It’s beginning to look a lot like Christmas (Christmas)

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

It’s beginning to look a lot like Christmas (Christmas)

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

First up, one of my highs of last week was this response to my tweet of Friday Speedrun.

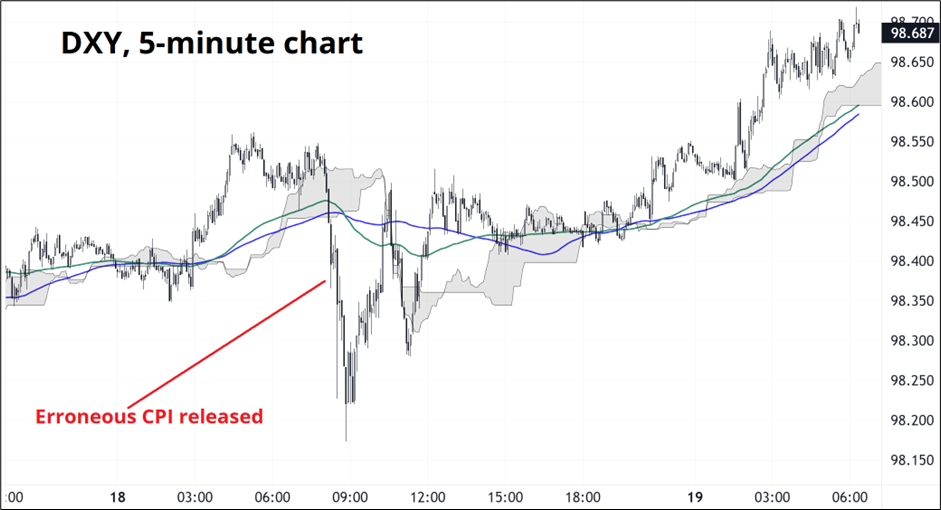

Ha! It has been a modestly interesting week as we had a flurry of central bank meetings, a jobs report, a clearly erroneous CPI figure, and some other stuff. Let’s start with CPI.

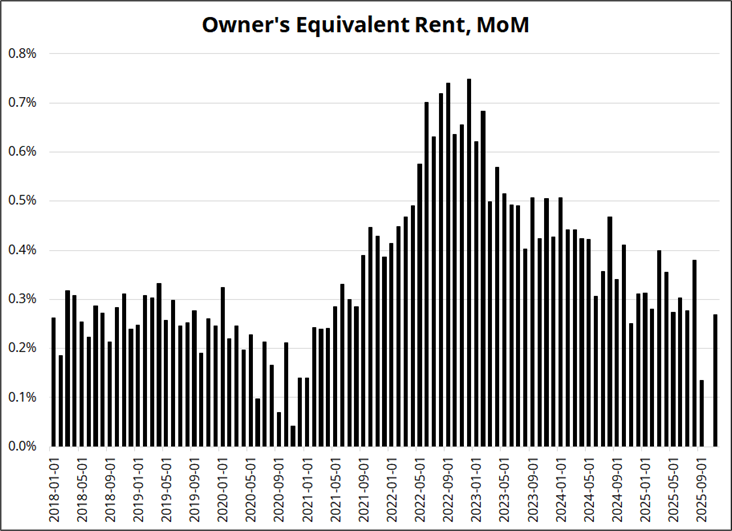

At my business school, we used the case study method, and when you were given a bunch, but not all the information you needed, sometimes you would have to make assumptions. For example, they might show you the company revenues for 11 out of 12 months and you had to make an assumption for the missing month in order to estimate a year-end income statement and balance sheet. If your change in revenues over the past 11 months were

+0.3%

+0.3%

+0.3%

+0.3%

+0.4%

+0.4%

+0.3%

+0.3%

+0.4%

+0.1%

X

+0.3%

What would you guess X might be? If you guessed zero, you would definitely fail that part of the exam in business school. But you could get a job at the BLS! That run of data is exactly what the BLS was working with and they needed to make an assumption for October (X) and they used 0%. Here’s the chart:

https://fred.stlouisfed.org/series/CUSR0000SEHC

What are we doing here? It reminds me of a joke I made up when I was in first year economics.

