The SELL AMERICA theme got oversubscribed, but that doesn’t mean it’s over

Hardcore

The SELL AMERICA theme got oversubscribed, but that doesn’t mean it’s over

Hardcore

Long EURUSD @ 1.1346

Stop loss 1.1184

TP above 1.17

Short USDJPY @ 143.85

Stop loss 145.41

Take profit 140.11

First up, I am making a small change to my stop loss in EURUSD, moving it from 1.1214 to 1.1184. Here’s why. Three reasons. One, the old highs in August and September 2024 were all 1.1200/15. Old resistance should now be support.

Two, when I look at the EURUSD Market Profile, I see a long tail 1.1190/1.1240, and a strong equilibrium zone 1.1250/1.1430. I want my stop to be below that tail because tails identify areas where buyers could not find any sellers (or vice versa) and thus there should be significant demand in that area.

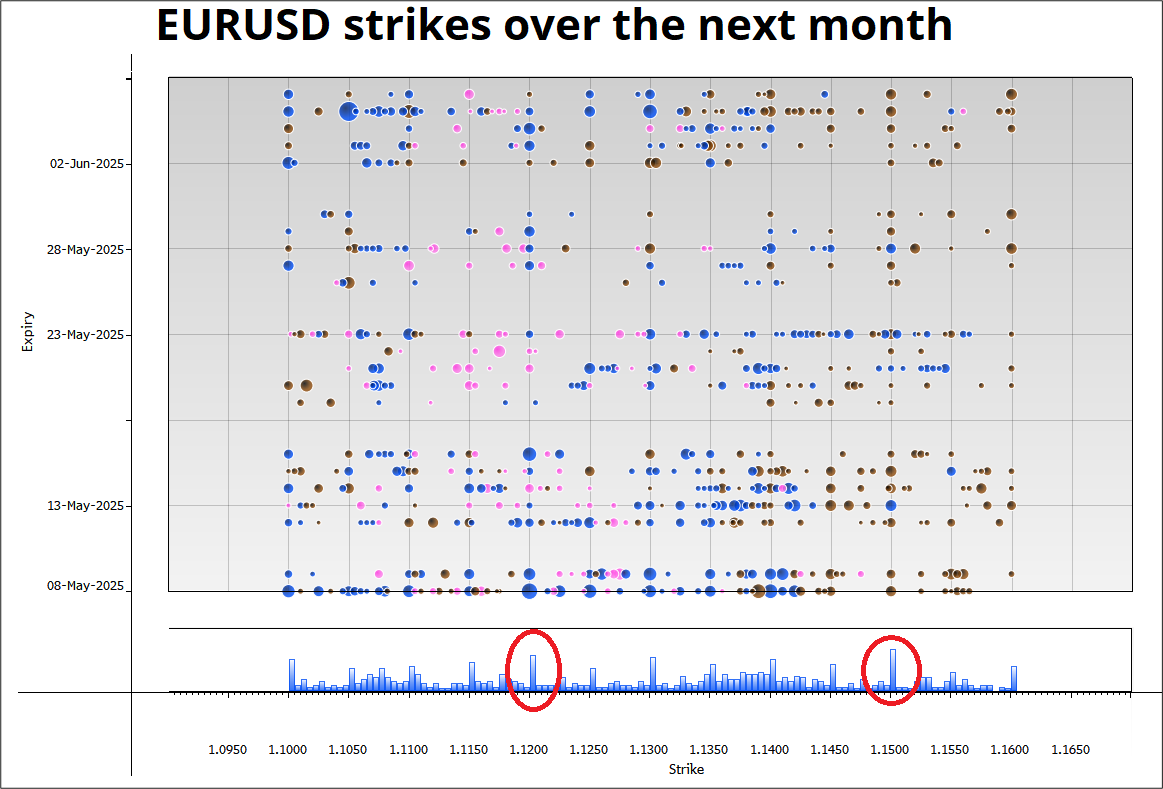

Three, the biggest strikes in the EURUSD options market are at 1.1200 and 1.1500 (see red circles in graphic below). Gamma pockets tend to be good technical levels because they change the supply/demand profile of the currency, as we saw at 140.00 in USDJPY recently.

I am splitting hairs a bit here, but I think my odds of surviving at 1.1184 are significantly higher than at 1.1214. This also means that if you are thinking of selling the one touch, you should choose 1.1184 not 1.1214. At current spot (1.1295), you can sell the 1.1184 OT for about 72%. That is, you risk 28 to make 72.

The good news/bad price setup in equities did not work as the market tried to take stocks lower after the Fed, then got rinsed on the revocation of Biden’s chip export ban. As long as NQ is below 20700/20800, I think the risk/reward will favor shorts, but my conviction is a bit lower today after yesterday’s inability to selloff.

The big break higher in crypto also does not support my risk-averse view, so if I am honest I would probably say that my view on stocks is mixed here. The charts say sell NQ from here to 20500, but I am scared. And the ETH chart is a beauty as the moving averages cross higher after a relentless down trend from 4000 to 1400.

We are in no man’s land as far as the macro story goes. The hard data comes in slow drips, and the headlines come fast and furious. We hit max SELL AMERICA with The Economist publishing three contrarian covers in three weeks, but I don’t think the theme is dead. Very often, when a new theme emerges, it becomes oversubscribed initially, corrects, then continues. I think we are in the correction phase. Very hard to be long vol right now as the beta of markets to news continues to drop and there are few headlines that would qualify as shocking at this point.

Anyone waiting for the hard data to roll over or store shelves to empty still has a long time to wait. Next week we will see April data for CPI and Retail Sales. That data will barely be impacted by Liberation Day and realistically only weekly Initial Claims or the jobs data in early June are likely to offer any signal that might move the needle on expectations for the US economy or the Fed.

GBP bears’ dreams of a dovish BoE have come and gone and there is the outline of a deal between the UK and the USA (maybe?). Much as 1.12 is the level in EURUSD, 1.32 is the level in GBPUSD. If you’re bearish USD, you could also consider long GBPUSD with a stop loss at 1.3169.

I hope your day is not snakebitten.