Powell revisited

Friday’s reaction to Powell was unambiguously dovish, but there is a sizeable camp that believes his commentary was not as “run it hot” as the kneejerk suggests. I think this is worth considering. You saw in Friday’s am/FX how radically skewed expectations were going into the confab, so maybe the reaction was more about positioning than the substance of what Powell said?

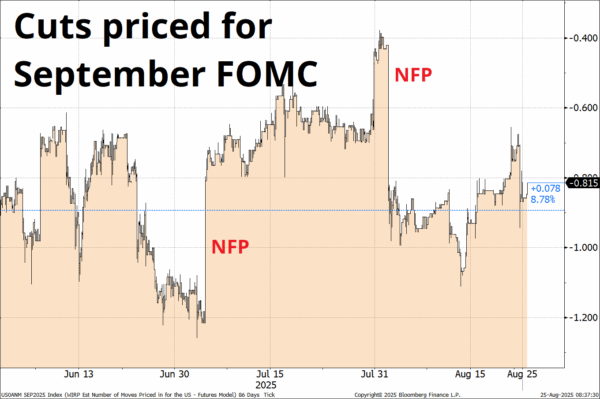

Anna Wong does a good job of covering the hawkish view here. I think my reaction: “He’s gonna run it hot!” was overstated and probably influenced somewhat by the market reaction. We are just about back to where we were before Jackson Hole. Services inflation is rising, headline employment is falling, labor supply is falling, and models say r* is lower while reality (credit spreads, etc.) suggest monetary policy is not at all tight. FOMC pricing hasn’t really moved in the past two months. It’s just running in circles.

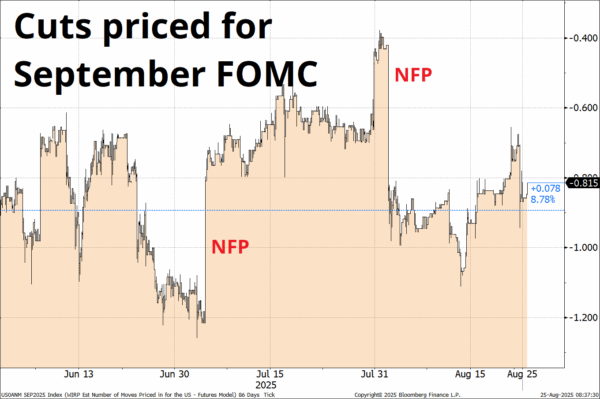

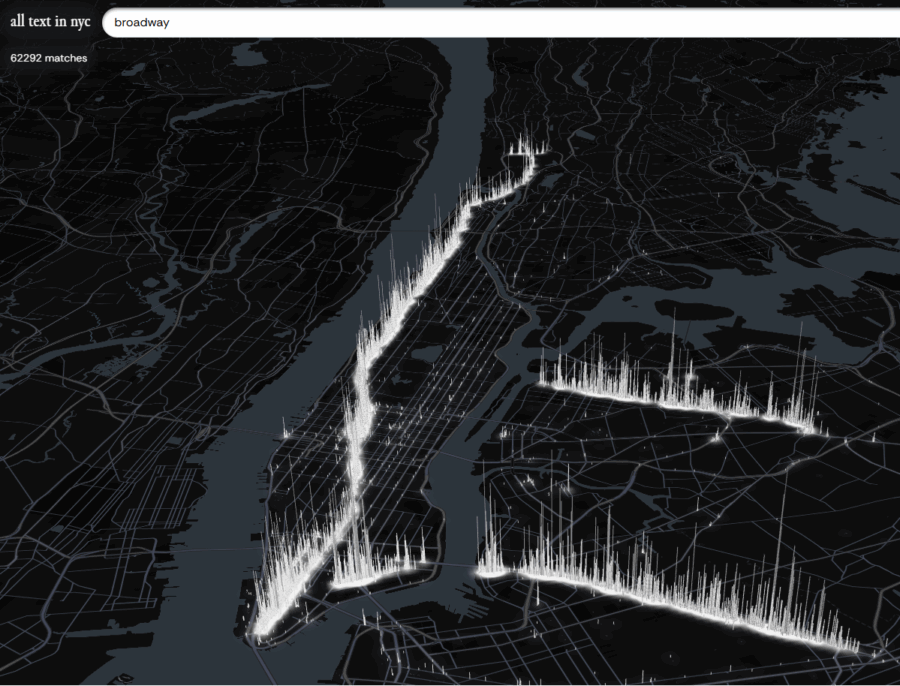

NFP moves pricing much more than Fed rhetoric because the market is ultra-tuned to the jobs data and believes the Fed is mostly just kneejerk reacting to the real-time data. You can see it here:

