Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

The AI imagines AI hurting youth employment

It was a weird week as my primary view (reacceleration) has horribly wrong but my expression of the view (long GLD calls and TLT puts) paid off substantially because the GLD calls 5X’d while the TLT puts went to zero. I try macro views on like hats and if one gets uncomfortable, I take it off right away. The reacceleration hat is prickly.

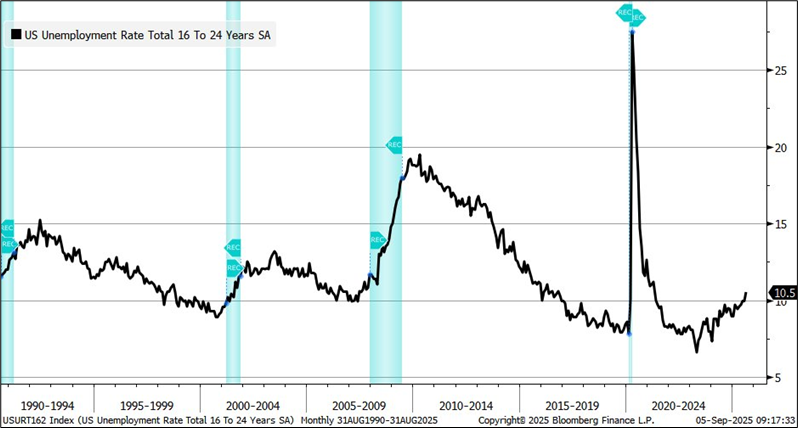

Sadly, much of the unemployment problem is happening in the youth cohort.

JOLTS, ADP, Initial Claims, and NFP all came in on the weak side hitting what horse racing fans would call the Superfecta. It’s worth noting that while the rate of change is extremely concerning on all the jobs metrics (UR and JOLTS, specifically)… The levels are similar to at the peak of the cycle in 2006/2007 and that was a boom time. So there’s room for the current soft landing to remain soft, but it’s getting sketchy.

