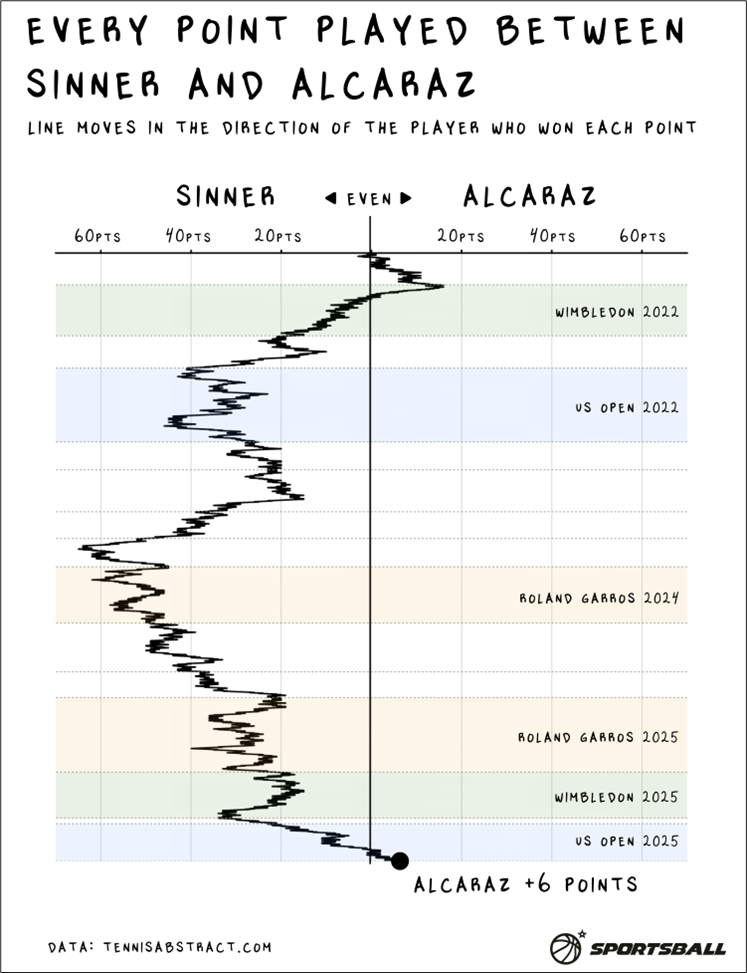

1-week EURUSD on a 6 handle into FOMC is not what you want to see.

