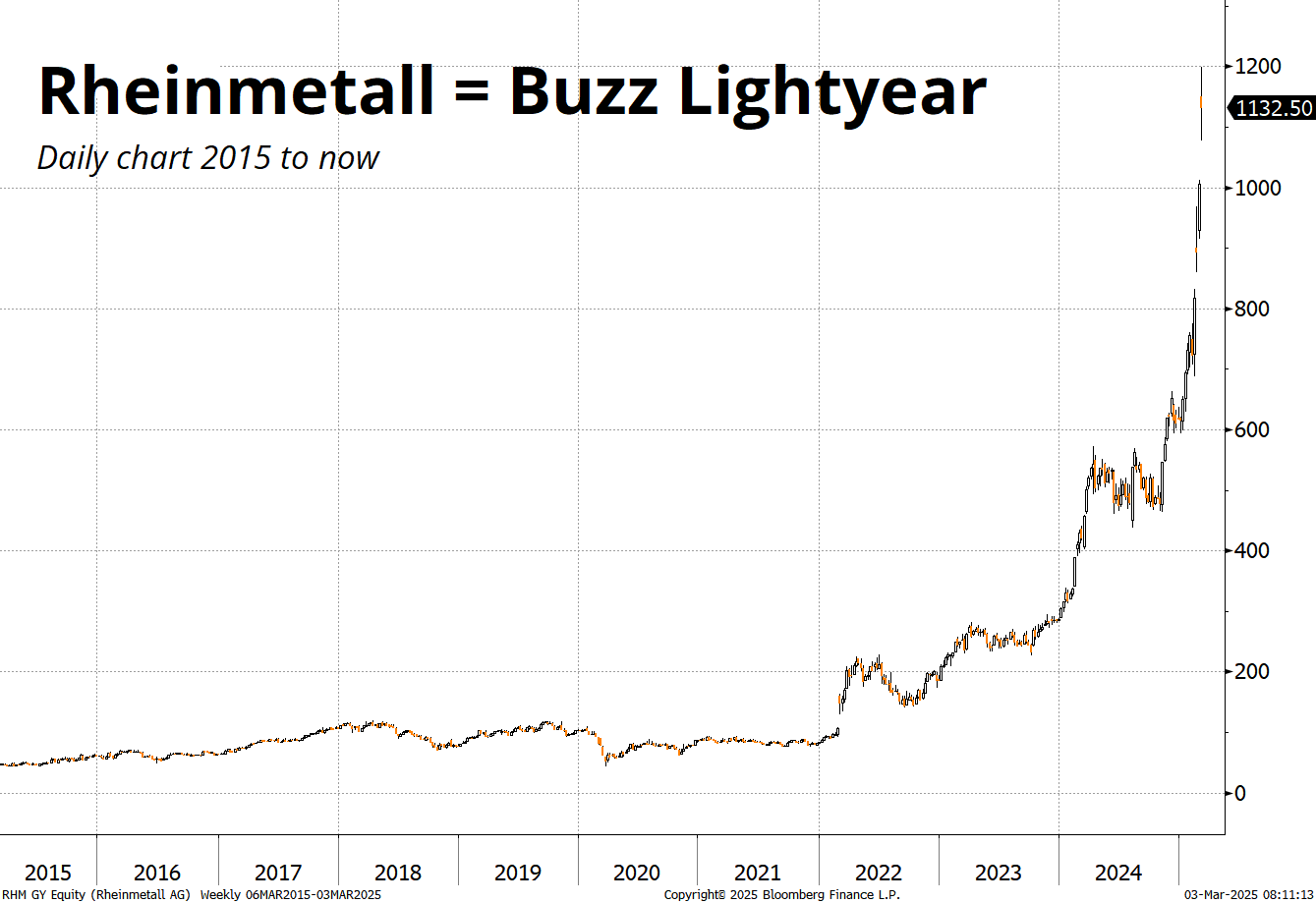

The market is so excited about EU defense spending, it forgot about tariffs

Before electronic trading, Japan used red tickets for buy orders and green tickets for sell and so stock market heat maps in Japan are opposite to those in North America.

The market is so excited about EU defense spending, it forgot about tariffs

Before electronic trading, Japan used red tickets for buy orders and green tickets for sell and so stock market heat maps in Japan are opposite to those in North America.

Long 10MAR 104.30 CADJPY put ~64bps

Covered ½ the notional at 104.30 and sold it out at 104.72.

