Too many USD bears. Too early for the long BRL home run.

Tarcísio de Freitas

Too many USD bears. Too early for the long BRL home run.

Tarcísio de Freitas

Flat

I have now caught up on my reading and man, the USD hate is strong.

All the arguments make sense. And there is no point putting on a counter trade just to be a wise guy. But still, the arguments for a weaker dollar are well-flagged, the dollar is already down 10%, and much of the stuff about the administration fully capturing the Fed is a bit fantastical to me. I don’t think Bessent or Warsh will come in and cut rates in clips of 50bps if inflation is running above 3% in May 2026. It’s all contingent on the economy. Sure, it’s fun to consider how Trump could appoint some random individual, Erdogan style, and order them to cut rates.

But that’s not how it works.

The Fed is a committee and there is a voting process. Rate cuts are not unconditional, even if Waller, Bessent, or Warsh is running the show. It’s a given that a Trump-appointed Fed Governor will be more dovish than Powell, but the idea that the Fed will just cut rates by 100bps while the Treasury moves all the issuance into T-bills and that will somehow solve everything is only realistic if the US economy is weak. If the US economy and US inflation reaccelerate, and the Fed cuts into it, the inflationary impact will be violent and politically destructive into mid-terms.

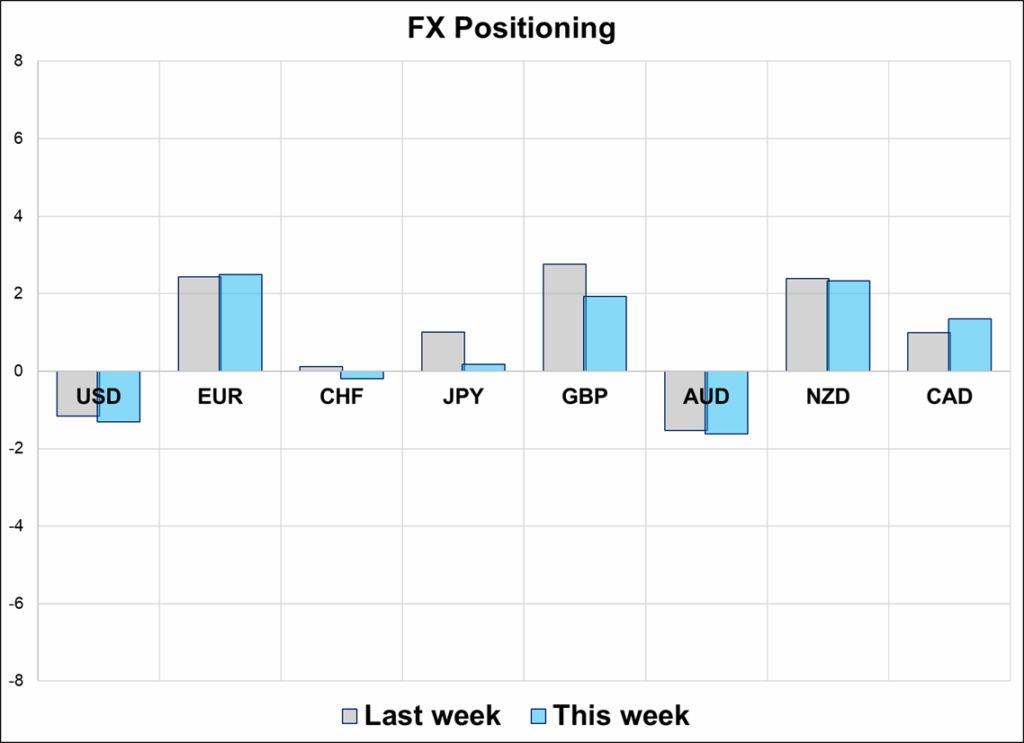

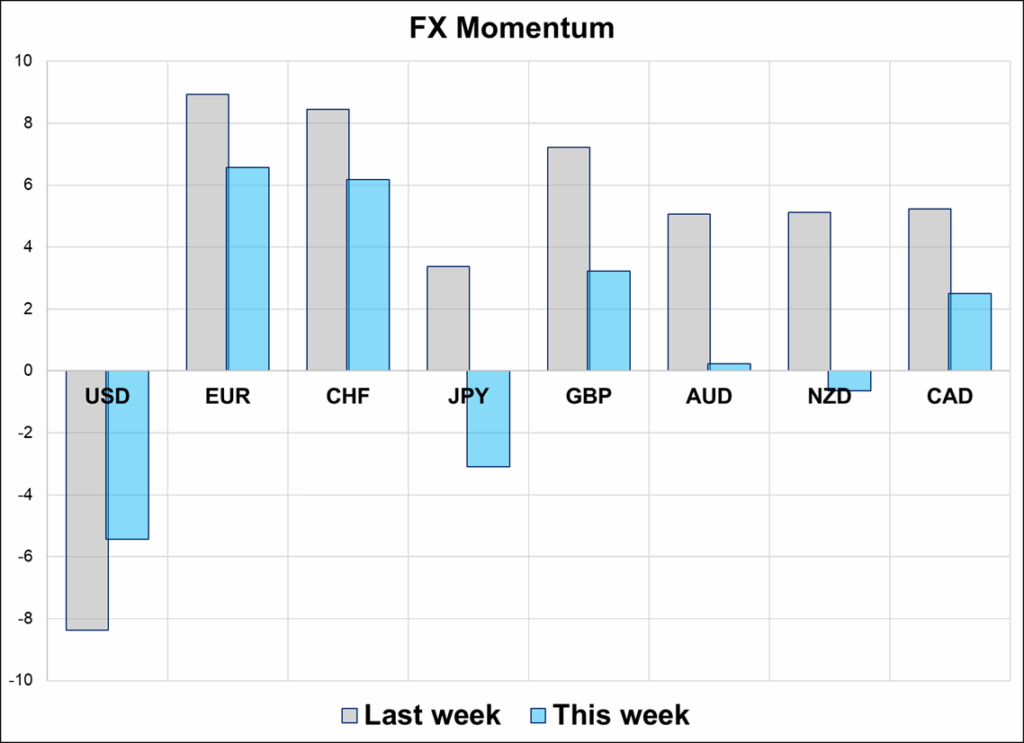

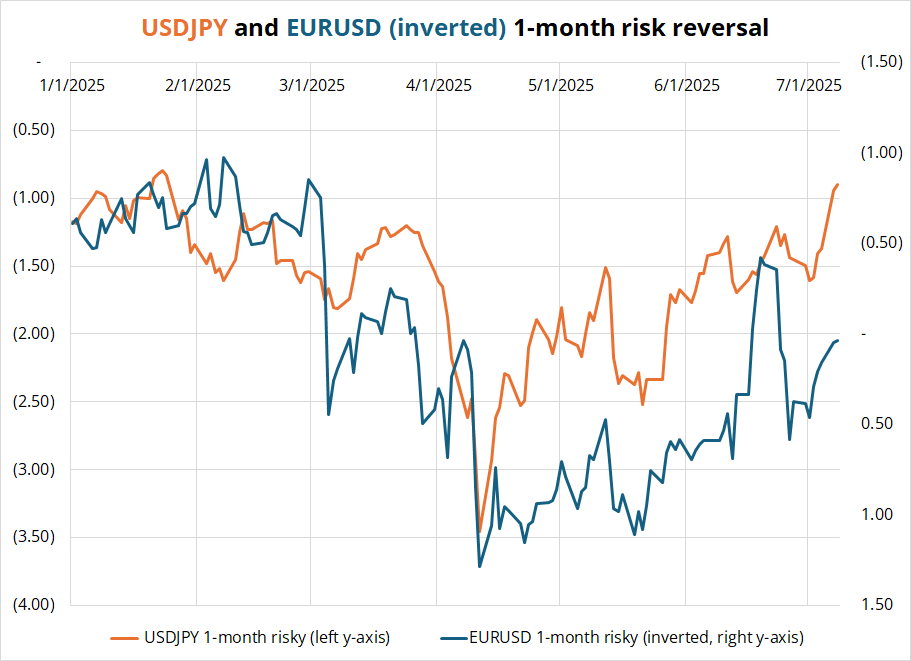

In the short term, I think suggestions of another 30% lower in the dollar right after a 10% drop are a red flag for USD shorts, positioning is universally short USD at OK but not great levels, USDJPY is showing that equity inflows and rate differentials still matter, and the risk for now is a correction higher in the dollar. Abenomics was an effort to beat deflation. There is no deflation in the United States. Anything remotely resembling Abenomics in the USA will be too painfully inflationary.

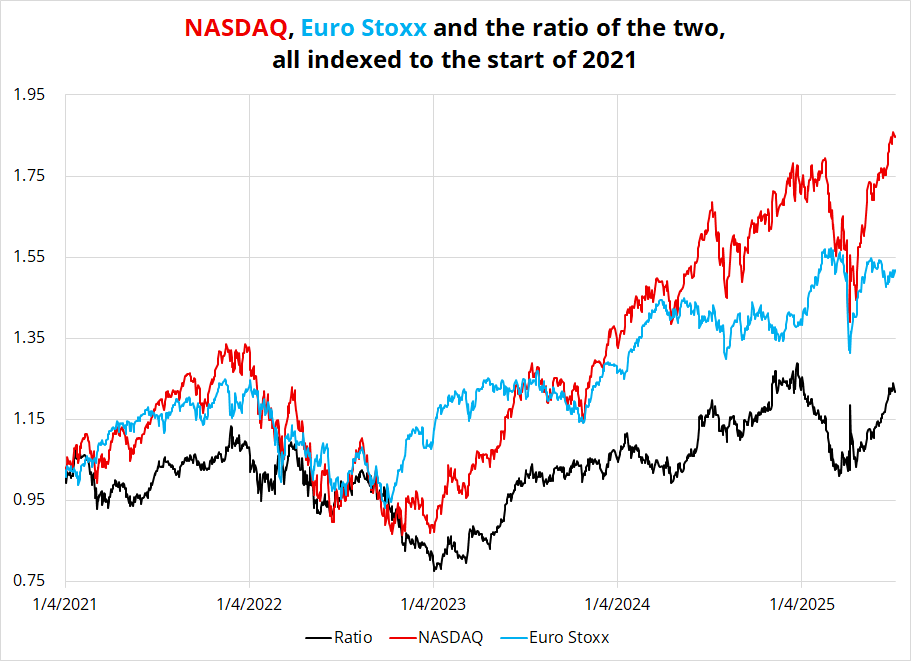

The capital flow story and the idea that money will leave the US and go to Europe is also stale as you can see in this chart:

The bearish USD story doesn’t quite add up right now. Meanwhile, options markets are showing demand for USD calls, not puts.

Our man Avi in Singapore notes the Japanese elections (July 20) are coming to the narrative forefront. He writes:

There are 248 member seats, the current coalition government made of LDP and Komeito needs to win 124 or more. As per current media polls and projections, both parties will not win enough seats to keep the majority.

Voters are upset primarily with high food prices and inflation and blame Ishiba for not controlling costs. Also there is an influx of foreign (primarily Chinese) money that has gone into real estate, that has pushed up Tokyo rental and property investment prices. Most voters have said that they will move from a left centrist to a right wing view and support the opposition.

The current opposition parties are CDP and DPP. Both have done well in the Oct 24 lower house elections and also in the June Tokyo assembly elections. But Sanseito (similar to Germany’s AFD) is trying to win more seats through its anti immigration, fiscal expansion, curtail foreign investment and implement tax cuts program. There is worry that Sanseito can influence the opposition or LDP in pushing forth some of these measures.

There are 2 outcomes – Ishiba loses (which is sort of expected) but holds on to the PM post, by forming a new coalition with some of the opposition parties. This is the most likely outcome, as no opposition party has raised their hands to be the next PM. 2nd outcome – Ishiba loses, and dissolves both upper and lower houses, calls snap election and tries to win the PM post again. However, given latest Trump tariffs, and voter anger, I doubt he will win in re-election.

