU Pension Fund hedging as a dominant driver at one point, and rate differentials have worked at times, as has relative equity performance. Commodities have not been a useful indicator. I enter 2026 with maximum humility and open-mindedness. While I am glad I took profit on the USD short trades, I still would bet USD lower by EOY, not higher.

Waiting for better entries or new inspiration first.

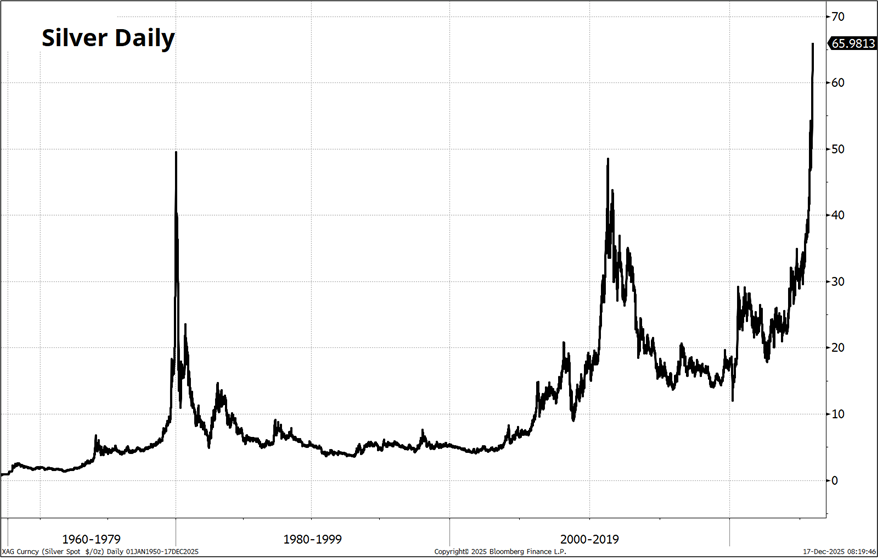

If assets were animals, gold would be the tortoise, the ancient and armored guardian of wealth, always moving forward, slowly but surely over many decades. EURUSD is a blue whale, massive and powerful, but somewhat gentle. It takes a long time to turn. USDJPY is a hairless cat, fickle, sensitive, and moody. It sits around doing nothing for ages, then goes wild when spooked. And silver, of course, is a honey badger.

Its history is punctuated by parabolic explosion and collapse. We are well into the third parabolic phase here. The most interesting and curious aspect of the silver rally is that despite some okay narratives (Big US deficits! Solar demand!), the rally is mostly happening in an impulsive way that has almost nothing to do with anything going on in the real world. Deficit expectations have not changed in the past six months. Other debasement trades (stocks and bitcoin) have been trading poorly over the past six weeks. It almost feels like some kind of short squeeze where you are going to hear later about a massive basis or RV trade that blew up somewhere.

