Good explanations for EURUSD movement are currently hard to come by

ChatGPT imagines an XKCD-style comic about currency trading.

Interesting (?)

Good explanations for EURUSD movement are currently hard to come by

ChatGPT imagines an XKCD-style comic about currency trading.

Interesting (?)

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

David Deutsch says that strong predictions first require good explanations. This is an observation that is obvious once you hear it, but not always obvious beforehand. The upshot is that if you can’t explain why EURUSD is moving, you are going to have a hard time predicting where it might go next. So, let’s take a look at the most useful explanatory variables for EURUSD in recent years and see how they’re doing as predictors.

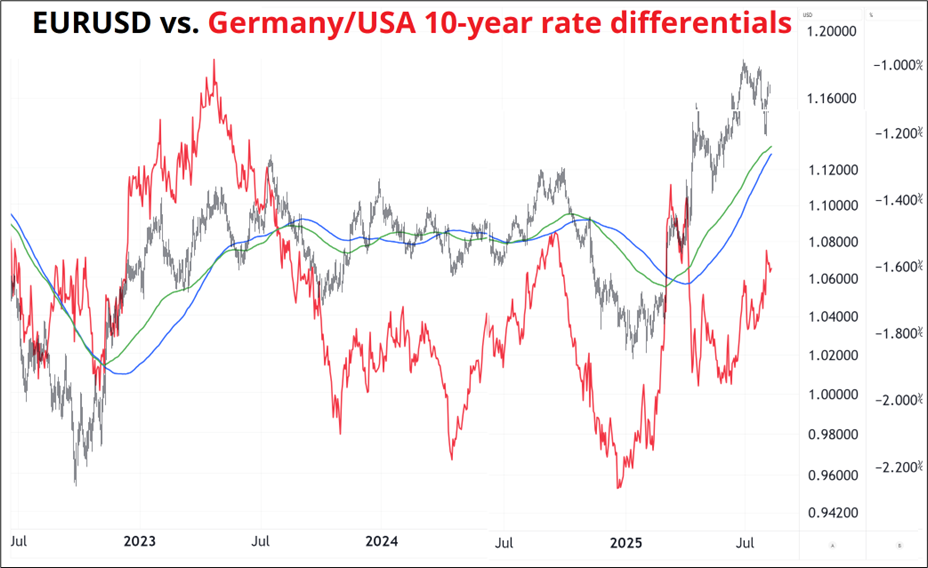

Old reliable is normally interest rate differentials. They tend to capture most of what is going on with relative growth and inflation and have been the workhorse overlay since I started in FX in 1995. Crazy fact: This summer marks the 30th anniversary of my first day on the FX spot desk at Citibank Toronto. Inconceivable! Anyway, here’s rate differentials.

Hmm. The correlation flipped around Liberation Day as we had two weeks of capital flight and then some bond vigilante appearances. Then, the fear subsided and eventually the pension funds ran out of USD to sell for hedging and the Asian central banks got filled in.

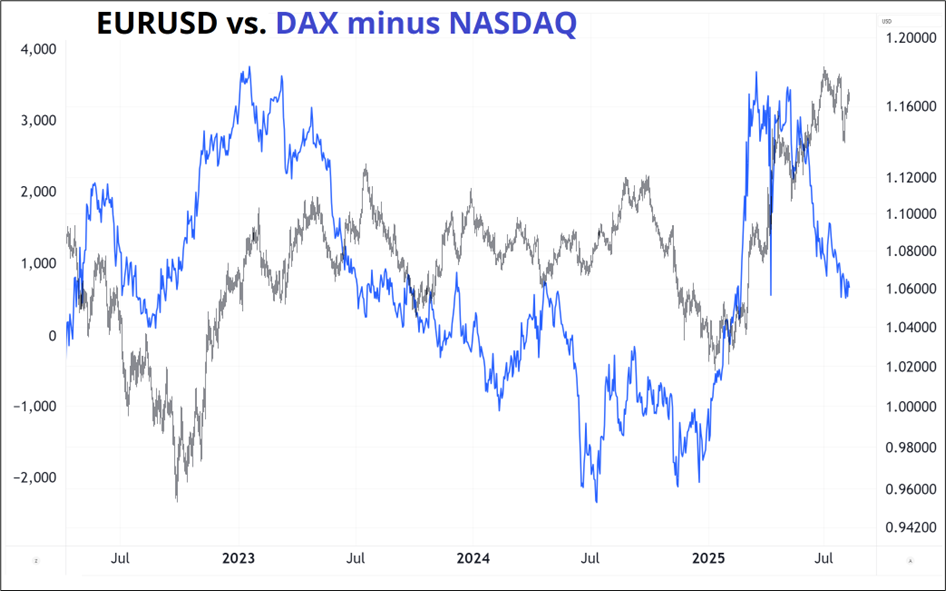

At times, another decent explanation for EURUSD in recent years has been the relative performance of EU and US equities. American Exceptionalism has been a driver of massive capital inflows to the United States, more than offsetting the major negative NIIP in the US. This flipped when Trump started to implement his plan for a New World Order just as the market questioned peak AI Capex, but the buy Europe / Sell US stock market frenzy didn’t last long. Here’s the chart:

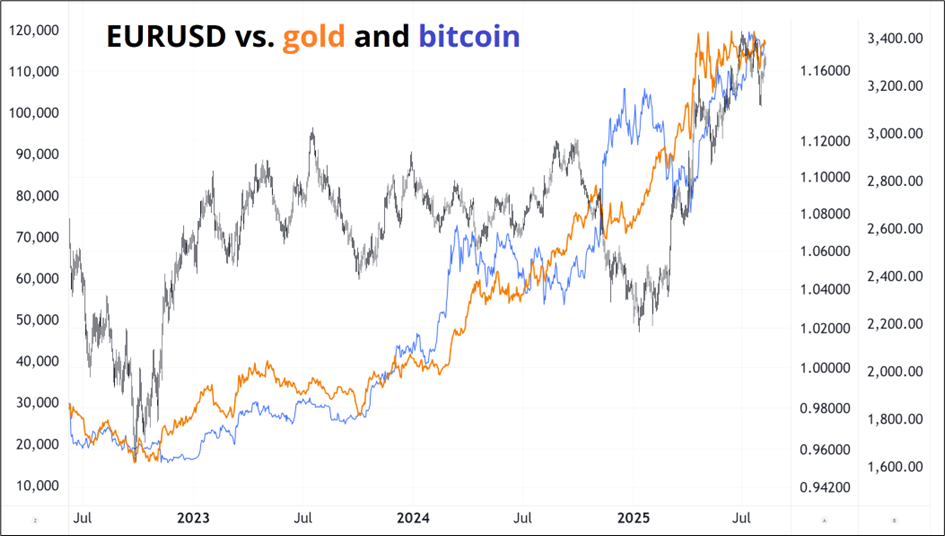

Another theory has been that huge US deficits will create a debasement effect which will benefit hard assets like gold and their digital cousins and lead to devaluation of the USD. In contrast, Europe is increasing the fiscal spend off a low debt base, so that should benefit the EUR. Here’s the chart:

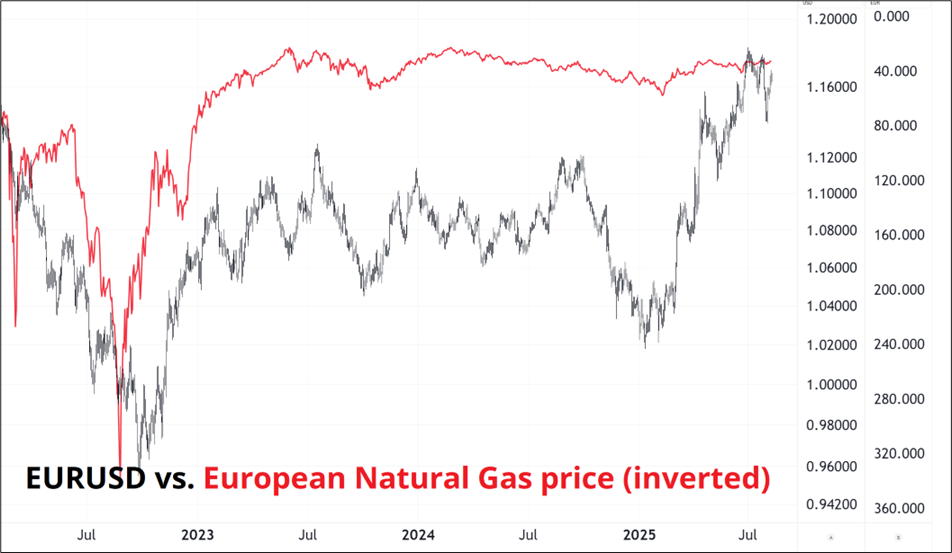

And if you’re old enough to remember the Great German Terms of Trade shock from the explosion higher in European natural gas prices, you might still have a tab with this obsolete overlay.

We are left with a confusing picture. The headline that Waller is a Trump favorite for Fed Chair generated a brief rally in the USD, which might make you think that institutional credibility is a possible driver of the USD, but then Miran was appointed to the Fed last night and EURUSD couldn’t rally. I thought the Miran headline would be good for a move to 1.1720 in EURUSD as he could vote for 50 at the September meeting (if he clears the Senate by then) and the market will need to price the possibility that he is subsequently promoted to the Fed Chair position. I thought the market would view a puppet appointment as bearish USD, but EURUSD is unchanged from when the headline came out. And USDJPY is higher.

