Powell can stick to wait-and-see. RBNZ might say they’re done cutting.

Source: Terrible Maps

Powell can stick to wait-and-see. RBNZ might say they’re done cutting.

Source: Terrible Maps

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

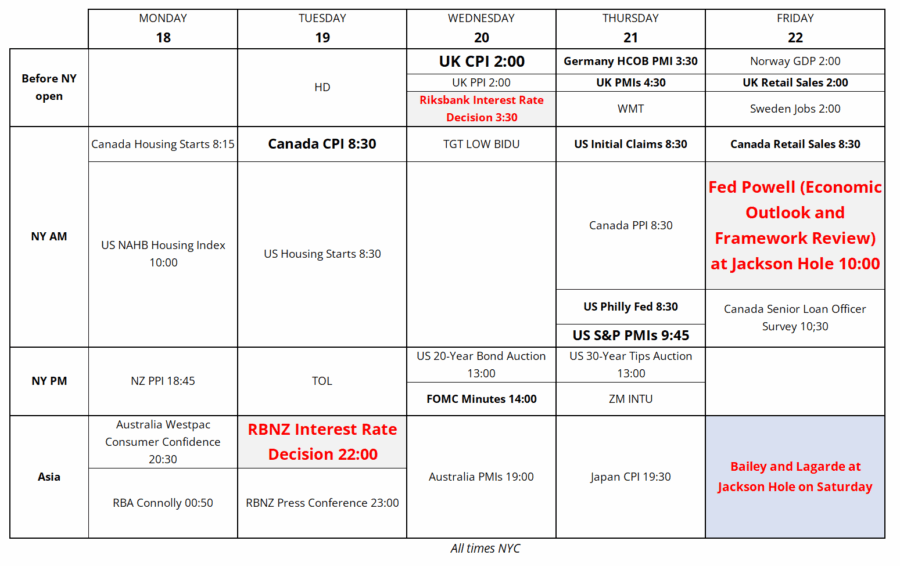

We wait patiently for Friday’s Jackson Hole speech. It would seem odd to me for a wait-and-see Fed Chair to telegraph an interest rate cut four weeks before a meeting when there are two major economic releases yet to drop (or three, as we are now going to watch PPI much more closely than usual after last week’s barnburner). In fact, I would think the risk is the other way: Powell uses Jackson Hole to explain that while demand for labor is falling (low headline NFP), labor supply is also falling just as fast (low unemployment rate) and therefore there is not necessarily an urgent need to cut rates. He can give a nod to the dovish camp by simply saying that if labor market data confirm the weakness seen in recent months, a rate cut makes sense.

In other words, “we are still data dependent, but the labor market data trumps the sticky inflation data because we are always going to err on the side of dovish, and the inflation target is 3%, not 2% (but we can’t say that out loud).”

September 5, 10, and 11 are the key dates as they feature NFP, PPI, and CPI respectively. There’s also Core PCE on August 29, and while that is usually very easy to model using all the data that’s already available by that time, this one could be a bit more interesting with the zippy PPI inputs creating possible variance.

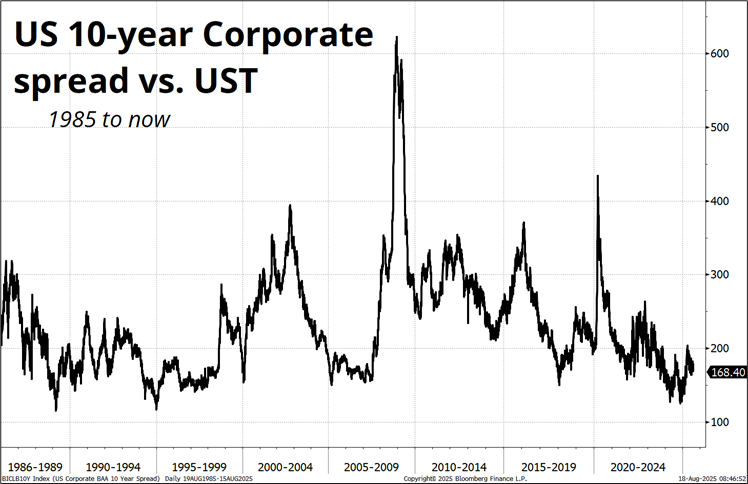

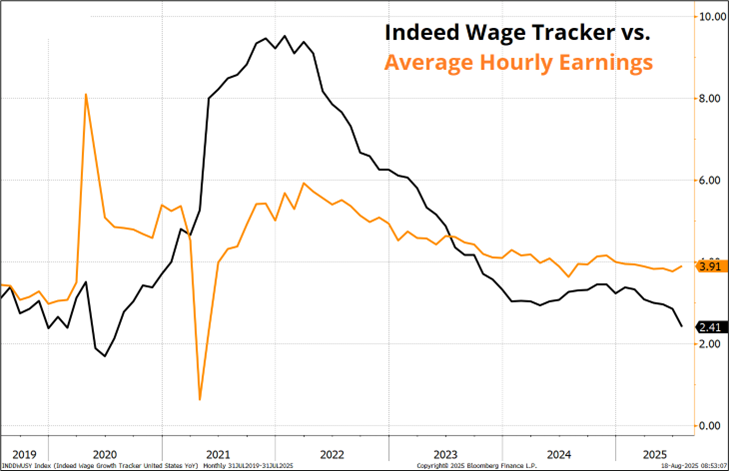

I suppose the most important and strange aspect of this resurgence in inflation is that it’s mostly coming from the services side, not the goods side, and so even if the Fed is comfortable looking through goods inflation, that’s not what this inflation is. GDP is tracking 2.5%, Core PCE, Core CPI, and Core PPI are all going to come in around 3.0% over the next few months, the UR is 4.2%, Wage Growth is 3.9%, and Initial Claims 225k and we are prepping for rate cuts. This shows that either the political pressure is working, or the Fed has high confidence in r* and is supremely confident that rates are restrictive despite equities at the ATH, crypto bubbling, and credit spreads 50bps off the all-time tights.

