There is not much scope for Fed surprise. Maybe the MAS can surprise instead.

The longest word that can be spelled only with the roman numeral letters is “divi-divi”, a shrub-like tree native to Aruba.

There is not much scope for Fed surprise. Maybe the MAS can surprise instead.

The longest word that can be spelled only with the roman numeral letters is “divi-divi”, a shrub-like tree native to Aruba.

Long USDSGD @ 1.3560

Stop loss 1.3478

Take profit 1.3664

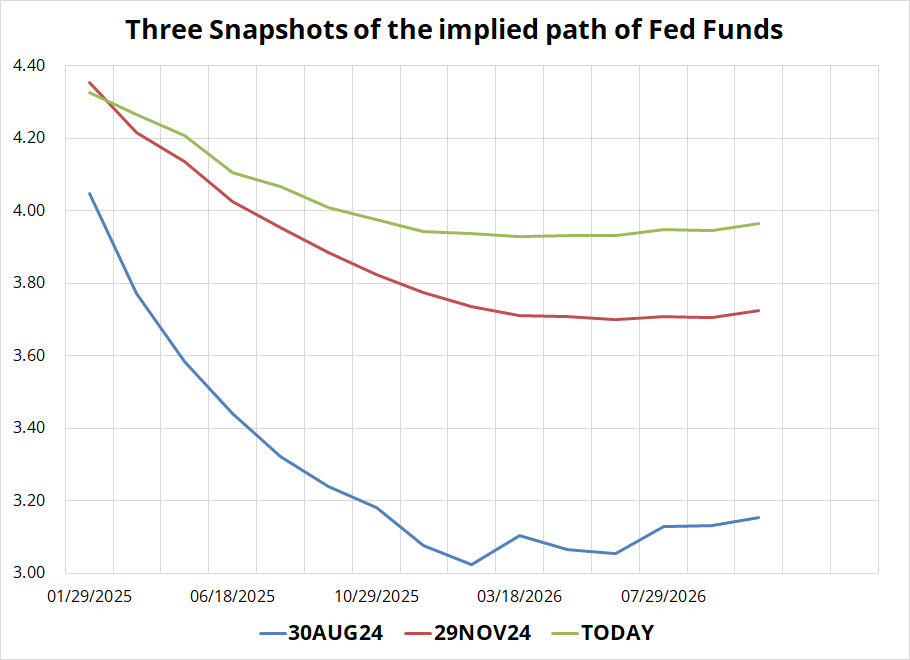

First, mostly for my own information, I wanted to check on the current Fed Funds implied curve. Here it is, snapping the shot for end of summer (blue), pre-December Fed meeting (red), and now (green).

Hard for the curve to do much other than flatten or go back to more cuts as the bar for a rate hike is just about impossibly high in my opinion. You still have people like Waller saying that they are way above neutral, despite much evidence to the contrary.

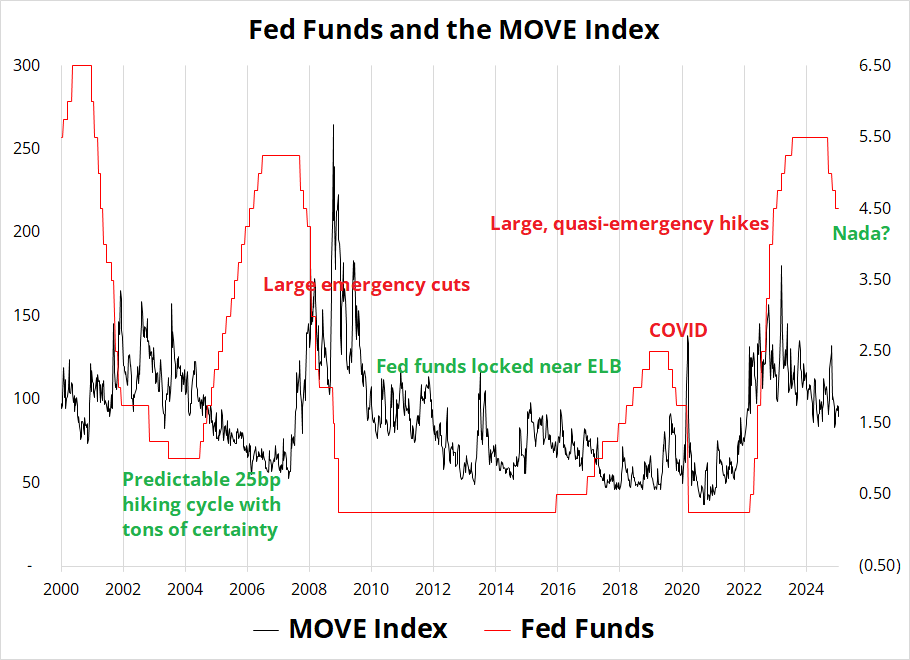

This creates an anchor for yields and quite a lot of stability because “Fed on hold for all of 2025” has to be the base case at this point. Here is a brief history of how Fed uncertainty and surprise influences MOVE.

