Two low probability, but potentially high-impact events this week

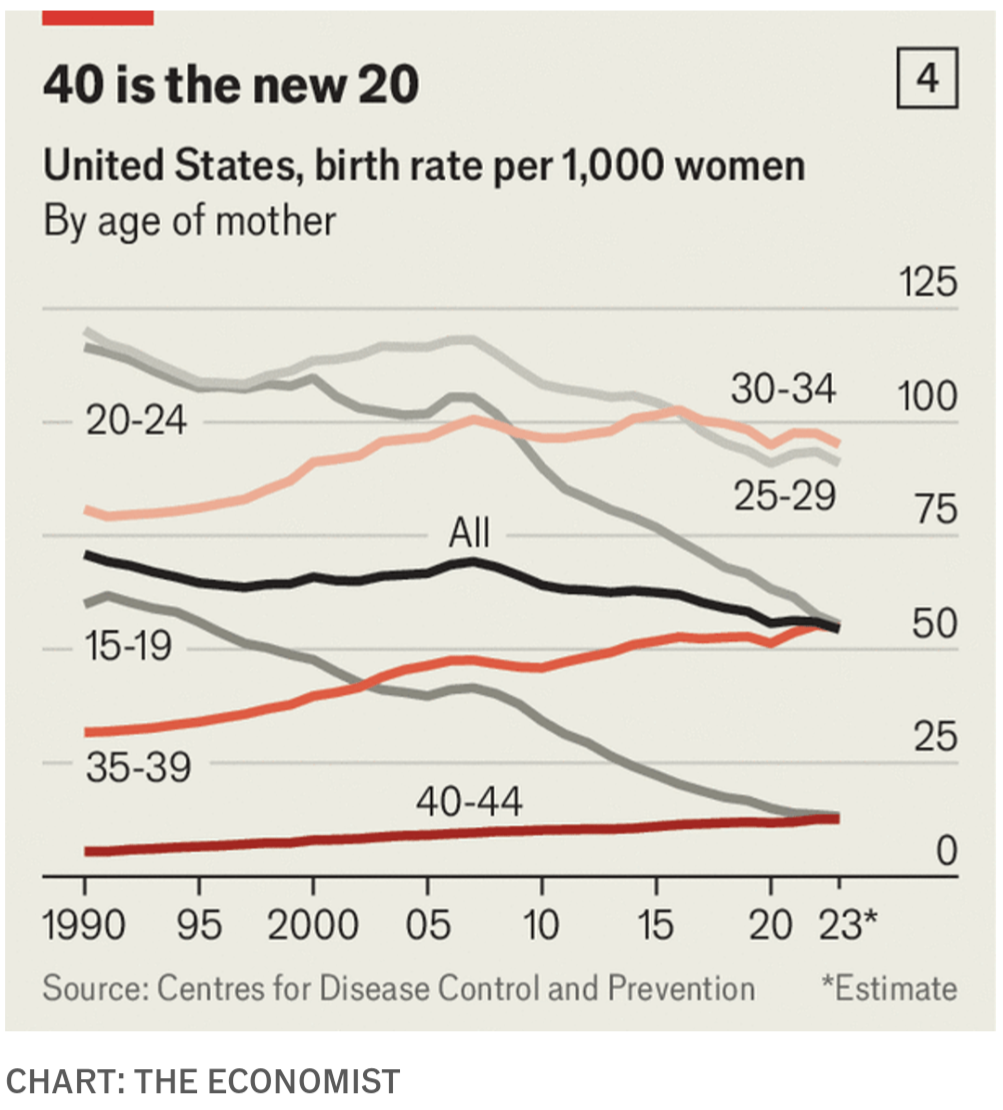

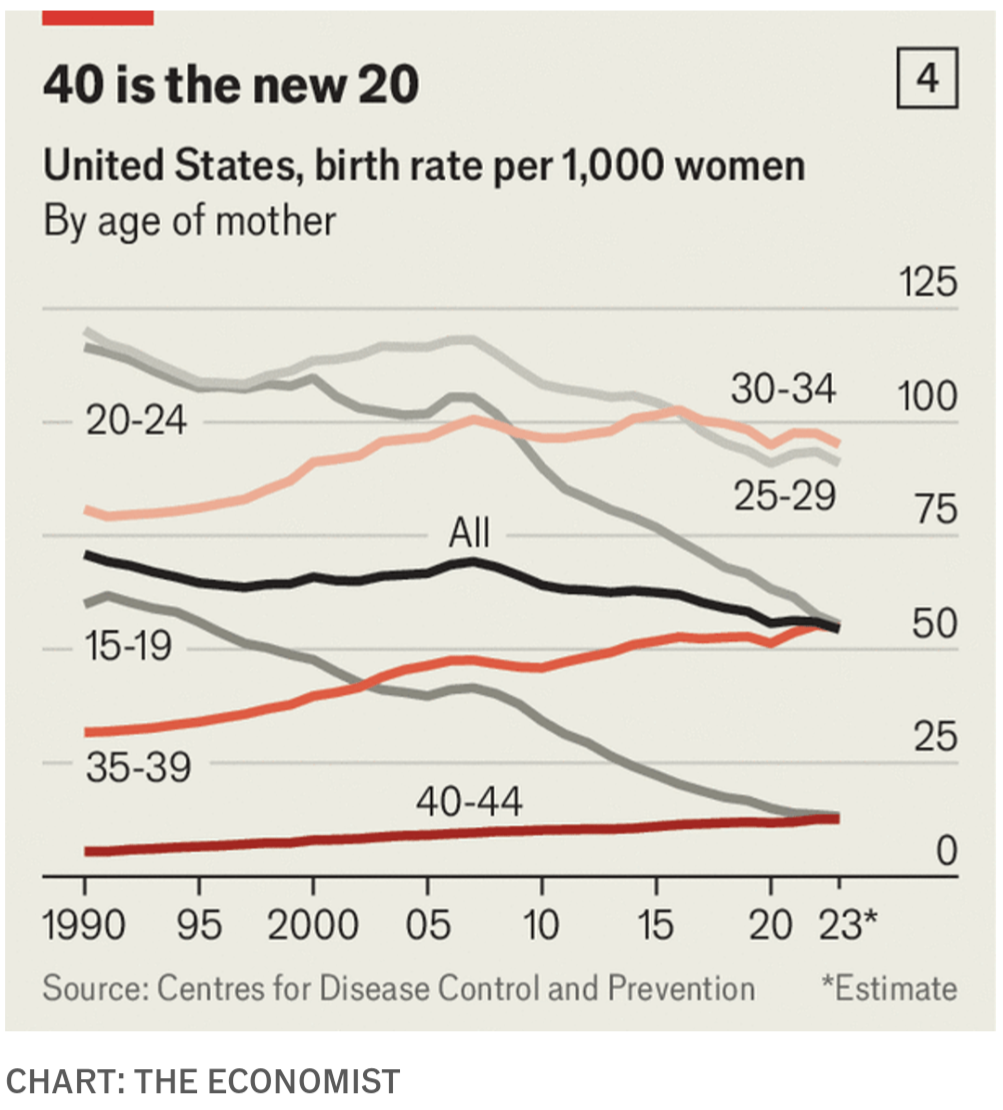

Chart crime

Two low probability, but potentially high-impact events this week

Chart crime

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Long EURSEK @ 11.54

Stop loss 11.3390

Flip short Friday at 11 a.m.

The market is completely ignoring Waller’s statements of conditionality and is also ignoring measured pre-blackout comments from various members of the Fed. E.g.:

Powell: “The U.S. economy is in very good shape,” Powell stated, reinforcing the idea there’s little reason to anticipate immediate economic deterioration. He added, “The good news is we can afford to be a little more cautious.”

*POWELL: CAN AFFORD TO BE CAUTIOUS AS WE TRY TO FIND NEUTRAL

*BOWMAN: INFLATION DATA NEXT WEEK TO HELP MAKE DECISION ON RATES

*BOWMAN: INFLATION BIGGEST PRIORITY WHEN MAKING POLICY DECISIONS

*FED’S DALY: NO SENSE OF URGENCY TO LOWER INTEREST RATES

*DALY: DECEMBER INTEREST-RATE CUT STILL ON THE TABLE

*MUSALEM: TIME MAY BE NEARING TO CONSIDER SLOWING, PAUSING CUTS

*FED’S MUSALEM SAYS PAUSE COULD COME AT DEC. MEETING OR LATER

*FED’S KUGLER SAYS SHE WILL MAKE DECISIONS MEETING BY MEETING

This does not sound to me like a market that should be priced 87/13 two days before a CPI release. But hey, here we are. With gas prices at a three-year low and ISM Prices Paid doing very little, I don’t have any real reason to expect a strong CPI figure, but core services prices refuse to back off and US wage growth remains strong. Anything can happen in a single month’s release.

