This new theme is reminiscent of 2003-2008

A die with misaligned pips

This new theme is reminiscent of 2003-2008

A die with misaligned pips

Long 11MAY 168/163 put spread in CHFJPY

~31bps off 175.25

Long EURUSD 1.1277

(only ½ position size, missed it at 1.1257)

Stop loss 1.1084

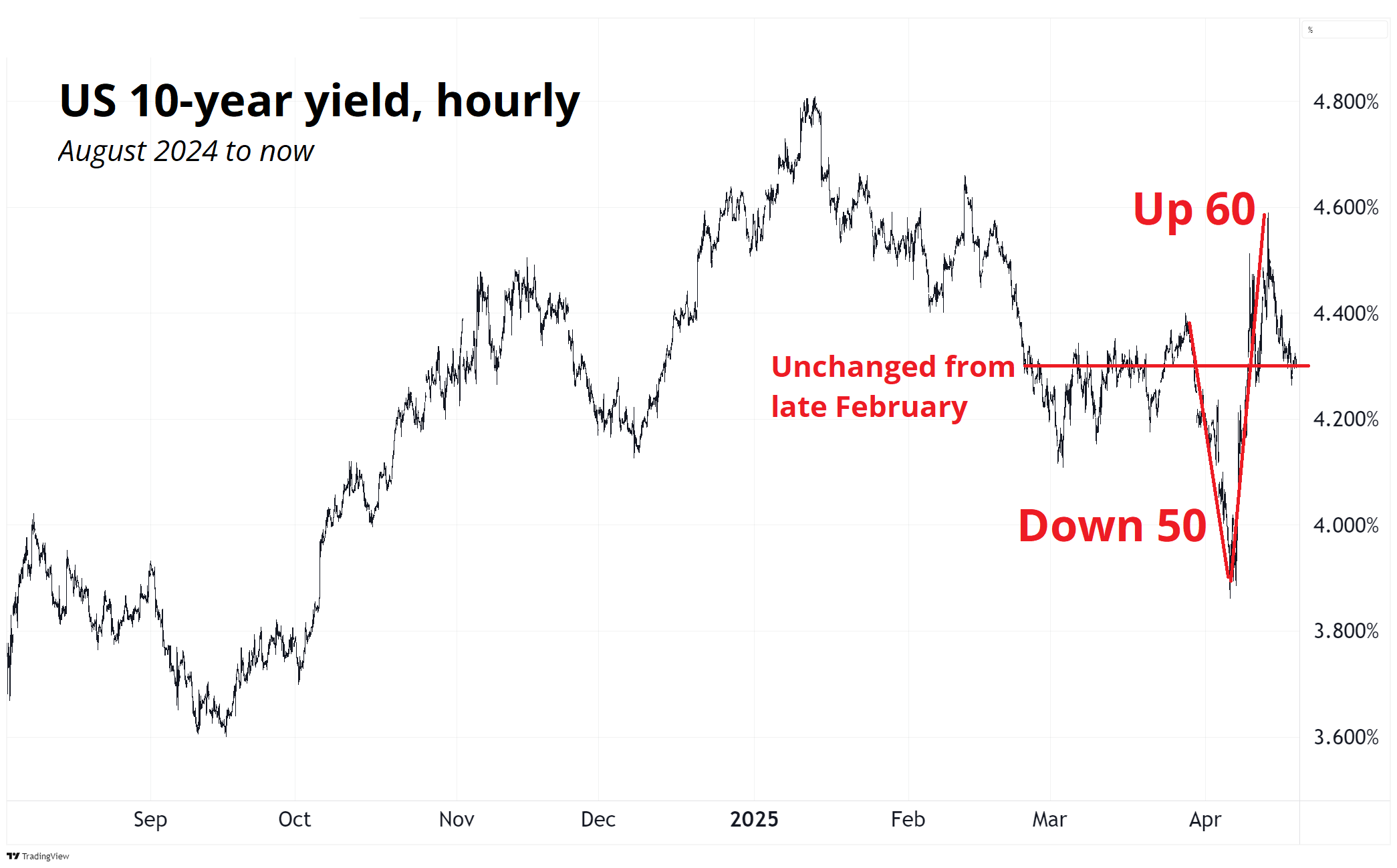

The US bond vigilante trade was hot last week and has cooled off, as The Economist trumpets the story, and a media flurry goes viral. The question now is whether the rip from 3.90% to 4.50% in 10-year yields was a one off and meaningless reversal of a meaningless drop after Liberation Day, or something more nefarious. The breathless reports citing the largest 1-week move higher in yields since 2001 fail to mention that yields went down almost as much right beforehand and currently trade at the same levels as they did in late February.

