This has been a pretty boring week in macro. 3/10 do not recommend.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

This has been a pretty boring week in macro. 3/10 do not recommend.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Not all weeks are equally exciting, and I give this one three out of ten stars. Equities were rangebound, the SaaSpocalypse took a breather, and all this angst over Iran has pushed oil just three bucks higher. Not nothing, for sure, but not explosive either. The rising price of oil helps boost the new current thing, which is “atoms not electrons.” This is the consensus theme now, and my inbox is absolutely jammed with reasons why you want to own energy, commodities, and “things that hurt when you drop them on your foot.”

If you know who that quote in italics is from, you are over 40 years old.

Reflexive contrarianism is a great way to lose money in markets because it causes you to prioritize feeling smarter than everyone else over profits. Trends trend and are sometimes your friend. You need to pick your spots if you are a contrarian, or you won’t be around for very long.

That said, there are some themes that have become wildly consensus to the point where some of my non-market friends are asking me whether they should be buying Brazilian equities or selling software stocks. So, if you must be contrarian, here’s a shopping list of the current “it” narratives in markets.

The overriding themes, all of which are well-known and potentially priced in are:

Go through this list and find anything you disagree with. If you’re right, there is money to be made going the other way.

Contrarians: Choose your fighter.

The epic rotation out of megatech and software into real stuff took a breather this week with the NASDAQ whipsawing to nowhere and XLE also sharply unchanged. This is a consolidation after gigantic moves and does not necessarily portend a reversal. NVDA reports Wednesday, and that will be a big deal because that stock has not benefited from the textbook picks & shovels trade unfolding in recent weeks.

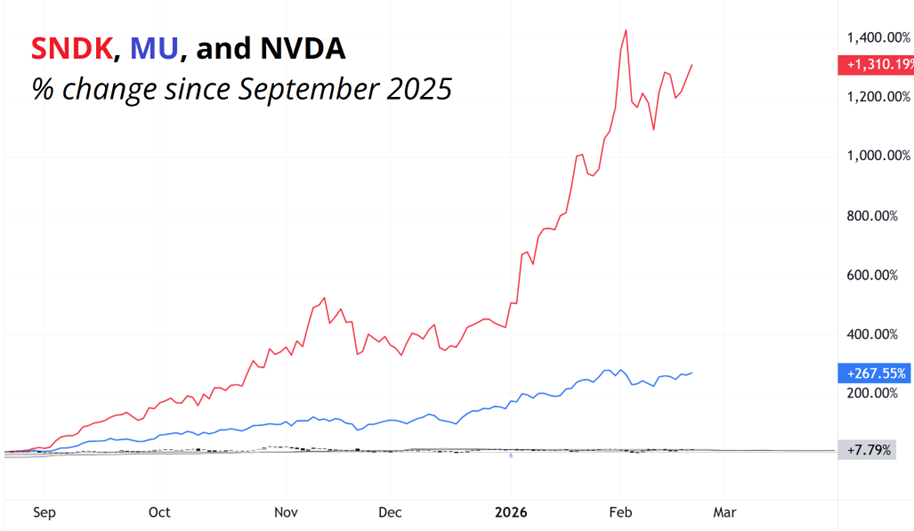

In case you are new to markets, the cliché is that in a gold rush, you want to be a seller of picks and shovels. That’s the logic that took CSCO to 40X sales in 1999 before it crashed and it’s the logic taking memory suppliers and other providers of AI infrastructure to the moon today. Compare, for example, NVDA and MU or SNDK back to September 2025.

DARM is the new GPUs as memory prices are skyrocketing and analysts are predicting a RAM price supercycle. The funny thing about shortages is that they inevitably lead to gluts. But it takes a long time to build capacity, so the sky’s the limit, until it isn’t. Capex is almost by definition cyclical, and timing the top of the cycle yields massive profits. But selling too early can be disastrous. Trading is hard.

Here are Micron and Cisco, back to 1993.

Anyway, NVDA next week. Get excited.

Here is this week’s 14-word stock market summary:

Tax refunds are coming soon, but might go into gold more than stocks/crypto?

https://www.spectramarkets.com/subscribe/

Bonds are pretty boring these days. False break higher through 4.20% in US 10s then a sloppy move down to 4.00% and now we’re 4.09%. The U.S. economy has been in a kind of steady state equilibrium soft landing phase for ages, and that continues. Inflation is drifting lower and both supply and demand for workers has dropped at around the same speed and so the Unemployment Rate remains steady. Initial Claims at 209,000 show the labor market is neither tight nor slacky.