Even if CPI comes in as expected, one could reasonably say / guess that the December FOMC meeting will deliver a hawkish cut as policy uncertainty is high and the US economy remains strong. GDPNow at 3.3% plus 2.5% inflation is 5.8% nominal growth. Not too shabby.

If you think the 1995 Fed mini cut cycle analogy is relevant, recall they cut three times, from 6.0% to 5.25%, and 2-year yields were about 40bps below Fed Funds after the third cut. Then, the Fed stayed on hold for all of 1996 and 2-year yields rebounded from 4.8% to 6.4% in six months (!). Now, 2-year yields are about 64bps below Fed funds, so if they cut in December and then pause, the setup would be similar as 2-year yields at 4.1% vs. Fed Funds of 4.5% would match the 40bp gap in 1995. I strongly doubt the rebound in 2-year yields would be as ferocious as it was in 1996, but we might at least go back to 4.40%?

MoM CPI above 0.3% (YES) is trading 19%/22% on Kalshi, while MoM Core CPI above 0.3% (YES) is trading 21%/24%. So this is not a zero delta by any means. 0.4% on those figures would probably send Powell scrambling to WhatsApp Nick Timiraos a disappearing message like “Need a headline from u — like … It’s a coin toss??”

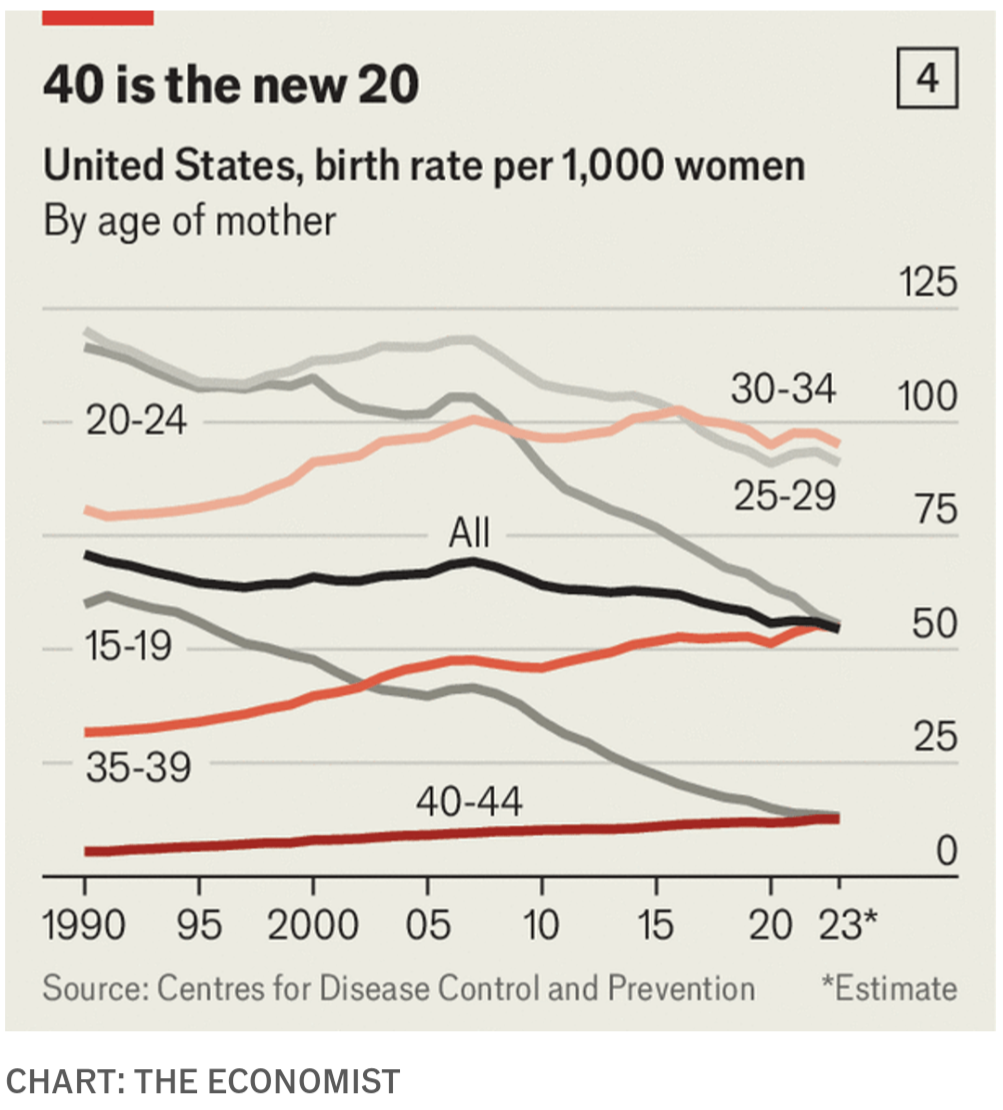

Another stimulus story overnight and at this point, I honestly don’t know what to think. It’s easy to be lazy and say “meh, fool me twenty-twice, shame on me” but I suppose China is still the third largest economy in the world and Europe, the second largest economy in the world, is dependent on China. So maybe best to keep an open mind?

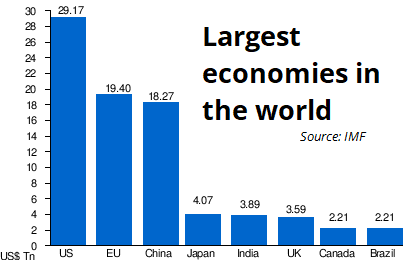

If you have any strong thoughts, I’d be happy to hear them. I feel stupid getting excited about yet another stimmy announcement given the uselessness of trading September’s “Whatever It Takes” moment, but I also feel stupid just ignoring what could be a major macro story in 2025.