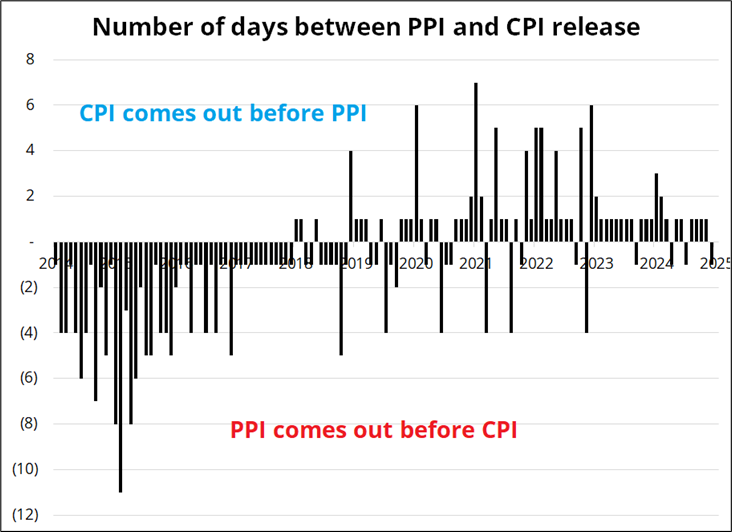

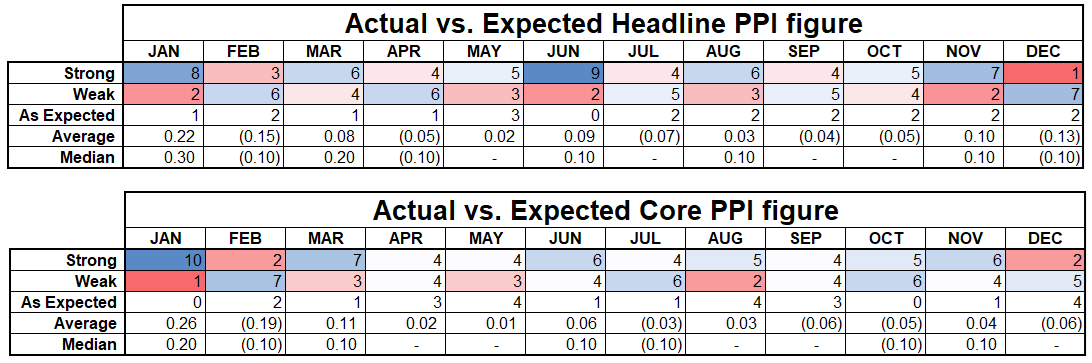

Now, we wait for PPI and CPI next week. People normally care more about CPI than PPI because a) it’s more important and b) it usually comes out before PPI but next week is one of the few times you will see PPI before CPI. This matters if you are a risk taker because PPI offers a useful signal as to the direction of the miss of CPI.

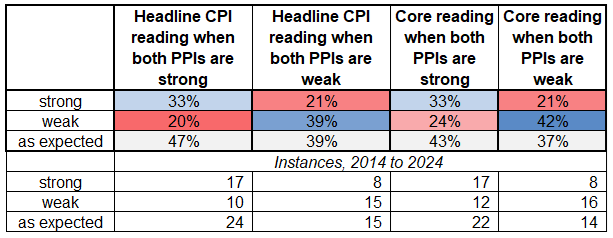

If both Headline and Core PPI are the same way (weak or strong), it’s a pretty decent predictor of both Headline and Core CPI. If they are mixed or as expected, there is no signal. Here are the stats:

PPI data only goes back to 2014 on Bloomberg, but there is some mild positive seasonality in August as you can see here:

Anyway, let’s see what happens. A strong inflation number will really put the cat amongst the pigeons as that’s the toxic stagflationary mix you don’t wanna see if you’re an optimist.

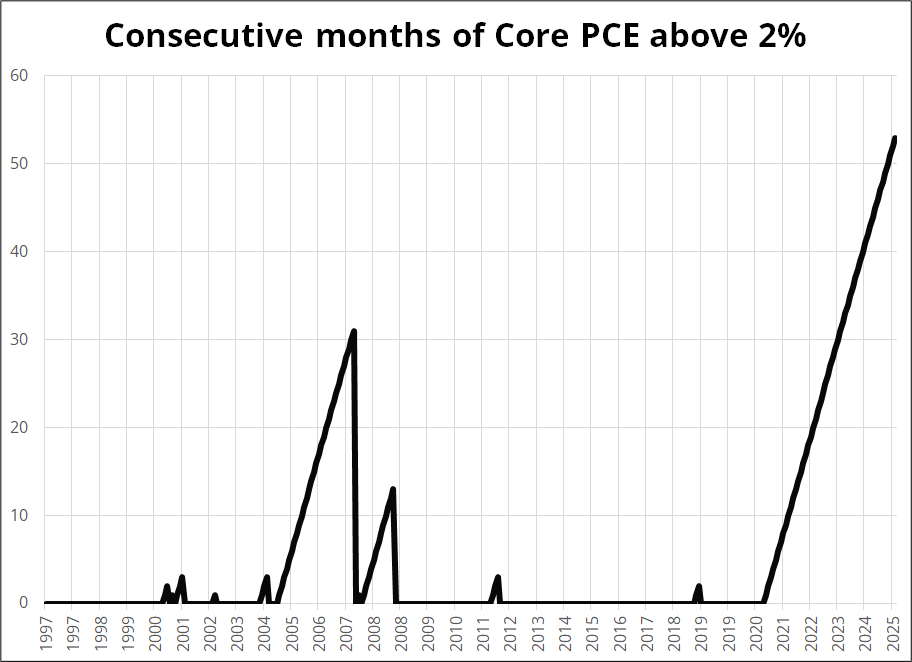

Meanwhile, let’s check in on how inflation targeting is going in the USA. The concept first originated in 1997, hence my choice of starting points for the chart.