And while the market and journos have been worried about Fed independence and a grillion rate cuts in 2026, the reality is that Kevin Warsh is literally the most establishment, vanilla, triple-z person Trump could have picked to run the institution and everyone knows his hatred of Fed balance sheet expansion will never mean a thing once he’s at the helm. Much as politicians claim to hate deficits when they are not in power, Kevin Warsh hated the bloated balance sheet as an internal dissident but will surely learn to love it once he’s running the show.

Even arch-dove and Trump-installed Steve Miran has admitted that more rate cuts, in this economy, are less necessary.

I really don’t think the 2026 or 2027 Fed is going to respond any differently to the US economy than the 2025 or 2022 or 2017 Fed. We will see.

Consolidasche in the currencies this week as USD shorts got over their skis after Trump appeared to endorse a lower USD on January 27. EURUSD has been bleeding slowly lower ever since, but there have been few fireworks. The most-popular G10 currency, AUD, is also down but not out.

The honest truth here is that there are no major themes in FX this week. Takaichi is priced in, the Japan story is a bit stale, the USD overshot to the downside but most of the weak USD shorts are now out, and EM is permabid like it has been for what feels like years.

AUDUSD is impressive considering how crowded it got there for a bit. It could easily have puked down to 0.6950 by now, but the buyers keep coming back. This chart is a classic example of a good trend. Steep, impulsive moves up (green) and slower, corrective pullbacks with much flatter slope (red).

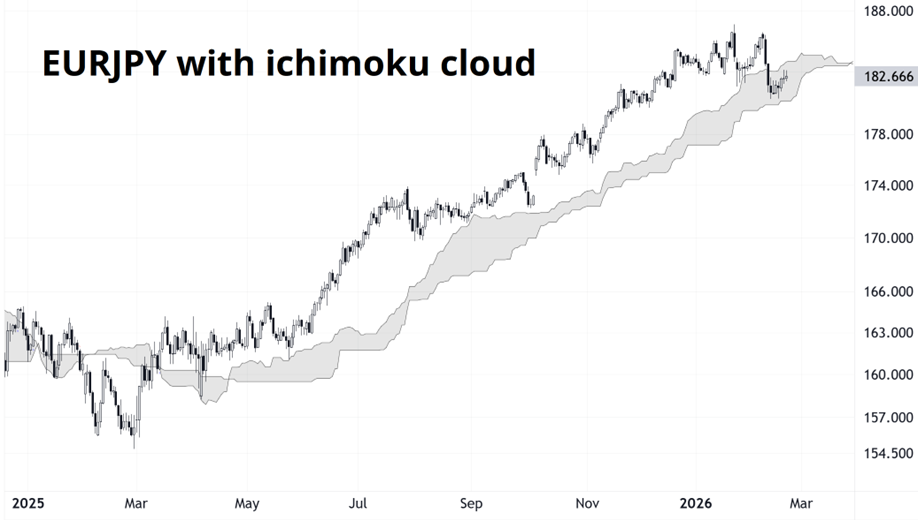

I still think the JPY will appreciate in coming weeks, and prefer EURJPY shorts. There is a simple technical approach that will tell me when I am wrong. If the ichimoku cloud breaks to the topside (see chart)—I am wrong. So above 183.55, I give up.

As an outsider, crypto looks pretty quiet to me right now. There’s the usual nonsense about NAKA and whining about MSTR and all that, but crypto prices are stable and volatility is low. Low vol is the crypto killer because half of the value proposition was the fun. I don’t have much of a view on BTC, though my guess is that we try a 5-handle, fail to go lower, and then range trade 58k/75k for a while.

There was some good regulatory news on stablecoins (HT Sophie) and that’s good for stablecoins but stablecoin adoption is neutral for crypto prices. It’s boring.

Nothing in Friday Speedrun is investment advice. I put out a bullish gold idea in am/FX a few hours ago. It’s a two-week view. Here’s the logic.

China comes back from Lunar New Year next week, and retail loves gold right now. Retail traders are about to get a money drop from much-larger-than-normal tax refunds and I think some of this money will flow into gold. Stonks and crypto are so 2021.