Bitcoin is struggling a bit above 100k, and while it’s unlikely to pass, it’s worth keeping an eye on Microsoft’s annual meeting tomorrow as one of the items on the docket is “Assessment of Investing in Bitcoin”. Here’s an excerpt from a corporate governance article:

The proposal was submitted by The National Center for Public Policy Research (NCPPR), a conservative think tank. According to news reports, the NCPPR pushed for the proposal because it sees Bitcoin as an “excellent, if not the best, hedge against inflation,” and argues that “in inflationary times like these, corporations should—and perhaps have a fiduciary duty to—to diversify their balance sheets with assets that appreciate more than bonds, even if those assets are more volatile in the short-term.”

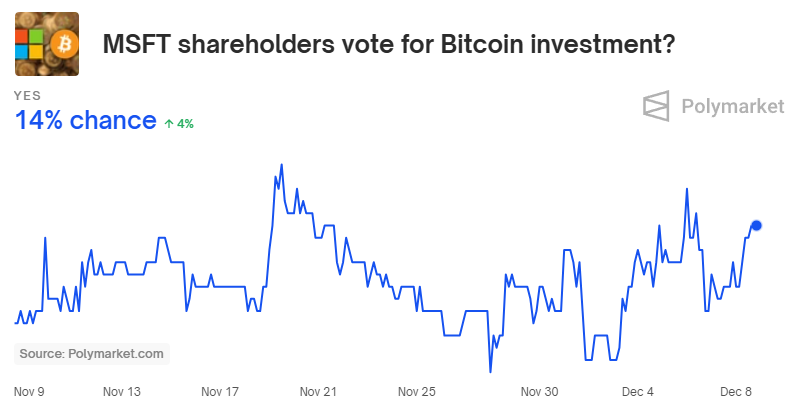

Inflation has been cratering as bitcoin goes to the moon, and bitcoin went down when inflation was skyrocketing, so this proposal could be hard to get over the line, but Polymarket is trading at a 14% probability. Less likely than a 0.4% MoM CPI release, but again, not zero!

Polymarket skews crypto-native, so this could be a bit of irrational optimism, but it’s clearly a low-probability / high-impact event that should at least be on your radar if you trade or own BTC.

CPI the biggie and then we get SNB and ECB on Thursday.

A clarification on the EURSEK seasonal flipper: I had said 15DEC is the day you flip back to short EURSEK, but that’s Sunday. Therefore, the flipper is this Friday at 11 a.m. Mildly interesting that copper seemed to anticipate the China news last week. Have a visually appealing day.

I am out tomorrow, back Wednesday.

Oof.