Today’s title is a bit facetious in that when everyone is greedy and there is no risk premium in any market, that is the moment of greatest risk.

A fun story from 2016

The 2016 election was a fait accompli, until it was not.

Today’s title is a bit facetious in that when everyone is greedy and there is no risk premium in any market, that is the moment of greatest risk.

Stop loss 112.16

The price action in USDJPY confirms, once again, that the BOJ is pretty much always a 1-day trade and after the initial excitement, the market stops caring rather quickly. Given the glacial pace of normalization, even when it finally starts, I don’t think you can trade BOJ policy in USDJPY. BOJ views are always and everywhere a Japan rates trade, not an FX trade.

There are many examples of this in 2022 and 2023, but the ultimate one was if you went long USDJPY when the BOJ cut rates to negative in 2016 and USDJPY went up for six hours and then straight down for six months… Japanese policy rate movements are microscopic relative to peers. Still, people want to care about BOJ, so here’s the upcoming schedule from a Bloomberg article via Rammerz.

March 13 Rengo releases prelim results of shunto

March 19 BOJ (3bps priced)

April 26 Tokyo CPI – reflects corps price adjustments for new business year

April 26 BOJ (8bps total)

May 24 April national CPI

June 5 April labor cash earnings data, partially reflects shunto results

June 14 BOJ (11 bps priced)

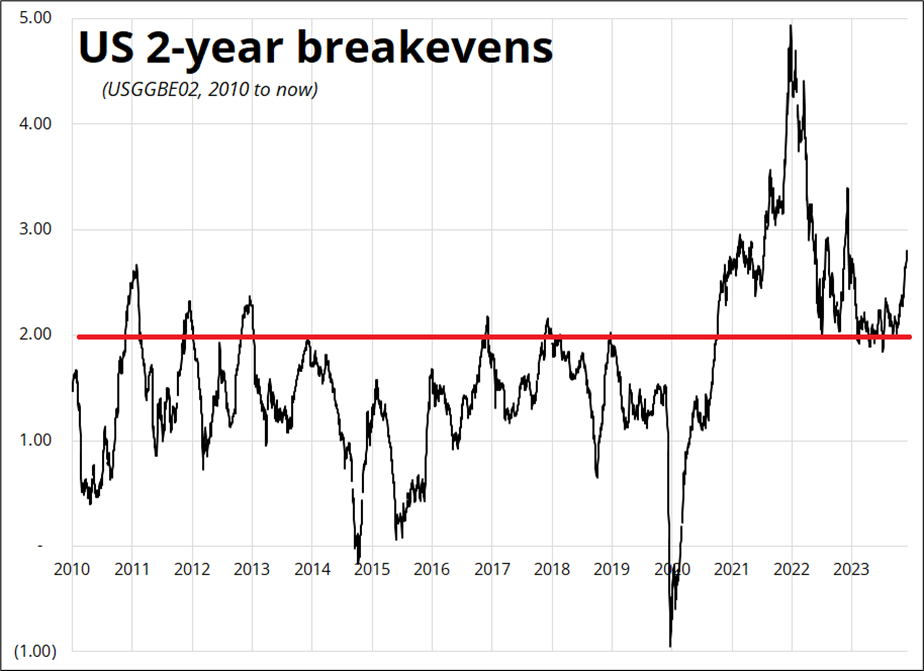

For now, global yields are not doing much, but I think it’s interesting that 2-year break-evens in the US bounced just about perfectly off the 2% level. There is a nice symmetry where 2% was the ceiling during secular stagnation, and now if we are moving into a Secular Stagnation Plus™ regime, this is what it should look like. You have the ongoing downward structural pressure on inflation that comes from technology and demographics but a higher floor as the psychology around price-setting has changed.

This is worth keeping an eye on as we await the February inflation data and learn whether this is all a January effect or something bigger. My feeling is that inflation is basing and will mildly reaccelerate but that will all be part of the slow return to target. In other words, progress to 2% will be choppy but eventually successful.

It’s interesting how the narrative has now come all the way to just about everyone agreeing that the Fed will be higher for longer and there will be very few rate cuts and there is absolutely no risk premium anywhere, whether you look at credit, FX options, equities, or Fed expectations. Fading that for no reason isn’t going to work, but it’s probably safe to say that every single capital market is priced for something between Goldilocks and outright US reacceleration. Greed is in control and fear is dead. Everything is awesome.