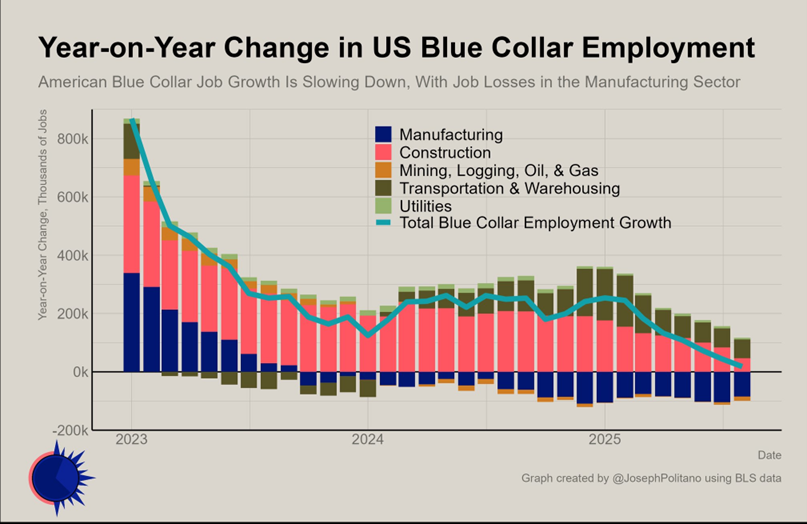

The inflation target appears to be: There is no target. Cool. And let’s see how the great manufacturing renaissance is progressing so far in the United States under President Trump.

Neat. While it’s obviously far too early to tell whether the current policy mix and its dream of US manufacturing reinvigoration will bear fruit… If you spray pesticides on a peach tree in the hopes it will bear more fruit in coming years… And then all the peaches start turning brown and falling to the ground all mushy. You might become smalls concerned.

Related music:

https://www.youtube.com/watch?v=3GCrzjVdmSg

Meanwhile, the data in Canada is mushy peach as well, but we will discuss that further in the section on fiat currencies.

Elsewhere in macro, we keep getting flareups in the UK bond market but these are quickly extinguished as the market can’t wait around short GBP and gilts for the November 26 budget because that’s too long to wait.

Click on the ad to subscribe. If you’re not happy, just email me and I’ll refund you. Risk free. Unlimited upside.

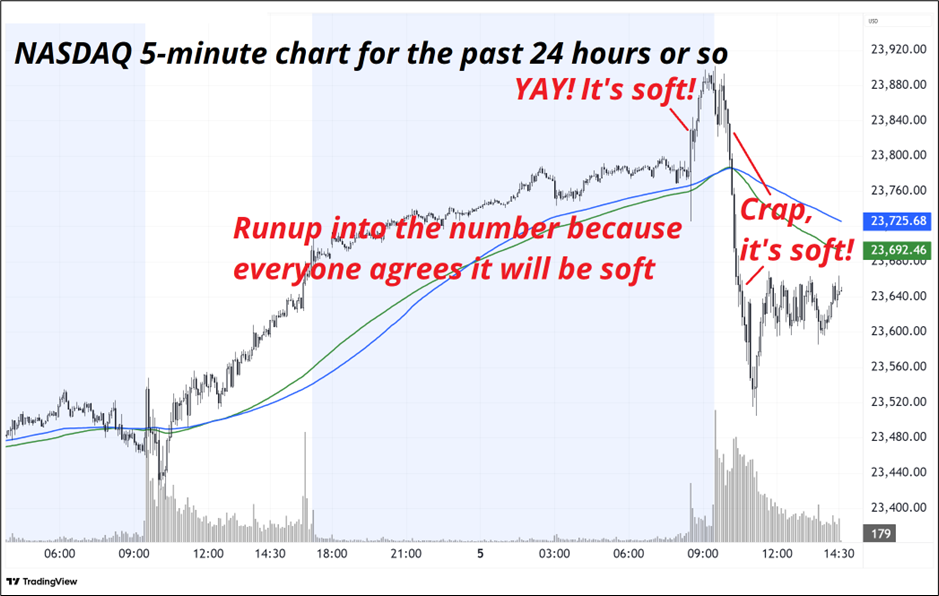

Trading stocks on nonfarm payrolls is double black diamond difficulty levels because bad news is good news if it leads to Fed cuts but bad news is bad news if it leads to Fed cuts + recession. 2001 and 2008 both saw a long series of rate cuts accompanied by collapsing stock markets while other cut cycles have yielded mega bullish stock returns as the economy held in OK.