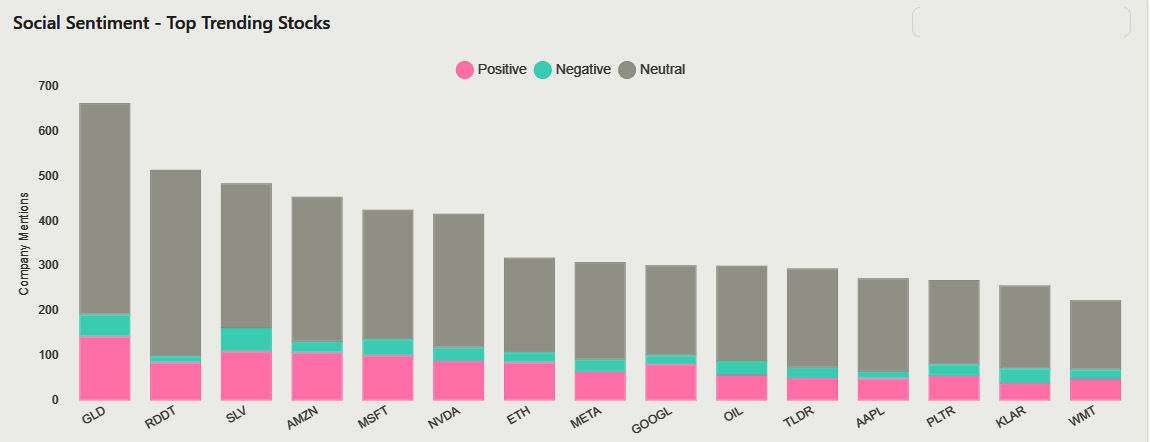

If you look at the most popular securities on r/wallstreetbets right now, GLD is number one. Often that would be a contrarian sign, but with retail about to get more ammo, I think it’s bullish.

https://swaggystocks.com/dashboard/stocks/market-sentiment

And the Iran story is still percolating.

Long gold here (GCJ6 at 5072). Stop loss 4845, take profit 5399. Risking 227 to make 327.

Or you could do 2-week 480/500 call spread in GLD.

This chart shows spot gold and the key 5115 level.

Like I said, it’s an idea. Incorporate it into your process. If you like it, go for it. Side effects could include gastrointestinal distress, life-ruining losses, or ecstatic glee. Past performance does not guarantee future results. Ask your doctor if Skyrizi (risankizumab-rzaa) is right for you.

Oil has rallied this week and that’s triggering some high fives in the “I have been long the cheap oil producers for 15 years and my time has finally come” group chat. To my mind, the rally is a bit lackluster. There does not seem to be much fear of a U.S. strike on Iran in the price action. Interpret that as you will.

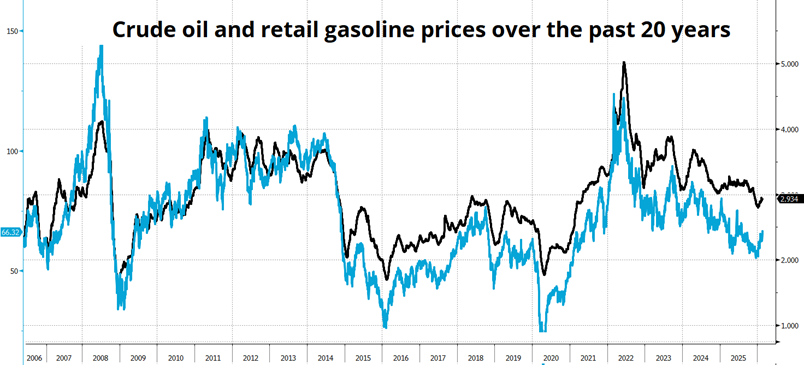

I am continually (continuously?) amazed at how oil and gas remain so cheap. Unchanged in 20 years even as the consumer price index has increased by 56% and rigs and exploration slowed down yuge. Wild.

That’s it for this week.

Get rich or have fun trying.

Not every podcast I do is great, but I believe this one is pretty good!

Kevin Muir (Macro Tourist) and I discuss yen and trading and moar.

*************

Kalshi and the Rise of Macro Markets (DC Fed)

Must read economic paper. Most of the conclusions are obvious, but there are some sexy details in here for traders and economists.

*************

Alysa Liu is the American America needs right now

The Olympics are the best. If you don’t know her story, go read it!

Another beautiful Olympic moment

And… One more (a photo).

Skiers who look like musical notes

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.