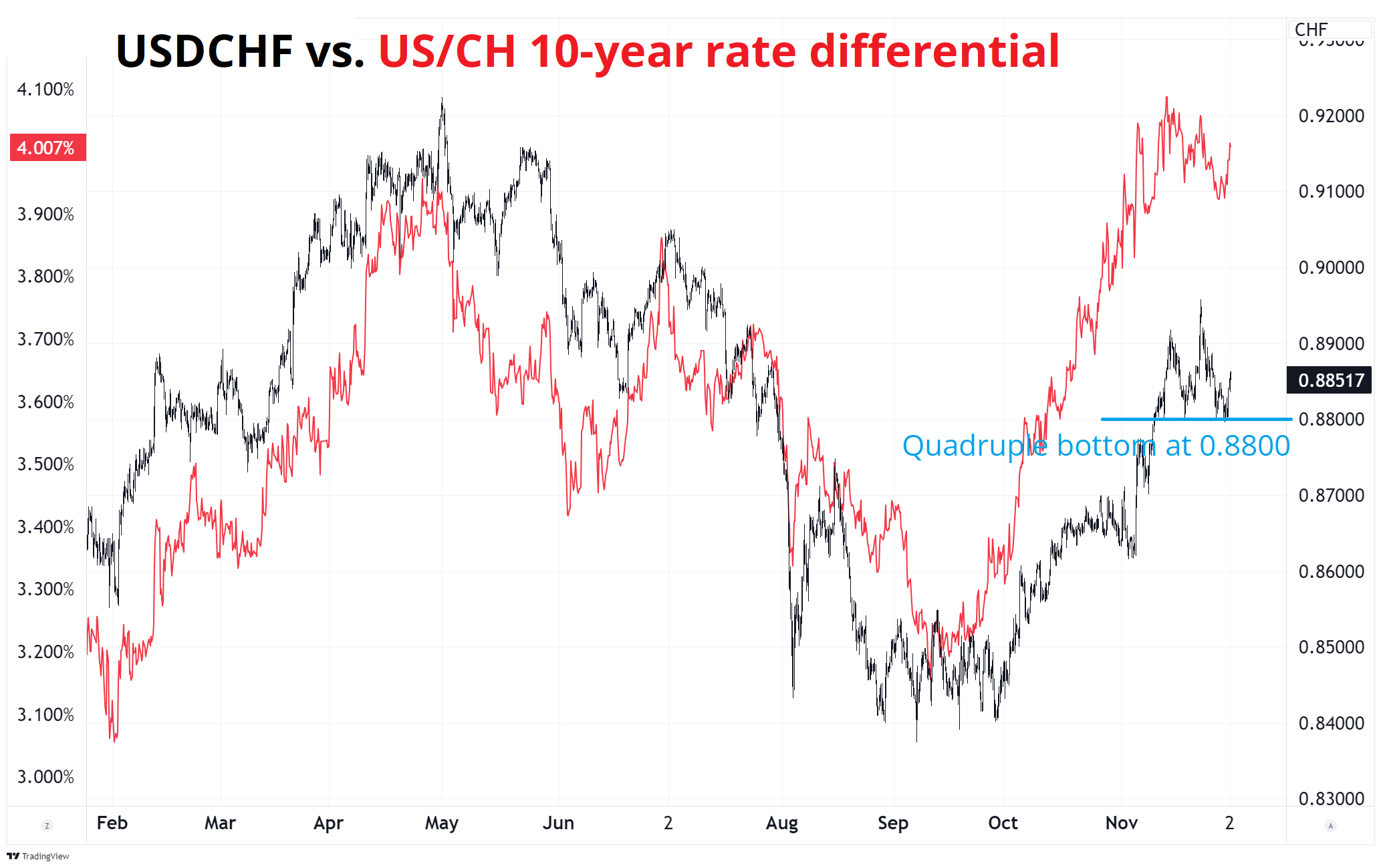

Adding long USDCHF today

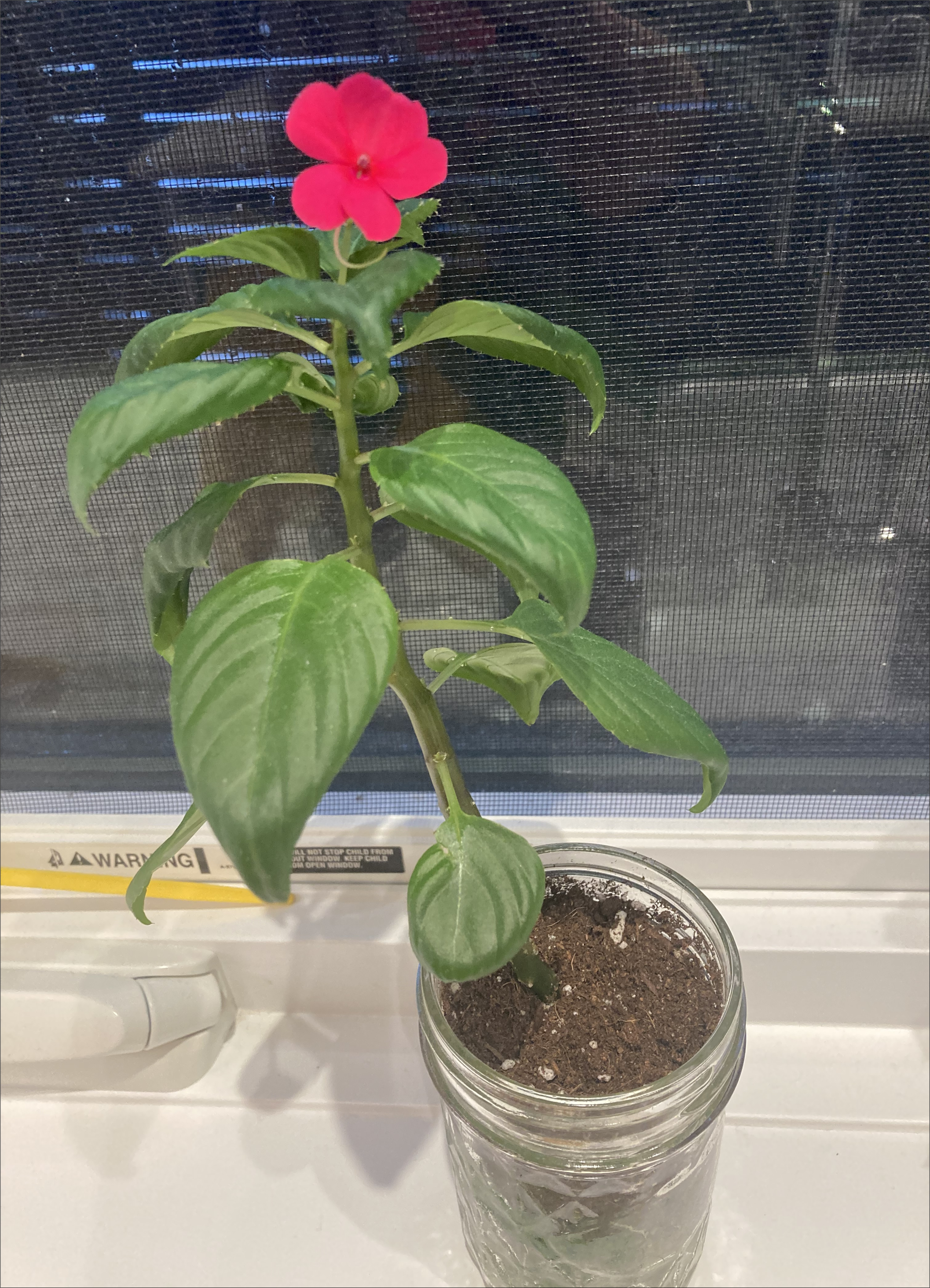

10 years ago, when my son was in 1st grade, he brought home a small green plant in a jam jar. It has been sitting on our windowsill ever since.

This week, it flowered for the first time ever.

Adding long USDCHF today

10 years ago, when my son was in 1st grade, he brought home a small green plant in a jam jar. It has been sitting on our windowsill ever since.

This week, it flowered for the first time ever.