The tail risk in USDJPY is that if opposition forms a coalition government with Ishiba, they will push for policies such as reducing the current 10% sales tax, and provide monetary subsidies and incentives. More fiscal spending + lesser tax revenue doesn’t fare well for yen, so we should see USDJPY creeping higher. There is also fear that the opposition will pressure BOJ from rate hikes. If this happens, expect USDJPY to stay above 150 levels

https://www.japantimes.co.jp/news/2025/07/07/japan/politics/foreign-politics/

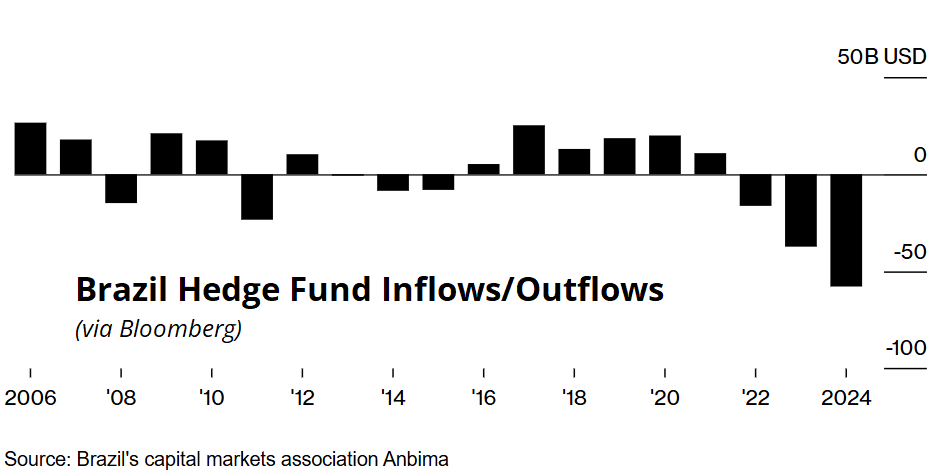

I have been beating around the bush like Yuval Polushko here for a bit, talking G10 and the USD but now let’s move to the takeaways from Brazil. First some context on the fund industry. After a spectacular run, the industry has shed significant assets under pressure from very high real rates, tax-free retail bond offerings, and performance degradation in recent years. This chart covers inflows and outflows to the end of 2024.

The mood was not as bleak as one might expect, however, as performance has been good in 2025 (Vista up 37% in April, for example!) and there is a massive bullish catalyst on the far horizon. His name is Tarcísio.

It was interesting to see how uneducated I am on Brazil because before visiting, I did not know the Tarcísio name and had only vaguely read of some potential bullish election catalyst in October 2026.

Who is Tarcísio?

Full name: Tarcísio de Freitas but somehow, he gets to have the single moniker like Ronaldo or Madonna. He was described by fund managers in Brazil as “Milei, but less crazy,” “Milei, but more normal,” and as a pragmatist, technocrat, and enormously bullish candidate for Brazil. He is a prominent Brazilian politician and engineer who currently serves as the Governor of São Paulo, the country’s most populous and economically significant state.

A graduate of the prestigious Military Institute of Engineering (IME), he built his career in public service, gaining national recognition as Brazil’s Minister of Infrastructure under Bolsonaro from 2019 to 2022. In that role, he was known for his technocratic approach and focus on expanding and modernizing the country’s logistics, highways, and airports through public-private partnerships. Seen as a pragmatic, results-driven leader, Tarcísio transitioned successfully into state politics.

