The USD selloff looks unimpulsive and tired, already.

“Told ya…”

This paper introduces an interesting yet really, really terrible idea.

The USD selloff looks unimpulsive and tired, already.

“Told ya…”

This paper introduces an interesting yet really, really terrible idea.

Flat

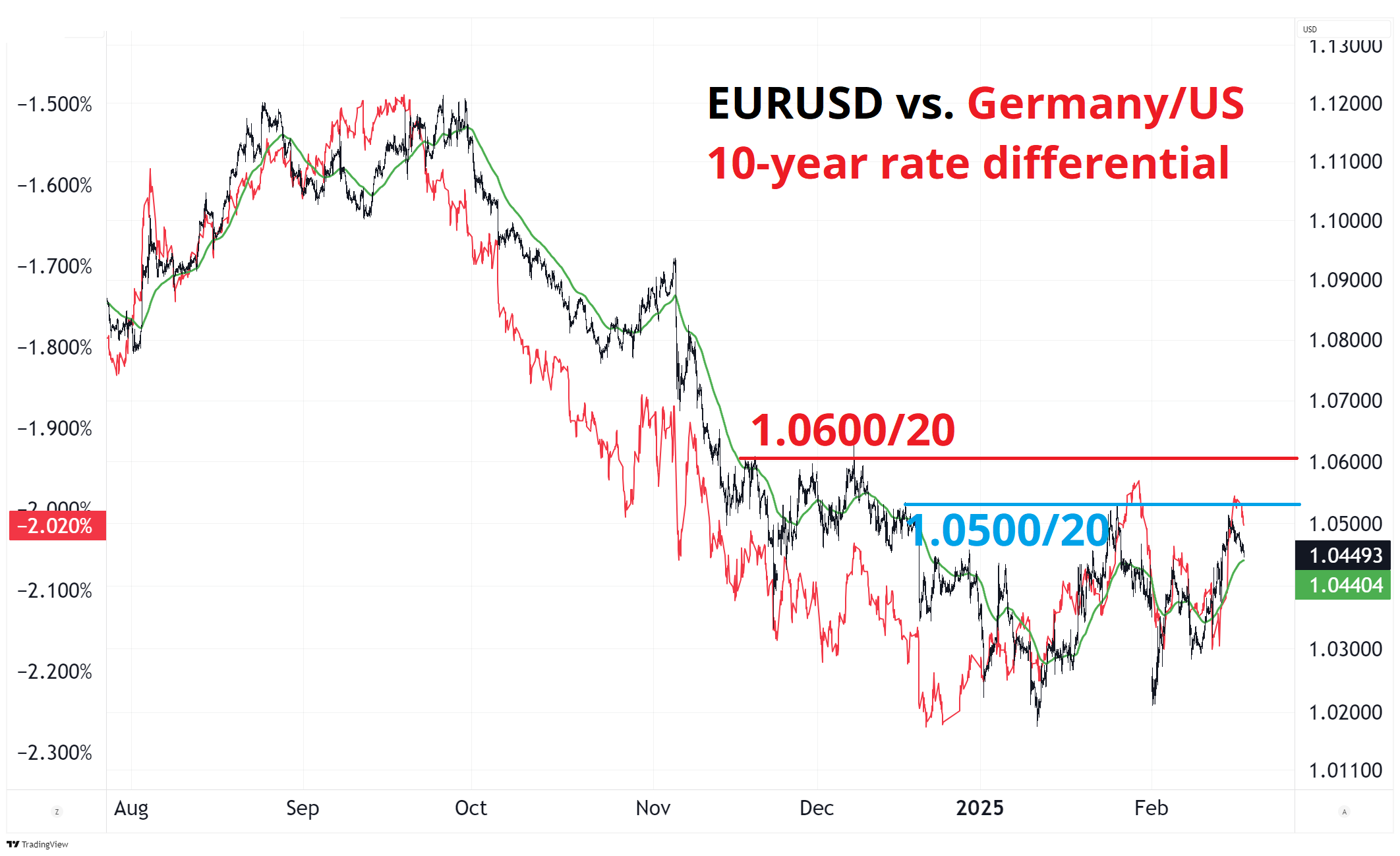

If you are bullish USD, this feels like a pretty good time to start reloading as sentiment on European equities has become super bullish, EURUSD can’t even take out 1.0500/30 (does not look impulsive at all), AUDUSD market is probably caught long hoping for the hawkish cut and USDCAD has to start thinking about the impending 01MAR Sword of Damocles date pretty soon. And any deal on Ukraine no longer looks like imminent topside headline risk for EUR.

