I like NZD but I don’t have a USD view so NZDCHF it is.

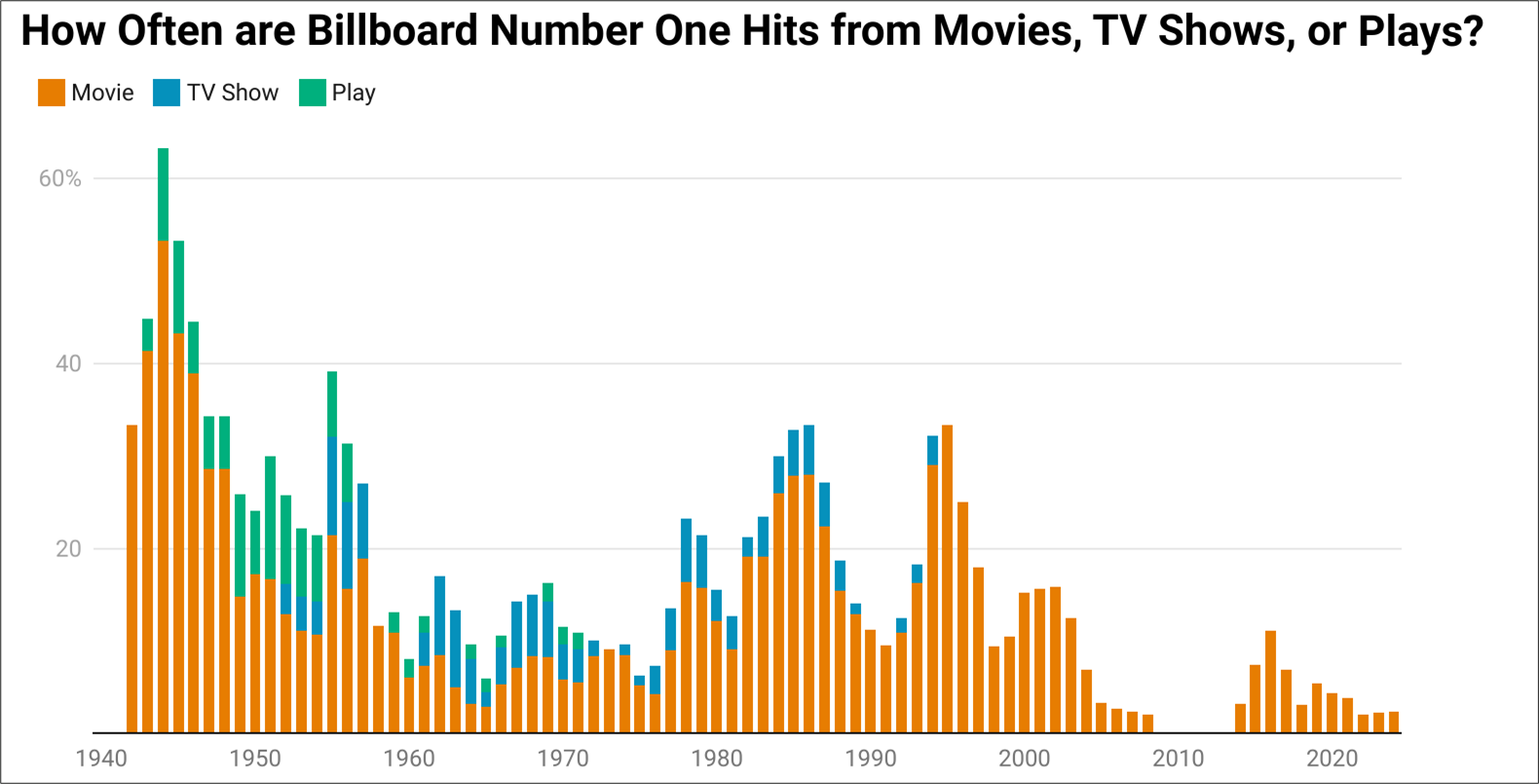

Number one songs used to come from movies and TV.

And plays!

Now, not so much.

I like NZD but I don’t have a USD view so NZDCHF it is.

Number one songs used to come from movies and TV.

And plays!

Now, not so much.