Just some food for thought as we are in a period of low uncertainty around the Fed and we could be in that sort of regime all year. We might not be! But that feels like a good starting point / base case and then we adjust to new info as it comes in.

I am not an expert on Asian FX, but one thing that stands out to me today is the setup going into the Monetary Authority of Singapore (MAS) meeting tonight at 7 p.m. NY. Singapore uses a currency-centered approach to monetary policy, and they have not loosened at all despite the global drop in inflation, the deflationary winds in China, and the low and falling CPI in Singapore. See here for a fantastically clear explainer on how Singapore uses its currency, not interest rates, to guide monetary policy.

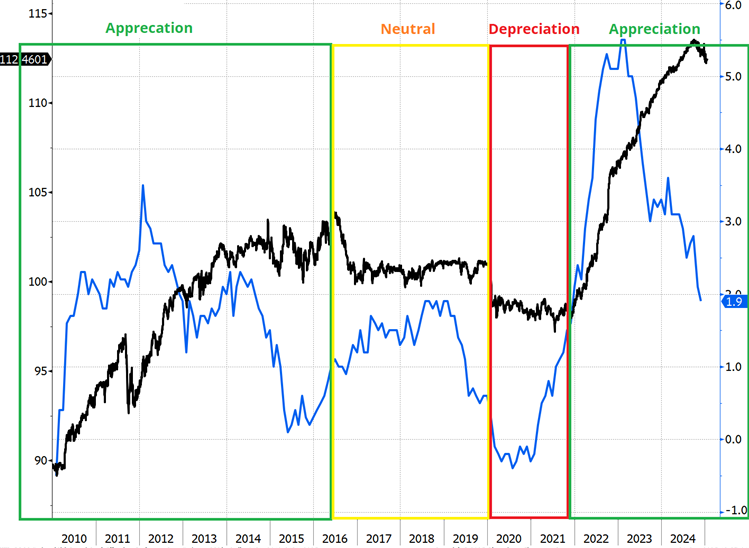

SGD is currently near the middle of the band, even as inflation drops, and their currency is strong to very strong. There are sophisticated ways of looking at this and there are simple ways. This chart is the simple way. First, just look at the black line (SGD REER) and the blue line (Singapore Core CPI YoY). You can see the aggressive tightening that took place in 2021/2022 as the MAS did what every other central bank did: Ripped everything tighter in response to rocketing inflation.

Now, SGD is strong, it’s still near the middle of the band, CPI is cratering, and they still have an appreciation bias. And the REER is just off its strongest point since 2010. Note that the MAS guided the currency in response to the path of inflation in the past. Each regime change in inflation saw a regime change in monetary policy (naturally!). You could also plot the SGD REER against other global central banks and see something similar. The whole world tightened in 2021/2022, along with the MAS. Now the whole world has loosened in 2024 and the MAS is behind the curve.

