Why are CAD markets not freaking out about tariffs?

Bull in a China shop, as seen on TikTok

Why are CAD markets not freaking out about tariffs?

Bull in a China shop, as seen on TikTok

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Long EURSEK @ 11.54

Stop loss 11.3390

Flip short Friday at 11 a.m.

If EURUSD follows the 2016 analog, it’s about to dump 2%.

Aussie jobs and a strange party invite last night pushed AUD higher even as we can expect a “No thanks” from Xi with regard to the inauguration invite from DJT.

If anyone has any theories as to why Trump would invite Xi to his inauguration, I am all ears. Seems quite random. Anyway, AUDUSD remains in this relentless downtrend despite an upward short-term trend in copper, lower-than-expected unemployment, and a strange olive branch from Trump to Xi.

I am tempted to fade the AUD move, but the problem with any USD bear trade right now is that we are in this unstable, bimodal equilibrium where we either get tariffs on Day One, or we don’t. And there is the omnipresent risk of a tariff-related tweet from the next Commander In Chief at any moment. So it just feels too random to be short USD when most of the headline risk is the wrong way.

I have been trying to figure out the Canada angle as we are just 39 days from inauguration and USDCAD is either 200 points too high or 400 points too low. A 25% tariff on all Canadian goods would be so damaging that it’s almost impossible to handicap where USDCAD might go if it came to be. After setting it up, it seems too weak for Trump to then simply back down without first inflicting some sort of psychic pain on Canada. Maybe he does the 25% tariff on Day One and all hell breaks loose and they quickly negotiate some sort of deal that involves tighter border controls and such? That would be quite the ride for USDCAD in January. 1.42 to 1.46 to 1.40 in one month.