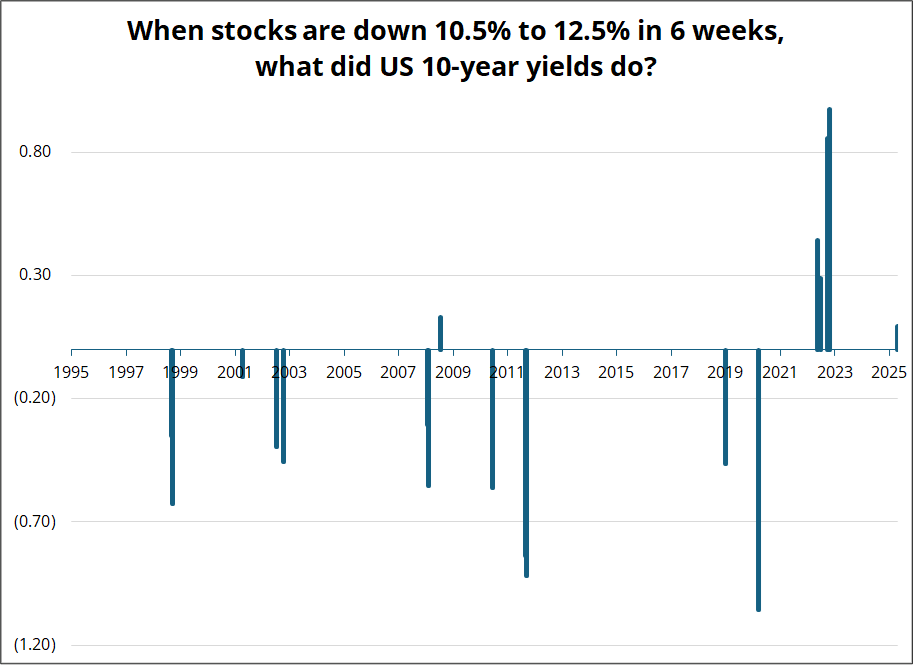

Then again, these unchanged yields come after an 11.4% drop in SPX, so that’s not totally normal. To get a sense of how abnormal it is, I looked at all the 6-week drops in SPX of 10.5% and 12.5% and then looked at the 6-week change in US 10-year yields. Here’s the chart.

