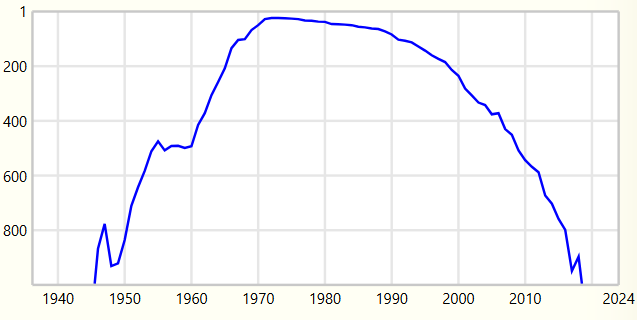

Rank of the popularity of the name Chad

1940 to now

Current Views

Flat

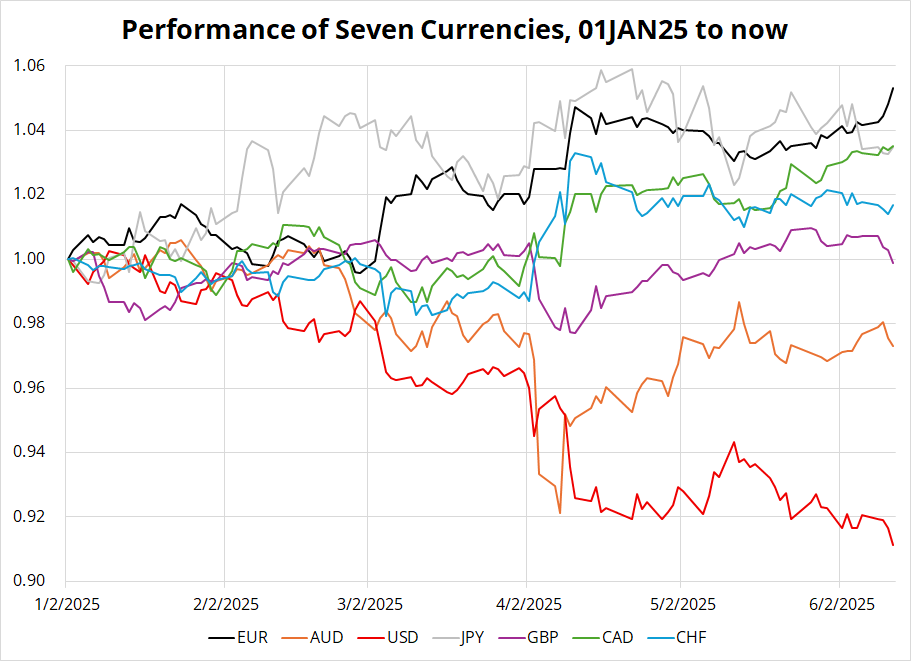

Dispersion

There has been striking dispersion in the performance of G10 currencies this year as the euro rips while the USD swoons and AUD is particularly soggy for reasons that are hard to understand. USD/Asia has tumbled, risky assets have been fine, commodities have held in, and emerging markets have been in favor and yet the Oz cannot buy a bucket.

The EUR theme has solid footing:

- ECB loudly declaring they are done cutting.

- Momentum towards mutualization simmering in the background (see here and here) as the ECB and others tout the EUR as an alternative to the USD (see here and here).

- European pension funds increasing USD hedges as angst and animosity towards hostile US policy increases.

- Massive defense spending increases lurk on the horizon.

- Eurozone stocks outperform US equities after years of trailing.