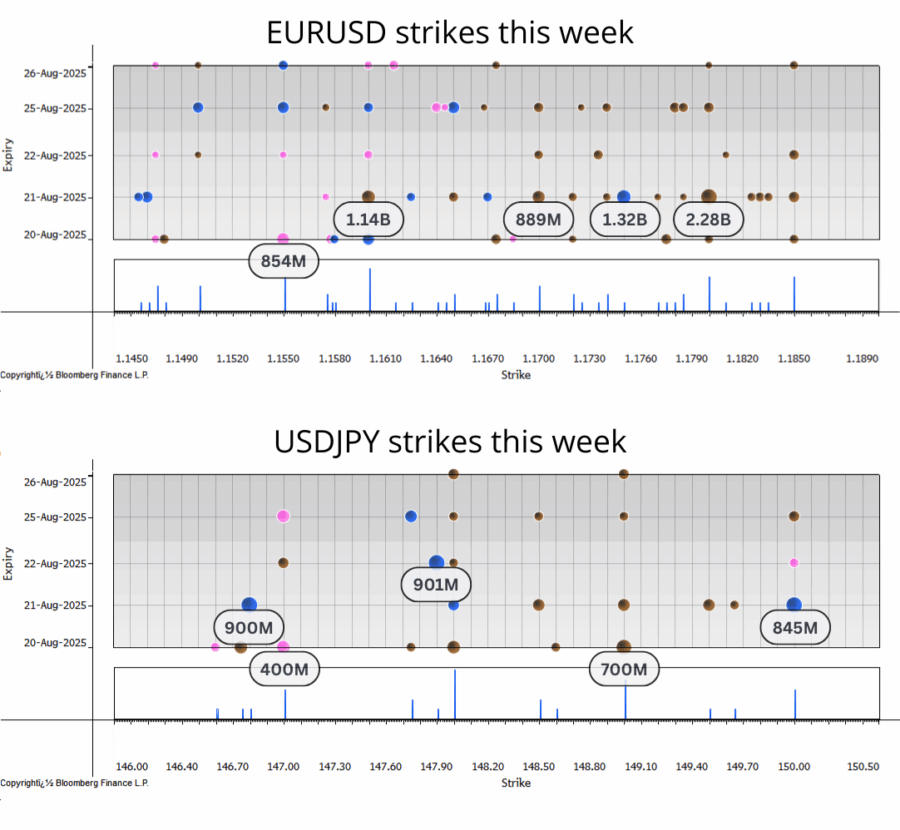

Long NZDCHF @ 0.4774

Stop loss 0.4689

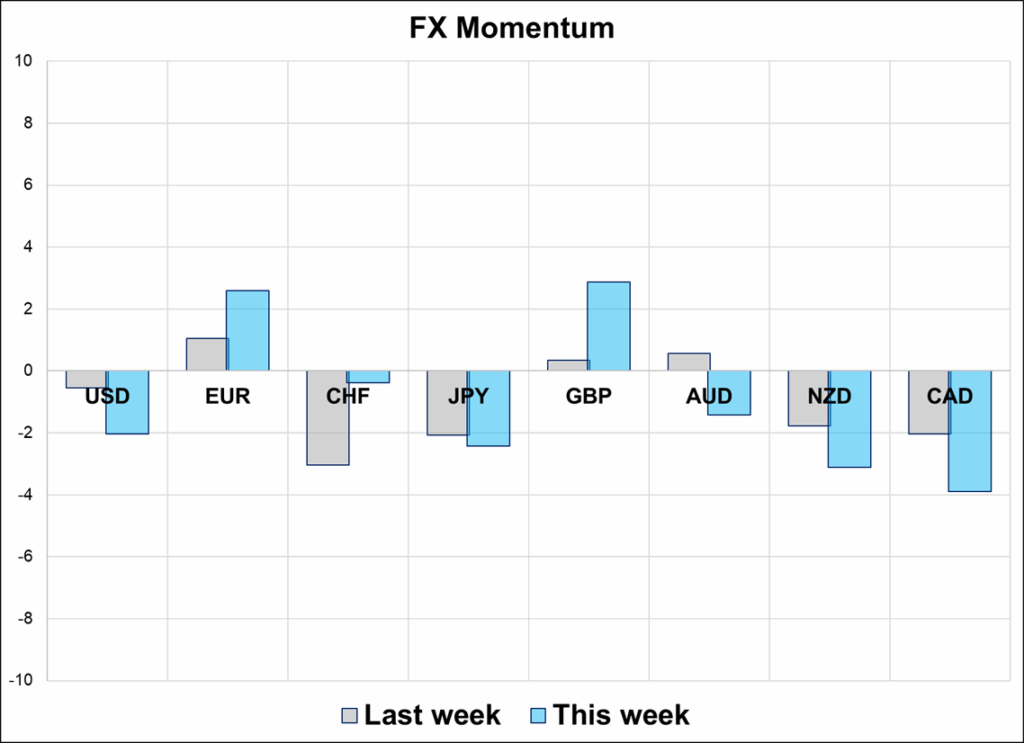

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

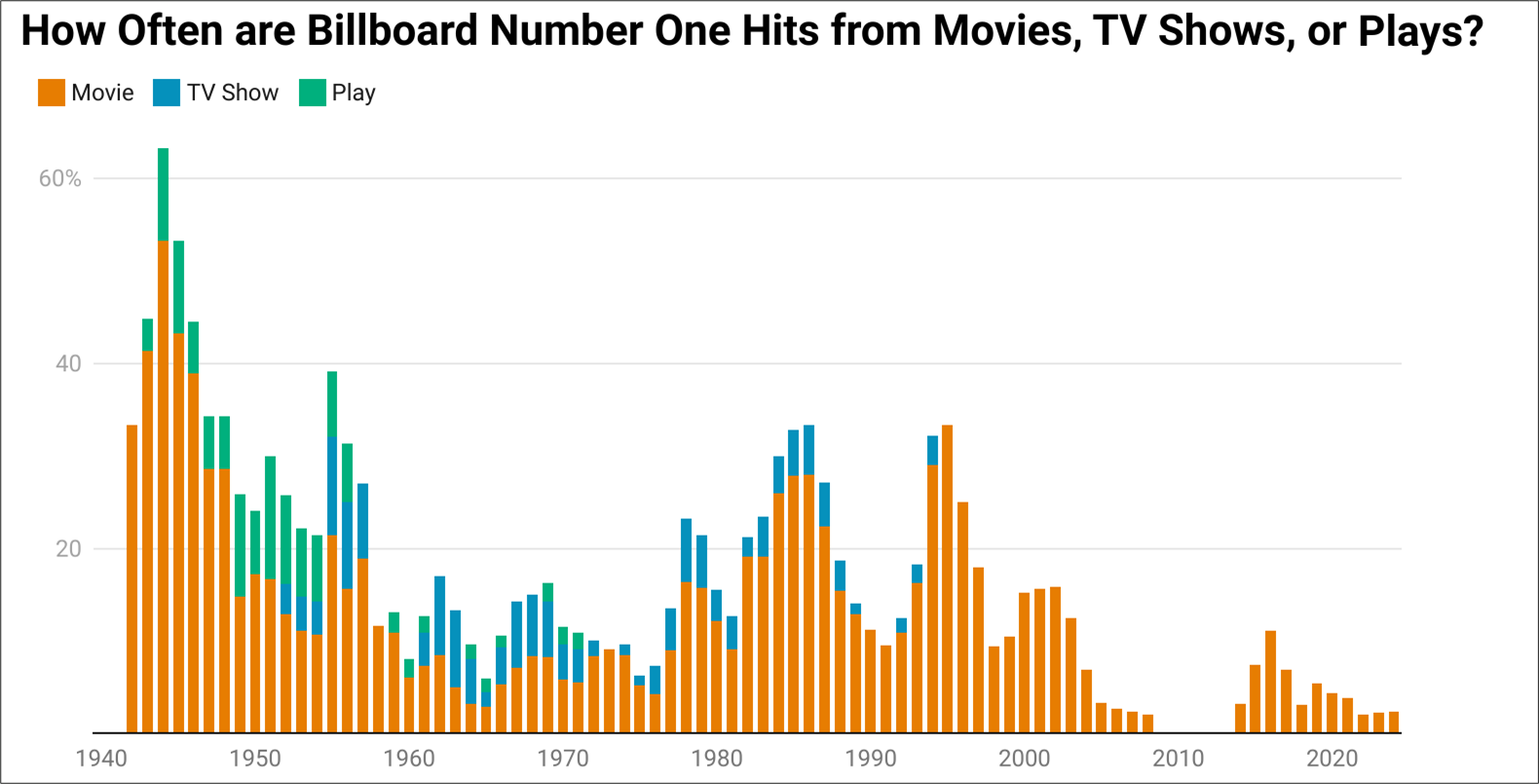

The RBNZ faces a similar dilemma to that faced by many developed market central banks right now. Labor demand is weak, and inflation is sticky. As I showed in yesterday’s piece, the recent release of food, electricity, and airfare prices indicates that NZ inflation is about to rise and will likely end the year back above 3%. Inflation expectations, which had been declining in tandem with CPI, are also ticking higher.