I could run through the other currency pairs and come to a similarly confusing conclusion as terms of trade doesn’t affect AUD, Bank of Canada policy doesn’t affect CAD, and EURCHF follows time of month patterns more than it cares about the deep negative CHF carry or broader movements in the euro. Tariffs were mega bullish USD, then they were mega bearish USD, and now nobody cares about them.

This is not to say that FX is dead. It’s just a summary of the current state of play as we await clarity. In the meantime, there are still short-term trades to do and events to trade and techs and seasonals to consider. But for now, I will say I don’t know what’s next for the USD. I had a pretty good feel on the EURUSD rally and the move back down from 1.17 to 1.14 but now I am clueless. Agnostic and alert.

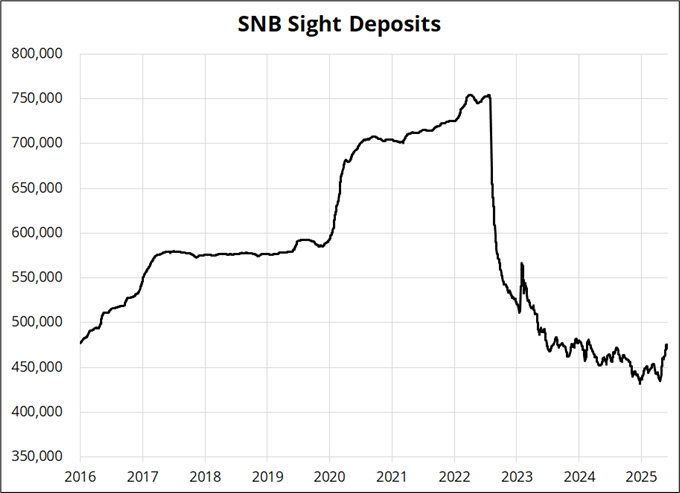

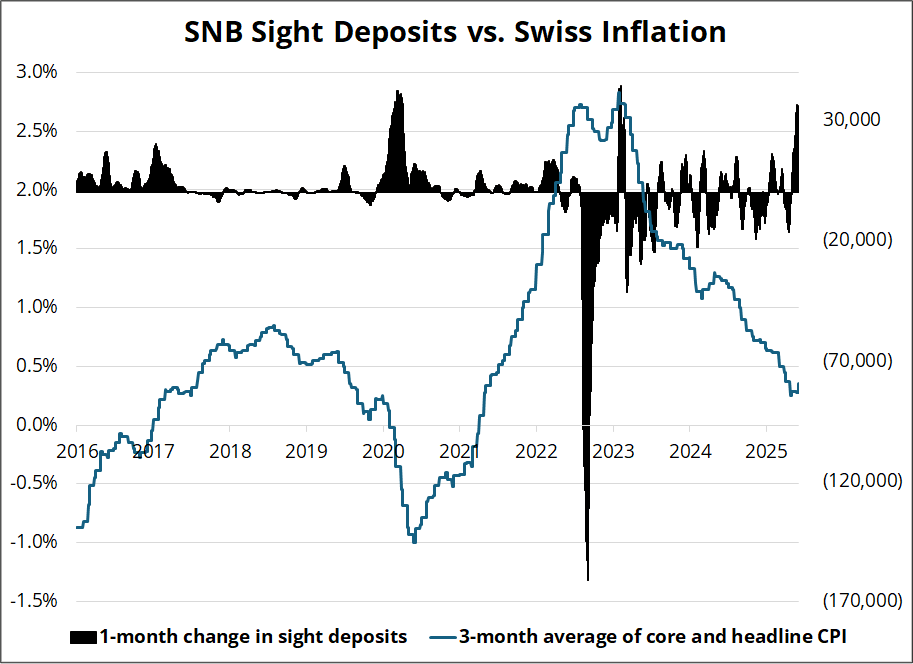

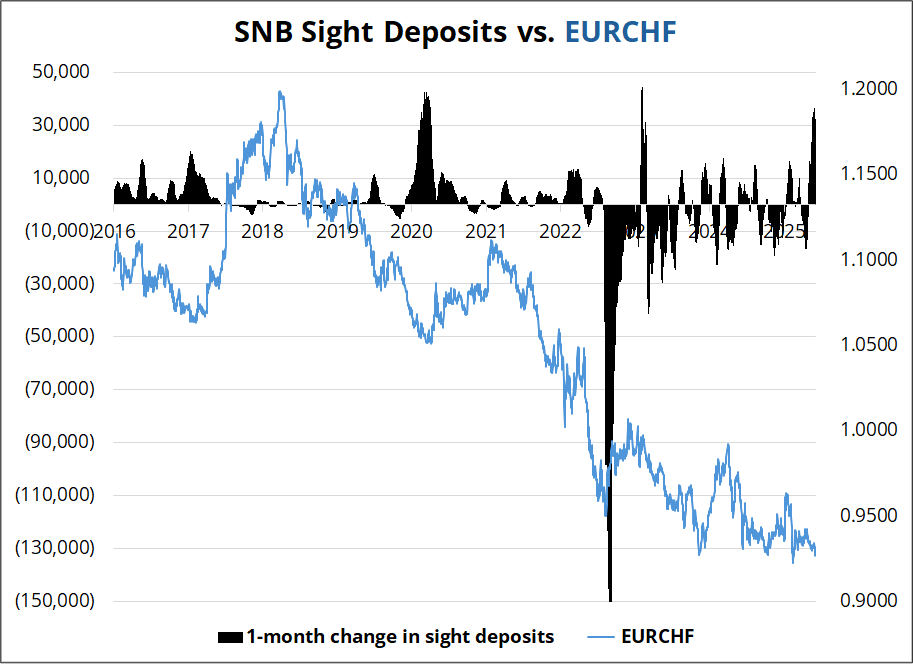

SNB Sight Deposits have been sneaking higher over the past six weeks, though there is always some mystery around when and why they move. While some of it is noise, some of it is related to SNB intervention. The rate of increase in the Sight Deposits is worth noting right now as anything above 20,000 in a month is notable and we are up around 30,000. Here are a few graphs for perspective…

Ticking higher…

You can see the COVID deflation brought the SNB on the bid in EURCHF, while high inflation readings in 2022 “forced” them to sell EURCHF. Now, inflation is slumping towards zero and they have little room to cut rates and so some mild selling of CHF would be consistent with their monetary policy goals. There is the political aspect of whether or not that will anger the US, but my feeling is that most countries still believe that monetary policy is sovereign and not to be dictated by political forces across the ocean. It depends how scared they are of the US.