“Why did the economist crash his car?”

“He assumed all lights are green.”

This OER abomination (plus a later survey period, deeper into discount season and Black Friday) pushed CPI lower. In an encouraging sign of rationality, markets mostly ignored the figure. The USD sold off for about two minutes then retraced more than the entirety of the move.

The jobs report wasn’t much better as the market didn’t really trust that data, either. We are still in the fog of the government shutdown. We went from policy shock in April muddying the waters ‘til October then government shutdown muddying the waters again and we will probably have another government shutdown in January. It all has a bit of a banana republic feel to it.

The ECB meeting came and went with no fanfare, while the BOJ meeting came and went and while the meeting outcome itself was boring (25bp hike, as expected), the JPY sold off hard after as the market continues to fall into the trap of buying yen into BOJ hikes. The Bank of Japan is not a serious inflation fighting central bank. They are an arm of the government attempting to minimize interest payments while maintaining financial market stability. Despite these paleolithic-speed once/year rate hikes, real interest rates in Japan remain deeply negative. 25bps ain’t gonna change anything.

It’s that time of year again.

The fourth annual handbook has arrived…

The 2026 Spectra Markets Trader Handbook and Almanac is live

Use The Spectra Markets Trader Handbook and Almanac as a trading journal/day timer, and as your guide to seasonal patterns and key economic events throughout the year. It will anchor your process on proper journaling and planning—and help you thoughtfully assess your performance at the end of each month. Goals and plans written down are much more likely to come true than a flurry of ideas and thoughts and hopes swirling around in your head.

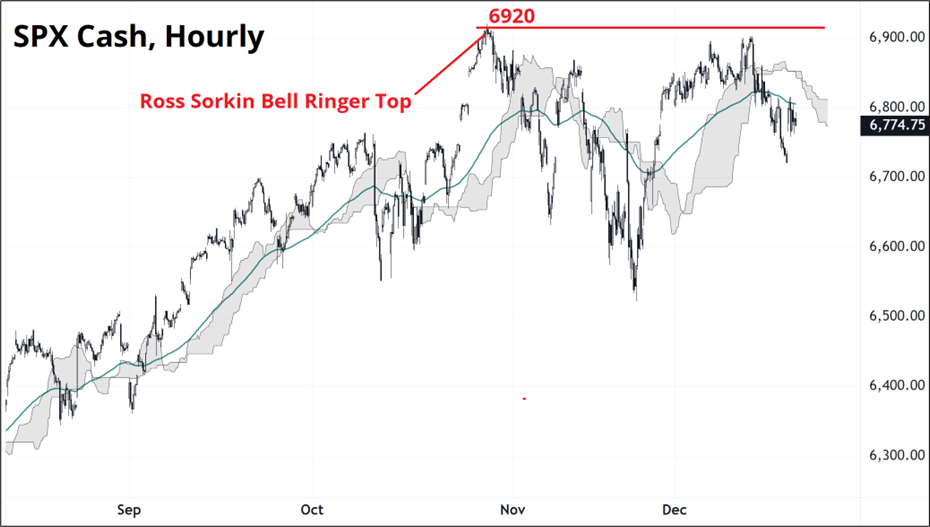

I have written over the last eight weeks about how the NYSE made the strange and fate-tempting decision to allow Andrew Ross Sorkin to ring the opening bell in celebration of his book about the crash of 1929. Seemed like bad karma at the time, and a bit tone deaf considering many of the features that set up the 1929 bubble exist in markets today. Even the same BS use of the word “democratization” as institutions suck in retail flow via FOMO price targets and newtech hype.

The Crash of 1929 destroyed millions of lives and pulled the US into the worst economic depression in its history and Wall Street played a role in that. Hardly something to celebrate? I mean they’re celebrating the book, not the depression, I guess. But still.

