It’s time for the Fed to tap the brakes

Mexico now produces more avocadoes than bananas and could thus be considered an avocado republic

It’s time for the Fed to tap the brakes

Mexico now produces more avocadoes than bananas and could thus be considered an avocado republic

Short EURUSD @ 1.0490

Stop loss 1.0616

Take profit 1.0306

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC 7:30 a.m.

Short EURSEK @ 11.52

Stop loss 11.7110

Cover 31DEC 7:30 a.m.

It is probably time for the Fed to signal some concern on inflation. As has been well documented outside and inside of am/FX, inflation in the US is sticky and well above the Fed’s target. Meanwhile, the unemployment rate is lower than forecast, and other labor market indicators remain fine.

The Fed’s September Statement of Economic Projections showed Real GDP of 2.0% (actual closer to 2.6%), Unemployment 4.4% (actual 4.2%), PCE Inflation 2.3% (actual 2.5% / 2.8%) and so on. The economy is outperforming the Fed’s expectations and while the market has somewhat priced this in with only two cuts expected in 2025, the Fed’s ratification of a pause and increased topside uncertainty around the neutral rate should be a bit of a wakeup call for the market. The Fed isn’t necessarily cutting anymore.

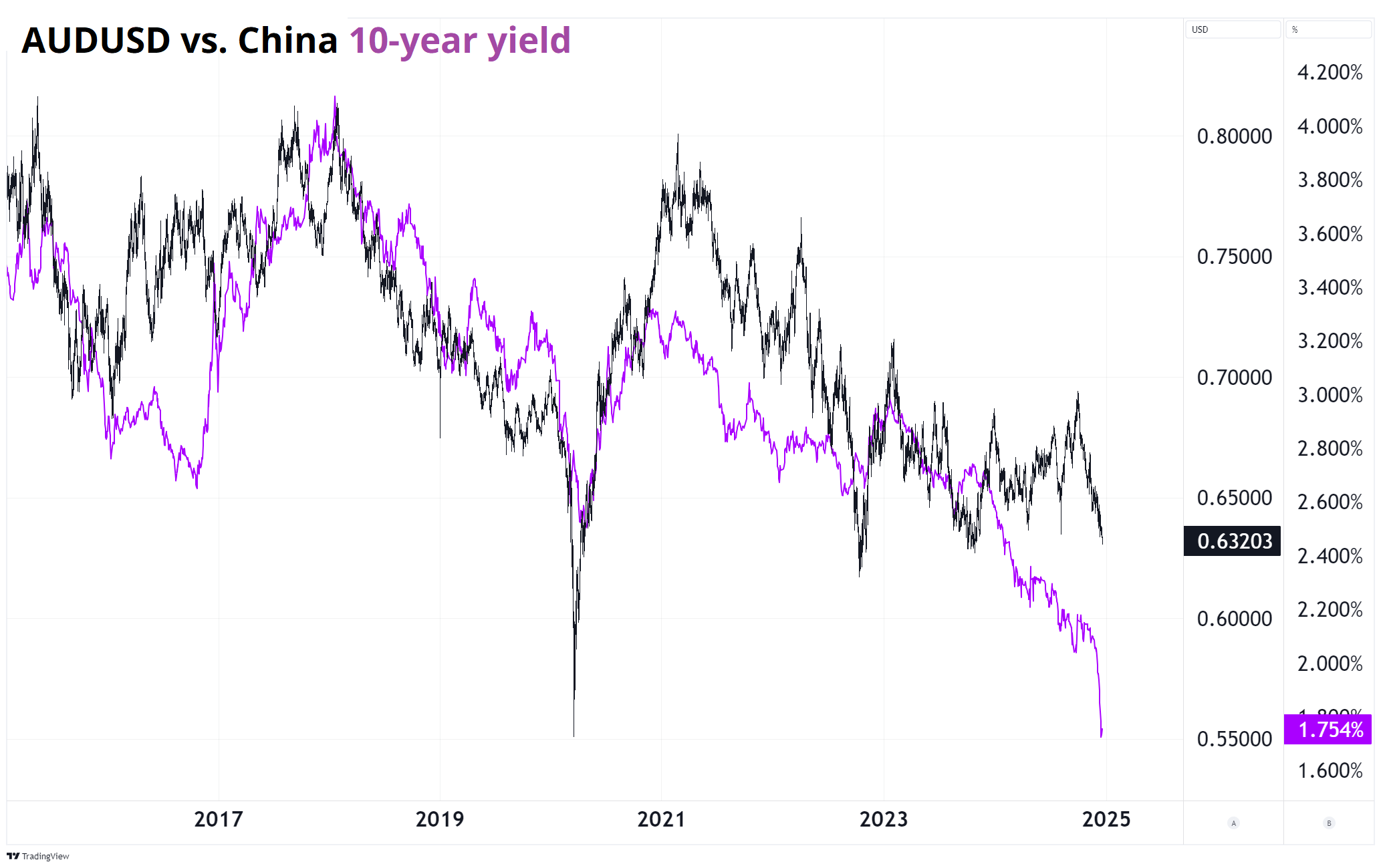