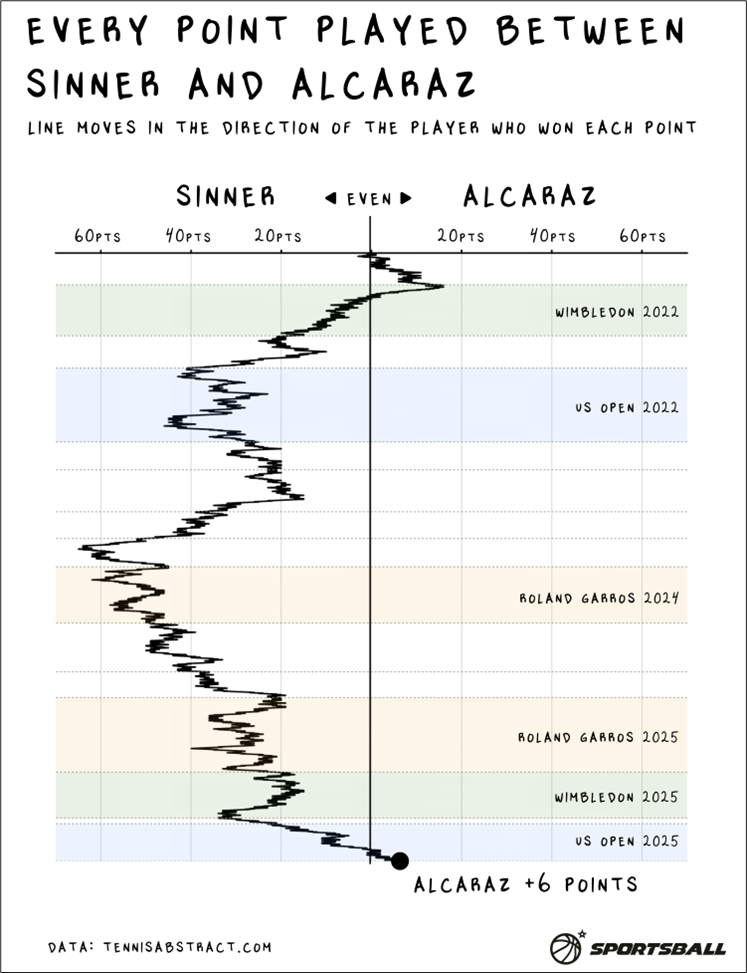

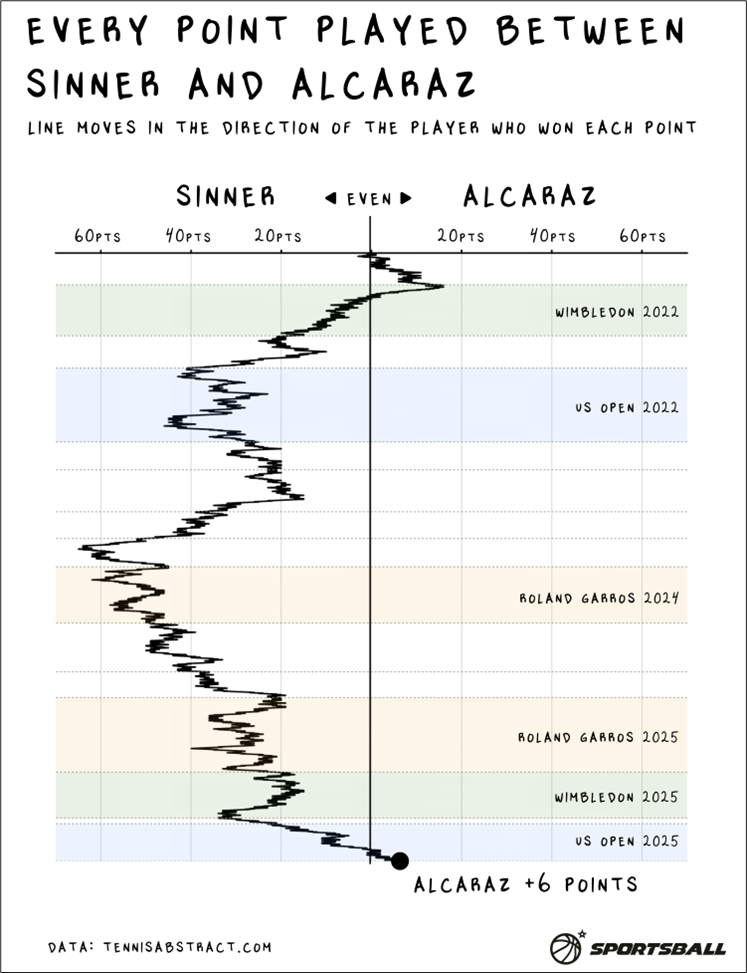

Cool data visualization

1-week EURUSD on a 6 handle into FOMC is not what you want to see.

Cool data visualization

Flat

The FX market is in malaise mode here as this week’s FOMC, while chock full of political drama, is not expected to be particularly market moving. 1-week FX vols are at the very, very low end of what you would normally see going into a Fed meeting.

The Fed is on dovish autopilot as it has ditched the inflation target and moves right on the spectrum, away from independent and towards captured. While one can point to historical examples of Fed policy that was government-directed, there is no precedent for a White House staffer as Fed voter, something that will be true tonight once Miran is confirmed. What that means for financial markets depends on the data. If the US rolls over, the predetermined policy direction will be AOK, and if inflation picks up, there’s going to be a problem.