Anyhoo! Here’s the chart. We are tracing out a nifty double top.

I have mostly been trying to play stocks from the long side over the past few weeks because of seasonality and because I expected markets to front run massive retail buying in late Q1 2026 on the back of a flood of cash from tax refunds. But it hasn’t worked. I guess if I had to have a view right now, it would be to buy the next big dip in an attempt to get long into 2026.

For now, we have the largest options expiry day ever (today) and we often see a flurry of weakness after quad witching so I’m not eager to be super long right now. SPX is a clear range 6500/6900 right now so buying anywhere close to 6500 before New Year’s Eve would be the play. We could get there. I am old enough to remember the Christmas Eve meltdown of 2018. Amazing that if you read that article, you see Trump celebrating trade wars and railing against Powell a full seven years ago. Gotta love the commitment level.

The rotation out of OpenAI and into GOOG seems to have run its course and as the highly commoditized models flip flop for dominance, you can expect xAI to take the lead in 2026. That might lead to some profit taking in GOOG as the market has piled in bigtime over the past 6 weeks. They hated Google at 5X sales but love it at 10X sales. Natch.

Here is this week’s 14-word stock market summary:

The 6920 Sorkin Bellringer Top holds for now. Rotation out of exposure to OpenAI.

https://www.spectramarkets.com/subscribe/

Interest rate volatility, like volatility in many other areas of financial markets, is low. The US 10-year yield has been in this 3.25/5.00 range since late 2022 and we are smack dab in the middle of that range. Like. Exactly.

This lack of volatility is the result of the fact that we have now spent three full years in an economic soft landing. Soft landings are great because they mean the Fed slowed the economy while avoiding recession, but they are bad for financial market traders and bearish pundits because the base case, year after year, is more of the same.

Interest rate hikes had almost zero transmission to the real economy in this cycle, and so the Fed hikes that bludgeoned the stock market in 2022 didn’t change things much IRL and here we are. Now the Fed has cut six times and inflation remains around 3% by most measures, and bonds are asleep. Fiscal insanity continues, but the bond vigilantes have very little patience. The second the market jumps up and blocks their move to the hoop, they take their ball and go home.

I was going to list a bunch of scenarios that might jolt the bond market out of its slumber in 2026, but I can’t think of any.