I think a hawkish Fed outcome today will unlock the next round of EURUSD selling and therefore I am going short EURUSD here with a stop at 1.0616, looking for 1.0306. Risking 121 to make 189. You could also consider short AUDUSD as the situation in China does not seem to be improving and yields there are in freefall. Here’s the chart:

The only reason I am avoiding AUD is that the entry point is tough as we’re at the ding dong lows, and there’s always random headline risk on some new China stimmy. If you agree with my Fed view, I would avoid USDJPY longs due to the enormous gap risk on a potential surprise hike by the BOJ tonight.

The 2016 EURUSD analog is lagging, by the way.

Note that tomorrow we also get Riksbank (25bp cut expected), Norges Bank (unchanged) and Bank of England (8-1 for unchanged with Dhingra still voting for a cut). After that, we enter a quieter period as there are very few events to chew on between tomorrow and New Year’s. Expect next week to be super quiet.

I am keeping it short today as the view is simple: Fed will be more hawkish than expectations as they need to send a bit of a message to the market in an effort to claw back some inflation-fighting credibility as financial conditions are extremely loose and the economy is chugging along nicely. This should unlock further upside for the USD and could threaten the rally in stocks.

Note, too, that the NASDAQ is getting way too lopsided with the megatech behemoths outperforming yet again. The top eight stocks in the NDX make up 52% of the index, and that weighting isn’t supposed to be far above 40%.

Have a guac-filled day.