You could also argue that Germany/USA 10-year rate differentials look double toppy around -195/-198 bps. Waller flipped from lots of rate cuts to on hold in his speech last night, though he (like other Fed members) gave a nod to the seasonality of prices in the first part of the year. Thing is, that seasonality applies to February data, too.

There is nothing special on the calendar this week, really, though the German election on the weekend, the RBNZ tonight, and a flurry of stuff on Friday mean there is not nothing, either. We are a little bit themeless, with the exception of a faint whiff of the end of US Exceptionalism percolating in the background. For that to get real momentum, you are going to need some actual good news out of Europe, China, or both. Higher Chinese tech stocks and a ripping DAX are not going to be enough to get us confidently trading the middle of the dollar smile.

Global investors are feeling frisky again as they gobble up foreign stocks with an ongoing focus on Europe and a renewed focus on China. The BofA Survey shows investors have not been so fully invested since 2010. The sentiment whipsaw in China has been frenetic as the market sees opportunity in cheap valuations but an on again/off again threat of communist / Marxist vibes. Right now, the Marxist vibes are receding as Xi Jinping met yesterday with a variety of tech leaders.

There is currently an interesting parallel where stocks in both the US and China respond to endorsements from the leader of the country as both nations seem keen to pick winners in a system like capitalism but with socialist characteristics. Trump’s endorsement of Musk gave his company a 40% boost while the winners picked for Stargate (such as ORCL) rallied nicely when their CEOs stood alongside the new US leader. Meanwhile, Jack Ma was selected for the Monday meeting, but the Chairman of BAIDU was not. Reuters reported:

The Hong Kong shares of Baidu plunged on Monday, wiping $2.4 billion off its market value, after the founder of the Chinese search engine giant was not spotted at a rare meeting between President Xi Jinping and corporate leaders.

I mean, it’s a 250B company. And it lost $2.4B in market cap. But generally, investors need to consider which CEOs are tight with the government and which are not when considering single name investments these days. This is nothing new in the US as Biden was obviously picking winners with emissions policy and Bush and Obama picked who to rescue and who to let die during the GFC. Still, market perceptions of government endorsement have never been more important for Chinese tech and specific US stock valuations. I am intrigued to see how it all plays out in 2027/2028 as the meme-like premium in stocks like TSLA and DJT will either go to zero or continue under a JD Vance or similar administration.

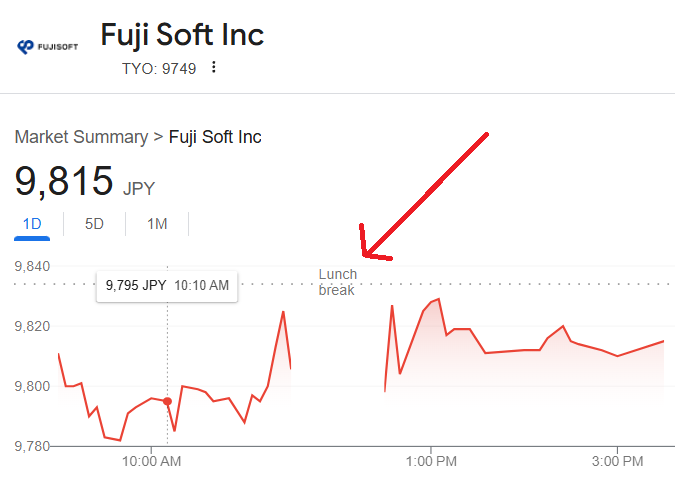

While that particular similarity between the Chinese and US political economy is interesting, I was recently reminded of this fun difference between US and Japanese stock trading.

