There’s a blind man looking for a shadow of doubt

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

There’s a blind man looking for a shadow of doubt

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

The seasonal surge in volatility has arrived right on schedule. It’s common for July to be quiet and realized vol heads into the toilet, then implieds follow and become juicily attractive towards the end of the month. That’s the pattern this year too, so far. That said, this week was the Super Bowl of economic events with something yuge on the calendar each day and next week is more like preseason Browns/Jets.

The hilariously fickle markets were again hilariously fickle this week as we had some hot US data and a hawkish Fed followed by some softish payrolls data that stepped on the tail of a cat named Two-Years.

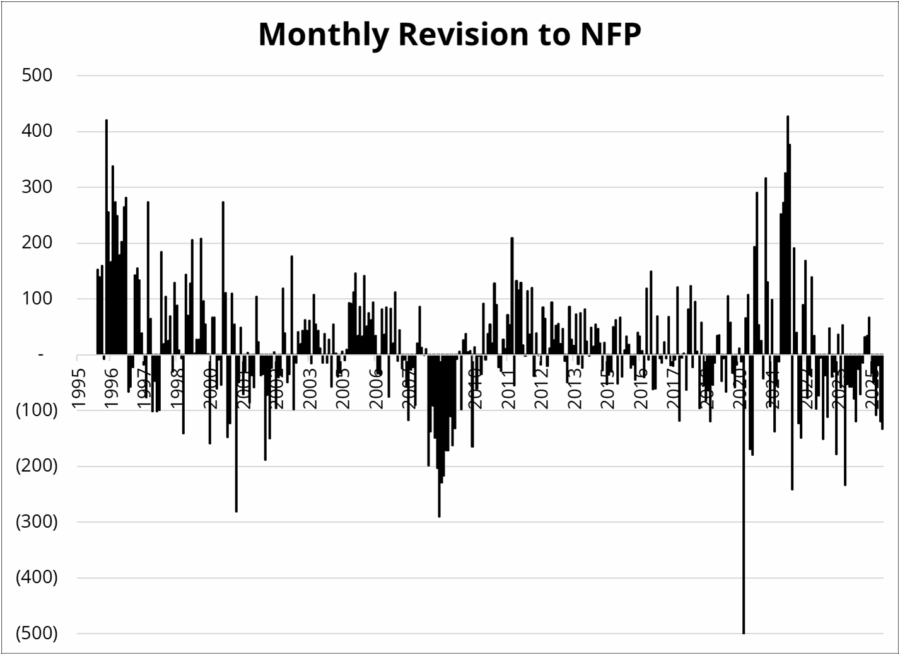

The large downward revisions to today’s payrolls data are catching a lot of press, but it’s worth noting that we have been playing this game for four years now. The revisions have been deeply negative since 2021 and there is nothing remarkable about this month’s revisions as compared to anything that happened in 2021, 2022, 2023, or 2024.

I’m always open minded, but using NFP revisions to time a slowdown feels to me like using the yield curve to time a recession. I.e., not actionable.

The market reaction to today’s jobs report seems overblown to me as we have had a persistent string of “as expected” payrolls accompanied by large downward revisions over the past three years and none of those scary revisions meant squat.

Furthermore, Powell explicitly said he’s watching the Unemployment Rate, not headline jobs growth because we have both falling demand for, and falling supply of labor right now. That’s why despite what some are calling a weak jobs number today, you see no backing off in Average Hourly Earnings. The immigration crackdown and other demographic factors are creating a simultaneous drop in both supply and demand for labor and that’s why the Unemployment Rate isn’t moving.

Here are my takeaways from the Fed meeting:

We got some final tariff numbers from the US president this week, and while there were some stupid headlines like “Stocks fall on Trump tariff angst,” the tariffs and timing were all telegraphed far in advance and whether Switzerland is paying 39% or 31% tariffs doesn’t matter one iota for MAG7 earnings.