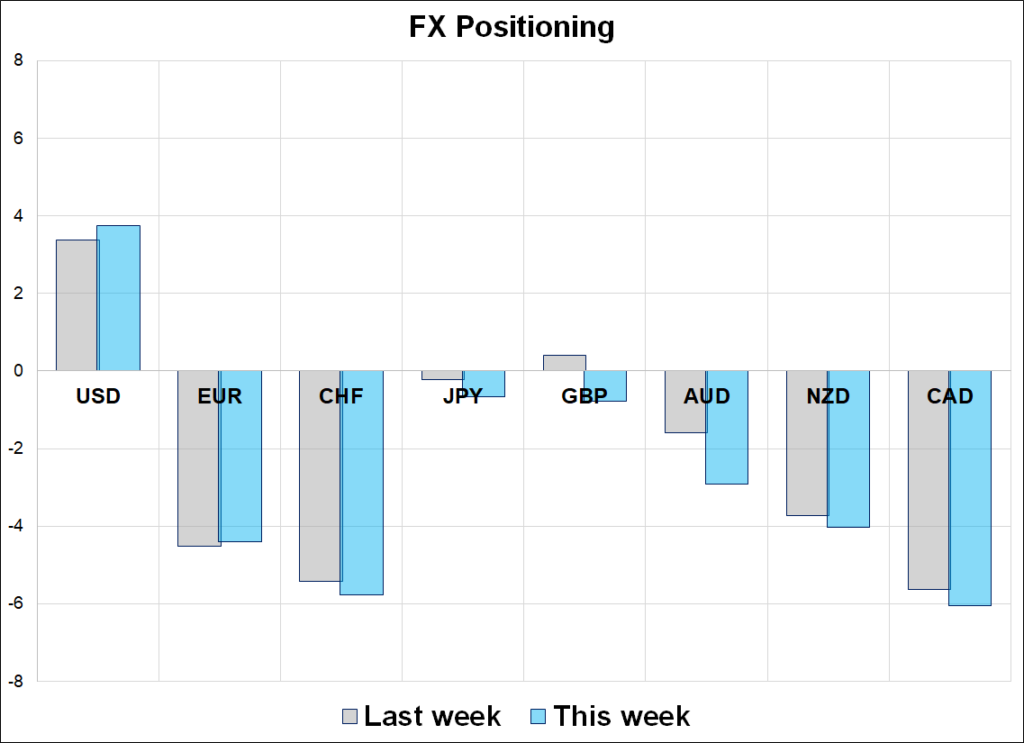

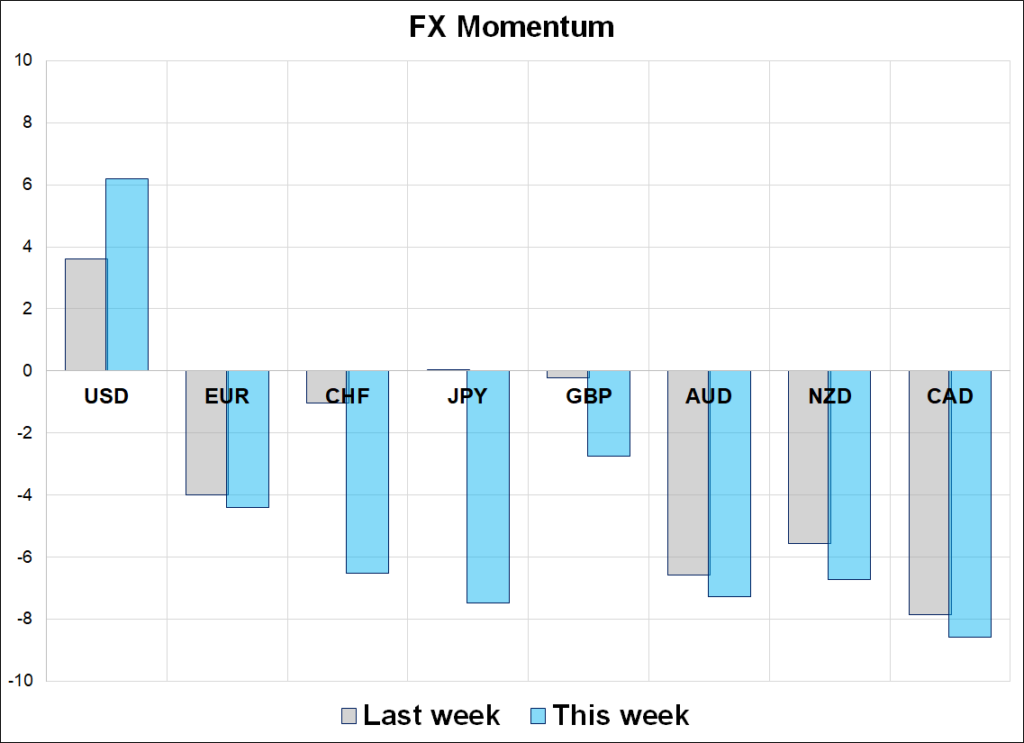

Comfortably Long

Hi. Welcome to this week’s report. Speculators remain long USD and are happy to earn the carry in a low-vol environment as the year approaches its end and equity and fixed income volatility remain low. USDCHF carry is back near extremes seen only in 2019 and July 2024, though it’s worth noting that the CHF outperformed the carry in both of those instances. The relentless appreciation of the CHF and the juicy carry profile are at odds and make for a tricky but potentially interesting setup.

USD longs remain large and stable near the 2022-2024 extremes, but as time passes, the probability of a short squeeze in the euro feels like it’s falling. Downside structures are burning off, and only the strongest and most patient hands remain short euro at this point as we have gone nowhere for a full month now. A reversal in EURUSD will take more than a collective flinch from shorts—it will take a turn higher in European yields.