Civilized!

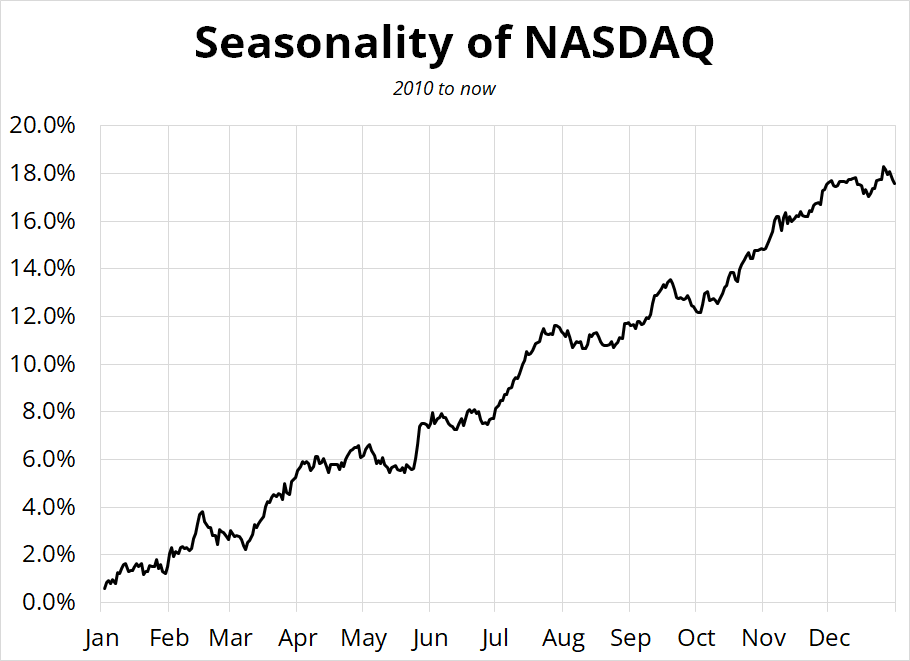

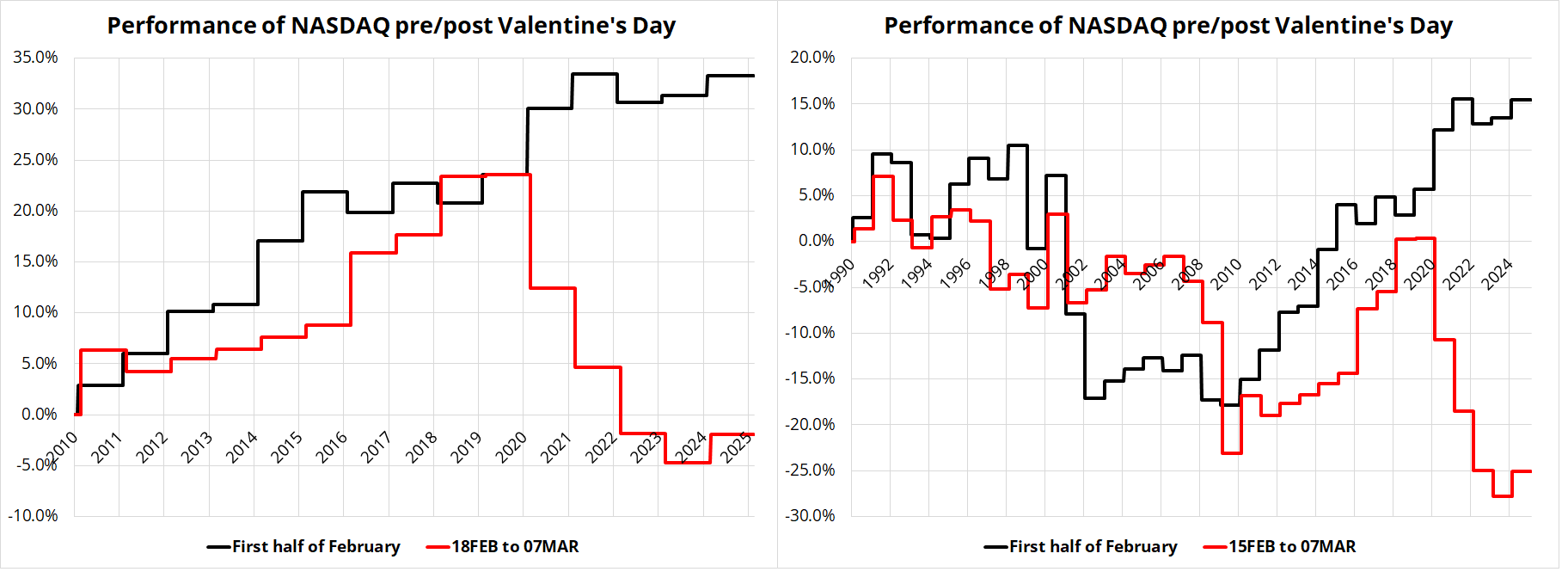

Anyway… US stocks are entering a mini period of bearish seasonality as the stretch from 15FEB to 06MAR has not been great for equities. Here’s the average performance:

Drilling down, the negative seasonal is a product of down moves in 2009, 2010, 2011 and five of the last six years. As such, I am really not sure whether this is anything more than randomness as I can’t think of any particular money flows that would explain the weakness, other than the fact that the start of the year is over and those massive new year inflows perhaps dissipate after 6 weeks of trading or so? That kind of makes sense, but my feeling is that the signal-to-noise ratio here is not very high. Here’s the granular look at two levels of zoom.

As mentioned earlier, the End of US Exceptionalism has rapidly become a theme here mostly because a) everyone loves to buy cheap European stocks and it’s actually working this time so that appears to validate the thesis, b) MAG7 earnings look peaky as they potentially overinvest