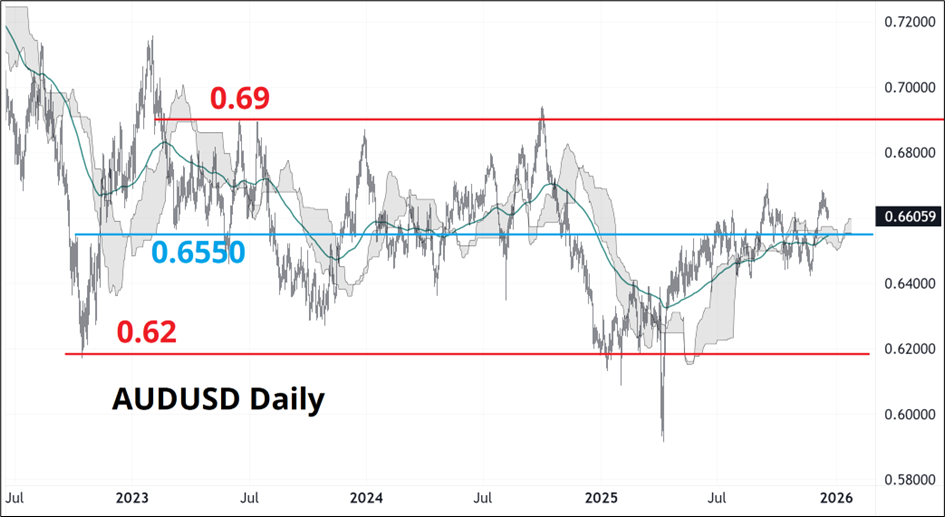

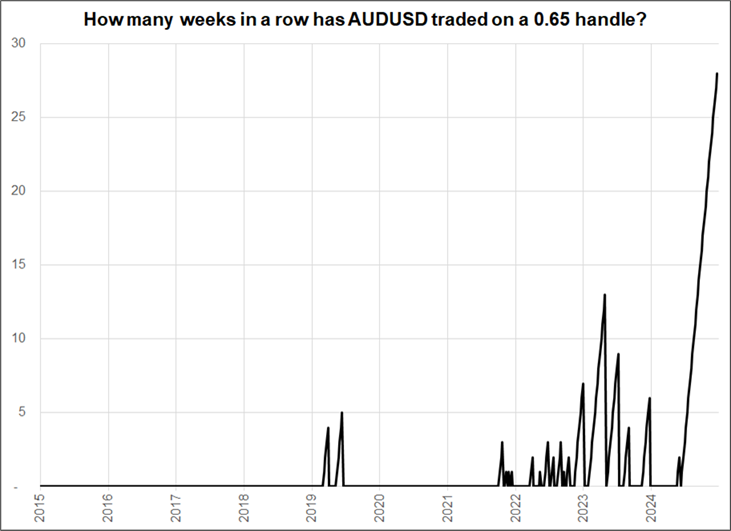

AUDUSD 2023 to 2025 is the most disappointing three-year run for a currency pair I can remember. AUDUSD, like bonds, has been in a moribund range. It has mostly traded 0.62/0.69 for three years. And (like bonds), it’s right exactly in the middle.

It traded on 0.65 for 28 weeks in a row! What are we doing here?!

The currency has had plenty of narratives to choose from in both directions, but it can’t deanchor from the six five. While interest rate differentials have not been very good for tracking USD direction, the fact that the Fed is cutting and the RBA is now priced for hikes has led to a breakout in the 10-year AU/US spread. I’m reticent to get overly excited, but if I had to bet on a direction for a breakout in AUD, I would definitely bet on the topside.

I have mostly avoided the Aussie terms of trade trap because that has been a red herring since pre-COVID, but the reason positive terms of trade haven’t helped the AUD is clear: There was no transmission to rates or monetary policy. Now, the monetary policy divergence is creating a big jump in rate spreads, and ceteris paribus, that’s good for AUD. On a micro level, though, AUD continues to trade like it’s wearing cement boots.

Sometimes it just works when it works and if we can see some CNH appreciation in early 2026, maybe AUDUSD can finally get up that hill.

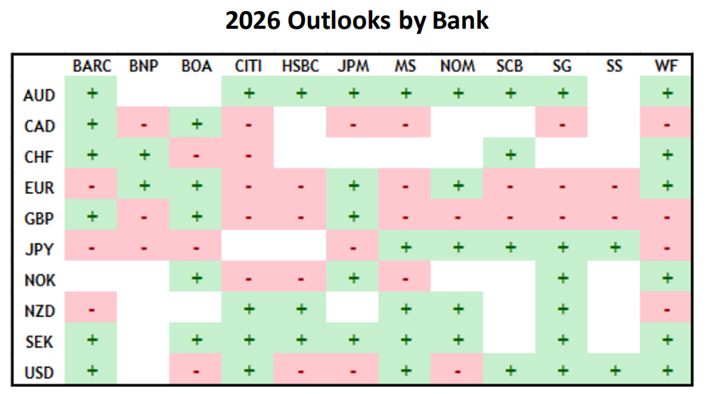

With regard to the big dollar, I was surprised to see that the bank strategists are not particularly bearish. You can see a nice summary via Dan Steptoe of Spectra FX right here.