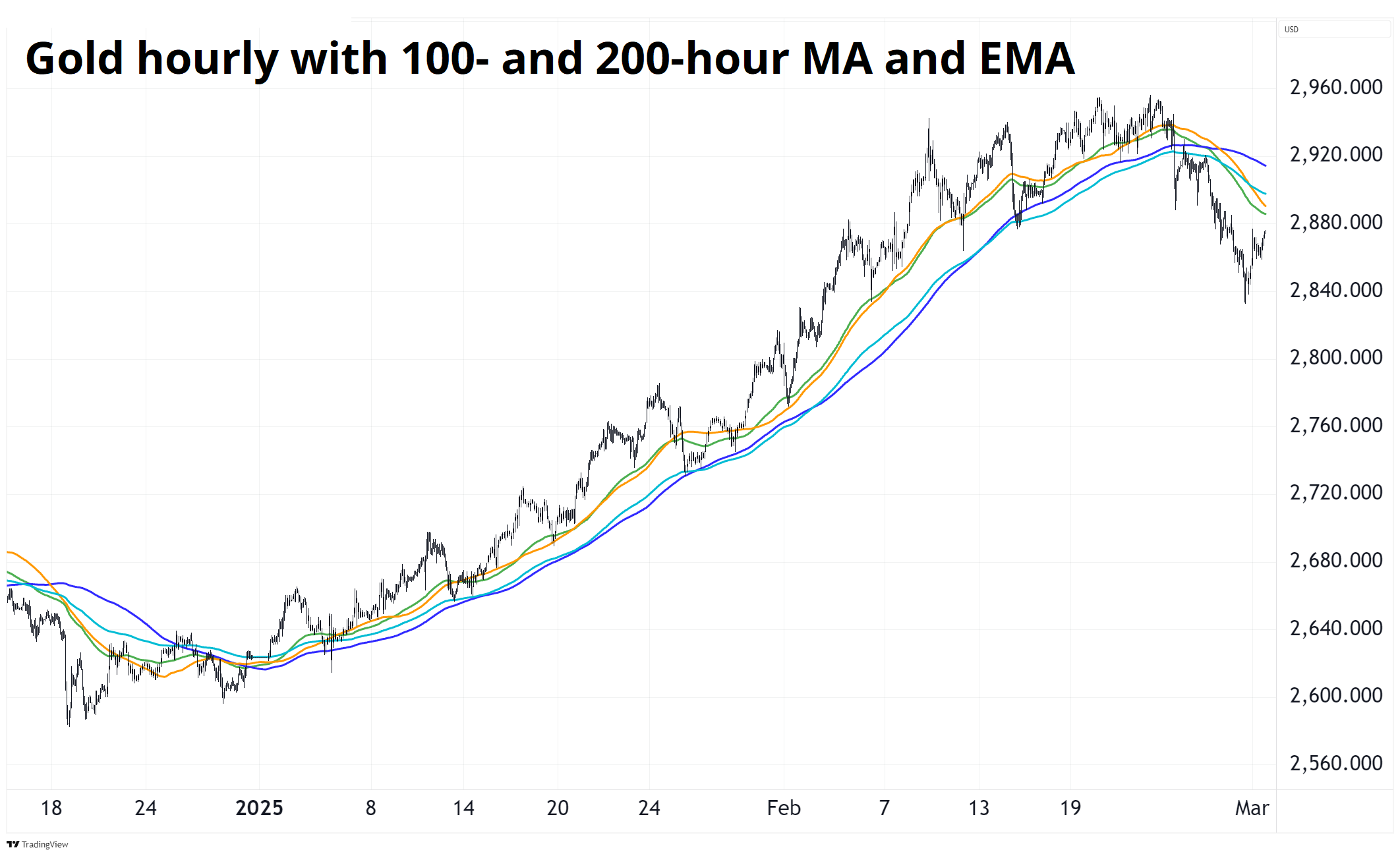

Short gold at 2940

Stop loss was 3011 now 2936

Take profit was 2805 now 2843

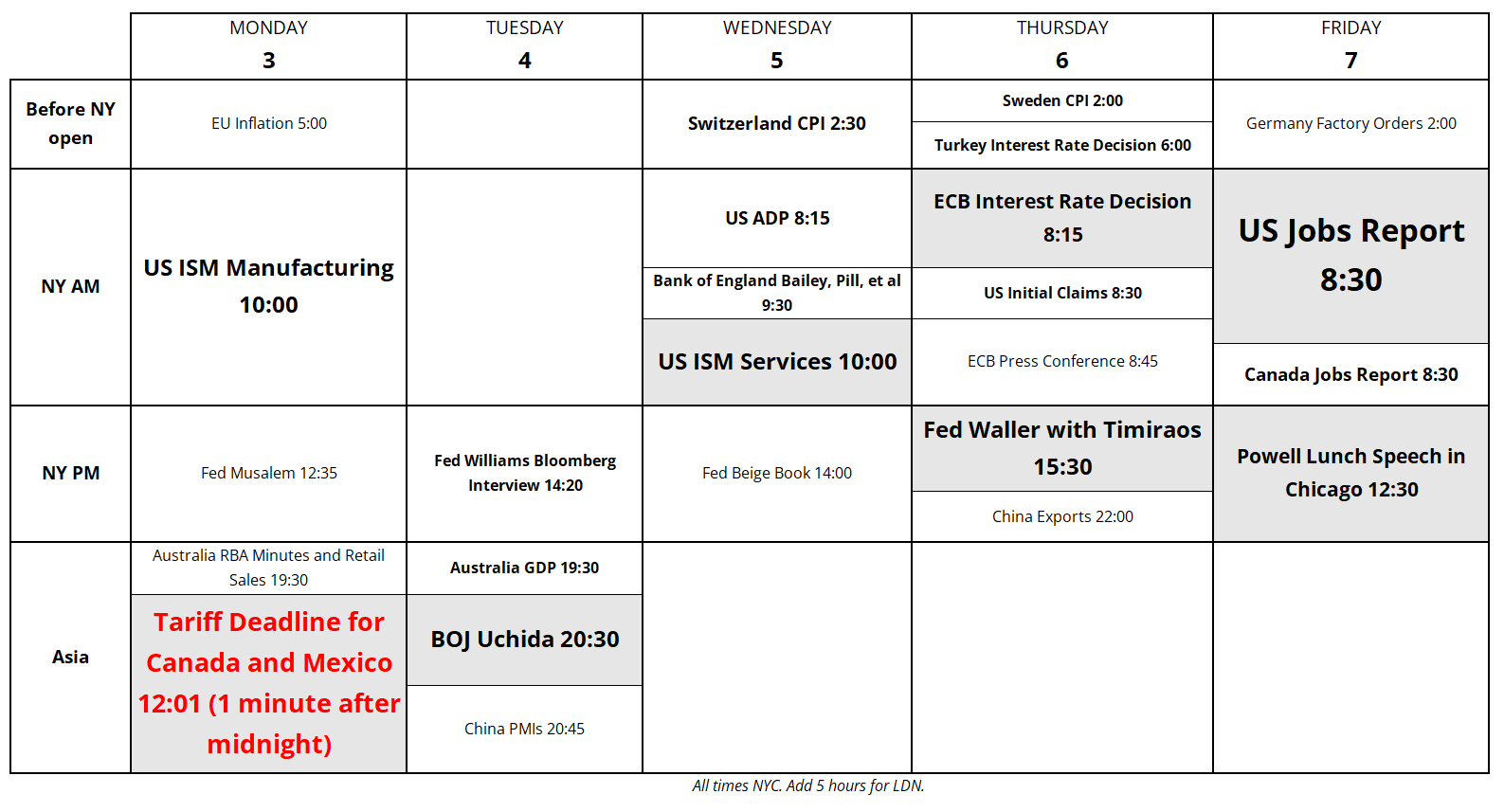

The countdown is on for tariffs on Canada and Mexico. Lutnick said on the weekend that the 25% number is up for debate, but otherwise we haven’t got much insight into what’s happening. Meanwhile, CADJPY is at the highs, nobody seems all that tense or scared, and some questionable news on crypto has lit a fire under heavily oversold risky assets. Seasonality and positioning converged just as the weekend announcement from Trump landed, and here we are. Amazing. More on crypto below but first let’s talk about FX.

