Short USD into April

Short USD into April

Short USDJPY @ 150.40

Stop loss 151.66

Take profit 148.26

Buy EURUSD 1.0711

(Limit order)

Stop loss 1.0484

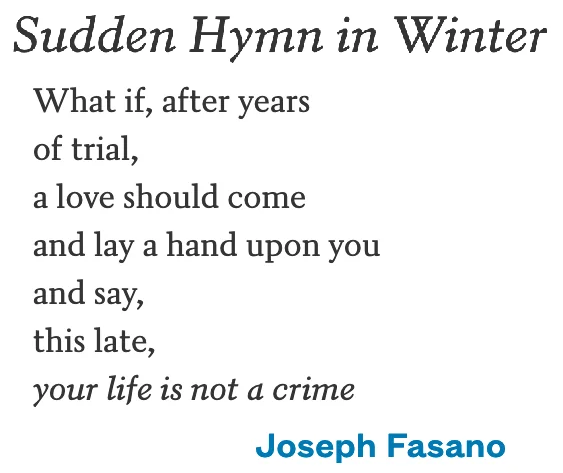

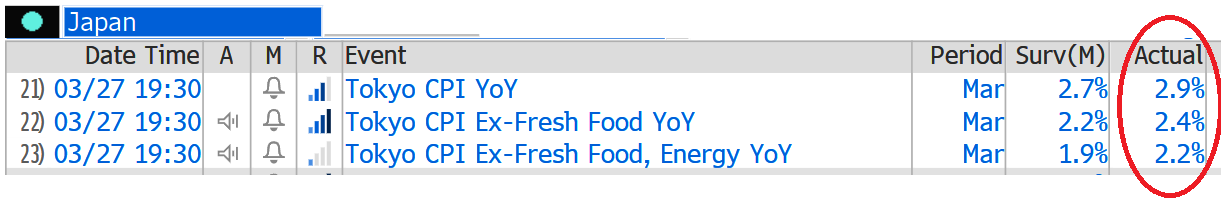

First up, a quick comment on Tokyo CPI, which came in super hot on the back of the delayed feedthrough from rising food prices into core discussed yesterday. This helps the bullish JPY trade. While the seasonals suggest some caution, the failure to take out 151.20 is super encouraging for USDJPY shorts and with stagflation not pushing yields higher, maybe it’s time to get short USDJPY?

Rate spreads are pointing lower, the seasonal USDJPY buying should almost be done, and the 151.20 pivot held perfectly (twice overnight). I am going short USDJPY here (150.40) with a stop at 151.66 and take profit 148.26.

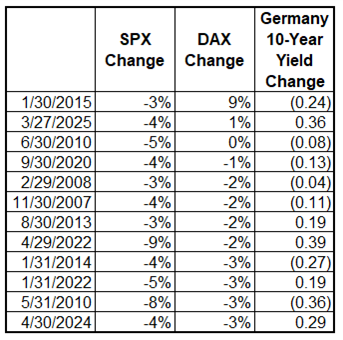

Monday is month end. We have seen a nearly unprecedented event this month as the S&P is down 4% and the DAX is up 1%. Since the year 2000, there have only been three months where the S&P was down 3% or more and the DAX was up. Here are the best performing DAX months in months where SPX was down >3%.