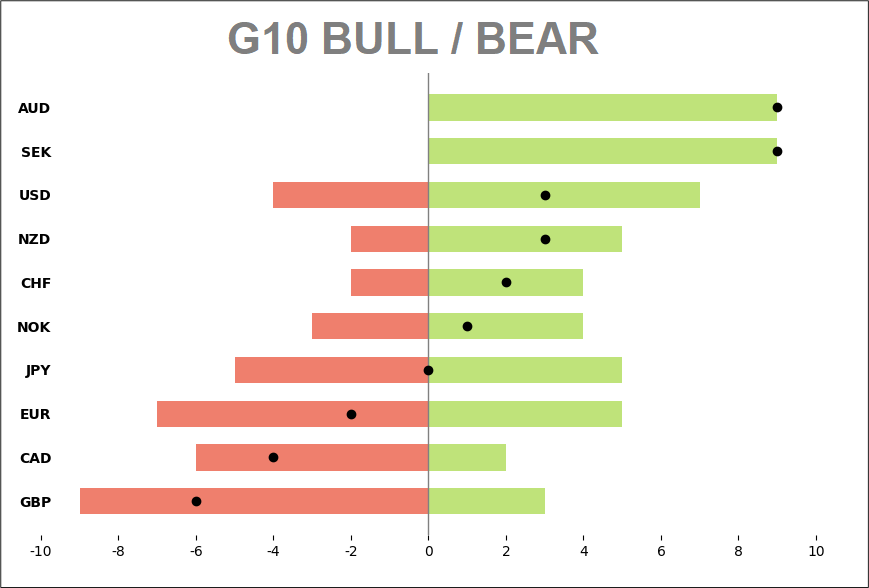

They love the AUD! They love the SEK! These bank views tend to match speculator views around the turn of the year so I would not be surprised to see AUD and SEK in demand into the new year as central banks, real money, and hedge funds rebalance out of things they hate and into things they want to own for 2026. Very often, the most popular trades for the new year start working around now and stop working towards the end of January once big money has been deployed.

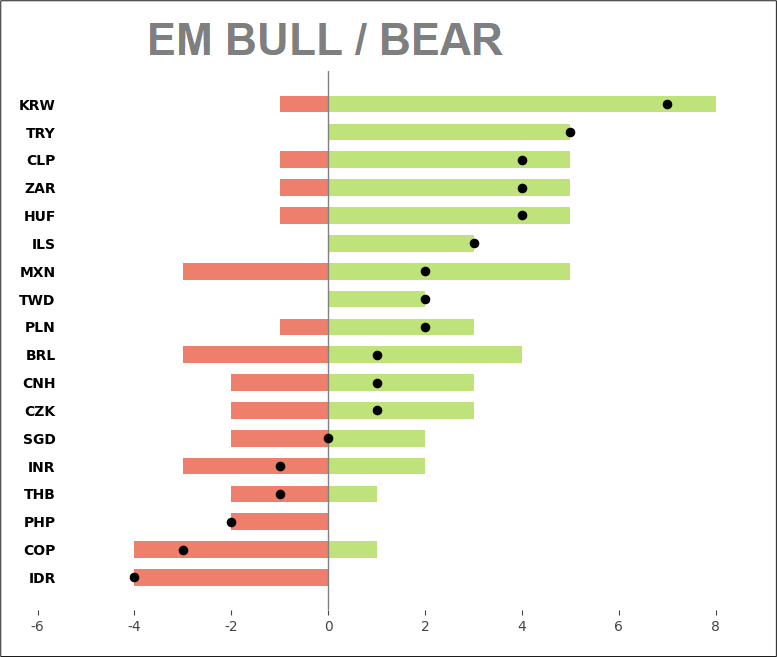

Here are the summary charts for G10 and EM. They show the balance of bulls (green) and bears (red) along with the net (black dot).

