The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it

Jobs are not plentiful

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

The risk reversal is a bit of a yellow flag in euro, even though I don’t want to believe it

Image source: Wikimedia Commons

digitaltaxidermist on insta

HT CnD

Flat

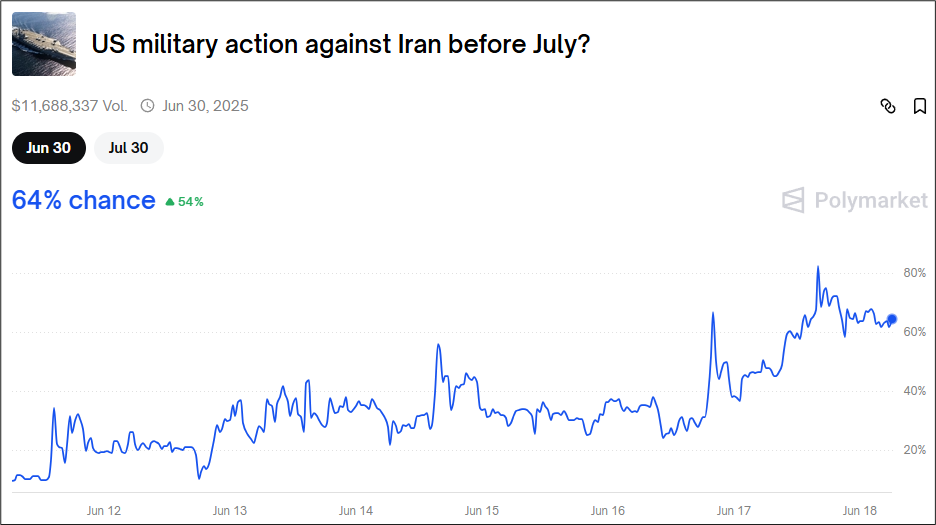

Polymarket has been good for real-time tracking of US military involvement probabilities. Yesterday, you could watch EURCHF and the Polymarket odds of US military action move perfectly up and down with strong inverse correlation. The odds of US military strikes in July peaked at 81% and are now trading down at 64%.

The Israel bombardments are expected to continue through week’s end.

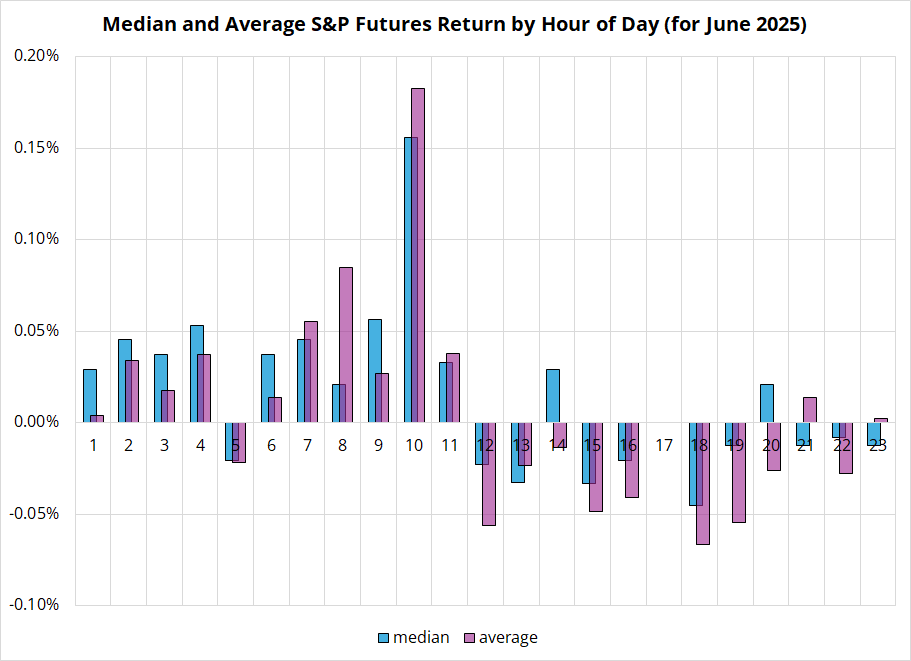

The newsflow has had a steady intraday cadence with the bad news mostly coming between 3 p.m. and 8 p.m. NY time as this is the window where a) Trump often speaks and then b) it’s night time in the Middle East. Here are hourly returns for S&P futures in June. Asia sells, Europe tentatively buys it back, then NYC rips it.