in the race to see who can spend the most on capex and c) even at current levels, you can easily argue RoW is cheap and USA is expensive. I don’t really have a strong view; I’m just pointing out this view is becoming rather consensus rather quickly and will require some kind of good news on the German and/or Chinese economies at some point soon or the flows will fizzle.

You could argue that the China 10-year yield basing is a bit of good news but most of what we are seeing is market-based measures flashing green (German stocks, Chinese yields, etc.) At some point we need actual good fundamental news to take the baton from pure price action.

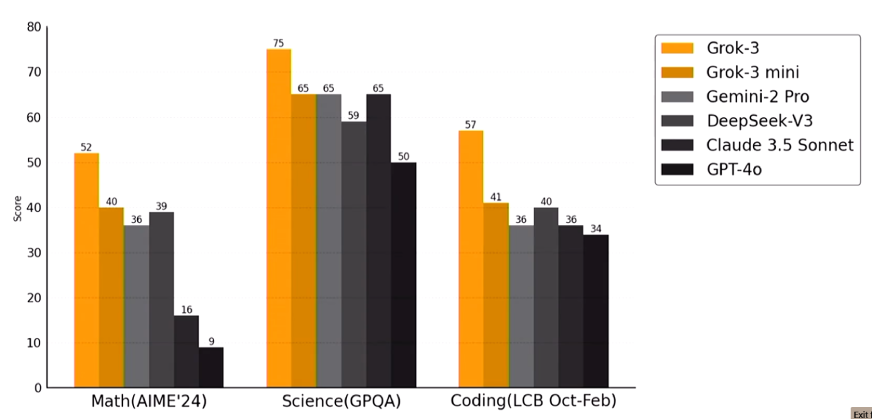

Depending on who you believe, Grok3 has leapfrogged the other models as the commodification of LLMs continues apace.

I toggle between the paid version of Claude and the free versions of ChatGPT and Perplexity and often get the exact same answer three times when I ask them the same question. For everyday usage, there are nuances, but they are like the nuances between using Google Sheets and Excel. Minimal.