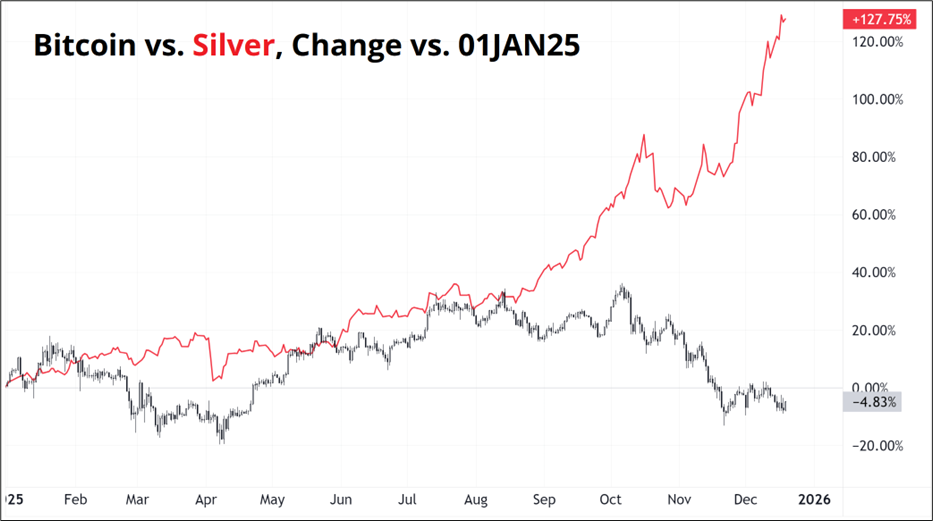

Crypto is kind of sluggish, though the unwind has cooled and the bottom in BTC printed almost a month ago. What started with a flash crash event on October 10 took us from 125k to 80k in a month so I suppose a consolidation isn’t all that surprising or bullish, necessarily. As a lead/lag guy at heart, I find it very hard to be bearish crypto down here given the decoupling from other risky assets like silver and QQQ, but then I look at the chart and see a perfect bear flag.

And I remember all the other 70% and 85% corrections in bitcoin and I can’t find the will or logic for a long, either. So I’m flat. There is no juice left in shorting the crypto DATs as they all converge towards 1.0X mNAV and so I don’t really have much inspiration to trade anything crypto-related right now. You can see in that BTC chart that the cloud and the 100-day both come in around 100k, so we are bounded by that zone on top, and the 80k November low and 74k/75k megasupport below.

Crypto had everything going for it coming into 2025 and if we end the year here, BTC posts a red year. Predicting the future is hard.

Speaking of silver. It’s going apeshit.