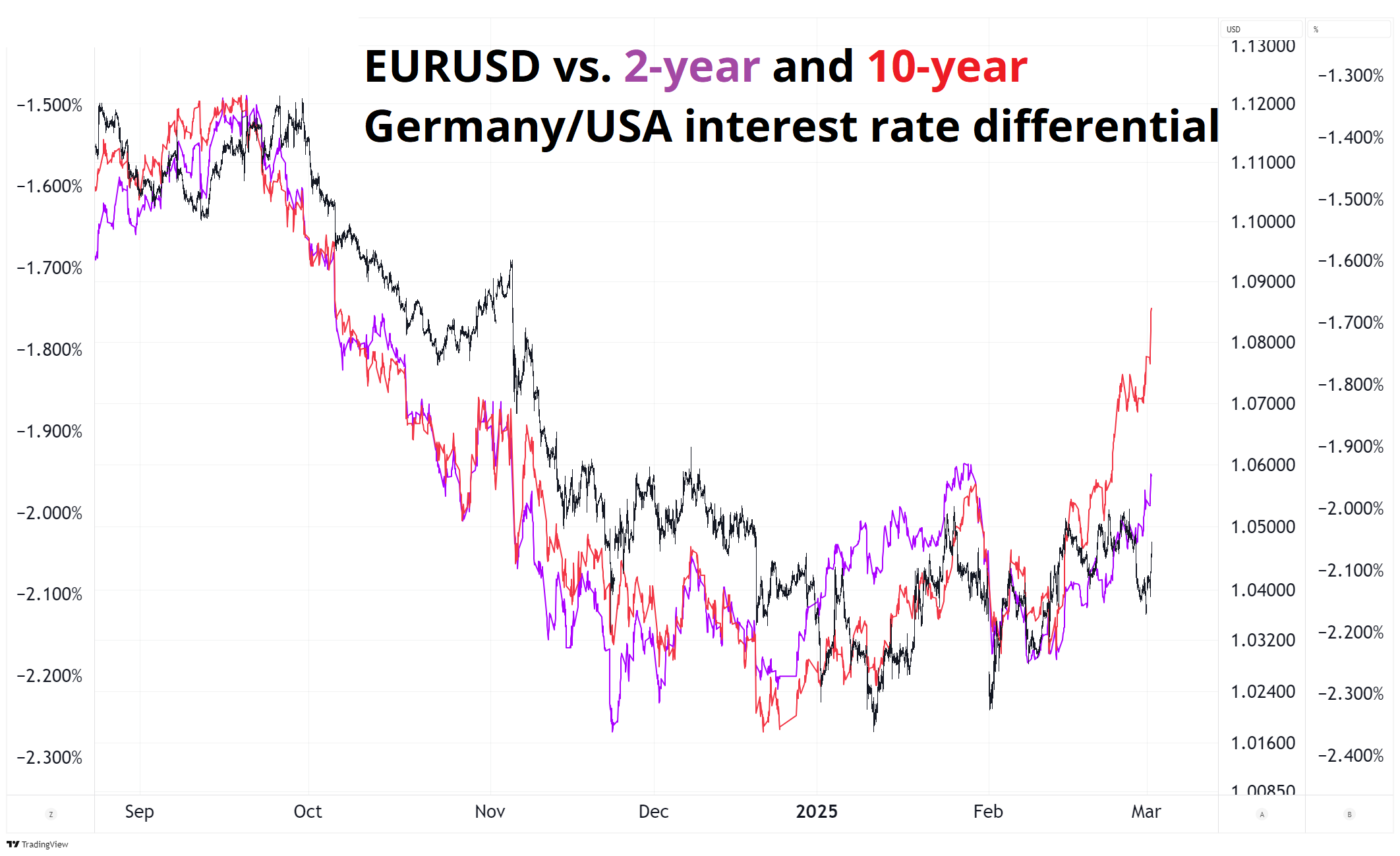

The USD wants to sell off but can’t release to the downside because of the looming threat of tariffs, and the endless demand for USDJPY. Every day, USDJPY gets ripped higher, and even with tons of bullish news on German and EU fiscal upside, and ripping interest rate differentials, EURUSD is up, up, but not yet away.

There is also a flurry of US data to contend with this week, plus speeches from Uchida (BOJ), Waller, and Powell. Meanwhile, USDCAD and USDMXN are just hanging out at Friday’s levels, assuming nothing bad is coming at 12:01 a.m. tonight. Seems kind of crazy to me, but also understandable given the empty threats against Colombia, Canada, and Mexico so far.

I had hedged ½ the CADJPY put and will go back to unhedged today, selling CADJPY here now and locking in a bit of profit on the move from 104.30 to current spot.