So stocks did this after the number:

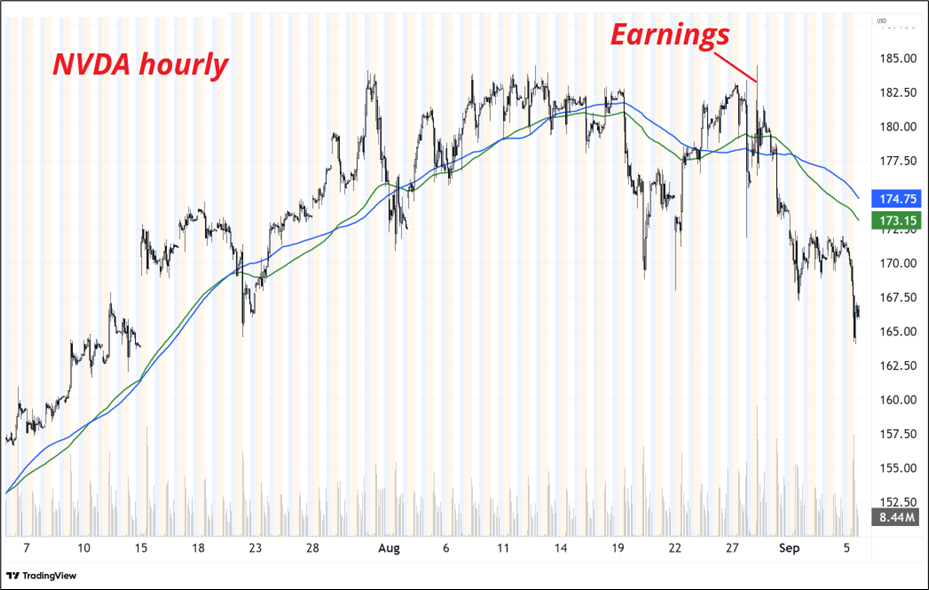

AI favorites continue to make a drawn-out topping process as ticker AI (C3.ai) laid an absolute egg on revenues, while NVDA might see more competition from Broadcom. NVDA made a wicked decuple top before and after earnings and now that 182/184 zone looks like mega distribution.

The crypto DATs are all under pressure, too, which warms my heart.

The other big theme is housing as the market believes that the government will fiddle with Fannie Mae enough to get mortgage spreads and mortgage rates down and this will lead to a boom in financing and purchases. Stocks like RKT and LDI have benefitted from this, and XHB is ripping too.

The administration’s desire for lower housing prices is unlikely to be satisfied by lower mortgage rates, but hey. At least Ackman is long a sh*tton of FNMA and it’s up 500% since he tweeted about it last Christmas. So that’s good?

Here is this week’s 14-word stock market summary:

AI is so last week. The cool kids are all in Opendoor and RKT.

We continue to oscillate between the end of the world caused by a collapse in US labor demand and the end of the world caused by fiscal imprudence and a collapse in the bond market. The bond market is winning this week as the soggy NFP and three other squishy labor market indicators have taken yields down hard. The US 10yy is now at 4.10% and might soon be ready to challenge the bottom of the range.

