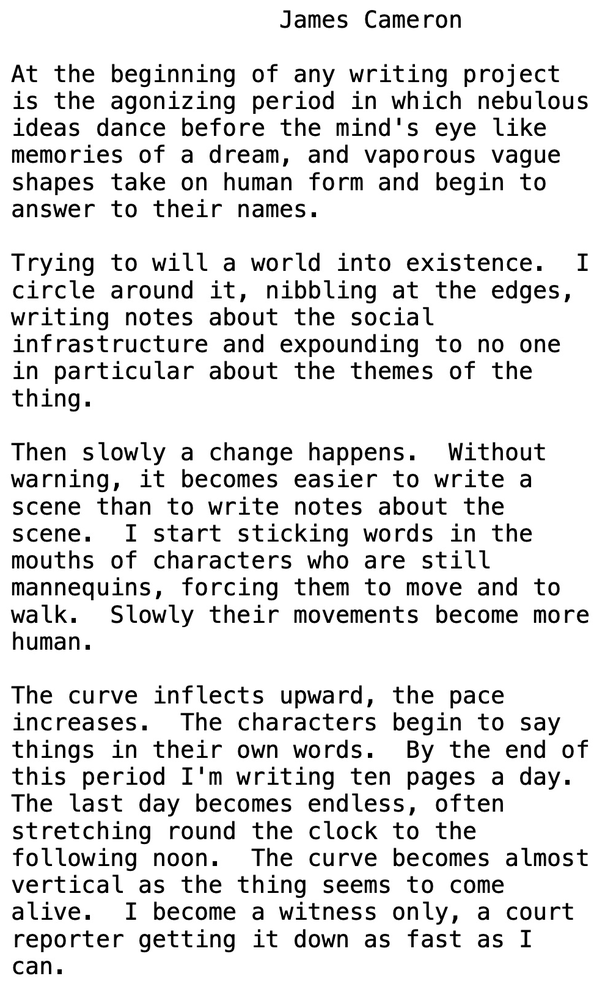

It’s not the same as May 2023, but it’s also not completely different.

James Cameron on how a script slowly comes together

It’s not the same as May 2023, but it’s also not completely different.

James Cameron on how a script slowly comes together

Flat

The last time we saw a freakout like this was April/May 2023 when Silvergate and friends went under, and the vibes are quite similar now despite a completely different setup. I suppose the big difference there was that the government simply came in and bailed out uninsured depositors while there is not as much of an obvious fix to this situation. The other difference (an important one!) is that the market has been buying NVDA every day for 2 years and has taken it up 7X from $500B to $3.5T. KRE was a much-hated dog when SIVB blew up.

I suppose one short-term fix here is for Trump to tweet something like:

Chinese AI SOFTWARES should NOT be RUNNING on US SMARTPHONES!

For now, the market is wondering whether this is the end of US exceptionalism. Seems rather abrupt, but then again the Capex numbers coming out of Mag7 were becoming kind of ludicrous with 80B here and 60B there and 500B for Stargate (not a real number, but still a large one).

For now, we are on the front edge of an urgent reevaluation of a narrative that has gripped the market for almost two years. That makes it hard to shrug off after 36 hours.

The price action in the USD is certainly interesting and informative as even risky currencies like AUD and CAD are outperforming the USD as the feeling is that money should flow out of MAG7 and US exceptionalism trades and into Asia and into anything cheap like China, Europe, and “other”. The only currencies weaker on the session are ZAR and the LATAM currencies that have felt the Colombia tariff scare.

Overnight saw the enactment and rescinding of a 25% tariff on Colombia, which doesn’t really add or subtract from the credibility of Trump’s desire to put yuge tariffs on close allies. Had the tariff stuck, it would be a big concern for Canada and Mexico, but the instant pivot is more like the craziness in 2019 where Trump threatened 25% tariffs on Mexico then backed off after a week or so.

The Wall Street Journal is sending around another “sources say” article, but the market isn’t playing that game anymore and USDCAD doesn’t care. Recall the market moving article from the same paper on January 6 that said that targeted tariffs were coming out of the gate. There’s a lot going on behind the scenes, and their guess is as good as yours. The market is becoming immune to threats, WSJ articles, and other noise, and will now only trade tariffs on real signal.