The market is happy with the outcome so far, as US yields remain rangebound, risky assets are at all-time highs, and volatility is in the cellar. The narrowing triangle in yields is bounded by 3.85% and 4.35%/4.50%.

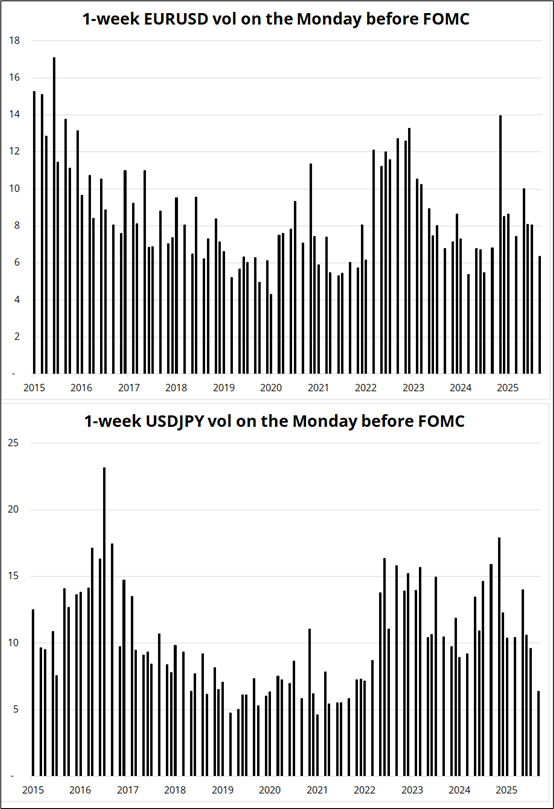

As one might expect in a period of low volatility and confusing policy, positioning is light. Here is the latest, where you can see that while the nearly-static CFTC positions remain in place, active traders are close to home. There is a bit of love for AUD and NZD and some mild dislike for CAD (all reasonable!) while the momentum scores (ex-AUD) all hover near midrange.