Meanwhile, in the Great White North…

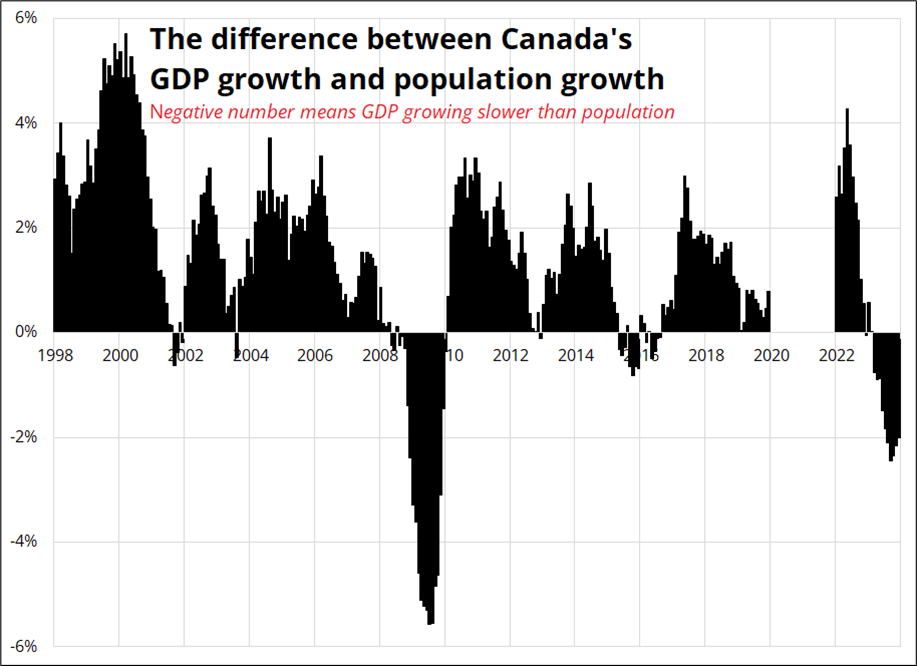

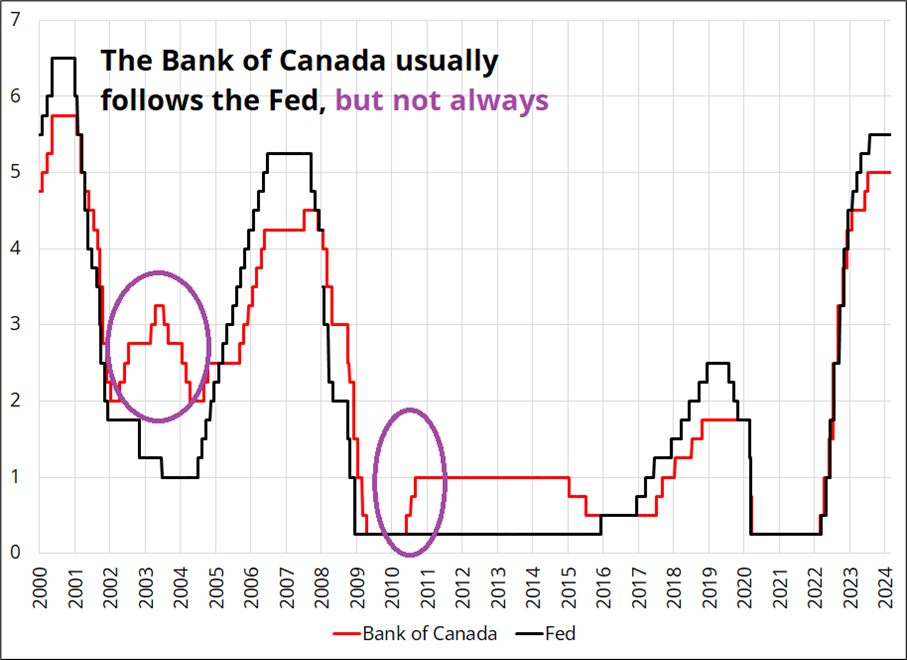

This chart is just another way of framing GDP per capita, and it paints a sluggish picture. Population growth has exploded but business and residential construction investment is creating a huge drag. The consumer continues to chug along thanks to a strong labor market, but some are starting to feel the drag from higher mortgage payments. Next week’s BoC meeting will be of more interest than normal given everyone just assumes that the Bank of Canada will do exactly what the Fed does, even though that has not always been true in the past. Usually, the Bank follows the Fed because both central banks are looking at nearly-identical stories. But now the US and Canada look quite different. So I don’t think we can exclude a more dovish outcome from the Bank of Canada next week. If the RBNZ can be dovish, the BoC can too.

I have a friendly relationship with Grant’s Interest Rate Observer and so I am sharing their upcoming event with you because their stuff is always great. If you are interested in Private Credit—here you go!

Event Preview: Our long list of speakers is a veritable spice rack of the industry’s leading investors, dealmakers and thinkers. Hear these bright minds, under one roof with you, contribute their unique perspectives on the income opportunity, systemic risks and the cyclical test to come of the enormous $1.5 trillion entity that is private credit.

True to our modus operandi, we will take a hard-nosed approach and evaluate the landscape from every angle. And one of our most pressing questions—”Is private credit in the public interest?”—will be considered in a special panel led by William Glasgall, senior director of public finance at the Volcker Alliance.