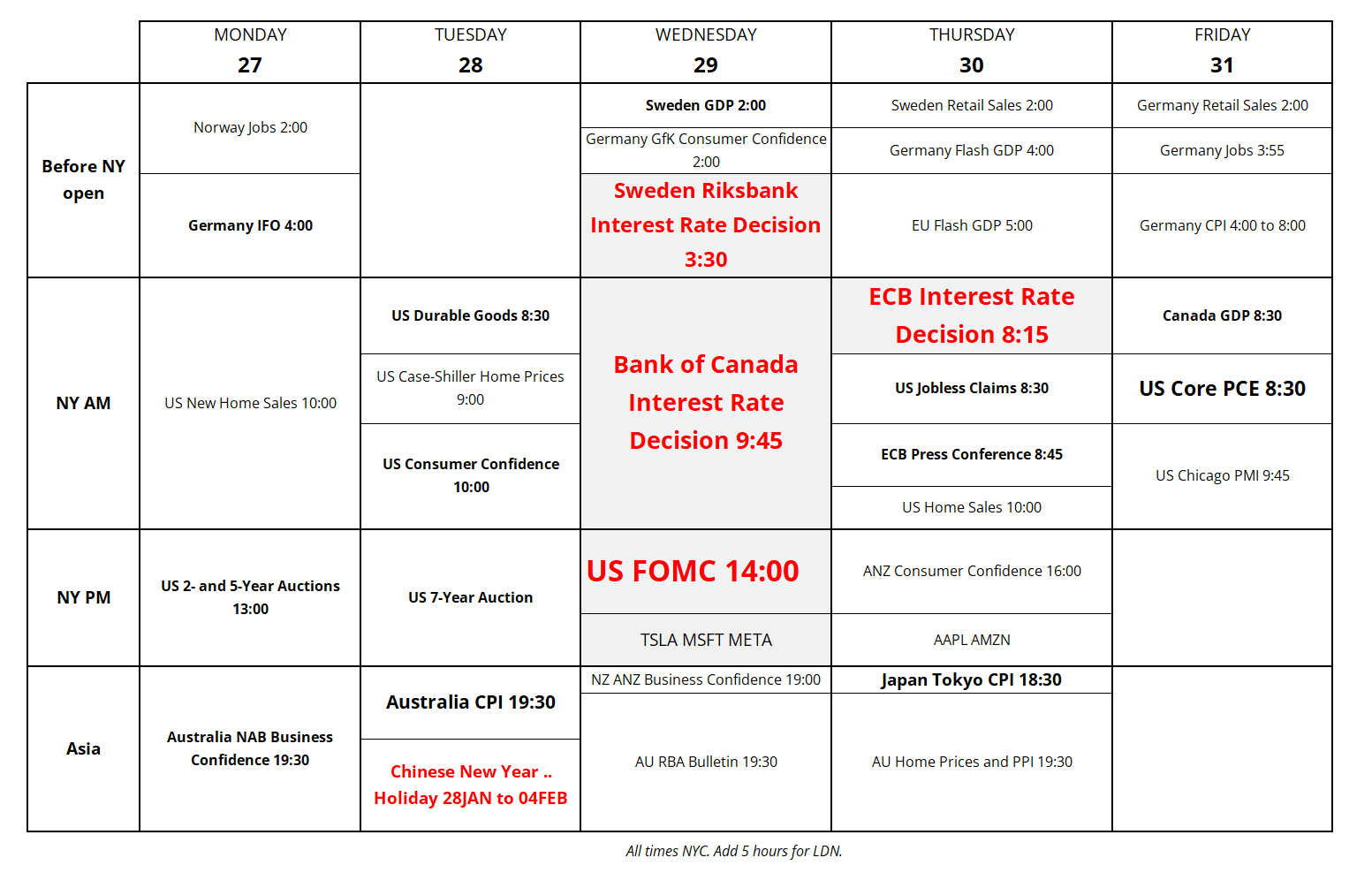

A juicy week of interest rate meetings and economic data, along with a massive flurry of tech and other earnings to complement the DeepSeek panic. It’s also a holiday in China starting tomorrow.