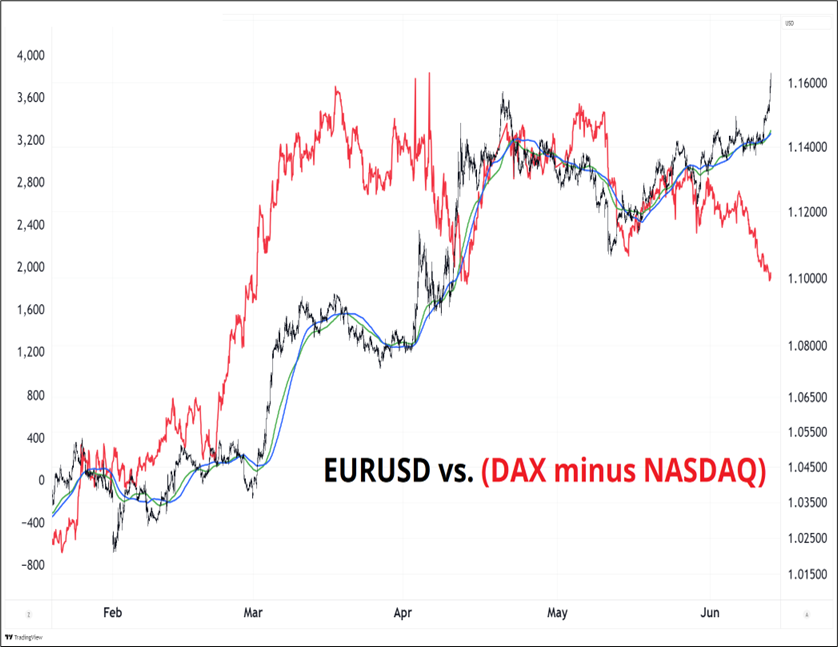

The trade has not been easy, at all. EURUSD touched 1.1573 on April 21 and finally breached it today and yet as you can see in the chart up there, EUR vs. USD was the best pair of the bunch. Most option trades put on in April are barely ITM.

The charts in EUR are a bit of a mess. The toughest part of the EURUSD trade has been that the dominant theme of SELL AMERICA has completely disappeared. US equities are fine, US bonds are fine, and yet the USD continues to be shellacked by central bank and pension fund selling, even as fast money specs get left behind. The market is bullish EURUSD but super underinvested because of the long and variables lags in the pair’s performance.

You can see here how this move might be confusing to anyone (like me) who was thinking the SELL AMERICA theme was a thing. All the angst around DeepSeek and the end of US exceptionalism and policy chaos and the bond vigilante anarchy in the USA has dissipated. And yet here we are. The SELL AMERICA theme was a red herring in both stocks and bonds (for now).

The Fed looks behind the curve with rates still deep in restrictive territory, and the ECB is done cutting and so there is room for monetary policy divergence as a new theme. July FOMC, while very unlikely to result in a rate cut, is in play somewhat as this could be the meeting where they signal that cuts are imminent.

Choosing the right currency to be long has been as important as just hating the USD. Long EUR or long EM carry have been the real theme, more than sell USA. And while I am saying it’s a ECB vs. Fed story, rate differentials have barely moved either. It’s just a “pension funds and central banks want to sell dollars and they don’t care about oscillations in micro or macro variables” story.

Lovely Language Machines

I have been using LLMs much more for trading and ideas of late as I start to fully understand their power. A few times I have been able to simply drop a Bloomberg headline into ChatGPT and ask it: What does this mean for the stock price? And it gave me answers that allowed me to make money day trading biotechs, for example. There will be a whole chapter in my new book about this. I am just at the part of the learning curve where it starts to slope steeply upward and so I would appreciate any advice or ideas you have. Have you found some cool ways to use LLMs for trading ideas, news interpretation, or information processing?

One application that is pretty cool, though not exactly life-changing, is a script my son built for ChatGPT to objectively rate covers of The Economist for their contrarian value. The reason I asked him to build this is that sometimes I feel that my personal bias might cloud my interpretation of a cover and block me from objectively announcing the contrarian trade idea for Magazine Cover Capital. If you are not familiar with this topic, the backgrounder is here and a recent tweet is here.

Using the criteria from my original article, I now have a script where I can paste in the cover of The Economist and the prompt and it will give me an unbiased answer.