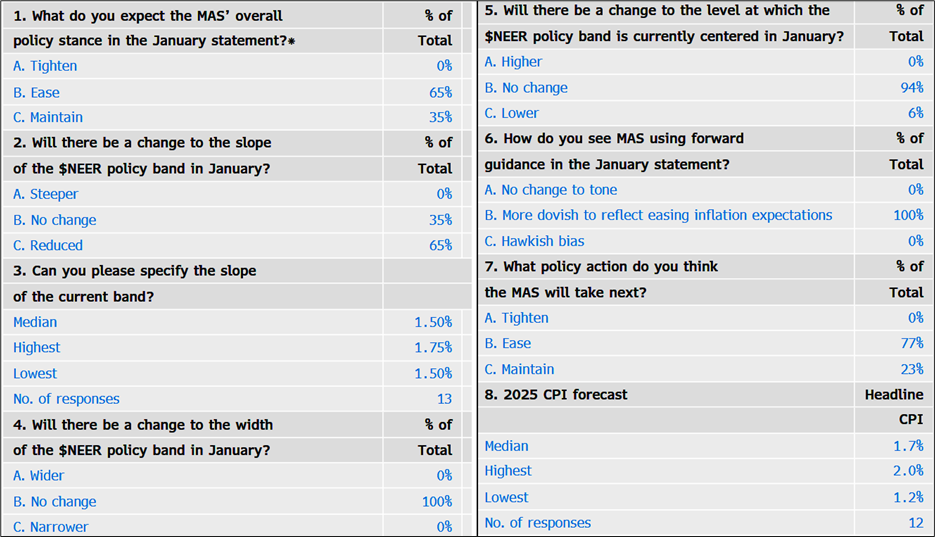

As a tourist, it looks like a good setup on paper, but what is expected? Surely a huge majority expect some sort of easing?

Kind of, but expectations are not that aggressive. This is a recent Bloomberg survey. The MAS Survey of Professional Forecasters reflects similar views, though it’s from mid-December.

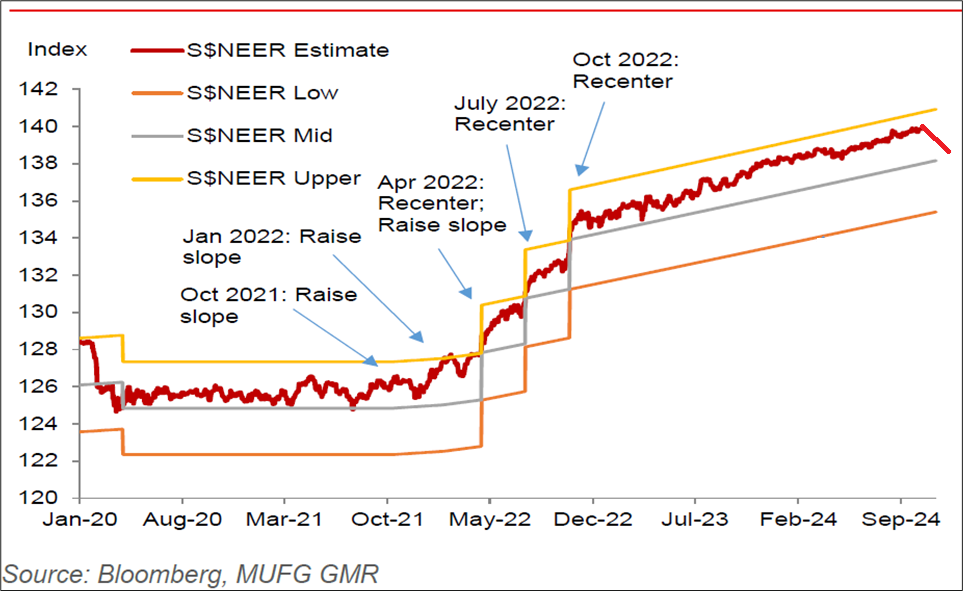

Forecasters expect a reduction in slope, but no recenter or change in width. Next is a nice chart from MUFG. I added in that downward red bit of line at the end to show you where we are now. SGD has moved towards the middle of the band of late on expectation that the MAS will ease and therefore an easing is not a monster surprise.

But I think there is plenty of room for them to surprise on magnitude or even on recentering given how far behind the curve they are relative to the inflation story and other global central banks. Again, I acknowledge that I’m a tourist here, but I like the setup.