Long USDCHF @ 0.8867

Stop loss 0.8784

Take profit 0.8994

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1216

Close 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long 06DEC

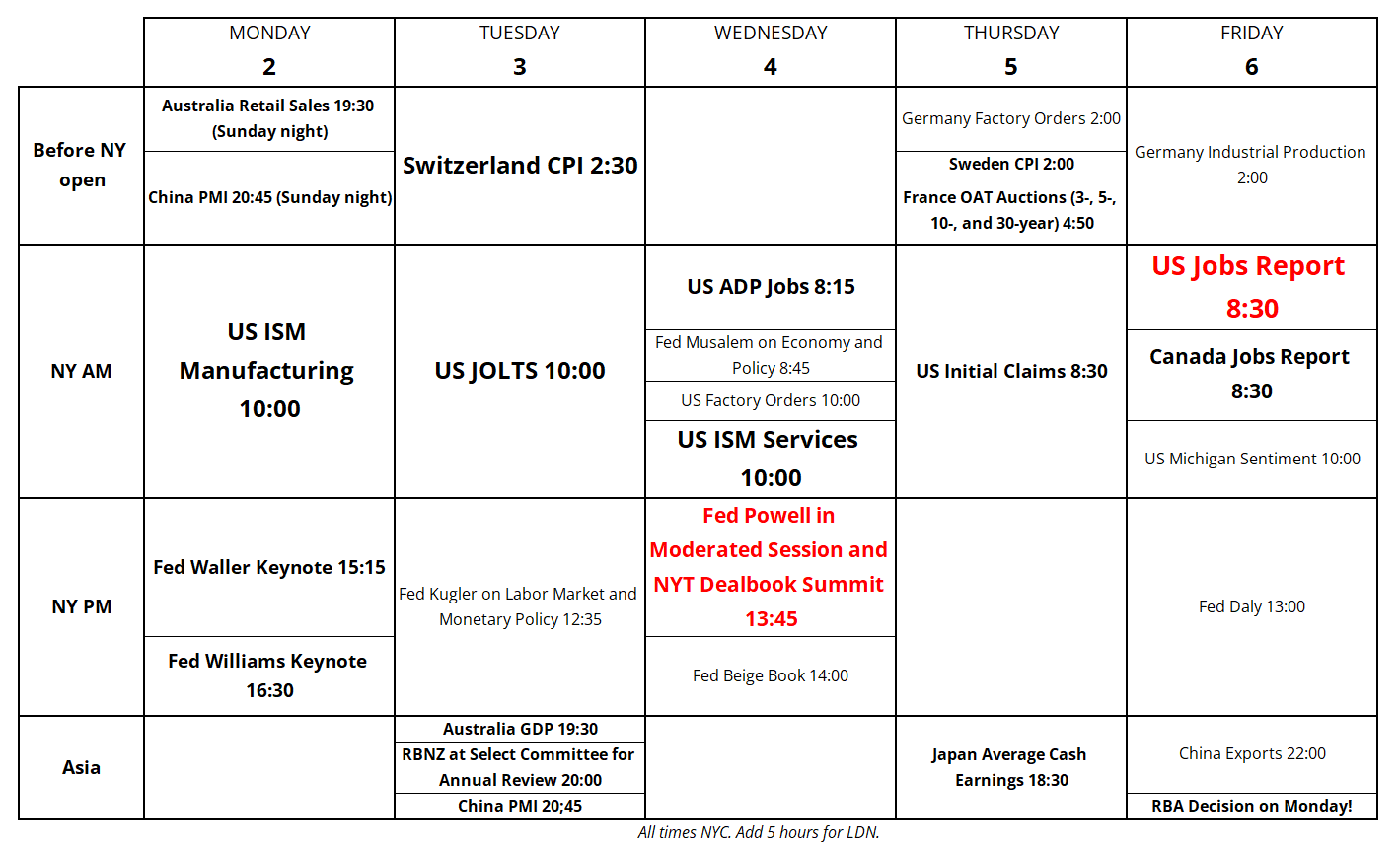

Long USDCHF looks good to me over the next few weeks. Here’s why:

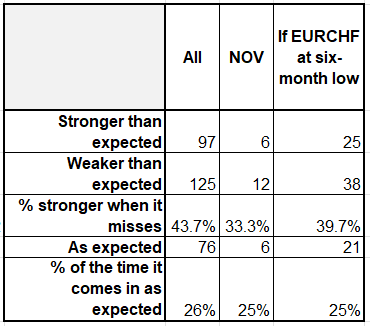

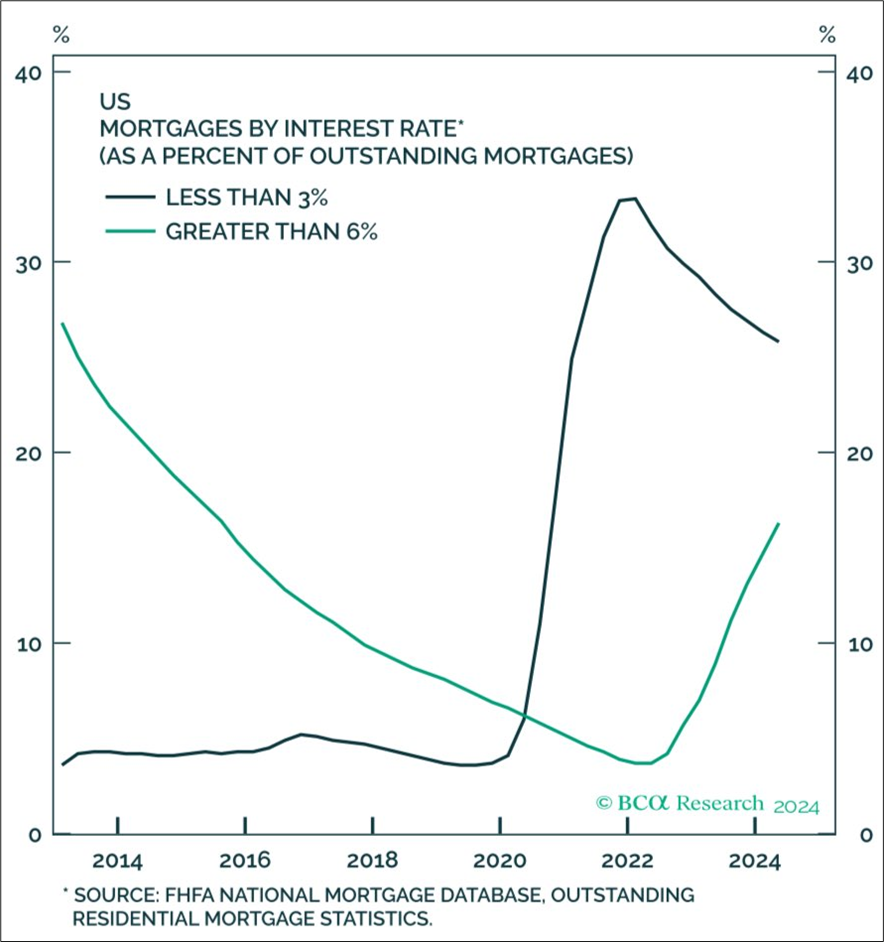

I like the spot trade here, because it’s simple, but the ginormous carry makes options extremely attractive, too. Spot is 0.8867 as I type this and the 2-month forward is 0.8795. That’s quite a lot of cushion considering USDCHF vol is sub-8%. Compare that to USDJPY where vol is closer to 12% for similar carry and a central bank that is cutting in Switzerland and hiking in Japan. 2-month 0.90 digital trades under 25%.

I have decided to ignore year-end seasonality for now as I think the negative pressures on Europe and the bullish USD forces remain in force as the market needs to prepare for Day One policy shifts from the Trump admin (i.e., tariffs and tariff threats galore). From Axios this weekend:

Trump has been telling friends he denied Robert Lighthizer — his pro-tariff, China-hawk U.S. trade representative in the first term — a Cabinet role because he’s “too scared to go big.” He’s loyal but too timid to take big, risky swings, Trump contends.

Why it matters: Trump advisers are running out of words to describe what’s coming in January. They say he feels empowered and emboldened, vindicated and validated, and eager to stretch the boundaries of power.

Sure, that sounds hyperbolic but maybe hyperbole is well placed here. PS: The majority of the movement in USDCHF comes from changes in EURUSD, so this is a long USD play with a side order of short CHF.

This week’s calendar is decent with ISM, Swiss CPI, Waller, Williams, Powell, and Jobs on the docket. Swiss CPI is especially interesting as deflation and the dreaded ZLB could soon be in play again in Switzerland.

I hope your December flowers beautifully.

10 years ago, when my son was in 1st grade, he brought home a small green plant in a jam jar. It has been sitting on our windowsill ever since.

This week, it flowered for the first time ever.