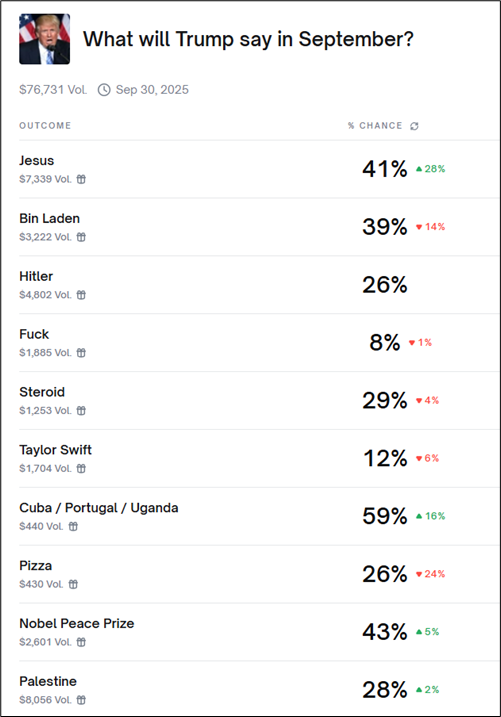

Fed Funds are pricing 100% chance of a Fed rate cut in September, but for some strange reason, Polymarket and Kalshi still trade it 90/10. If you have a vehicle than can trade TradFi, Polymarket, and Kalshi, you can lock in an 8% or 9% return over the next 12 days just by receiving Fed Funds and paying the prediction markets. Tell me what I am missing here other than the fact that the arbitrate is operationally complex. Surely someone somewhere can do this arb? Cmon guys!

I used to trade CAD all the time because it was fun but then it stopped being fun for a long time and maybe now it’s ready to be fun again. The market is kind of sleeping on how bad things are getting in Canada as we now have three straight months of negative GDP, -1.6% GDP QoQ, a new cycle high in the UR and an immigration stoppage that will make horrendous GDP/capita flow more aggressively through to GDP as the number of Canadian capitas stops increasing.

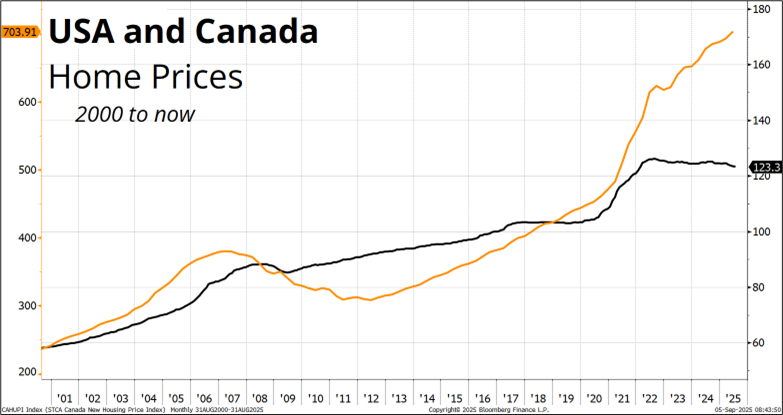

The data in Canada is getting uglier by the minute. Home prices in Canada peaked in 2022 and are now falling. We have been worried about Canada’s overreliance on housing for the past 12 years or so, and maybe the chickens are finally coming home to roost?

Canadian Unemployment has gone from a low of 5% in 2023 and just made new cycle highs at 7.1% today. Inflation is annoyingly sticky, but at this point I don’t think the Bank of Canada cares much about inflation as they can just assume it will fall as housing, GDP, and employment fall. A weakening US economy is also bad for Canada, and my view that the US is about to reaccelerate is not helped by today’s data. At all.

My bet is that the market hammers CAD soon as the reality of all this data starts to pile up / hit home. We don’t even have a full cut priced in for the September 17th BoC meeting yet, and regardless, the currency cocktail looks bad. Nobody has been particularly focused on Canada, and vols are low, so I think it’s time to buy a 1-week 1.3850 USDCAD call for around 12bps off 05 spot.