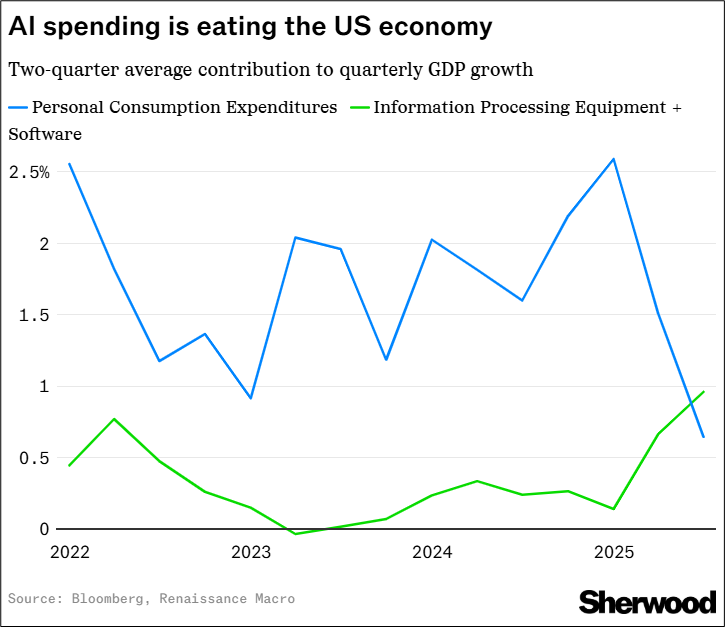

Much of the economy is driven by AI capex right now, and one is left to wonder whether we should even bother analyzing the real world at all. If AI Capex keeps going, we’re fine. When it stops, we’re all dead.

AI capex is 6% of the economy and consumers are 70% and yet the 6% thing contributed more to GDP growth than the 70% thing over the past two quarters.

https://sherwood.news/markets/the-ai-spending-boom-is-eating-the-us-economy/

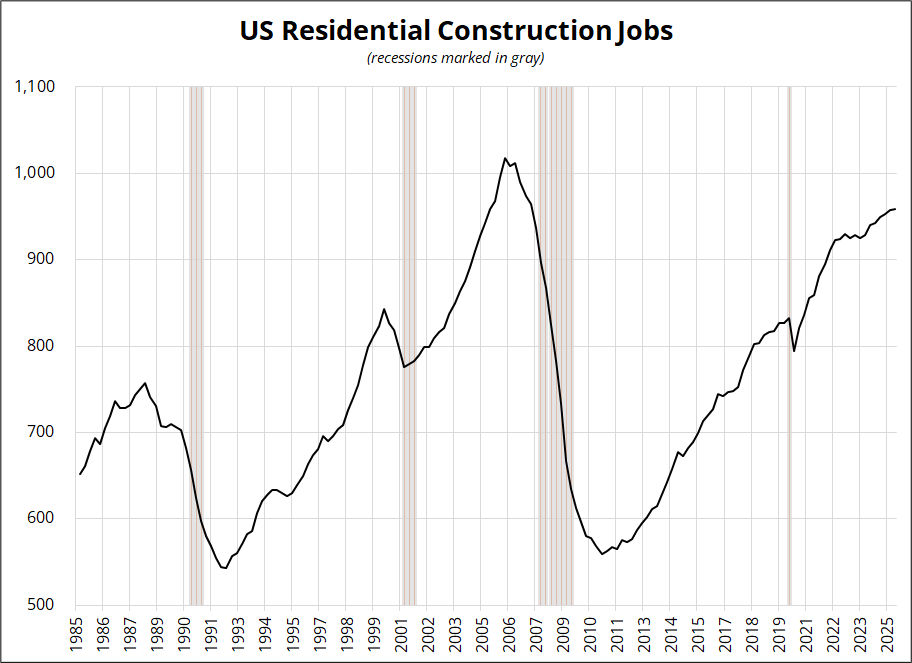

On a similar note, Microsoft, which announced blockbuster earnings this week, made more money last year than the fifty largest companies in Canada, combined. That includes RBC, BMO, CIBC, Manulife, Enbridge, Imperial Oil, and a whole host of other huge and profitable companies. MAG7 earnings dwarf everything by a huge margin so while it’s fun to talk about “manufacturing jobs” or “the housing market” … These are not the marginal drivers of US growth or stock market performance.