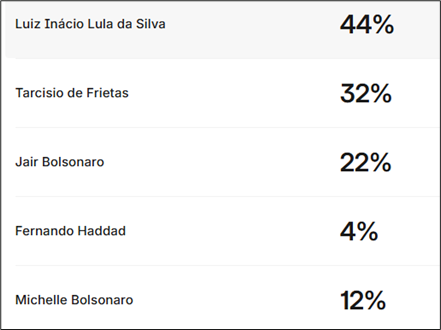

The financial industry in Brazil leans heavy to the right and mostly does not like Lula, so there is a strong bias towards Tarcísio as he is most likely to lift the industry malaise and deliver a bullish impetus for the Brazilian financial industry and its equity market. Because of this bias, Tarcísio’s odds trade significantly higher onshore than offshore. Tarcísio trades around 37% vs. Lula at 27% in the broker betting market in Brazil, while these are the Kalshi odds:

Part of this discrepancy is explained by the fact that Kalshi is USD and Brazil is… BRL. If Tarcísio wins, your BRL will be worth more and if Lula wins, your BRL will be worth less (presumably) and therefore local and offshore should trade with a basis. Regardless, this gives you a sense of Tarcísio’s odds—they are somewhere in the 30%/35% area. But the election is a long way off and there are many branches on the flowchart as we look ahead to October 2026.

The consensus is that Tarcísio will not run without an endorsement from Bolsonaro, so that is the first hurdle. This could happen at any time, in theory, but Bolsonaro faces house arrest or even jail by the end of 2025 and the view was generally that he wants to extract maximum leverage by holding the Tarcísio card close to his chest. He could also endorse his wife Michelle, or his son, Eduardo. With a Bolsonaro endorsement, Tarcísio would have strong support in Congress and a clear path to a solid run in October 2026. Without such an endorsement, he is unlikely to run.

The next hurdle is for Tarcísio to announce his candidacy. He would need to do this by April 2, 2026 because that’s when he would need to resign from his post in São Paulo if he wants to run for President. There is not a ton of incentive for him to declare earlier than that, especially because the view is that one reason João Doria (former Mayor of São Paulo) failed to garner support in his bid for the presidency in 2022 was that he declared way too early and that hurt his chances. The Brazilian electorate doesn’t get excited about the elections until July or so, and declaring super early has little upside.

If Bolsonaro endorses, and Tarcísio declares a bid for the presidency, things heat up and the election on October 4, 2026 will be a humdinger. That’s round one, and if there’s no majority in the first round, then round two is October 25.

Everyone agrees Tarcísio is a massive bullish catalyst, if elected, but most feel it’s too early to trade it. That said, many PMs were long Brazil anyway, saying: “You get paid to wait, and I don’t want to miss it.” Also, somewhat comically, some equity managers said there was no point worrying about the election—you just have to be long because: “If Lula wins again, we’re all out of a job anyway.”

So for now, the market is watching to see what the Supreme Court does with the Bolsonaro case. The harder they come down on him, the more likely he is to endorse Tarcísio because he will need a strong ally and someone to protect/extend his legacy. Bolsonaro sees Tarcísio as loyal, pragmatic, and electable.

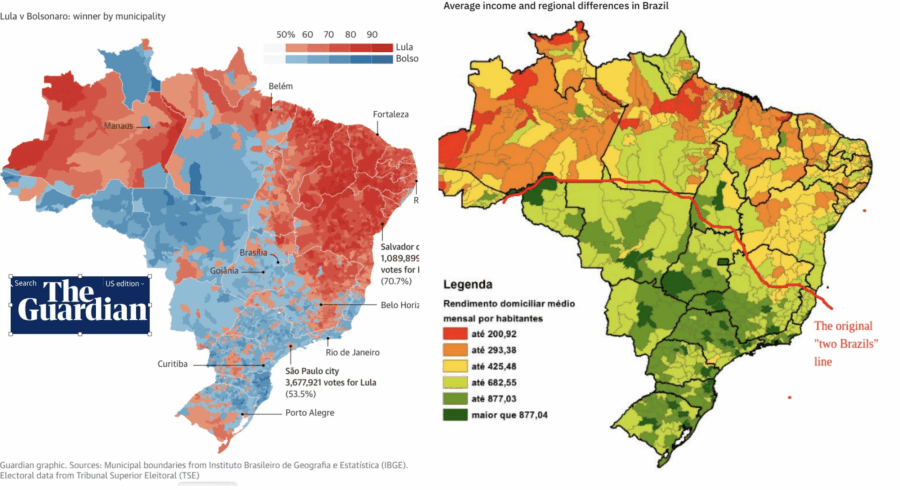

In the meantime, the biggest downside risk is Lula spending to get more votes. He remains popular with a large swath of Brazil’s population, especially the lower-income segment. Such spending would be a double whammy as it would increase the already-worrisome deficit situation (bad for BRL) and potentially increase the odds of a Lula win (also bad for BRL). These maps show the 2022 election results on the left and average income on the right.