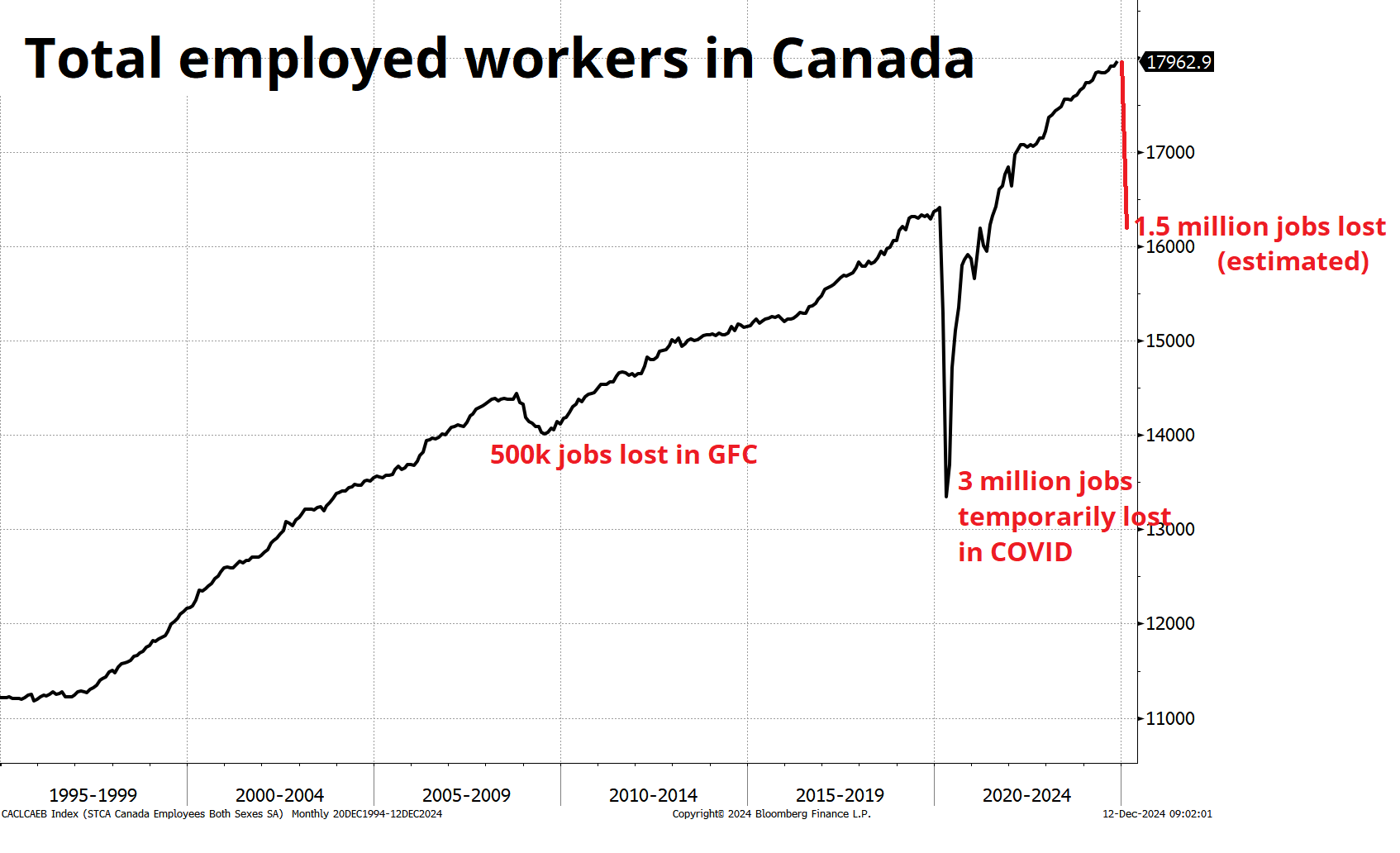

Sometimes I type things like that and think I’m being hyperbolic but this really seems like a time where a bigger imagination is less risky than too small of an imagination. My alma mater wrote up a short piece here which suggests that a 25% tariff would lead to 1.5 million job losses and a GDP reduction “significantly greater than 2.4%”. I suppose the easiest thing is to simply assume Trump is bluffing and not worry about any of this, but it’s certainly not a zero probability that these tariffs get announced on Day One, and the negative employment impact would be 3X the impact of the GFC or 0.5X the impact of COVID.

Can we even say that the base case is that he’s bluffing? The base case is probably smaller tariffs on Day One with the threat of scaling increases over time. This gives Trump the power to push allies around without actually blowing a huge hole in the US economy. Bessent and Musk have both spoken about the need for gradualism on implementation, while Trump does not want a repeat of 2016/2017. He wants quicker results this time.

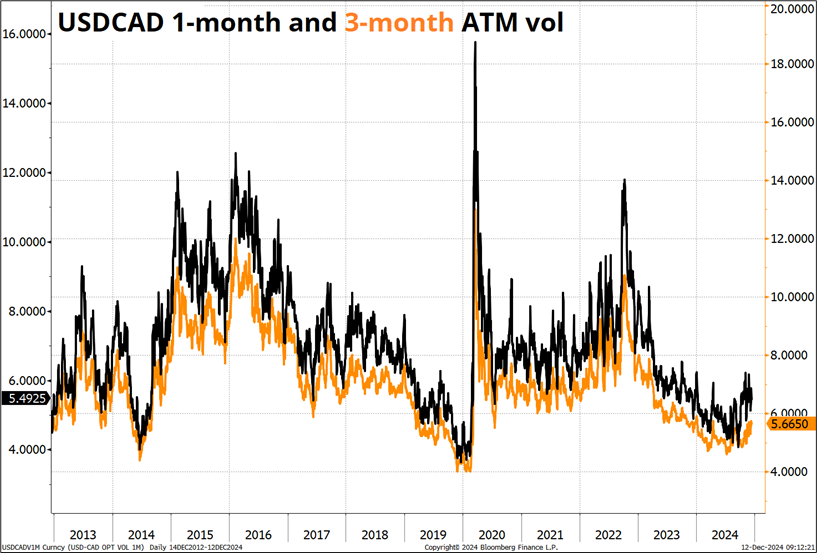

Meanwhile, here’s USDCAD volatility. The market is just not taking any of this seriously, at all.

Volatility is close to the lows and the spread between pre-inauguration and post-inauguration vol does not suggest that there is any risk at all on the horizon. Maybe I am missing something because this makes no sense to me. Does everyone just think he’s bluffing? Do they think it’s fully priced in? Me confused. Even with USDCAD up 150 points since I first mentioned the 3-month 1.45 digital… It still looks wickedly underpriced sub-20%.

Call your friendly Spectra FX salesperson for live pricing. :]

Today is 12+12=24, something that only happens every 2 years, 1 month, and 1 day.

This is one of the funniest financial articles I have read in ages:

Financial Times: A guide to 2025 investment outlooks by someone who hasn’t read them.