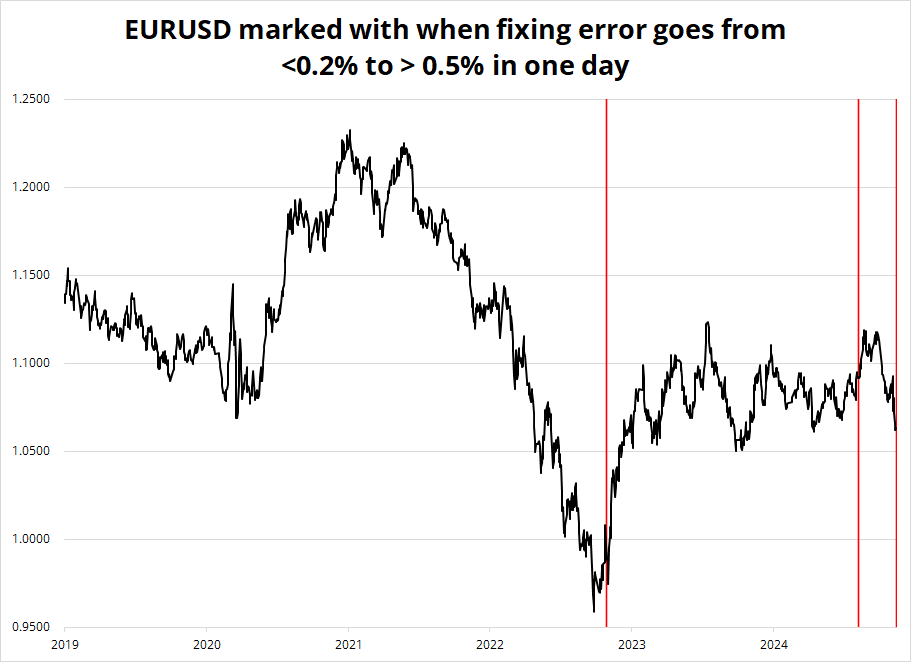

If you caught the EURUSD move via options, this is a good place to square up.

Image source: Wikimedia Commons

If you caught the EURUSD move via options, this is a good place to square up.