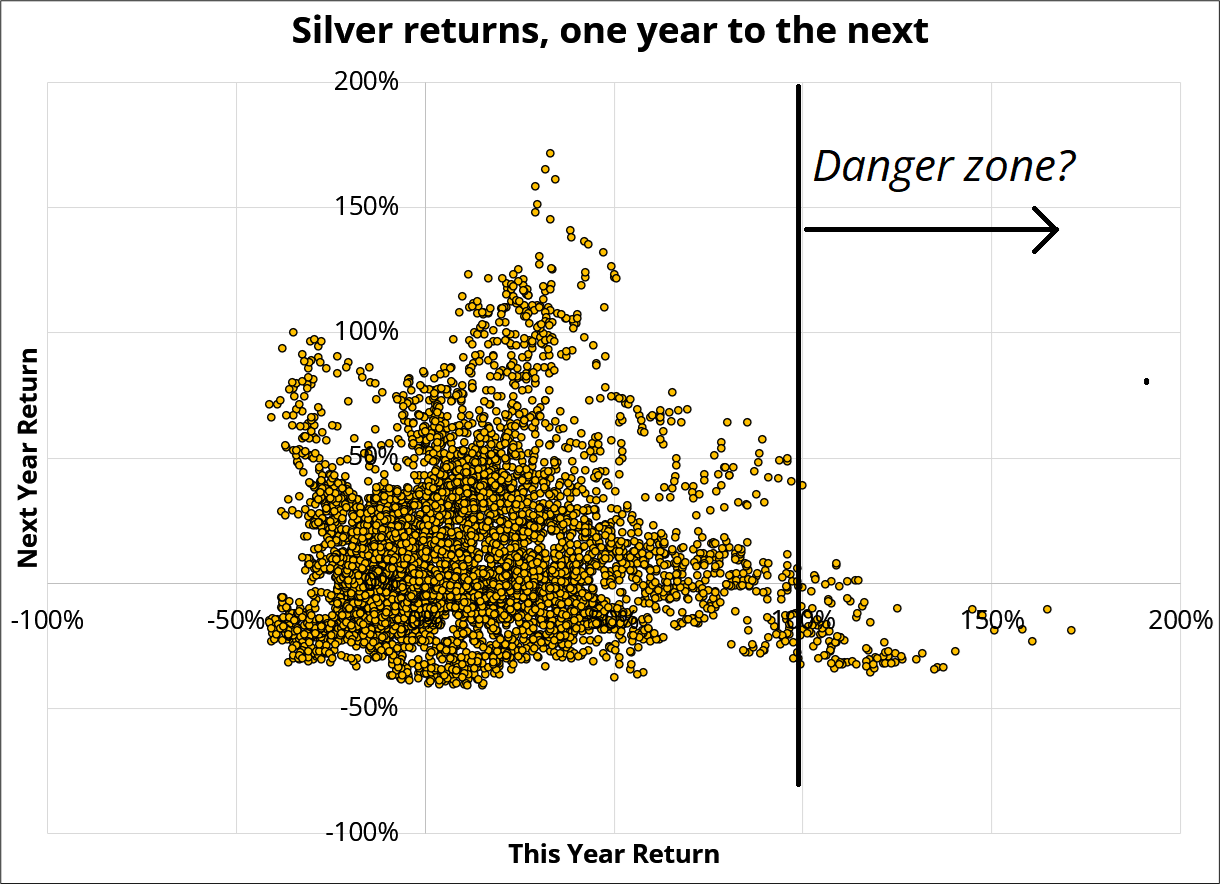

Silver’s history is punctuated by parabolic explosion and collapse. We are well into the third parabolic phase here. The most interesting and curious aspect of the silver rally is that despite some okay narratives (Big US deficits! Solar demand!), the rally is mostly happening in an impulsive way that has almost nothing to do with anything going on in the real world. Deficit expectations have not changed in the past six months. Other debasement trades (stocks and bitcoin) have been trading poorly over the past six weeks. It almost feels like some kind of short squeeze where you are going to hear later about a massive basis or RV trade that blew up somewhere.

There is no real reason to take the other side and short silver here, but it’s worth noting that after 100% rallies in a single year, forward returns are bad. This chart shows daily data for 1-year return (x-axis) and then compares that to what happens in the year that follows. You can see the sample of above 100% yearly returns is not huge, but when they happen, the next year tends to be meh.

To serve the same data in a different way, the chart below shows a chart of silver along with all the times it rallied 100% in the prior year.

Again, you can see that those were generally not good times to be long. This is not a call to short silver (yet!) … But at this point I think you can make a good argument that this rally + the Time Person of the Year cover suggest deleting silver, META, AMZN, NVDA, TSLA, and Alphabet from your portfolio as we enter 2026. You can always buy gold if you want precious metals and avoid the negative convexity of trading from the long side in an asset that has now gone parabolic. You don’t always have to be long or short everything all the time.

Sometimes avoiding danger can be a strategy.

That’s it for this week.

Get rich or have fun trying.

*************

Much truth here. Read it!

https://squareman.substack.com/p/people-are-tired-of-innovation

*************

I found this documentary inspiring, entertaining, and uplifting. A rare win for art over the soul-sucking agents of capitalism and shitty urban planning.

https://secretmallapartment.com/

*************

This podcast with Gavin Baker is excellent. Topic is AI and the current technology frontier.

*************

*************

One of my favorite songs from high school. The song holds up well, but the video is soooooo dated ha.

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.