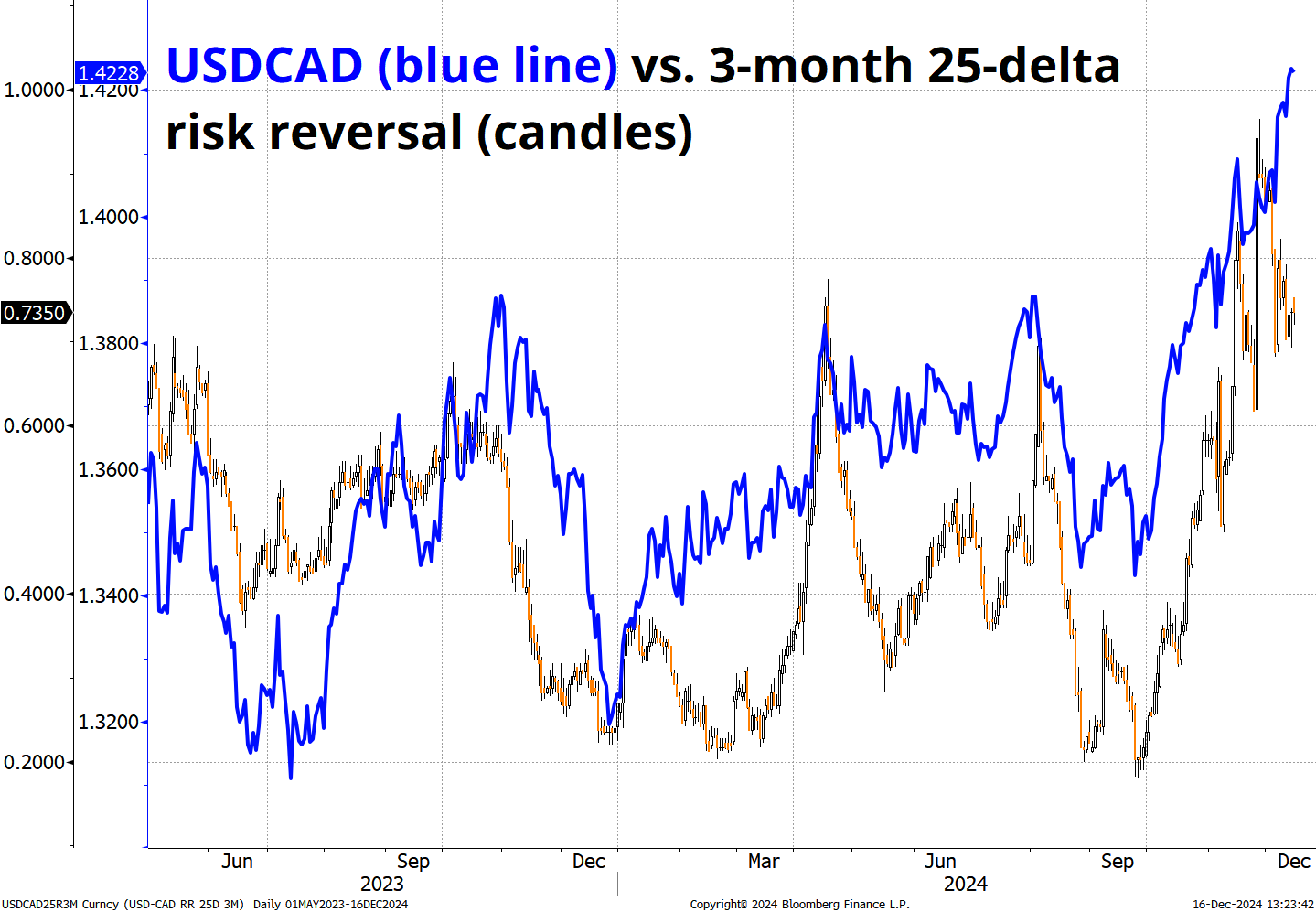

I am bearish CAD for a bunch of reasons outlined recently in am/FX, but it’s worth mentioning that positioning in CAD is extreme. You can see in the chart that each thrust higher in the risk reversal (bid for calls) coincided closely with a major top in USDCAD.

Sometimes the risky turned first and sometimes spot turned first. Then again, this was a period where USDCAD was mostly rangebound. Positioning indicators work best when markets are rangebound or macro is buffeted by crosswinds. When there is a huge macro story, positioning will lock onto it and stay locked in for a major trend.

The upward trend in USDCAD depends almost entirely on what happens around January 20, 2025. If the US places tariffs on a significant list of Canadian goods, USDCAD will be retesting the massive 1.4660 double top in short order. If the US backs off, USDCAD will experience a large and painful whoosh—back down to 1.3875 in a heartbeat. The 2-month 1.3875 and the 1.4550 one touch each cost around 33%. Good value if you have a directional view.

Short CHF is the other position that is particularly crowded right now as the 50bp cut has attracted carry-seeking peeps and many view USDCHF as a turbo, superior-carry way to play short EURUSD. Hard to argue with this, although two quibbles would be 1) Carry has not been useful for forecasting CHF direction and 2) year-end tends to see heavy repatriation (i.e., CHF-buying flows). Even acknowledging these two factors, it’s hard to look at the 1-year USDCHF outright trading 370 pips below spot and not be attracted, or at least intrigued!

Mexico: Avocado Republic