Image source: Wikimedia Commons

Forrest Gump’s running route

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

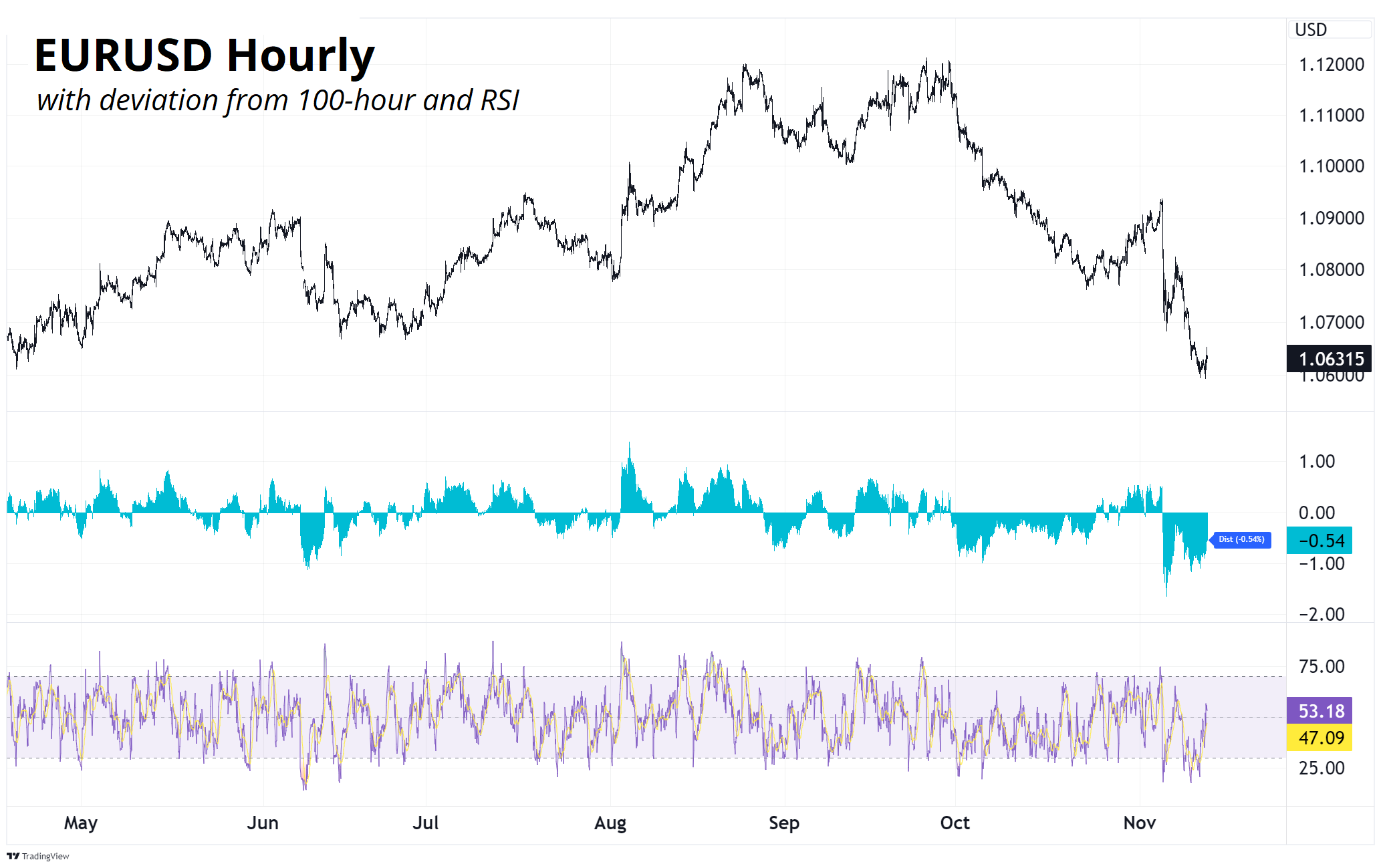

Today’s CPI should allow the 25bp cut from the Fed to remain the base case, though we still get another jobs report and another CPI before the Fed meeting as it’s not for another 35 days. That should help put a floor under EURUSD as positioning is extended, momentum is overbought, and policy uncertainty remains high enough to matter.

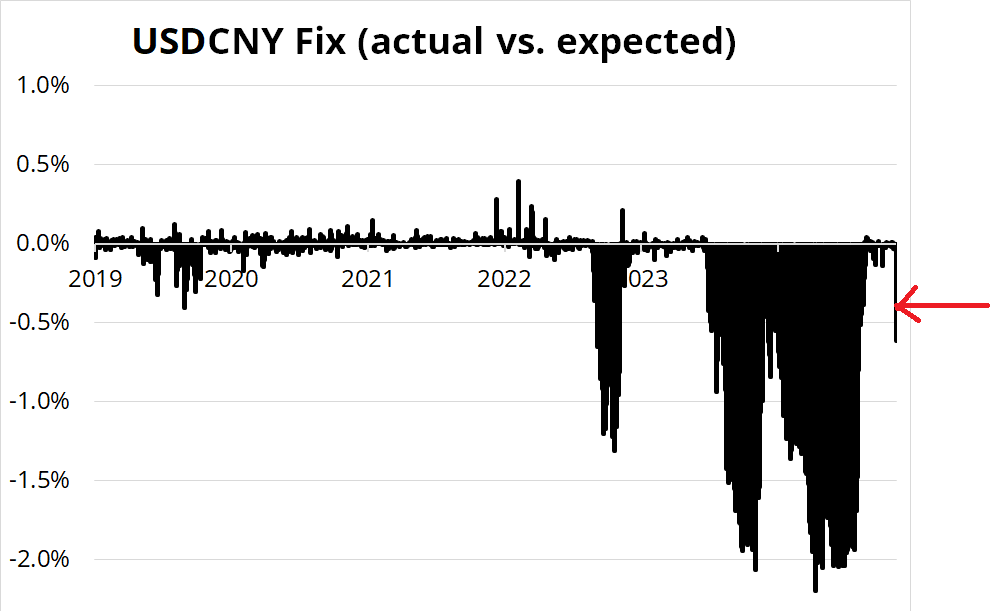

Also, the PBoC fixed on the very strong side for CNY overnight. While past performance does not guarantee future results, especially when Donald Trump has just been elected, I see many reasons to square up short EURUSD positions here. To be clear, I have not been short EURUSD, sadly, I am simply addressing the many EURUSD shorts out there.