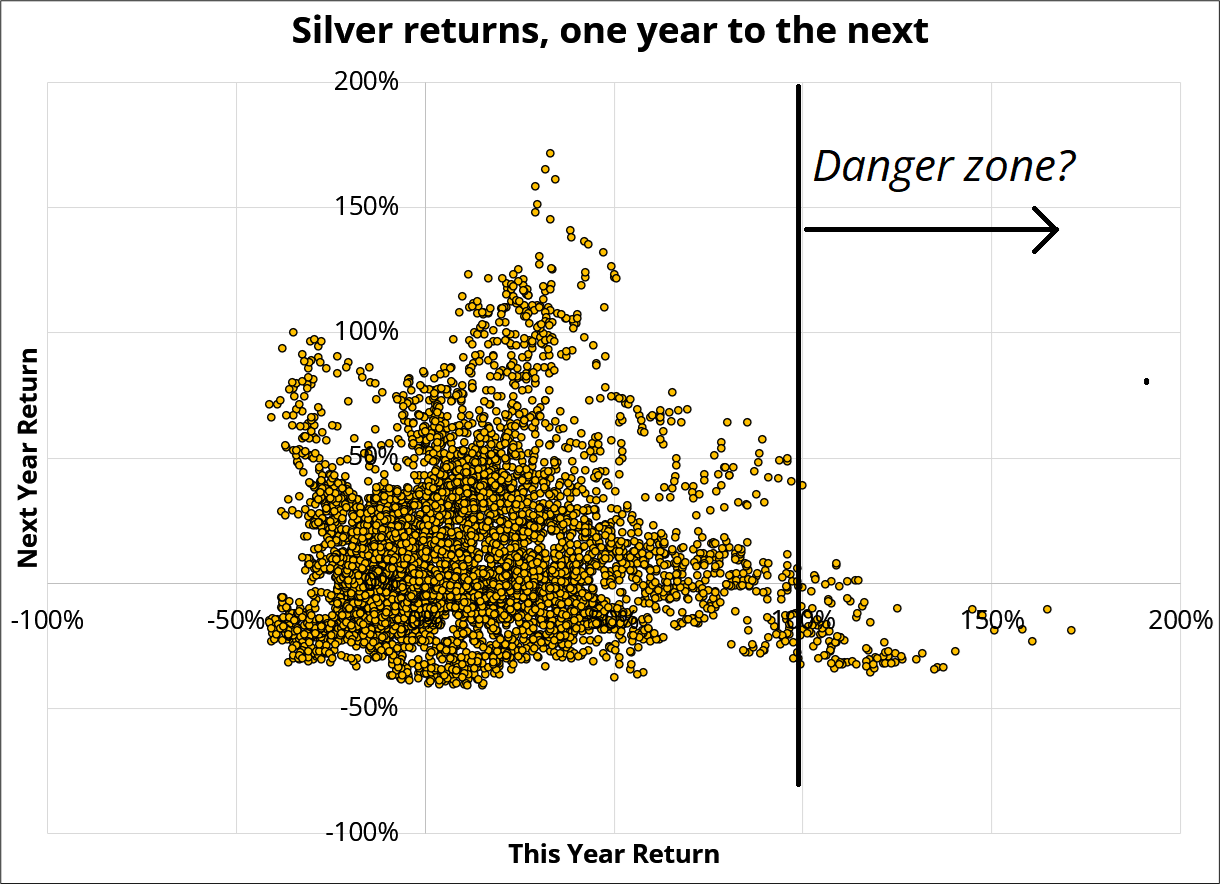

There is no real reason to take the other side and short silver here, but it’s worth noting that after 100% rallies in a single year, forward returns are bad. This chart shows daily data for 1-year return (x-axis) and then compares that to what happens in the year that follows. You can see the sample of above 100% yearly returns is not huge, but when they happen, the next year tends to be meh.

To serve the same data in a different way, the chart below shows a chart of silver along with all the times it rallied 100% in the prior year.

Again, you can see that those were generally not good times to be long. This is not a call to short silver (yet!) … But at this point I think you can make a good argument that this rally + the Time Person of the Year cover suggest deleting silver, META, AMZN, NVDA, TSLA, and Alphabet from your portfolio as we enter 2026. You can always buy gold if you want precious metals and avoid the negative convexity of trading from the long side in an asset that has now gone parabolic.

Speaking of Google. If you listen to this podcast with Gavin Baker, you might come to the conclusion that xAI will cancel out the Gemini 3 hype in early January. Another takeaway from the podcast for me is that AI is a capex-heavy industry where the low-cost producer wins, in contrast to previous iterations of tech which were cashflow-heavy where the most innovative products win. Invest accordingly.

!ke e:/xarra //ke !

The flag of South Africa uses the black, green, and yellow of the African National Congress (ANC) along with the Dutch red, white, and blue, forming a “Y” to represent the convergence of diverse paths into one nation.