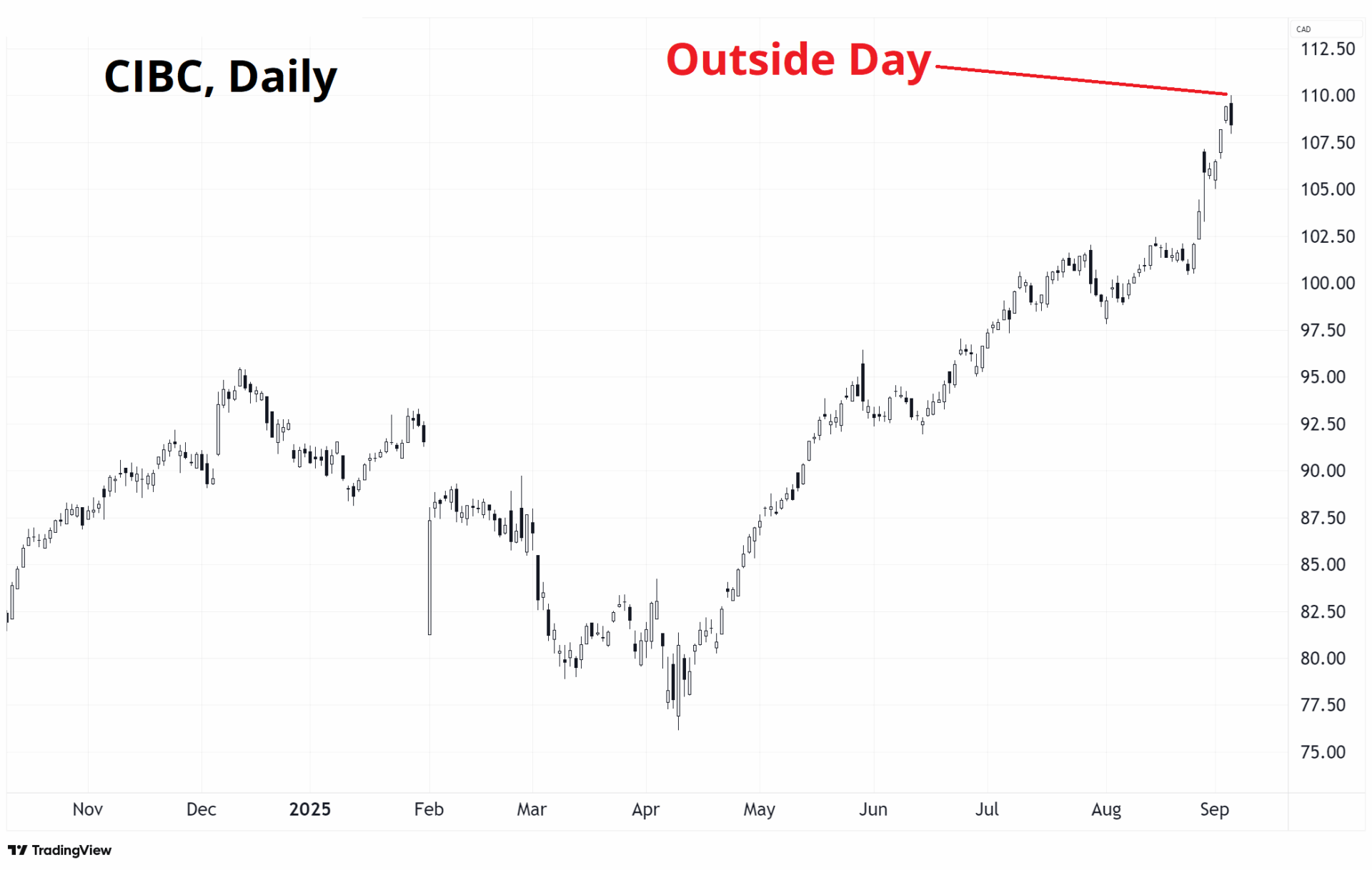

I spent a long time thinking about whether it’s best to be long USDCAD vs. long EURCAD AUDCAD, short CADJPY, etc., but with PPI and CPI next week and given the fact that yes NFP was weak, but it wasn’t so far off weak whispers, I like the simplicity of USDCAD. Obviously there is a risk the USD weakens broadly, but I think that’s an OK risk to take here. Long spot USDCAD with a stop below 1.37 would also make sense but with vol down here, it’s spicier to do an option and if PPI/CPI come in strong, it’s potentially high leverage. Short CIBC (ticker: CM) might work too as they are a proxy for Canadian housing bloat and the stock made a spicy outside day today. October 75 puts, perhaps?

Ceci n’est pas investment advice.