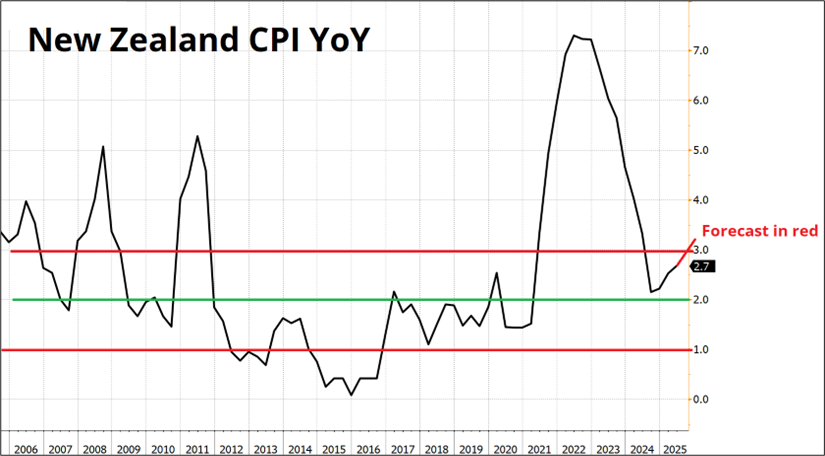

Importantly, in the last MPS (May 2025), the RBNZ saw inflation rising up towards, but staying below 3%. That view is now in jeopardy. Below is CPI with the RBNZ forecast from the last MPS. In their last rate decision statement (July 9, 2025), the RBNZ said:

“Annual consumers price inflation will likely increase towards the top of the Monetary Policy Committee’s 1 to 3 percent target band over mid-2025. However, with spare productive capacity in the economy and declining domestic inflation pressures, headline inflation is expected to remain in the band and return to around 2 percent by early 2026.”

Now, they cannot be so sure a the higher-frequency data is not cooperating. While the labor market has been weak in New Zealand, housing has been stable and the agricultural story remains bullish. Milk, cattle, and other export prices remain firm and provide a partial offset to weaker immigration and a soft consumer.

Hawkesby’s term as interim governor of the RBNZ ends on October 8, so there is not much reason for them to send a super strong forward-looking signal now that they will have cut 250bps from 5.5% to 3.0%. They could leave the door open to one more cut, or signal they are done. Either way, it’s extremely difficult for them to outdove pricing and very easy to outhawk it.

The global risk assessment (an important input into RBNZ policy) has also improved significantly since the May MPS as worst-case scenarios around economic impacts from tariffs have been averted. If the RBNZ suggests that the bottom has been reached, that could be a nice support for NZD, much as the last cut from the ECB was the start of a multi-percentage rally in EUR vs. most of its peers.

I don’t have a USD view right now, but I am intrigued by the skepticism around the Russia/Ukraine negotiations. This is in sharp contrast to the stronger belief that a deal would be reached in February. At that time, the talks were spotty and bilateral. Now, the talks are coordinated and involve the US, EU, Ukraine, and Russia. I am not knowledgeable enough to assign odds to a peace deal, but I will say that people seem far more skeptical now and the setup is much different. Normally when heads of state congregate like this, they understand the reputational risk and won’t show up unless there is an enormously high probability of success. Either way, short CHF seems like a good denominator for a long NZD position as it takes the USD out of the equation and makes the trade long carry. Either way, short CHF seems like a good denominator for a long NZD position as it takes the USD out of the equation and makes the trade long carry. This is not a peace deal play, but that’s an obvious kicker that’s not priced in imo.

So I am going long NZDCHF here (0.4774) with a stop loss at 0.4689. We have made a decuple bottom at 0.4735/50, so below there my idea is wrong. To the topside, you can see that we have been below the 100-day for eons, so 0.4857/77 is the first hurdle and if we get above there, the triple top at 0.4980/00 is in play. Two-month NZDCHF forward points are around 25 pips, which is quite significant for a currency pair that is moving less than 25 pips per day[1]. If you are more of an options lover, a 2-month 0.4870 digi sub 25% makes sense or the vanilla costs ~36bps.

Whether you’re near, far… Wherever you are… Have a great day.

—

[1] Long NZDCHF is somewhat at odds with the long EURAUD call, but I guess you can kind of say (facetiously) that I’m long EURCHF and short AUDNZD synthetically for the time being (with different notionals and a mix of cash and options).