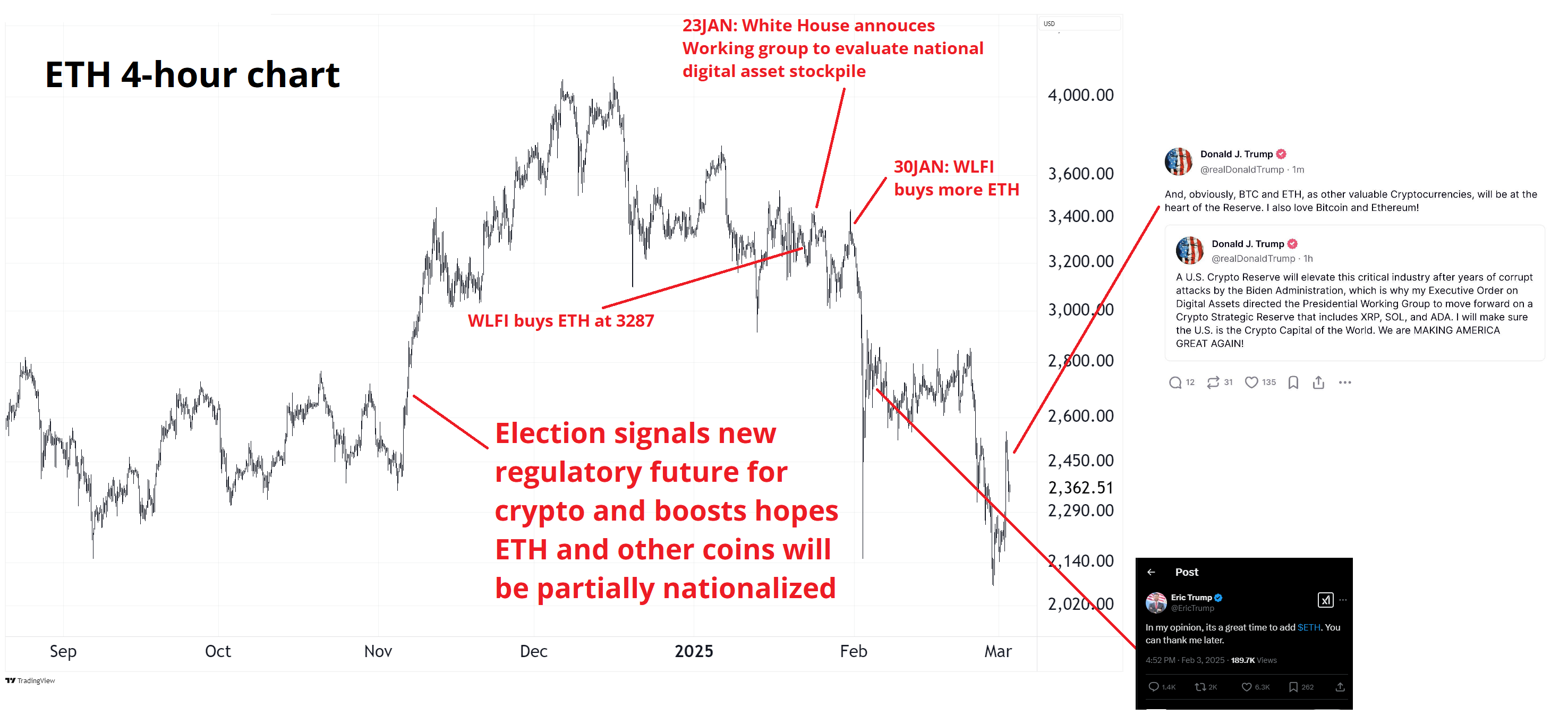

I am skeptical on this Strategic Crypto Reserve announcement because a) this was already floated 23JAN (in admittedly less detail) and b) the government and its agents are rapidly hitting diminishing returns on these crypto pumps. If you believe in the greater fool theory of crypto, there is no greater fool than the government as it redirects resources from orthodox government spending towards partially nationalizing arbitrarily-chosen digital coins.

Nationalization appears superficially bullish but may crowd out participants with more libertarian or capitalist views and create a deeper aura of cringe. It also reeks of late-stage news, not early-stage news. I was briefly sucked into this bullish narrative in ETH around 3000 (see am/FX 30JAN25), but the announcements keep leading to lower highs and diminishing returns and unintended consequences are important considerations now.

I acknowledge that my distaste for this particular type of government intervention may be coloring my view, and the goal is to make money, not occupy the moral high ground. The nausea I feel seeing one “lucky” punter buy BTC and ETH with 50X leverage on Hyperliquid a few hours before the news announcement may be influencing my ability to forecast future ETH price movements.

My bearish gold view is getting stale as we got to 2832 before this bitcoin-fueled rally. The stop has been moved way lower and with the moving averages all rolling over, and my skepticism on crypto follow through I will stick with the trade. That said, I feel the idea is probably nearing its expiry date and I will try to close it 2840/2845ish. As always, the sidebar has the most up to date view. Here’s the chart.

The tariff deadline is one big event on the calendar, but there’s something to chew on every day. That Uchida speech is big, and so are ISM, Waller/Timmy, NFP, and Powell. Got gamma?

Three articles about Germany and EU defense:

https://www.ft.com/content/bbe9ec5a-9701-4d42-904a-52f021ccb0a2

Have a red day (Japanese version).

Before electronic trading, Japan used red tickets for buy orders and green tickets for sell orders and therefore stock market heat maps are in Japan are opposite to those in North America.