You can see that EURCHF bottomed a while after the SNB started buying in 2020 and went down hard in the period when they were selling, so it’s not unreasonable to think it bases here. I suppose it’s already based as the month end pattern worked perfectly—EURCHF bottomed on the last day of the month and then ripped immediately thereafter. Yes, tariffs were increased from 31% to 39%, but my bet is EURCHF rallying is more about the end of month-end CHF repatriation and maybe mild flurries of CHF selling from the SNB. Again, Sight Deposits do not always indicate intervention, they can simply reflect rejiggering of repos and bills. But large changes in Sight Deposits usually do, so the late-July move higher in Sight Deposits is at least worth considering.

Interesting article here:

https://www.quantamagazine.org/at-17-hannah-cairo-solved-a-major-math-mystery-20250801/

Includes some solid quotes, including:

“Growing up, I didn’t really know if I was talented,” she said. “I like to play piano, and people around me would tell me that I was really talented at math and at piano. And in retrospect, now that I look at it, I can see, sure, my piano was above average. But it was by no means exceptional. While on the other hand, it looks like mathematically I’m, like, whatever.”

“I didn’t have many social experiences, so I still had to learn how to interact with other humans,” she said.

Have a prodigious weekend!

Bonus Chart: EURCHF… Basing, or boring?

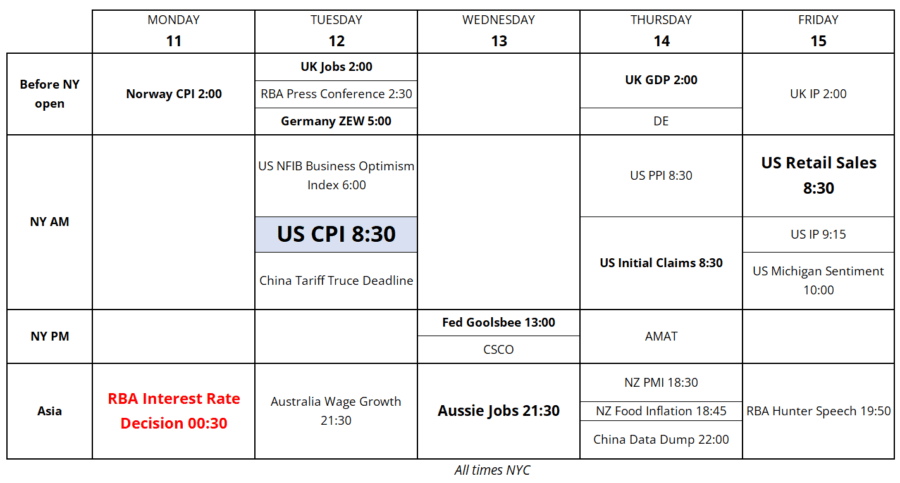

Trading Calendar for the Week of August 11, 2025

I asked ChatGPT to make a comic about currency trading in the style of XKCD. It’s bad, with some bright spots.

CHF HAS ACHIEVED SENTIENCE