If you are a writer or you’re into writing, this podcast (Ferris with Sanderson) is 10/10. It’s on Spotify too.

Have a human day.

Close to home

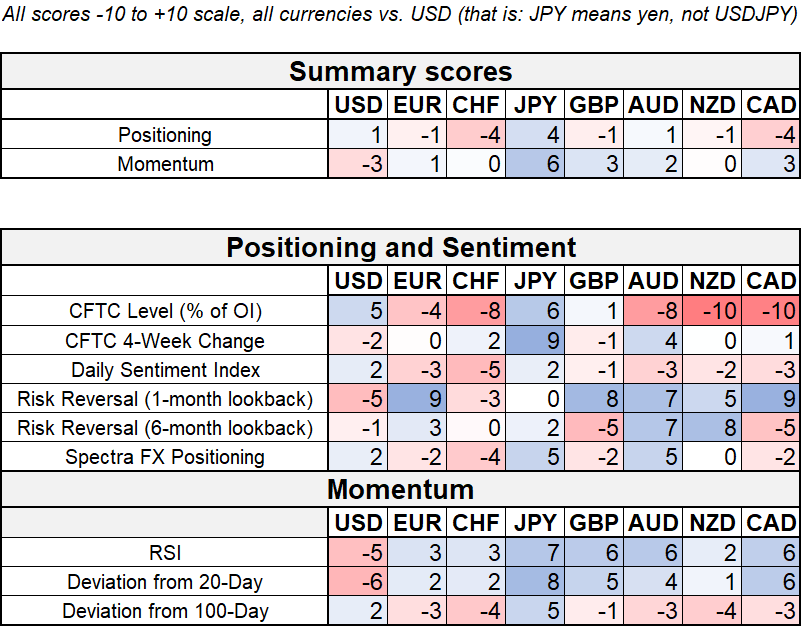

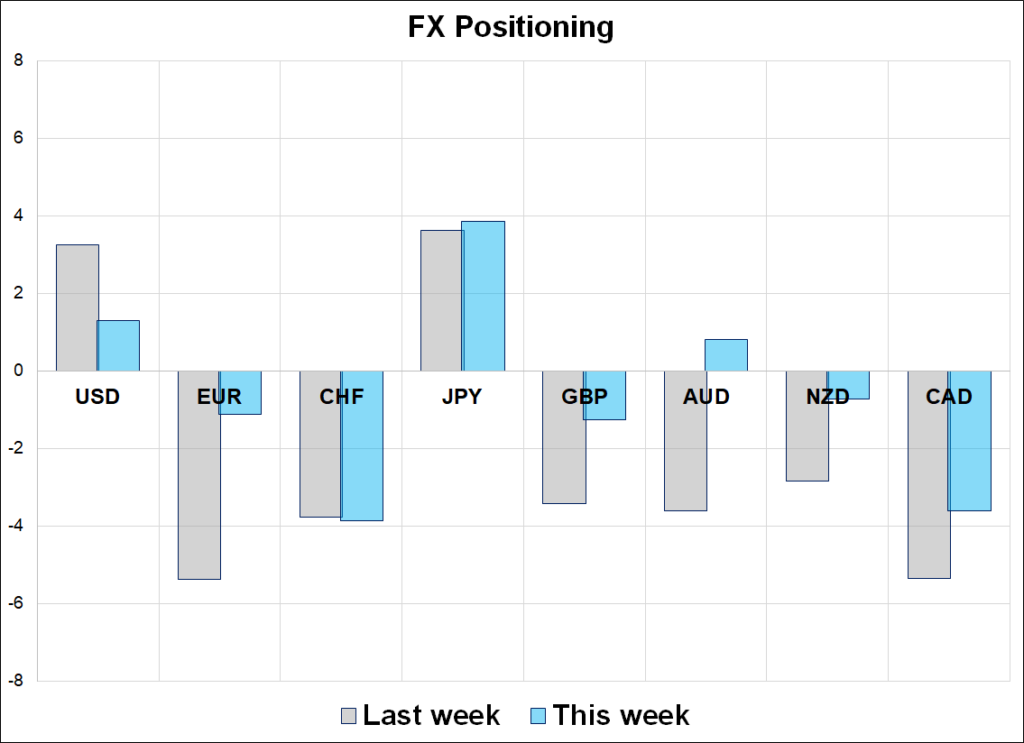

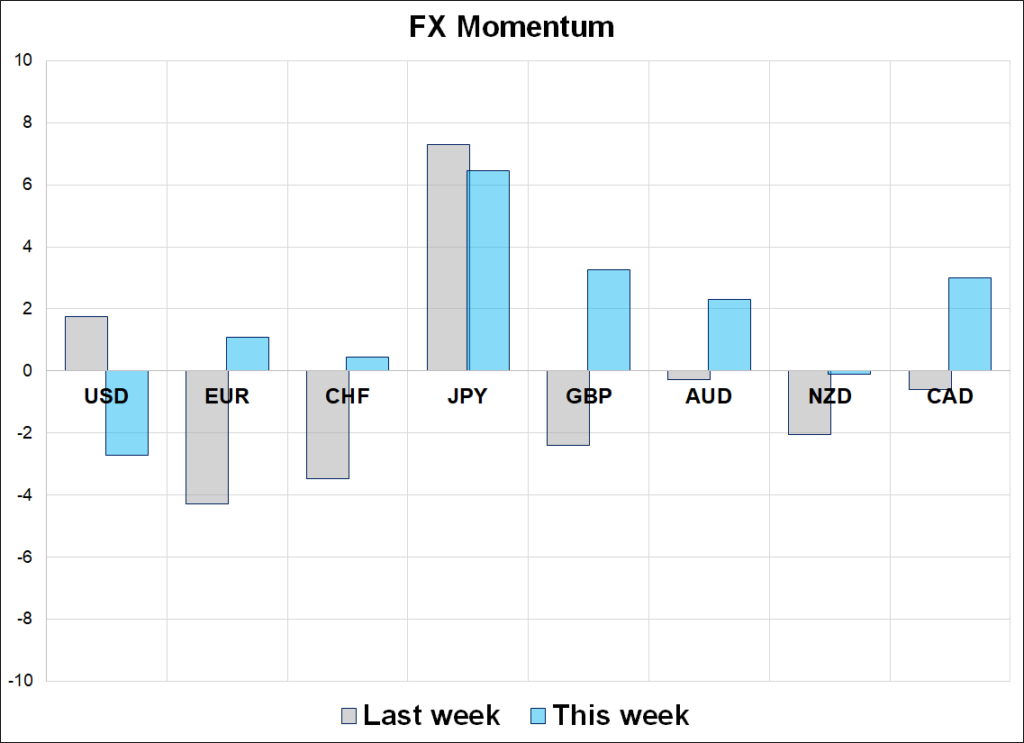

Hi. Welcome to this week’s report. FX traders are about as close to home as they have been in eons as euro puts burn off, cash positions have been unwound, and momentum has fizzled. This creates an interesting setup as we approach the March 1 and April 1 tariff deadlines.

The moves in spot have not been all that dramatic, but they have been big enough to trigger significant capitulation as we have gone from record long USD positions at the turn of the year to nearly flat positioning now. The whole thing has played out very much like the turn of 2016 to 2017 as USD longs cannot hold on, waiting for promises delayed or perhaps never kept. The USD did finally rally in 2018 when the tariffs arrived, so the analog would be that there is still hope for USD longs as the tariff deadlines near.