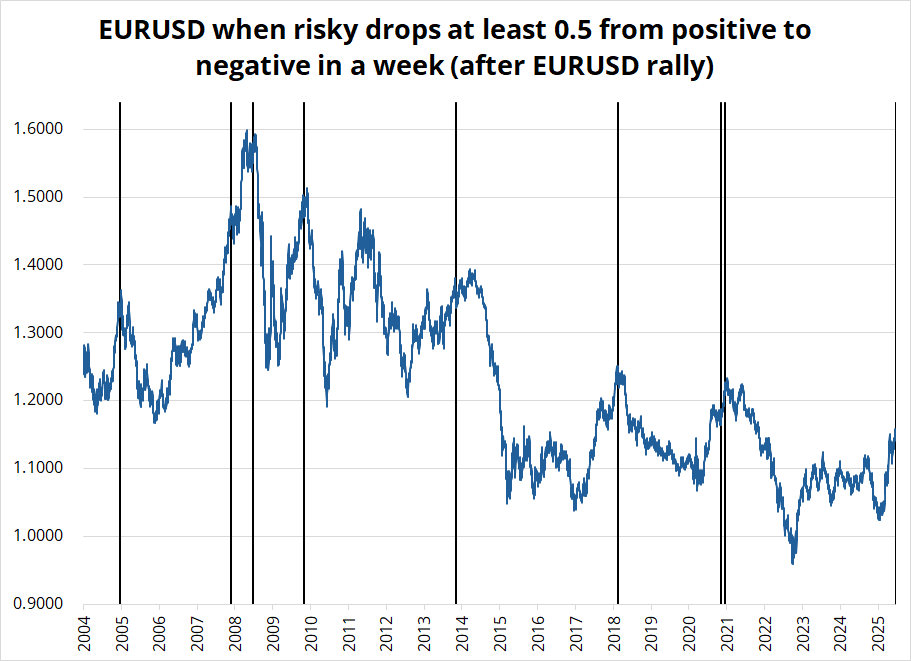

There has been an interesting move in EURUSD options as the market is no longer paying a premium for calls. This is a big move as the 1-month risky was 1% bid for calls, which is an abnormal level for that risky to be trading. In fact on April 11th, we reached the 6th highest reading out of 5584 daily readings back to 2004. You can see spot usually follows the risk reversal, but we have only seen a tiny move in EURUSD so far relative to the big move in the risky.

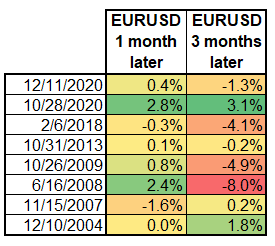

Looking back at times when EURUSD was rallying and the risk reversal dropped hard in a week and crossed below zero, you get eight occurrences since 2004. Here’s the chart.

Most occurrences were bad times to be long EURUSD, though when it happened in 2004, 2007, and 2020, you did OK staying long. The question is whether the peak in the risk reversal signals an end to the bullish EURUSD narrative, or is it just a rapid unwind of positions on Middle East fears? I am more inclined to believe that the signal here is not bearish, despite history. Still, even after the 2004 and 2020 events, where EURUSD managed to climb in the 1-month and 3-month periods after the signal, there wasn’t much upside left in the trade. Only the trigger in 2007 was followed by significantly more EURUSD upside. So it’s a yellow flag for sure, but given the circumstances (forced unwind due to random geopolitical event)… I am not sure there’s anything to trade on here.

FOMC expectations remain surprisingly hawkish. I suppose the US economy remains antifragile with Atlanta Fed GDPNow at 3.5% and the FOMC also faces mega uncertainty around the potential inflationary impact of both tariffs and rising oil due to Middle East fears.

Still, both of those are likely to have temporary or one-time impacts on inflation, and inflationary psychology is cooling. The dots are the key signpost today.

22300/22400 remains the no-fly zone for NASDAQ futures. Perhaps a dovish FOMC and holiday ramp into expiries will challenge it. If that happens, AUDJPY can challenge 95.65, the giant inverted head and shoulders that has been forming since February. It’s getting hard to make JPY-bullish arguments as the BOJ remains dovish and Japanese real rates are deeply negative. SNB, Norges, and BoE tomorrow. Hope you get to horse around on Juneteenth.

digitaltaxidermist on insta

HT CnD

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

There is too much bad news for the market to keep ignoring Canada

Comments relevant to backtesters and confusion over an early UK meme