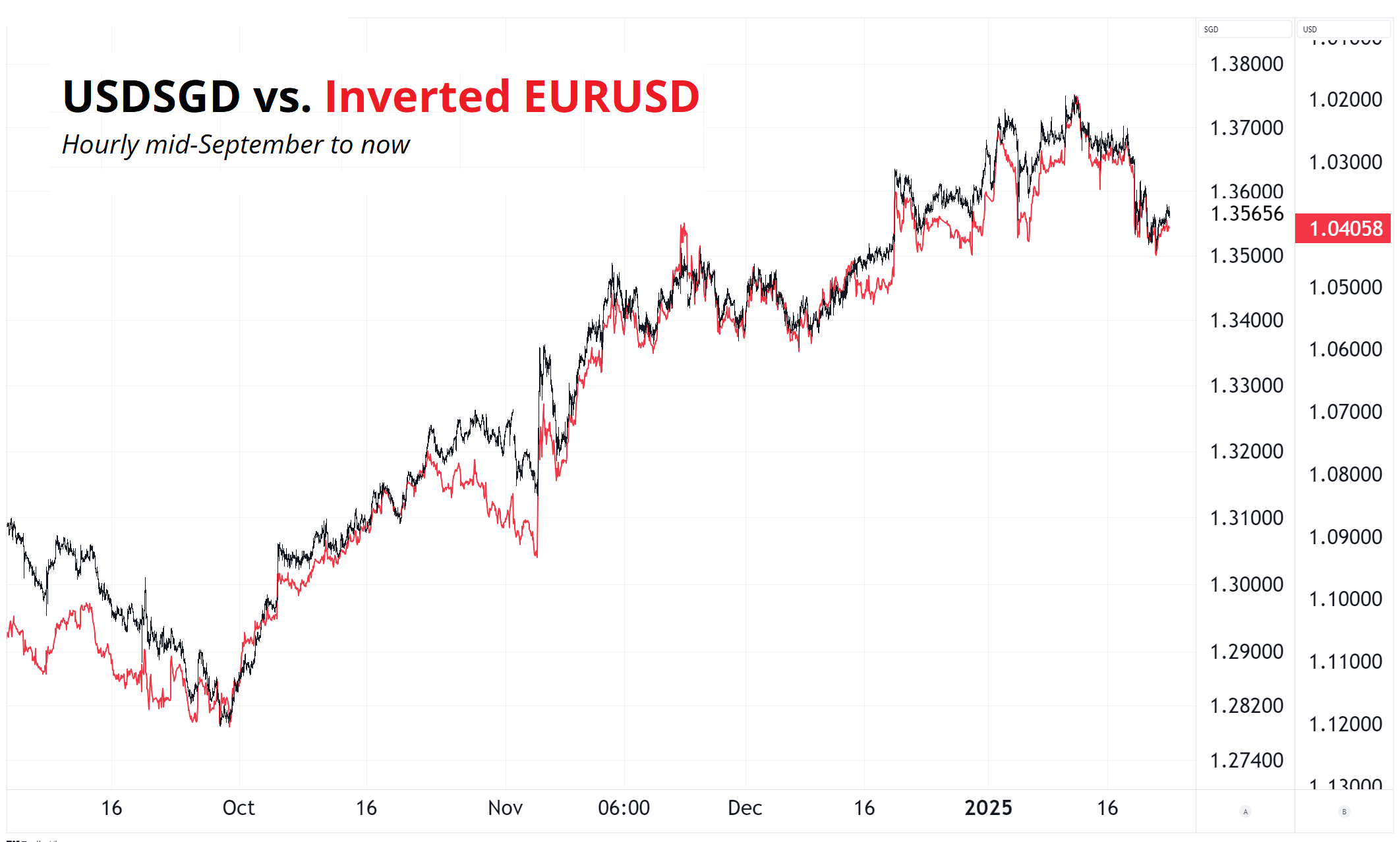

It’s annoying to trade USDSGD because that pair is just EURUSD with a bit of basis, so for bigger picture trades, you need to trade the SGD basket. For MAS-specific trades, you can get away with simply trading USDSGD, as long as you get out quickly afterwards before it becomes a EURUSD trade again.

In case you don’t know what I mean by that, here is EURUSD and USDSGD. USDSGD is mostly just a G10 proxy.