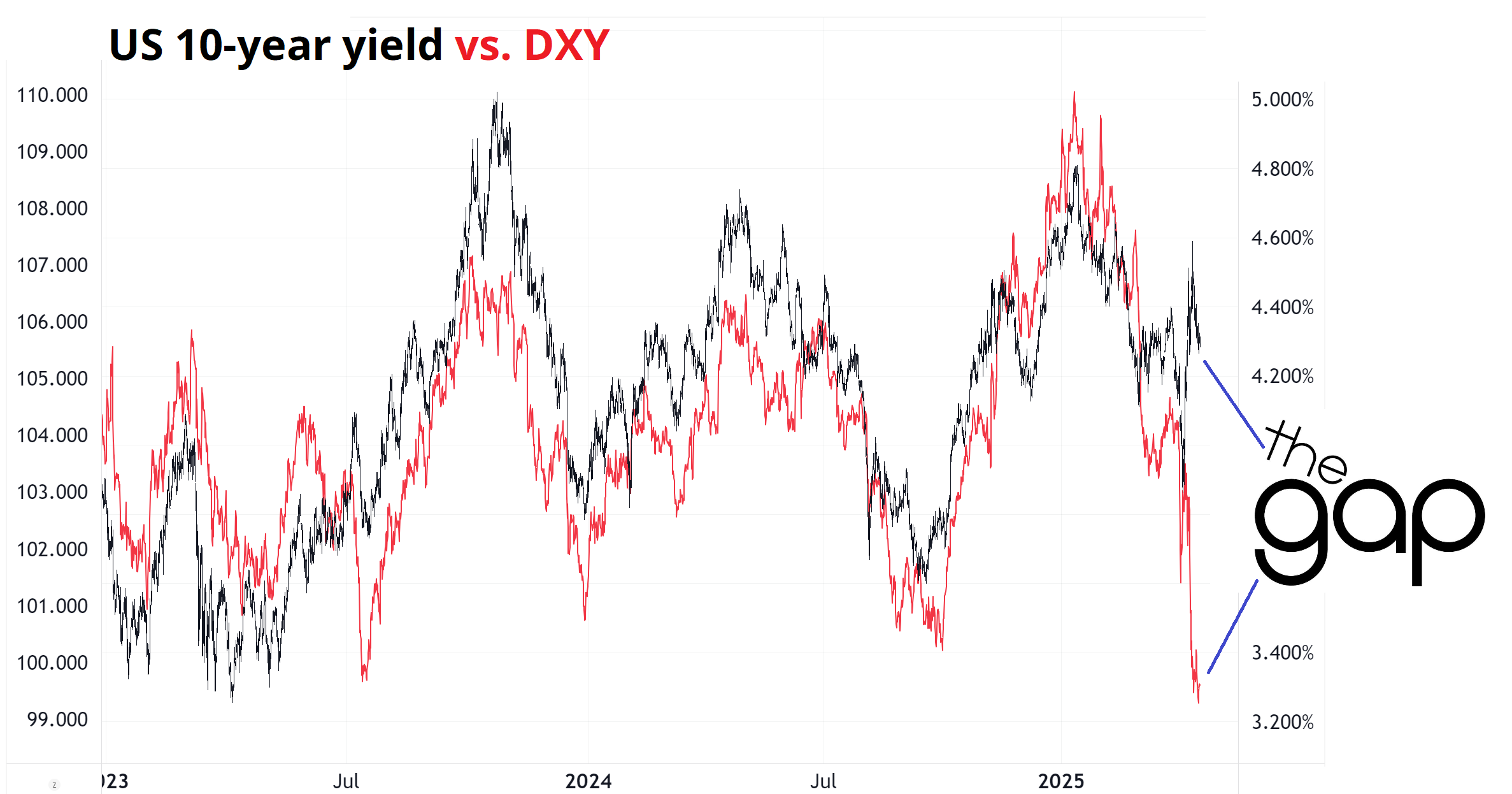

So, you can see this recent action is a bit odd, and when you add the fact that the USD sold off in the same period, it’s even more strange. I am guessing you have seen all those crazy charts of the DXY diverging from yields, but in case you haven’t, here’s one. In the olden days (i.e., before April 2), one would normally buy USD on this divergence as it would tell you the USD is cheap. But no more.

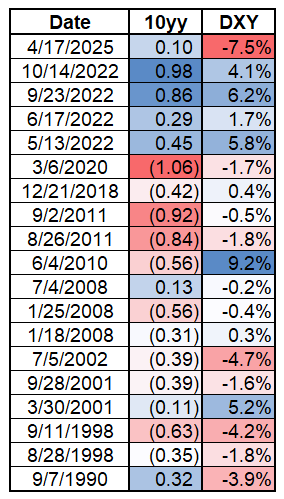

And for one last piece of evidence, here is a table showing the 6-week change in 10-year yields and the DXY for all 6-week periods when SPX dropped 10.5% to 12.5% since 1990. If you scan the two columns, you will see that yields up and DXY down at same time really only happened one other time: September 1990. Then, yields were flying all over the place on an 8% handle and the Fed was preparing to cut. This NYT article from September 1990 is a fun read. The most hilarious part of the article is that USDJPY was trading at exactly the same level then as it is now.

So, all this is backward-looking to lay the groundwork for the statement that I believe we have entered a new regime. I am not alone in saying that, as basically every bank strategist has moved from USD bullish at the start of the year to USD bearish now on the end of American Exceptionalism. That might make you want to fade the consensus, but we are in day 15 of a major macro regime shift. It’s just starting. As discussed in the positioning report Tuesday: Macro regime shifts are way more important than speculative positioning. The CFTC was short JPY as USDJPY rose from 90 to 125. Every single human was short EURUSD from 1.35 to 1.10 when the ECB did QE in 2015. And so on. This theme will be stale one day, but that day might be in 2028 with EURUSD at 1.37.

Everything right now is wildly reminiscent of the turn in 2002/2003 as we transitioned from “US tech is the only thing worth investing in” to “Twin deficits are the end of the US dollar”. Tech inflows turned to central bank USD selling almost overnight and it went on for six years. The only blip in the USD downtrend was the Homeland Investment Act in 2005 as that triggered $300B+ of USD buying, all concentrated in that specific 12 months. Here’s a brief history:

So now we have the same deficit issues, but much, much worse, and there is no hope in sight as Bessent’s 3/3/3 plan is a faint dream shimmering on the far horizon. Defense spending is going up, they are not touching entitlements, and DOGE cuts are cosmetic. Meanwhile, policy uncertainty looks to be driving the US towards recession (Philly Fed today, yuck), and recessions are unambiguously bad for deficits. If you run crazy deficits during boom times, the recession impact on your balance sheet will be historically ugly.