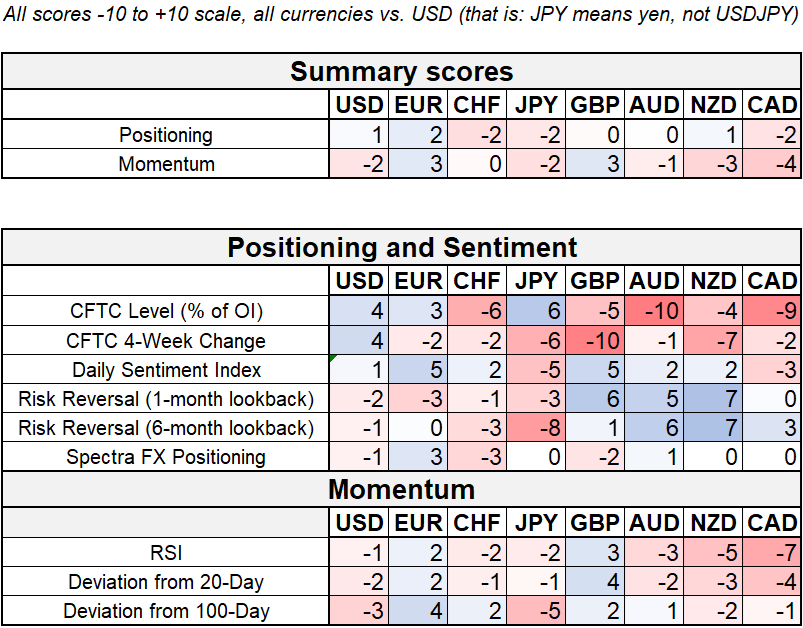

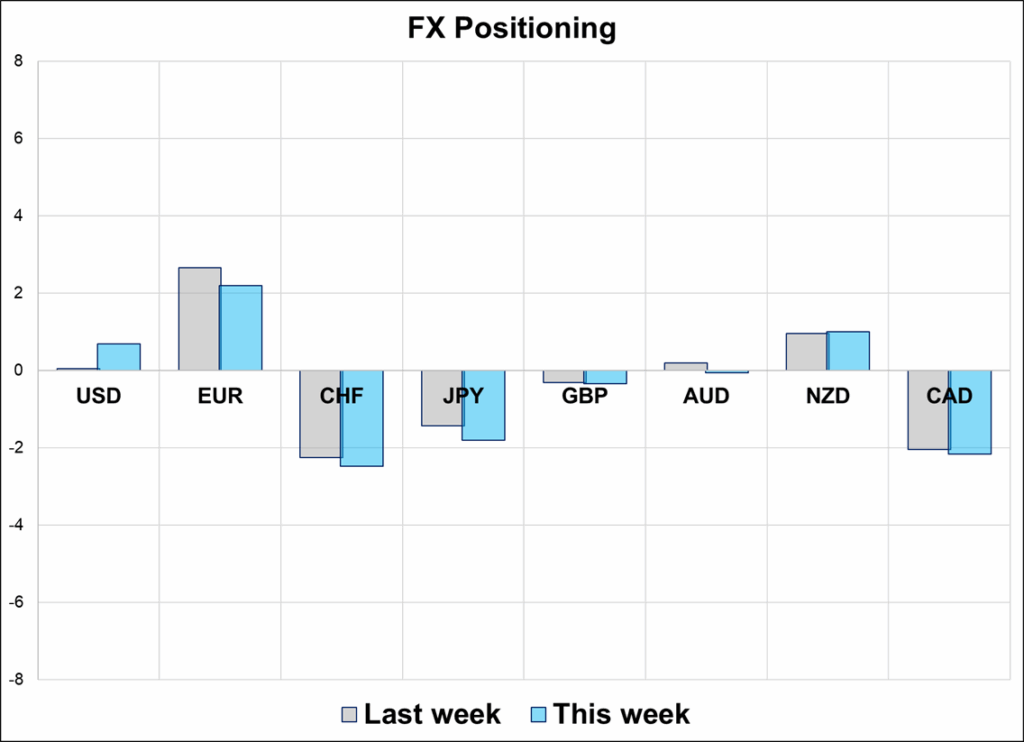

My philosophy on positioning is that it is usually irrelevant, and it’s sometimes the only thing that matters. Right now, positioning is light across the board and is not an impediment to further upside or downside for the dollar. There has been light engagement in short CHF trades and long carry remains popular. In G10, participation has been limited by low volatility and lack of direction.

Many are waiting for a cyclical signal to get on board the USD short train for dollar weakness into year end, but for now the signals on the US economy are mixed.

https://en.wikipedia.org/wiki/Soundtrack_album

And I… EE-aye… Will always love youuuu, ooo-ooh. And I…