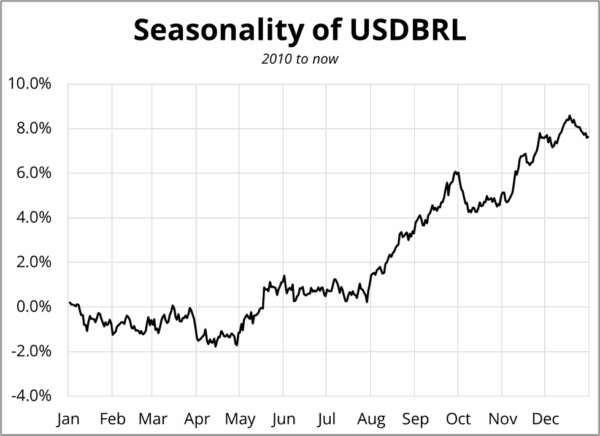

So what’s the trade? I don’t think there is one yet. Much like the G10 position, Brazilians are uniformly long BRL but not in huge size. There is some convexity higher USDBRL on a major USD correction, and there is convexity lower USDBRL on positive Tarcísio news. All in all, it’s a sexy theme for the radar, but it’s not ready for action yet. Especially as the seasonality turns super bearish BRL in August and September as you can see here:

I don’t think the RBA passing on a cut means much for the AUD.

Meanwhile, the bond vigilantes are doing pushups in the parking lot.

Have a pragmatic and technocratic day.

Data belies a uniform consensus

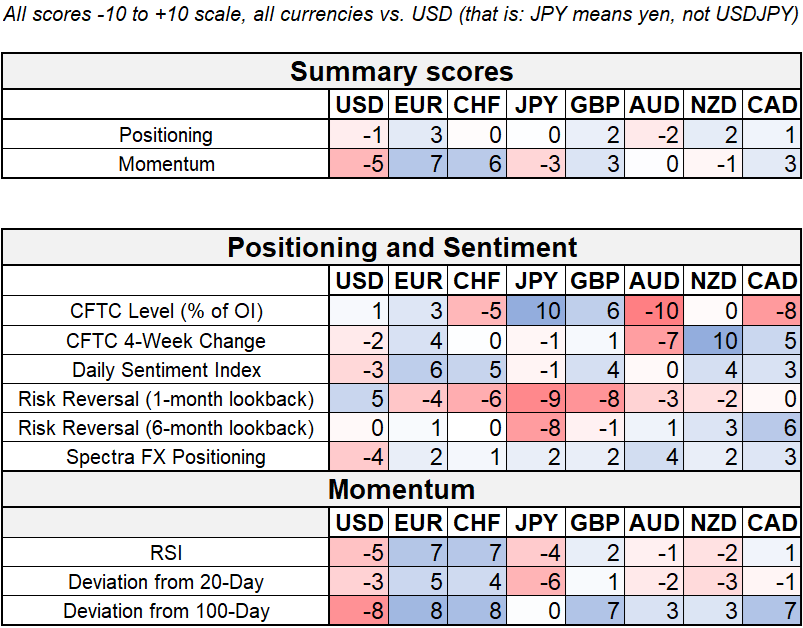

Hi. Welcome to this week’s report. I have discussed positioning a fair bit in today’s am/FX but suffice it to say that the data does not suggest any overly exuberant positioning story, even if the anecdotal evidence certainly does. Calls for multi-standard-deviation moves, and aggressive price targets are often signs of a local maximum for whatever asset is involved. Extrapolation bias. Recency bias. Etc.