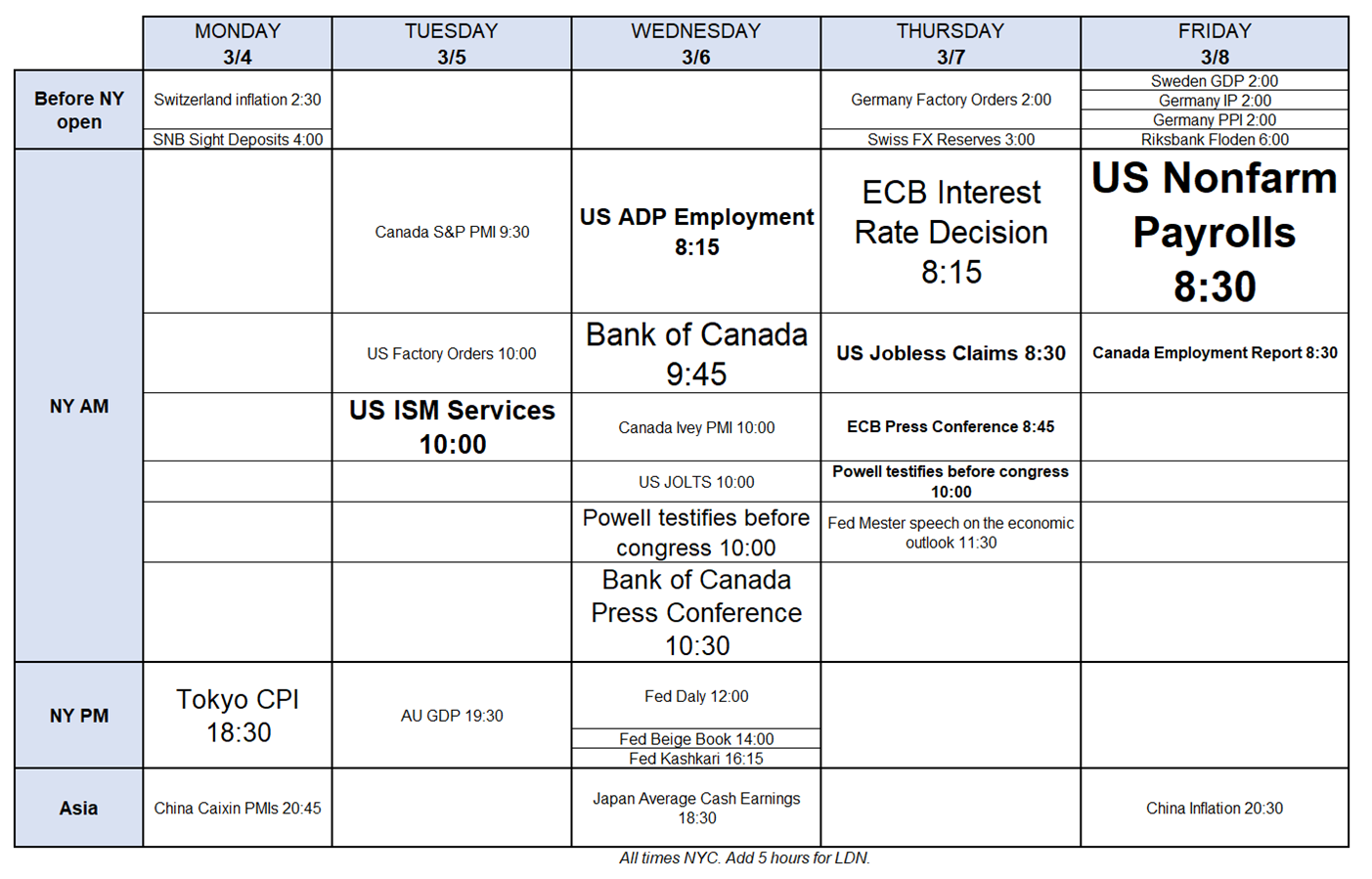

Next week looks pretty good, event-wise, as we have a variety of economic and central bank events. US ISM, ADP, and NFP plus the Bank of Canada and ECB meet to talk about when they might or might not cut. Powell is also in front of Congress. I have put the time there as 10:00 a.m. but in the past they sometimes have released the text at 8:30 a.m.

There is a ton going on over here at Spectra Markets. Justin and Mollie are losing their minds and working overtime. We’re launching our new look and feel and a new website in the next few days. Spectra School launches in the next few months, I’ve got a summer intern lined up, and…

I am now the co-host of the Macro Trading Floor Podcast with Alf Peccatiello.

We will release it every Friday for your weekend listening pleasure. This week, we discuss the outlook for the US economy, and how market pricing has adjusted to reflect the odds of a soft landing. Is there a trade? We also talk Canada, Europe, New Zealand, and China. Every week you’ll get two trade ideas and the most useful/stupidest thing we heard that week.

You can listen to the first episode of the new reboot here:

The Macro Trading Floor with Alfonso Peccatiello & Brent Donnelly

I hope your weekend tastes okay.

The 2016 election was a fait accompli, until it was not.

USDCNH looks like positive EV but there are four caveats. Short USDCAD into BoC.

I think it will be very hard for 2025 Bank of Canada pricing to come true.