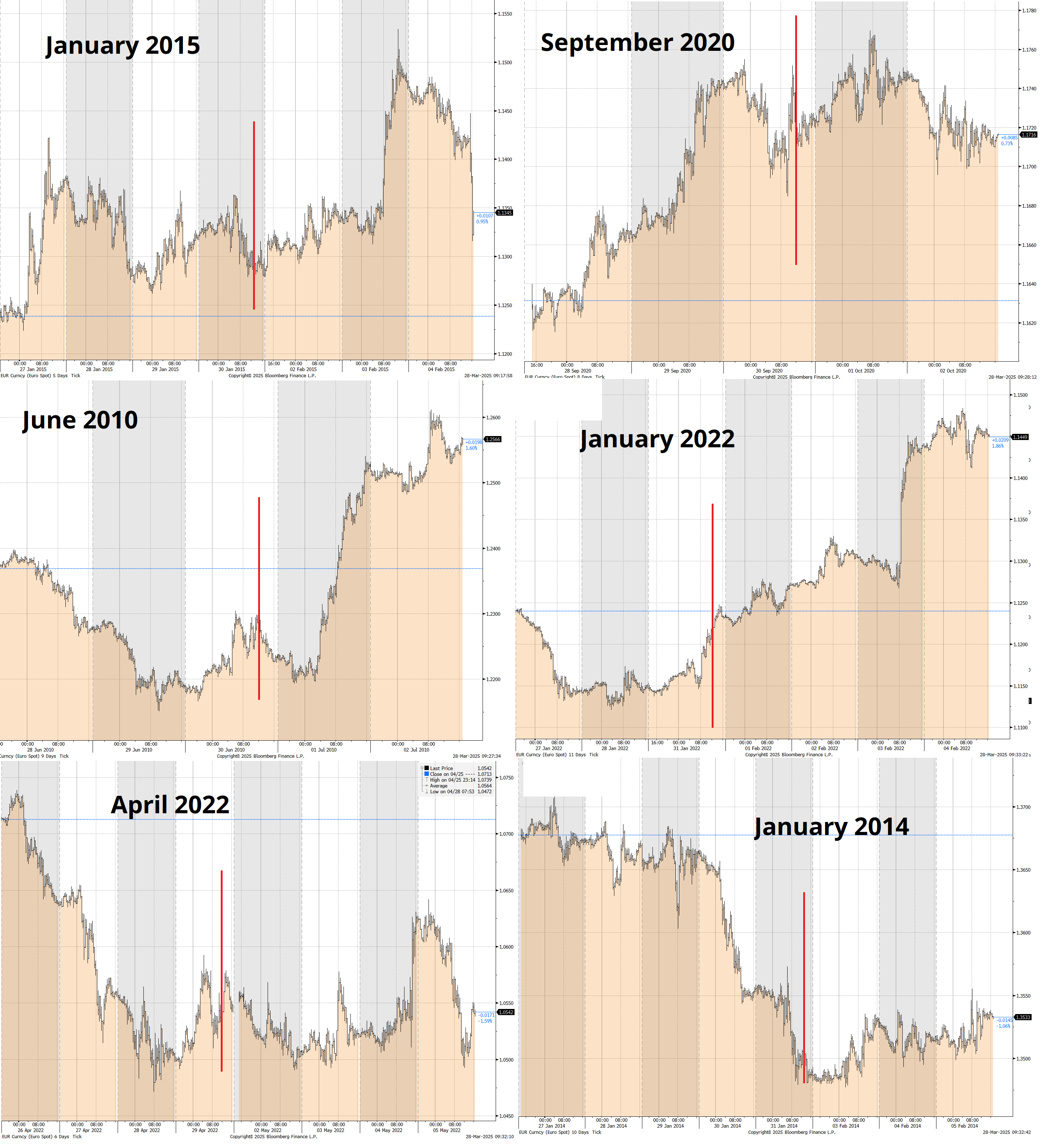

You can see that it’s also unusual for German yields to be higher in these situations. January 2015 was the massive QE month for the ECB (and the SNB defloor). June 2010 was a Eurozone bailout month. September 2020 was a second wave of COVID fear. I was curious how month end played out in these periods. The intraday data doesn’t cover 2007 and 2008, but I charted the six other biggies.

You can see that EUR trades heavy into month end and then rallies afterwards, generally.

I was pitching 1-month 1.11 digitals to clients yesterday and I still like those a lot.

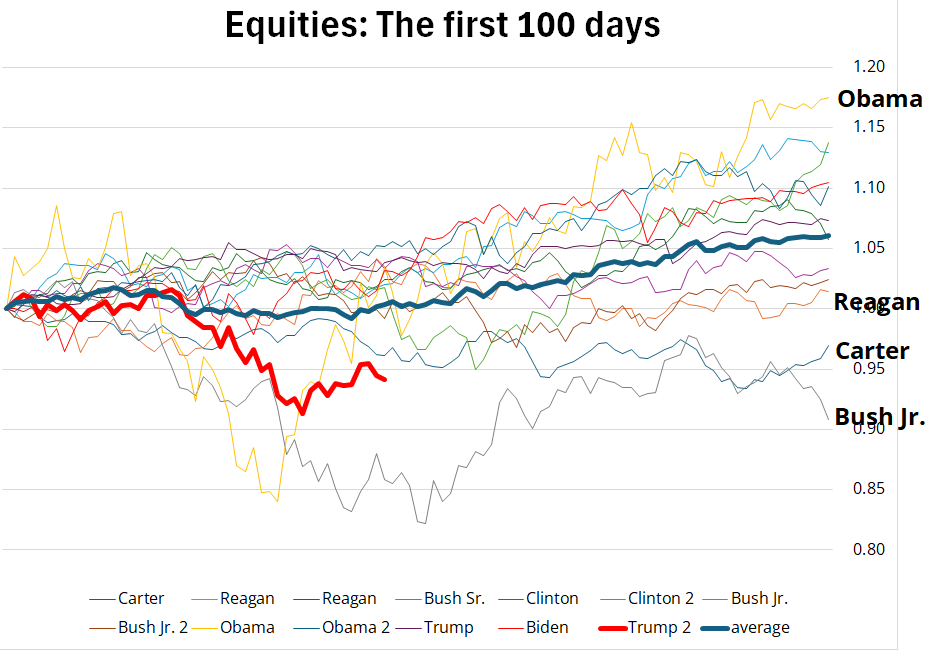

A chart.

Will be fascinating to see how CRWV trades today.

HT Gitts