In contrast, the first whiff of “AI is not paying off” and you get a 9% one-day drop in AMZN.

Click on the ad to subscribe. If you’re not happy, just email me and I’ll refund you. Risk free. Unlimited upside.

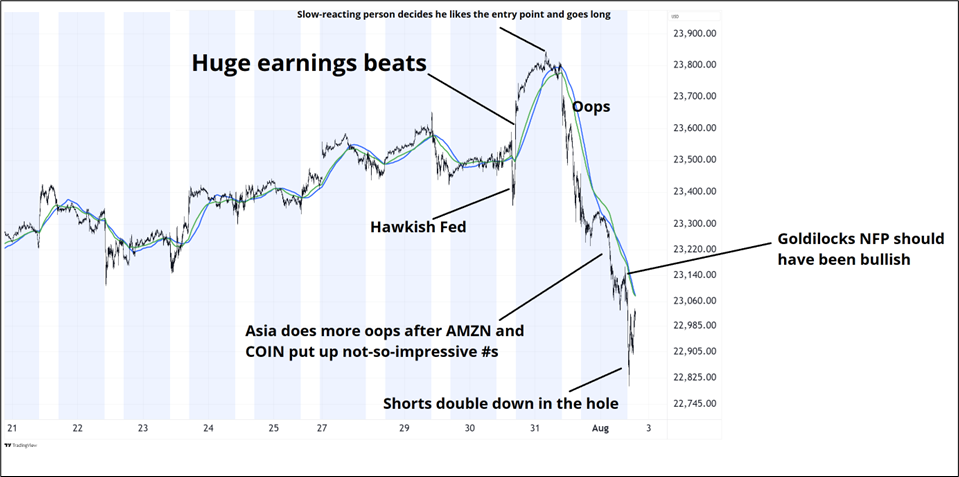

We got a zippy reversal this week on no particular news as META and MSFT crushed earnings, but the broader market could not hold on as AMZN and COIN pooped the bed. A hawkish Fed and tariffs got the blame for the selloff, but sometimes reversals are simply endogenous events as the greediest and slowest-to-react person in the world finally pays the highs and there’s no one left to buy. Then you get an “oh sh*t” moment like we saw Thursday.

Here’s a recap of stocks over the last two days.

NASDAQ 100, 5-minute chart

And here is this week’s 14-word stock market summary:

Highs get made on good news. Seasonals work often but not always. Cryptotreasurycopycatmetoostocks rekt.

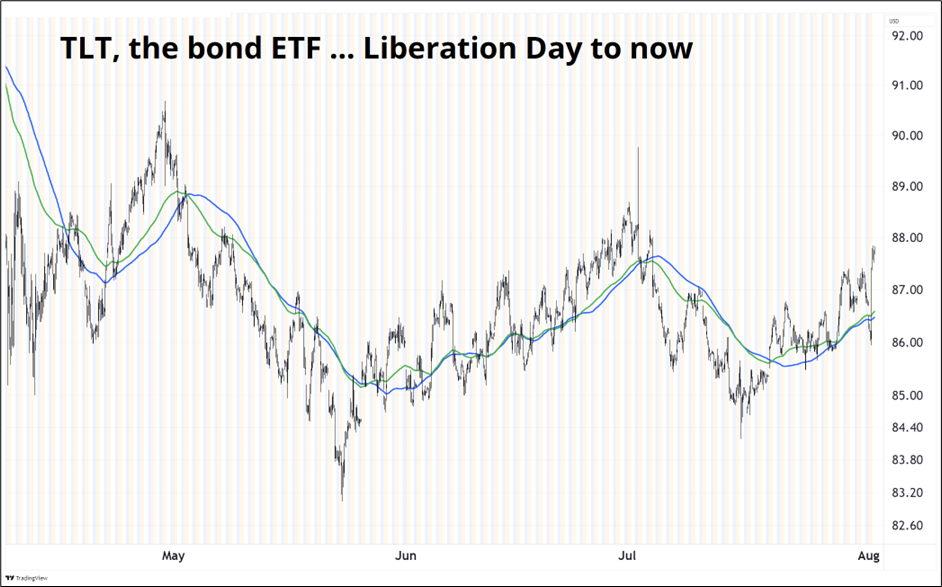

We are obligated by law to talk about interest rates, even when they are gyrating up and down and going nowhere for months and months. As smart and tapped-in macro folk, we need to rub our chins and discuss optimal Fed policy and then express strong directional views on bonds even when they are doing this:

In 2025 we have had the following strong global macro narratives:

I could go on. This is why macro trading is extremely difficult and I prefer to stick to sub-ten-day time horizons most of the time. Markets are a complex system like the weather. You can forecast weather out 10 days or so, and then the variations from the starting point become impossibly complex and impossible to forecast. Same thing with markets imo. That said, 2025 has been particularly extreme in terms of narrative spinaroodles.

My view is that today’s NFP does not change anything, Powell is focused on the UR and AHE, the bond market is priced about right for a continuation of the soft landing that has prevailed for the past 3.5 years, and while stocks got stupid to the topside there for a bit, no massive correction is imminent.

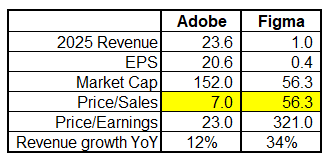

And finally: Figma went public yesterday and trades at 56X sales vs. Adobe at 7X sales. Okie dokie guys.

Click here for the 2025 FX YTD trading soundtrack.

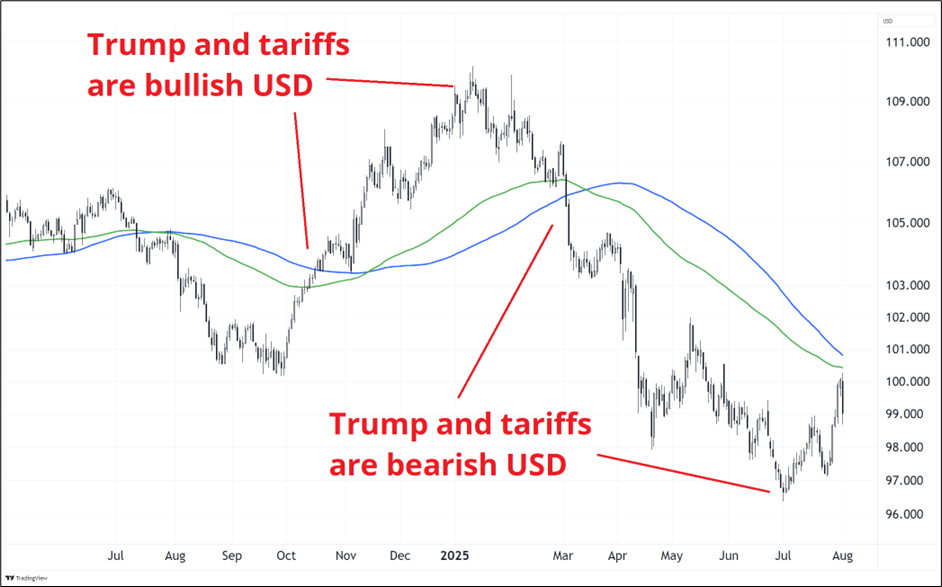

We have seen a full capitulation on the short USD trade as just about everything people expected has not happened. No Section 899, no capital flight, no end of AI Capex, no US slowdown, and no Fed cuts. And then the cherry on top came when the EU capitulated on trade and went from looking like hardcore defense spending tough guys championing a new pole in the New Global Order … To milquetoast, shrinky-bicepped vassals of the US …

Pretty much overnight!

This USD unwind has been painful for specs as the USD down to Chinatown narrative was as strong after the 10% selloff as the dollar bull narrative was after the 10% rally. FX is hard.