The short USD and short US equities trades (outright or vs. RoW) look more attractive to me than the short bonds trade simply because in bonds you are playing fiscal premium vs. recession odds and those two factors have offsetting impacts on yields. Speaking of fiscal premium, this headline just now is a bit alarming: *EUROPE’S FINANCIAL WATCHDOGS QUESTION TREASURIES’ HAVEN STATUS. It comes from a presentation a week ago, so not exactly news, but still kind of eye opening.

Equities are tricky because of headline risk, but I am blown away by how retail just keeps buying every single dip. Sure, some of the surveys point to bearishness, but the retail flows do not. This Pavlovian buy the dippishness needs to be eradicated by a massive purge. But: Short stocks is always hard work, and you have to sell rallies, and cover when things are dumping at high velocity, not the other way around.

A final comment on USDJPY positioning. There were no meaningful comments about JPY from Japan or the USA last night, and USDJPY didn’t really care that much. The market is long a lot of JPY, but it’s mostly in options and it’s mostly 130 and 135 strikes of various colors. When USDJPY gets to 135, positioning will probably start to matter. Here, I do not think it does.

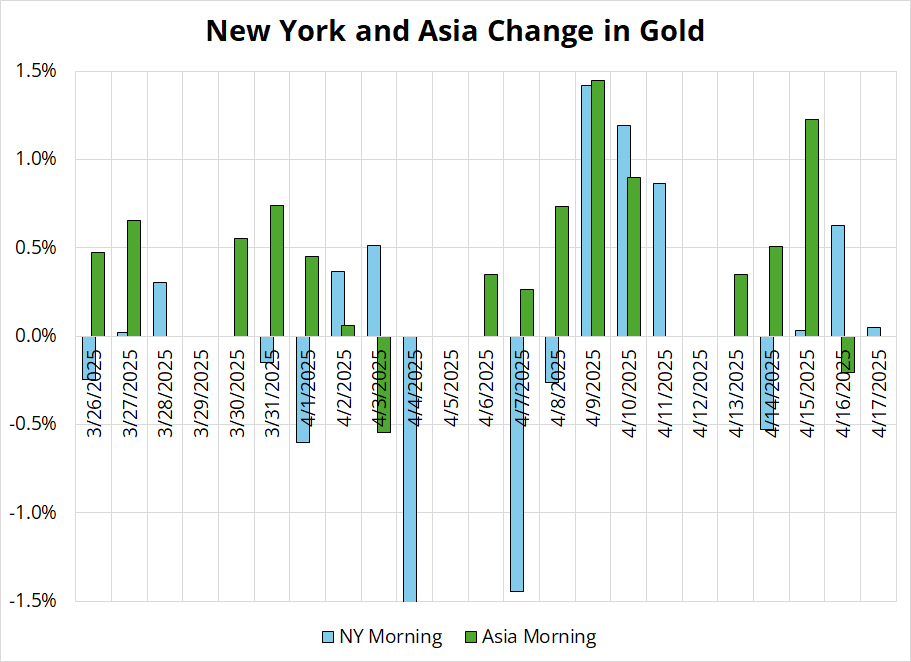

Zerohedge and others were writing yesterday about the big moves higher in gold in Asia time and I generally find that once time zone price activity enters the zeitgeist, it’s almost done. Everyone went into Asia long gold and silver last night and gold went down and silver got absolutely hammered. This ends a long run of Asia buying gold, as you can see here.

Look at the green bars and you can see that the only down move in Asia was the one little move lower before the post-Liberation Day… And last night. Keep an eye on gold today and let’s see if the NY session and/or Easter Weekend triggers a correction in gold and/or GDX.

Adding to the Sell America theme is the further evisceration of regulatory and financial supervision as the SEC and CFPB stuff is now moving towards attempts to eliminate Fed independence. Trump railing against Powell is nothing new (we saw it in Trump 45) but the Humphrey’s stuff is a big step up towards emerging market style government control of monetary policy. Not good.

Have a good Good Friday, Friday and let the pips fall where they may.

Pip means many things, but in the context of FX, these definitions are most relevant. Some say pip means “price interest point” in FX, but that is a definition that was attached after the fact. The root of pip is small increment as in: “My horse lost the Derby by a pip.” As in…