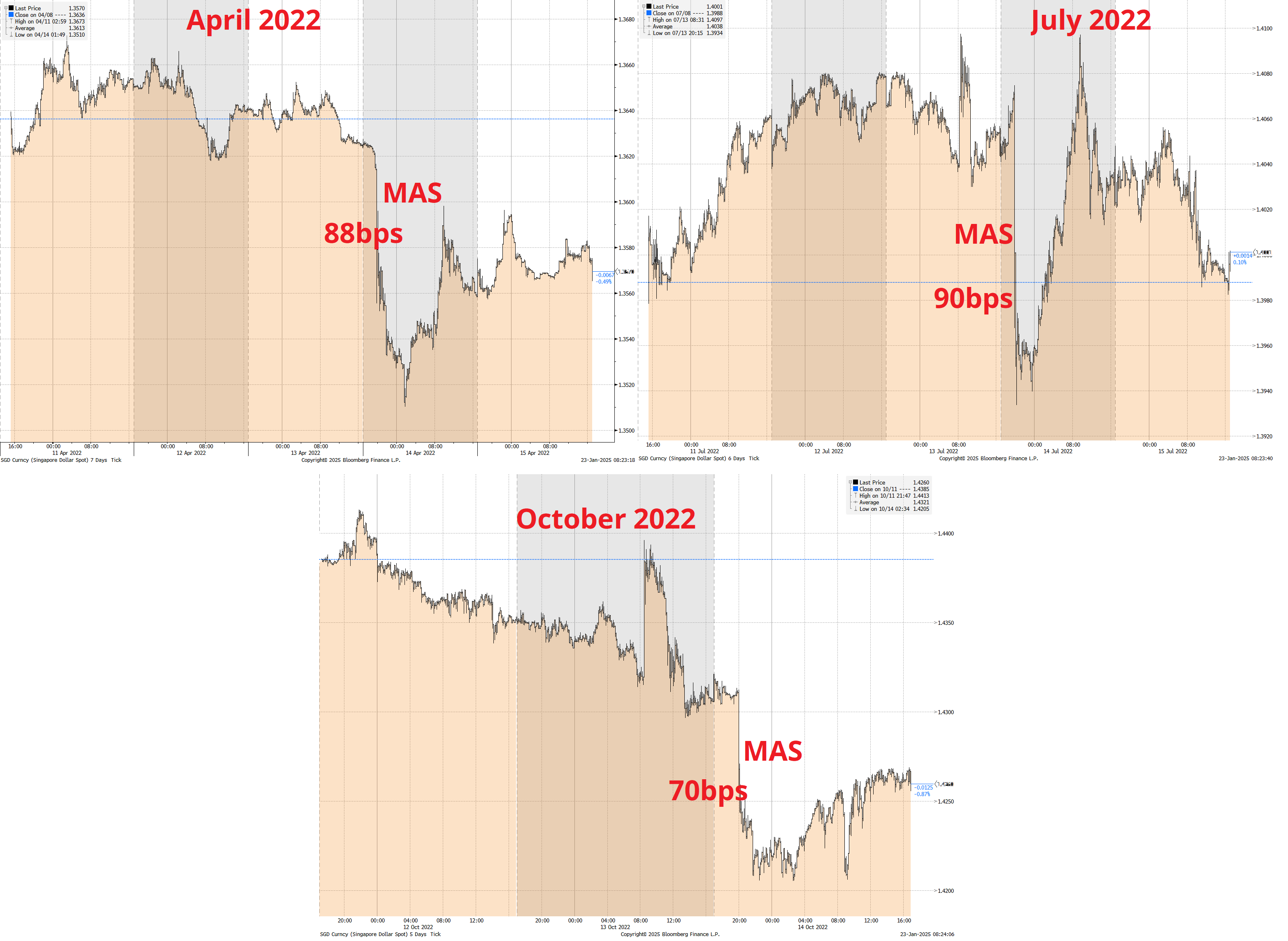

But look at how it moves around MAS surprises. It can be zippy for a bit, before it reanchors to EURUSD and G10.

So the trade here is: Long USDSGD here (1.3560) with a stop at 1.3478 and take profit at 1.3664. Risking 82 to make 124, though there are quite a few scenarios where it simply doesn’t move that much.

If neither side is done post-MAS, you need to decide if you’re bearish EURUSD because after the MAS dislocation / reprice, USDSGD becomes a EURUSD proxy again.

So if the trade is alive tomorrow (i..e, neither SL nor TP has been done) I will make a decision as to what to do and publish it in here. One final note: The biggest argument against a significant move towards depreciation is that Singapore GDP has been rather strong and therefore the argument can be made that there is not that much slack in the economy. This seems backward-looking to me, but it’s a factor the MAS might consider if they decide to slow play the regime shift to currency depreciation.

I received quite a lot of pushback on my skepticism about a Strategic Bitcoin Reserve. The release of Ross Ulbricht and the inauguration-day purchases of crypto by WLFI via DJT Jr. (which could be construed as obvious front-running of an imminent announcement) have crypto folks thinking the SBR is coming sooner rather than later.

Have a wind-swept day.

The longest word that can be spelled only with the roman numeral letters is “divi-divi”, a shrub-like tree native to Aruba.

I was wondering about this because Super Bowl LIX is this year.