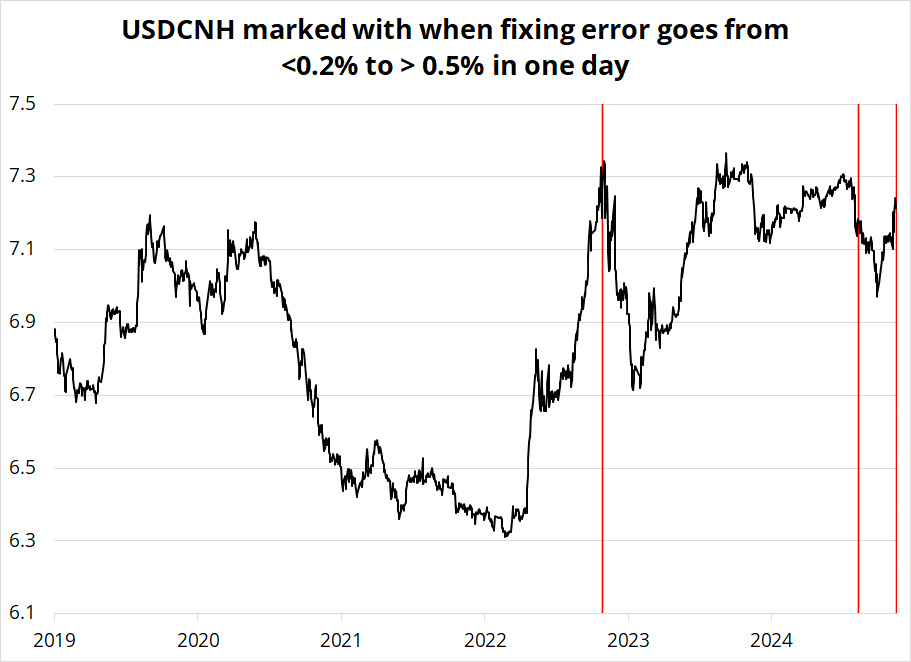

Small sample size, but obviously there is strong logic to the idea that USDCNH, a manipulated / managed currency pair, responds to strong signals from the central bank authority that does the manipulation / management. The impact on EURUSD is felt through either the mechanical USD relationship or (slightly more conspiratorial theory) the PBoC using its enormous coffers to buy EURUSD in an effort to stabilize USDCNH. Either way, when the PBoC becomes active in suppressing topside USDCNH volatility, downside EURUSD volatility becomes less fun to own.

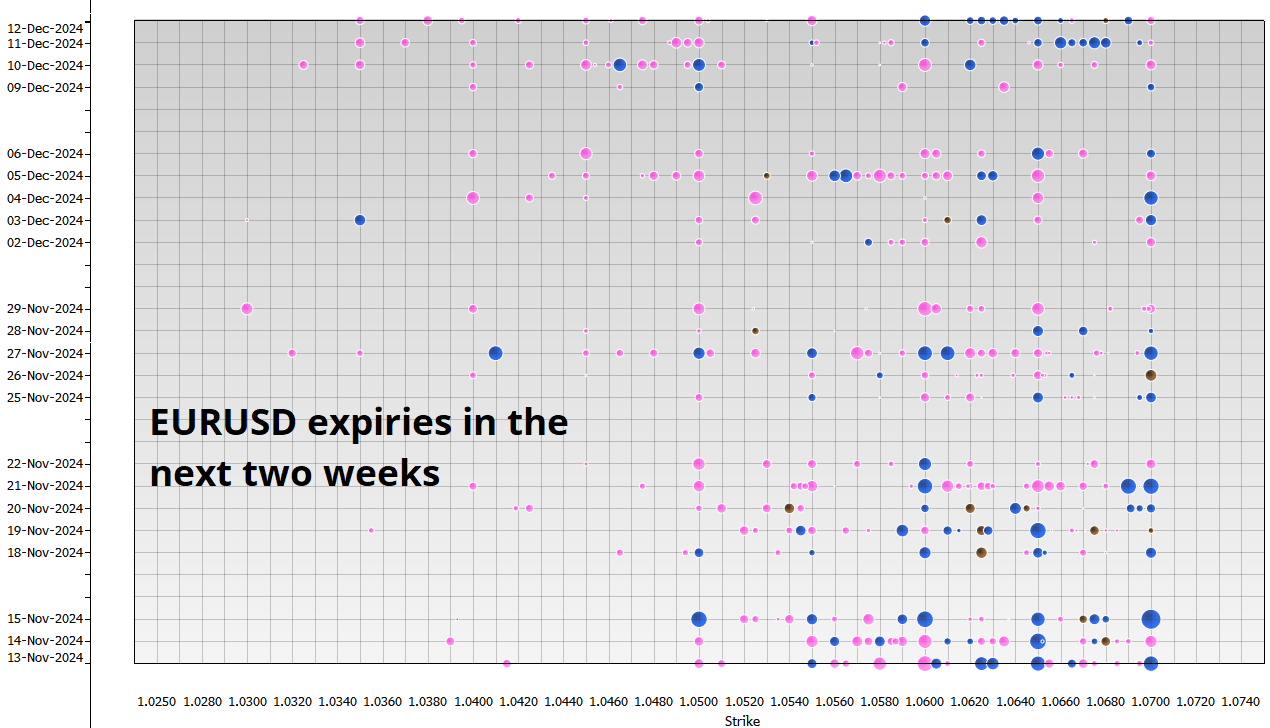

The larger dots represent expiries greater than $1B. For perspective, the 15NOV 1.0500 (blue dot) is 1.7B. So, we have at least a billion per day almost every day at 1.06 for the next little while.

It is also worth noting, for future reference, that there is pretty much nothing below 1.0500. So a close below there could lead to some serious FOMO / chasing. But I don’t think we’re going there.

The conclusion here is that I do not think EURUSD downside vol will realize over the next week or two. The Fed is probably cutting in December, EURUSD is oversold, short euro is well owned, PBoC has said no mas, and momentum is waning. I don’t think this means that we have to explode higher in EURUSD. A 1.0550/1.0780 consolidation would be my base case.

For your guide, a 1-month 1.0435/1.0825 double no touch trades around 33%.

Have a chocolatey day.

https://travegeo.com/Forrest_Gump

Forrest Gump’s running route.