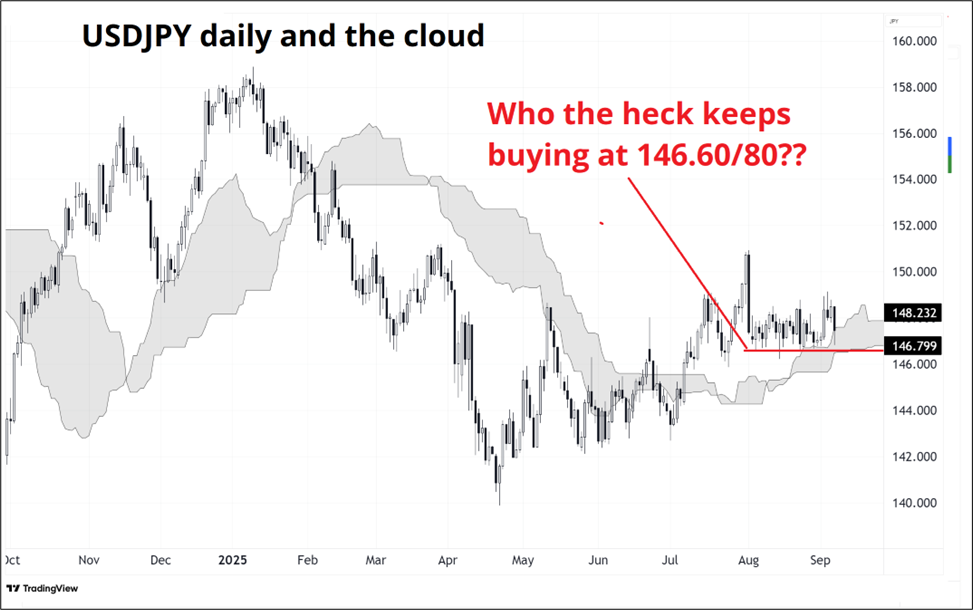

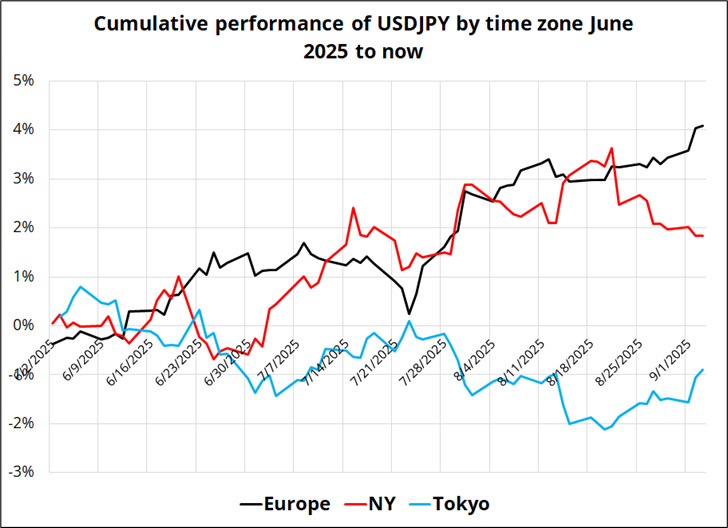

Despite the fall in yields, USDJPY held the cloud again. USDJPY can be extremely rude sometimes.

There appears to be an obnoxious buyer 146.60/80 and while you would think the rise in JGB yields would generate some rotation by Japanese pension funds, the time of day data shows no evidence of that. USDJPY hasn’t been selling off in Asia time the way it would if they were getting busy.

Crypto is a bit boring these days as BTC is floundering, ETH rockets then plummets, and the juicy overvaluation in many of the crypto DATs has dropped as they fall to earth. Meanwhile, Tom Lee continues to do his best Cathie Wood / Henry Blodget impersonation:

A similarly useful headline would read:

Brent Donnelly Could Play Major League Baseball If Time Machine Invented

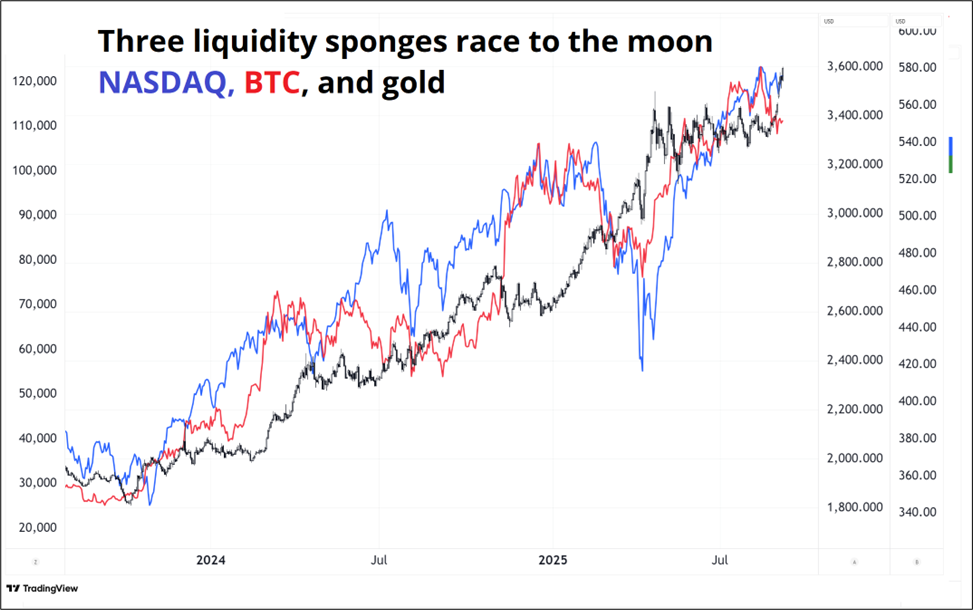

Much is being made of the divergence between gold and its digital cousin, but bigger picture, the ride to the moon for the three main liquidity sponges remains pretty much uninterrupted. BTC is a few sloppy MSTR buys from a new ATH. Imagine being the crypto salesguy that covers Saylor. :]

My instincts were good on corn, but I was too impatient and even though CORX is up around 8% from my entry, I locked in a 1% gain last week. I am not strong on the patience thing and there is a point where the mental capital drain becomes a bigger deal than the FOMO if I let go. So I let go.

The real story in commodities is obviously gold, not corn! A textbook breakout after last week’s close at the apex of the triangle and here we are. As long as we remain above 3450, it’s game on for the ‘bugs.

That’s it for this week.

Get rich or have fun trying.

*************

Must read from Ben Hunt on the current state of the political economy

*************

What is this world in which we live?

*************

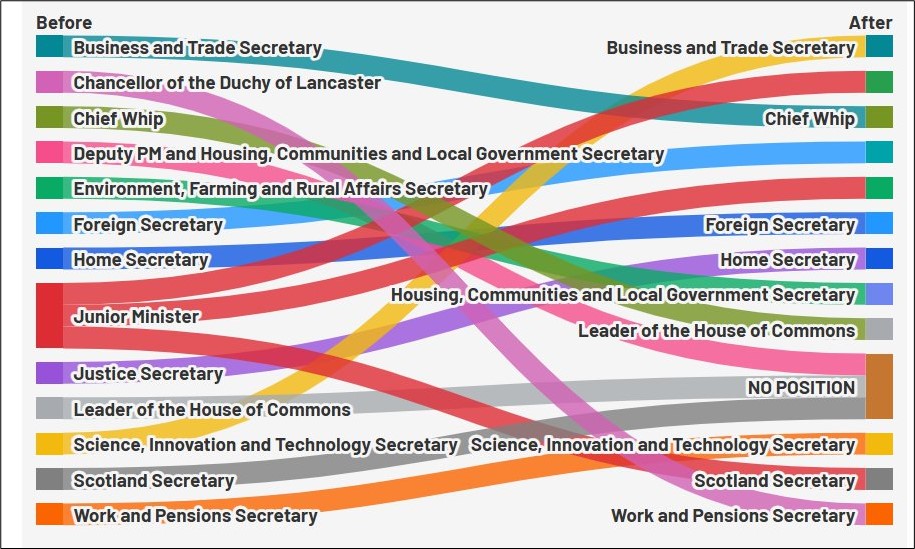

UK cabinet shuffle ha.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.