The Dollar Index, Daily

The thing is, both narratives made sense! Today, the dollar took a sledgehammer to the back as USD shorts are long gone and a few newly-minted USD longs were driven back by fiery gusts of EURUSD buying and USDJPY selling post-NFP.

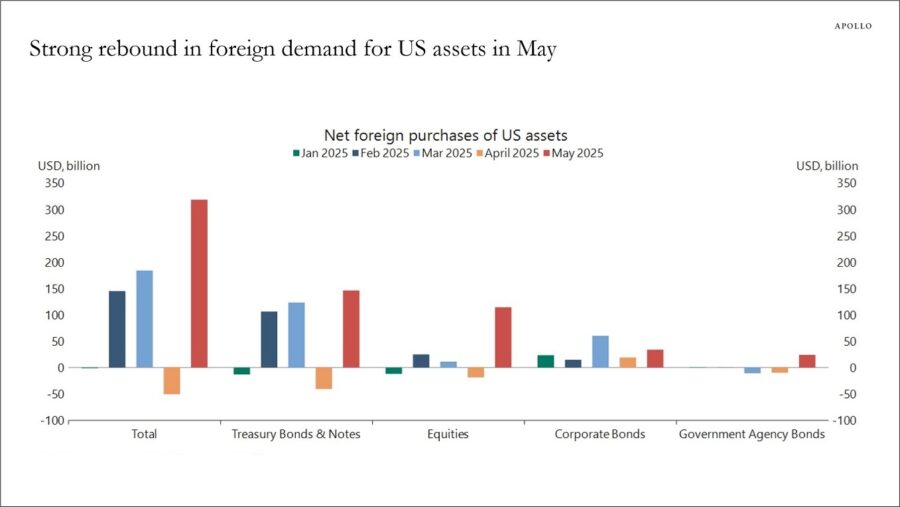

With regard to the capital flight story, here’s a nice chart from Apollo. There was microscopic capital flight in April and that’s it.

The foreign pension fund selling of USD to hedge US equity portfolios was only able to matter for so long and eventually the rebirth of TINA hit. TINA was so over and now she is so back and now maybe she is so over.

I am often wrong, but one thing I have been super correct about since I wrote about it in Friday Speedrun on July 18th (and in am/FX repeatedly) is that the failure to launch of CEPO (Adam Back’s BTC exit strategy) was a tell for the top in the scam called Crypto Treasury. This is an operation where insiders attempt to sell $1 bills for $2 to retail bagholders and it has been very successful as unprofitable companies and well-known crypto-rich peeps have been running MSTR copycat / MeToo operations attempting to dump as much supply of overpriced 2X NAV crap onto the market as they can before the joke’s over.

The joke’s over.

We saw a bunch more POS companies try the thing since July 18 (ZOOZ and VAPE, for example) and the market has now realized that:

You had the added benefit of Crypto Week mania ending right on July 18, too, which created a nice buy rumor/sell fact trade.

In the 18JUL Friday Speedrun, I said:

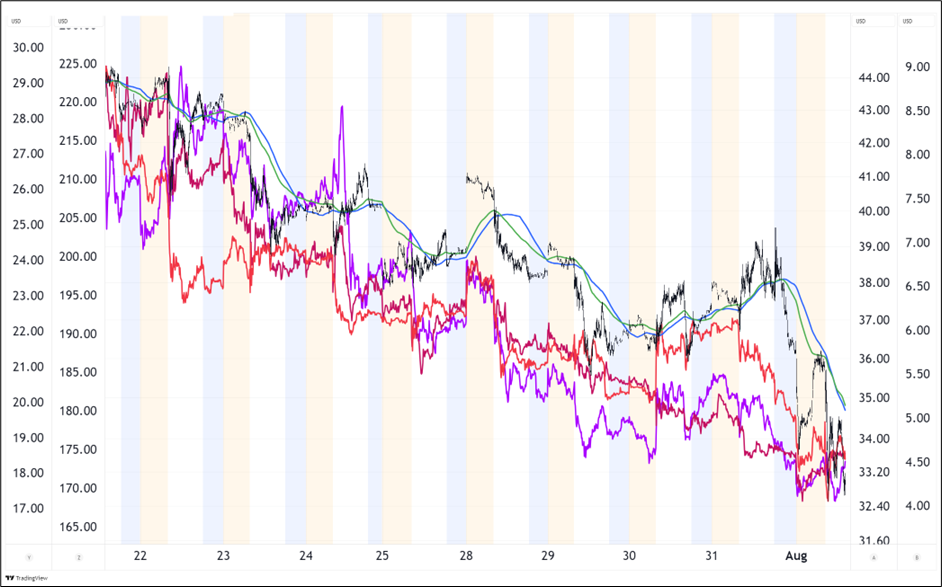

I am taking a shot at the buy rumor / sell fact trade by selling BTC at 119k with a stop at 124,100 (target 110,500) and selling a basket of SBET, UPXI, CRCL, and MSTX.

Crypto hasn’t done much, but the treasury companies have cratered in a straight line. Some are down more than 50% in two weeks. I respect Saylor and his whole operation, but these things are all going to trade below NAV at some point. I have taken profit on everything today because I think the market reaction to NFP is overblown, and stuff like RIOT has gone completely nuts to the downside. I will sell the next rally. Note that unlike MARA, which has already been smoked on a secondary, RIOT hasn’t issued stock recently. So things could get worse for RIOT before they get better.

A chart of MSTX and other stupid crypto things since 18JUL

Insiders will end up winning twice as they use retail as exit liquidity to sell their holdings at 2X to 4X NAV and they will be on the bid to buy them all back below 1X NAV in the nearish future. It’s all pretty dumb, but we’re just here to make money, not pass moral judgment.

Since I am taking victory laps, I also mentioned the shooting star in platinum in the last Friday Speedrun. It was another straight-line move. Never OTM.

Like I said, I am wrong a lot and I do sometimes point out my bad trades. But it’s also nice to feel good when you make money on good calls otherwise you just feel sad all the time because you will always 100% feel bad about the bad calls and the losing of the moneys.

I think gold might be in for some boredom with mild downside for a while as policy uncertainty subsides with the tariff rates set, and the weak USD trade dead in the water for now. Gold has not closed below the 6-month moving average since September 2023!

Gold daily with 126-day (6-month) moving average

That’s it for this week.

Get rich or have fun trying.

Here is a link to one of the best short essays I have read in quite some time. HT JROSS.

https://sashachapin.substack.com/p/what-the-humans-like-is-responsiveness

Two fun quotes from the essay:

“Everyone wants to know how to be liked. But I think we all know, actually, how to be liked, it’s just that it’s hard. It takes attention and openness, and the confidence to present your character like it’s a fun mask you’re wearing rather than a lesson you’re desperate to teach someone.”

“Life is good if it squishes nicely when you poke it.”

I particularly related to this part…

“A major factor in burnout is “broken steering”: people feeling, for a long period of time, that their efforts to exert control don’t do anything. They show up to work, click their mouse, make suggestions, and nothing happens, and it’s hard to tell if their work ultimately matters.”

At one particular market making job I worked at, I had a very bad trading year, and yet did not get paid down. In fact, I got paid the same amount as the prior year, which was an excellent trading year. The bank wanted to treat me nicely. Which was nice. They did an admirable and nice thing and I was highly appreciative.

But ironically, even though this should have made me happy, it only made me happy for about 7 minutes and then I soon transitioned to feel like there was no relationship between my pay and performance. That created a bit of an existential oof in my trading soul. The broken steering effect came into play as my subconscious was now telling me that my P&L doesn’t matter because it doesn’t change what I get paid. The following year, I sometimes drifted into lazy or sloppy trading, despite my best efforts to fight back against the drifty feeling.

If a trader works for you and has a bad year, but you really like them and want them to stay and be excellent—pay them down! Tell them they are appreciated but that there has to be a link between pay and performance otherwise that trader might subconsciously feel like: What are we doing here? Who cares how well I perform?

I realize that linking pay and performance is not controversial when it comes to employee motivation, but having experienced this firsthand, I think the broken steering wheel analogy is apt.

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.