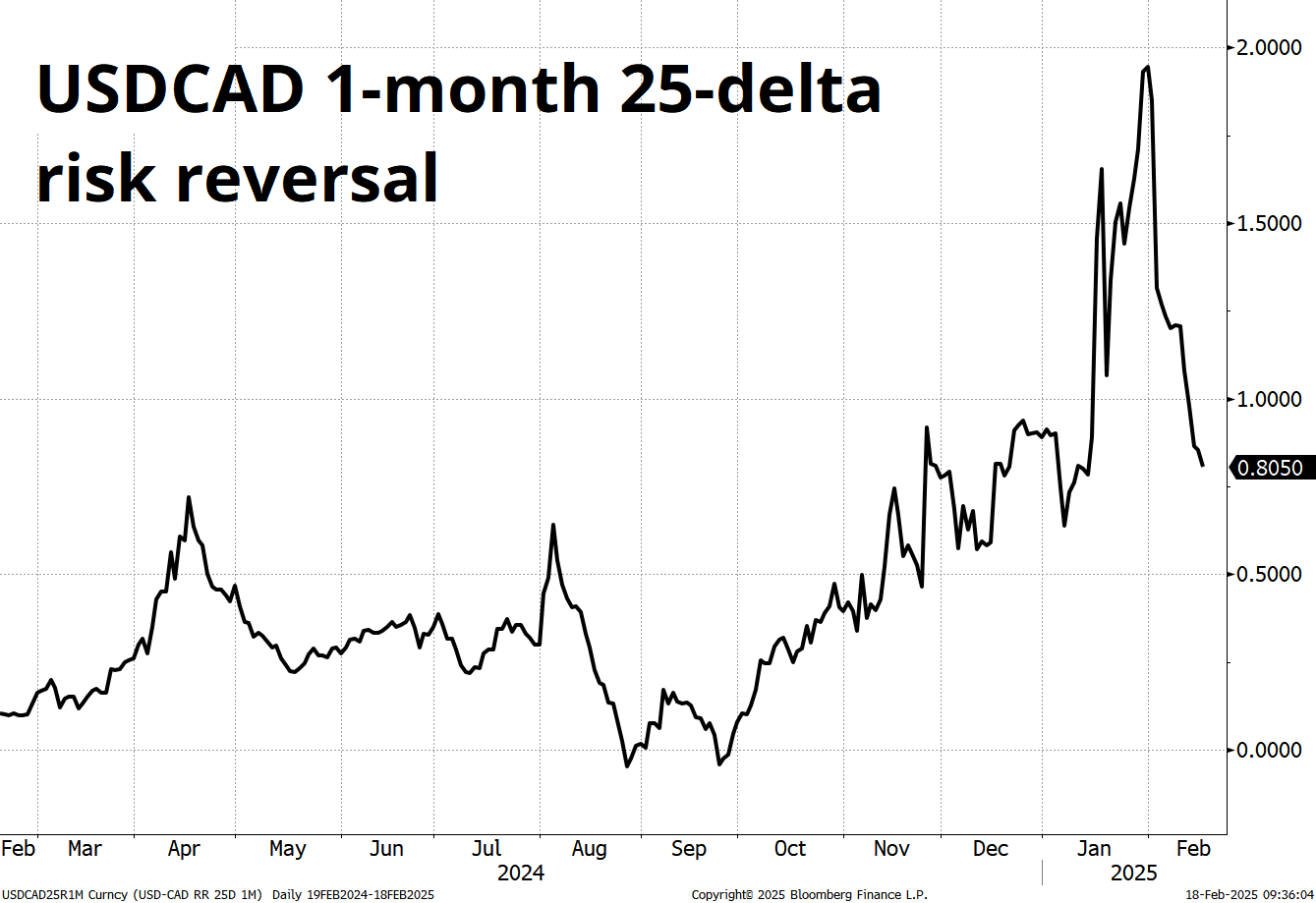

The real moves have been in the options markets as topside USDCAD, for example, has been obliterated.

These are incredible moves given the fact that the 1-month date currently includes the March 1 fill or kill date for the 25% tariff on Canada and there has been no movement towards a deal in recent days. If you believe that the leadership vacuum in Canada makes the tariff scenario live, these are incredible entry points for USDCAD topside.

1-month 1.44s at sub 24bps look attractive.

Similar arguments can be made with EUR as the risk reversal has ripped to the range highs.