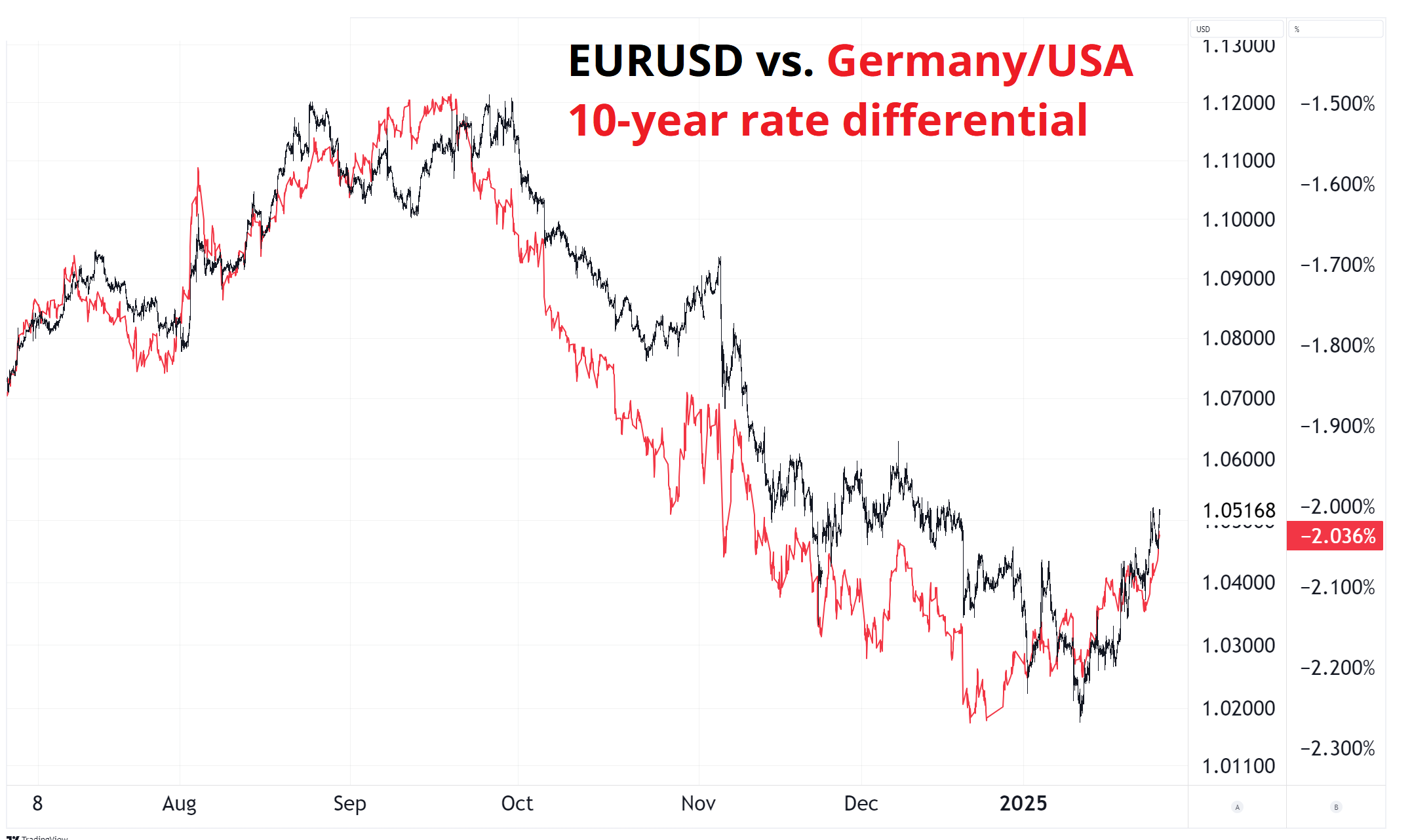

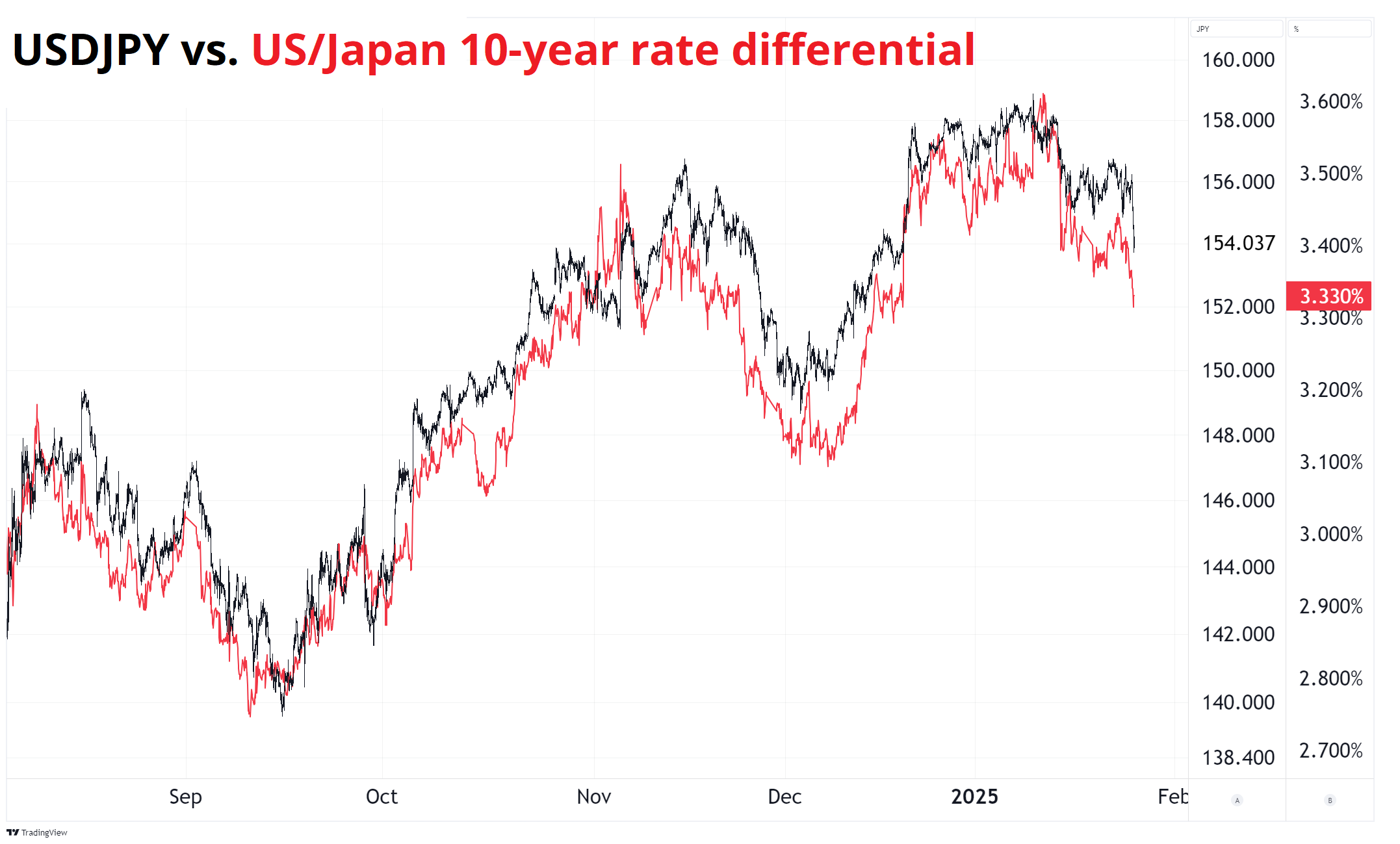

The USD is a straight rate differential play still as you can see in the next two charts. The USD as a safe haven doesn’t make any sense these days given such a huge proportion of global investment money has landed in the USA and crypto and both of these are denominated in USD. Unlike 2008, when the market was massively short USD, now the market is massively long US assets in a setup similar to 1999/2000. As such, I would not expect any safe haven bid to the USD, no matter how large the NQ selloff becomes.

The chart of NVDA suggests selling at $130 and buyers at $122 and $115. The stock will lead everything today, especially USDJPY and TLT. If the Capex cycle is peaked, earnings and economic data are about to head south and NVDA’s stock price will be the best barometer of how people feel about that potentially new economic narrative.

The scariest thing that could happen later in the week is for META and MSFT to post blowout earnings and see their stocks fall. That’s how the beginning of the end played out in 2000. Yahoo beats by a penny and drops 15%, etc.

The Strategic Bitcoin Reserve is on hold for 180 days or so. My SGD call was horrendous as the MAS loosened only modestly and the broad USD got destroyed shortly after.

Have a Hollywood day.