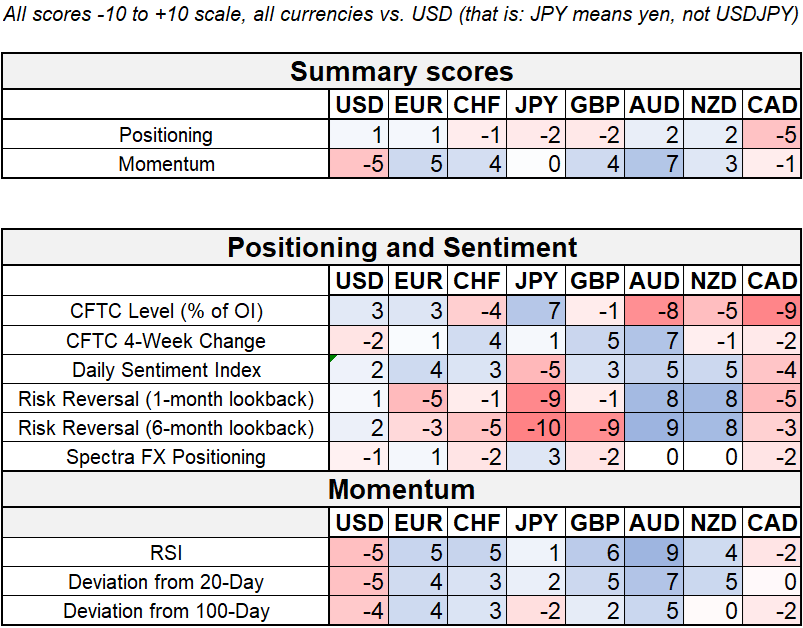

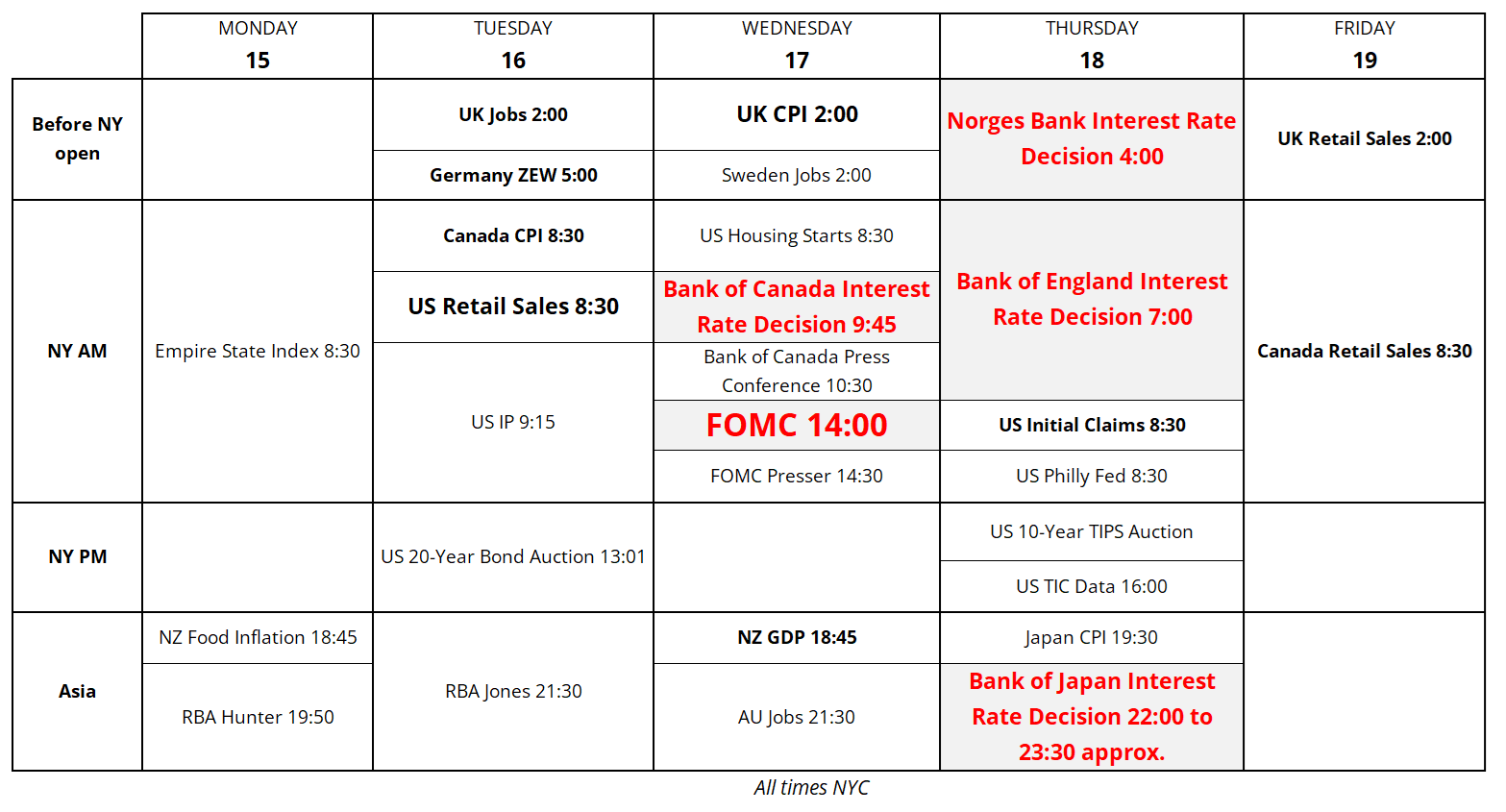

The calendar gets juicy as the week progresses (see below). May your week be free of unforced errors.

Trading Calendar for the Week of September 15, 2025

Cool data visualization