For example, if you use the prompt and paste in this cover:

ChatGPT responds:

Step 1: Qualification Criteria

- ✅ Asset Focus

The cover centers on Saudi Arabia’s economic transformation, which is closely tied to oil and sovereign-related investments (e.g., Aramco, Saudi ETFs). - ✅ Strong Predictive Statement

The phrase “All Grown Up” strongly implies a bullish transformation narrative for Saudi Arabia’s economy. - ✅ Obvious to Layperson

The palm tree imagery growing among skyscrapers and bold phrases like “surprising transformation” make the message clear to non-experts. - ✅ Tradability

The theme maps directly to U.S.-listed tradable assets such as the iShares MSCI Saudi Arabia ETF (KSA).

Step 2: sample_trade

Contrarian Setup: The bullish cover story may signal peak optimism around Saudi Arabia’s economic reforms and diversification efforts. Technically, KSA is near multi-month highs, with resistance around the $44 range. A contrarian short near $42–$43 could anticipate a pullback, particularly if oil prices weaken or geopolitical risks rise. Targeting support near $37.50 offers a ~10% move with a 5% stop-loss buffer.

Sure, the answer was fairly obvious here, but KSA is a good suggestion and the result is unbiased. Sometimes, the covers are much more difficult to interpret with certainty and this script will help me when people argue that my asset class choice is dumb or wrong. I put the full prompt as an appendix to today’s am/FX in case you want to try it on some back issues or in the future.

Final Thoughts

May you trade with the power of 100 Gigachads.

Appendix: Adam D’s prompt for contrarian evaluation of covers of The Economist

Paste all of the below text into ChatGPT and then paste in an image of the cover of The Economist and hit transmit.

—

🔍 IMPORTANT

When proceeding to Step 2, it is critical that you use real-time stock data by searching the internet to fetch the current price of the asset. Do NOT return any stock charts in your response. Only textual and numeric information should be included.

—

📋 Step 1: Qualification Criteria

(ALL must be reasonably satisfied)

Evaluate whether the attached magazine cover satisfies the following. Provide a ✅ or ❌ for each, along with a short justification (1 line max).

☑️ Asset Focus

Does the cover clearly center on a specific asset, asset class, or economically-linked theme implying tradable exposure (e.g., stocks, crypto, oil, gold, housing, USD, interest rates, sectors like gambling, EVs)?

☑️ Strong Predictive Statement

Does the cover make an explicit or strongly implied directional prediction (e.g., boom, bust, unstoppable, collapse)?

☑️ Obvious to Layperson

Is the message clear to a non-expert, using obvious headlines or imagery that convey sentiment and forecast?

☑️ Tradability

Does the theme directly map to a U.S.-listed tradable asset (e.g., individual stock, ETF, index, commodity)? A ticker is not required if the link is obvious.

✅ Step 2: If ALL 4 criteria are met, return the following trade setup in YAML format:

yaml CopyEdit trade_setup: asset: "[Name or ticker]" implied_market_sentiment: "[Bullish or Bearish]" contrarian_trade_direction: "[Long or Short]" current_price: "$[Real-time price]" meme_stock: "[Yes or No]" entry_stop_target: entry: "$[Suggested entry point]" stop: "$[Suggested stop-loss level]" target: "$[Profit target]" time_horizon: "[e.g., 1M / 6M / 1Y]"

📉 Step 3: sample_trade

Include one contrarian trade setup for the asset based on the sentiment, real-time price, and technical context (e.g., round-number levels, resistance/support zones, RSI extremes). Do not include price charts.

❌ If ANY of the 4 criteria are NOT met:

Return:

“Cover does not meet all criteria for a contrarian signal.”

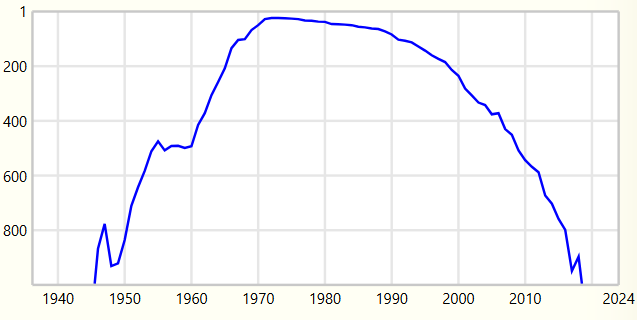

Rank of the popularity of the name Chad

1940 to now