Headline NFP data and dovish neutral rate models are doing a lot of work for the doves right now. Some of the private data like the Indeed Wage Tracker and Truflation are showing more disinflation than the official data, but their track record is hard to pin down given they are both new series. The Indeed data started in 2019 and the Truflation data came on board in 2021. The other issue with using these private data series is that the way they vary from the official data simply highlights how parameter-dependent all these black boxes are. We are not measuring the economy; we are estimating it.

Anyway, I am not as convinced that US interest rates are restrictive, but political pressure has moved two Trump-appointed Fed voters to the dovish side, and we will see if and when Powell and the others cave in. With 2.18 cuts priced by the conclusion of the December meeting, I don’t really see much room for a dovish surprise from Jackson Hole at this point. More likely Powell continues to say we are data dependent and then the proof is in the economic pudding that will be released in mid-September.

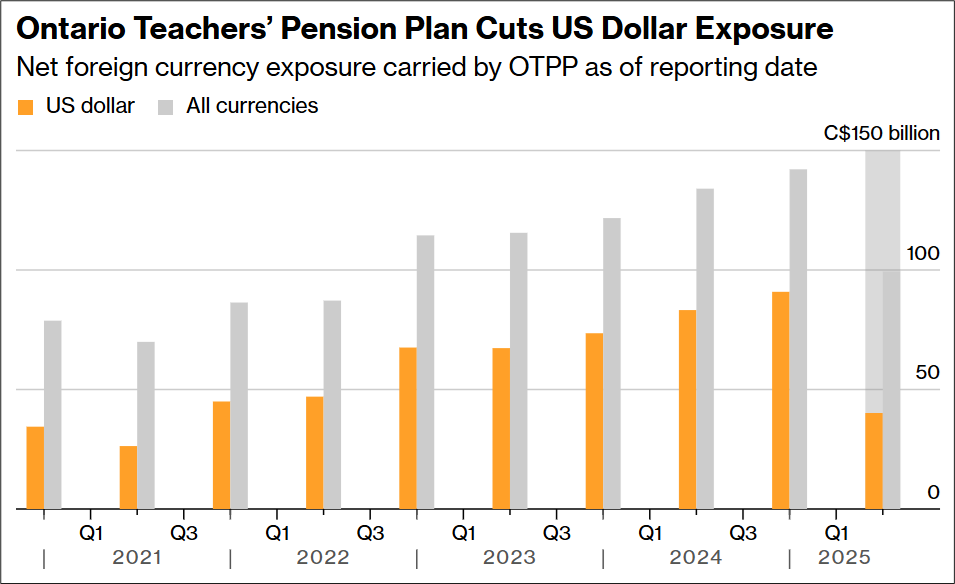

The seasonal pickup in FX vol isn’t happening, nor is the seasonal USD rally that often comes in August. We are kind of in no man’s land for the USD and yields here as the Fed is priced for two cuts and the data is all over the place. US yields are comfortable in the 4.20%/4.60% range that has dominated since May and while equities have lost upside momentum, they are still near the ATH. Pension fund USD hedging has died down, and there is little sign of Asian central bank USD selling anymore. It’s looking more and more like the structural USD selling story was overblown, and we will need a cyclical impetus to get acceleration lower in the dollar.

Data from Ontario Teachers’ Pension Plan released last week (see graphic) could be emblematic of how hard and fast foreigners cut their USD exposure. So now we wait for more clarity on where the US economy is headed. The Fed and the US government can say whatever they want, but US interest rates are more likely to be driven by economic data, not moral suasion or rhetoric.

Overall, the USD remains resilient while the EUR also trades well—and the JPY does not.

The calendar this week features the RBNZ and Riksbank meetings, with the RBNZ priced to cut (92% chance of a cut) and the Riksbank priced to hold (18% of a cut). Bloomberg’s monthly CPI data for New Zealand (which uses higher-frequency data to estimate the official data) is ticking quite a lot higher as food and airfare prices rise. The RBNZ faces the same problem faced by the Fed, BoC, and BoE: Jobs growth is slowing, and inflation is rising.

As such, I think the RBNZ will deliver a hawkish cut, signaling they are quite likely done. If 3% is the floor for the RBNZ, there is room to take out the final cut that is still priced—the market has a 2.75% terminal rate. With good resistance in the 1.10 area, I am considering a short AUDNZD trade but will give myself 24 hours to think about it and then post it in am/FX tomorrow if it seems like the way to go.

Have a colorful week.

Trading Calendar for the Week of August 18, 2025