While stocks and the USD had a huge reaction to Friday’s speech, bitcoin is lower, and Fed pricing is unchanged. Maybe it was a nothingburger and we just reacted to it because of positioning and because that’s what we do. I’m inclined to believe, now that the dust has settled, that nothing has changed. We continue to await Core PCE, NFP, and CPI. Then, the Fed will decide what to do, while applying a dovish filter to the data. That is, the bar to hold in September is high now, but 3/3 hot data points could still make no cut a reality.

BOJ

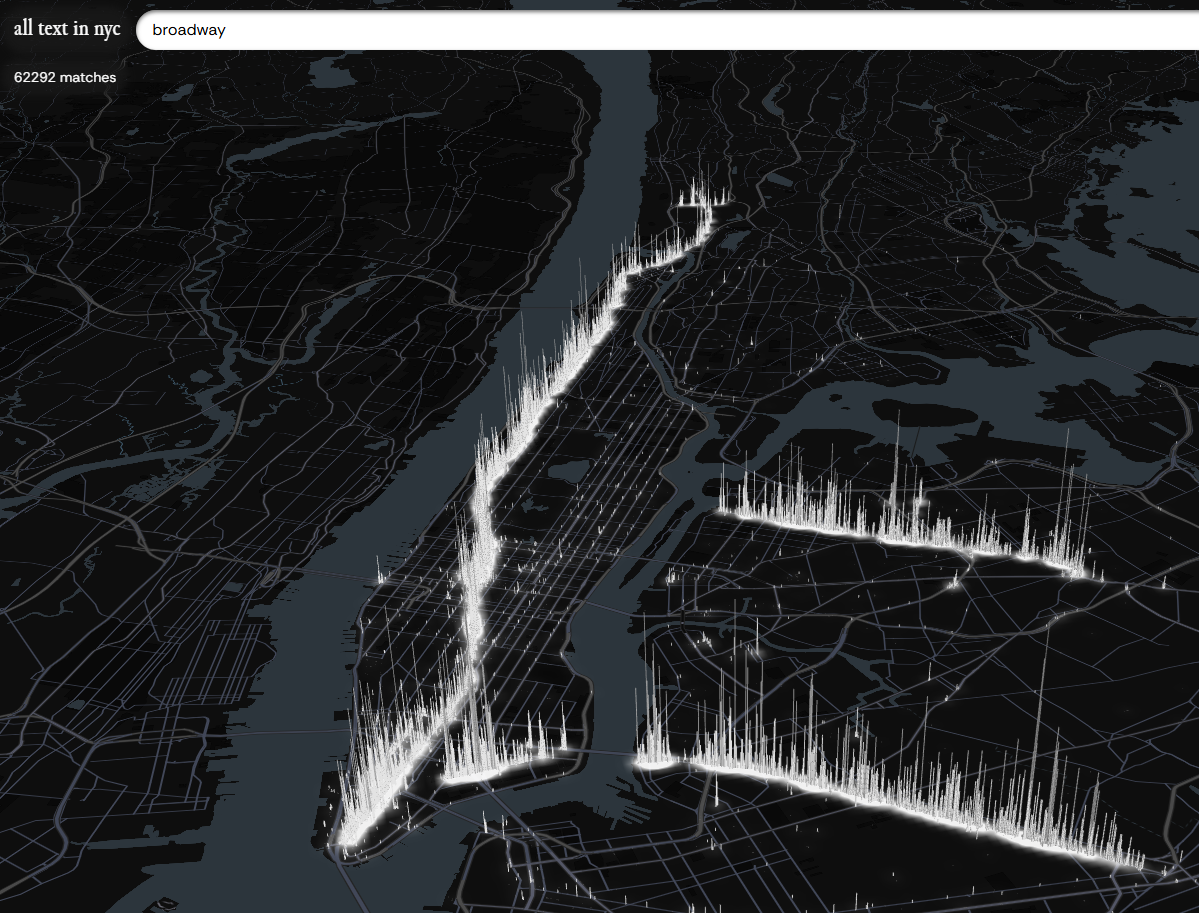

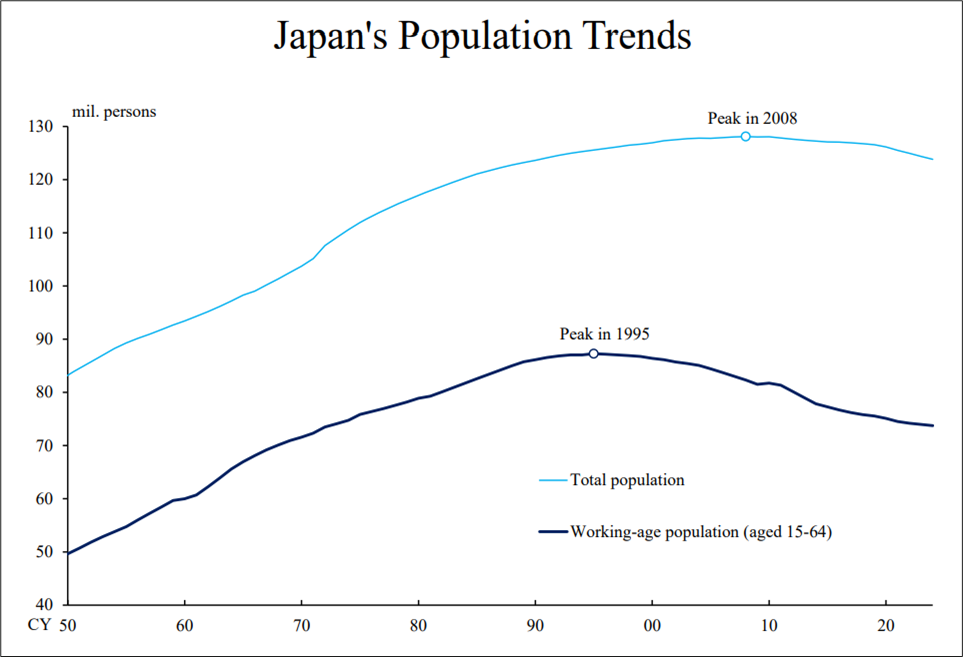

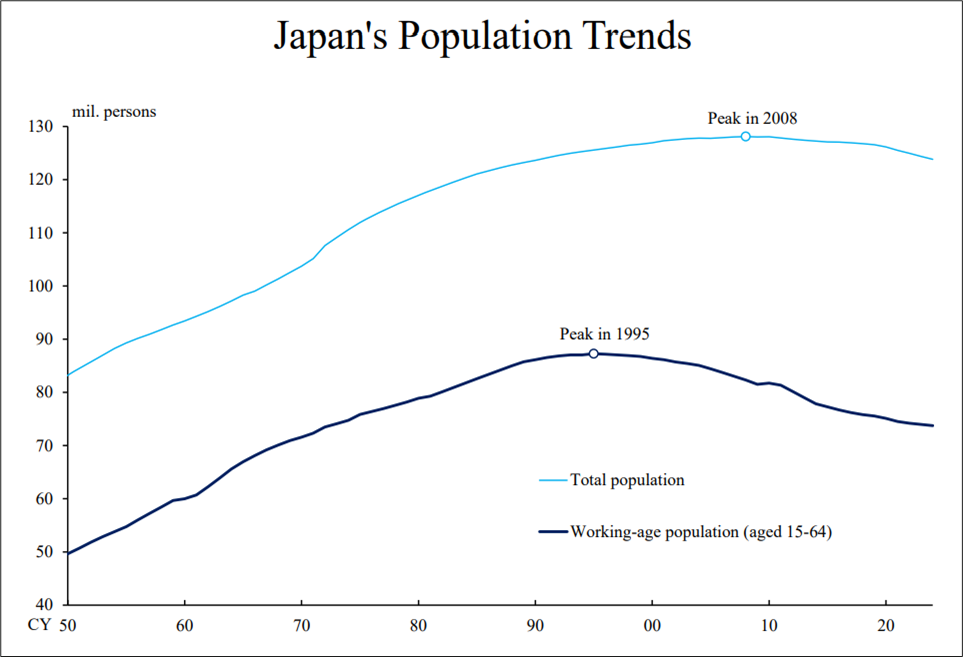

Powell was not the only one speaking at Jackson Hole. Ueda delivered this speech. It’s only 10 pages long, and worth a read, but in case you are busy, here are a summary and two charts:

“For many years after the burst of the asset price bubble in the early 1990s, the combination of near-zero inflation, economic stagnation, and structural policies aimed at stimulating labor supply masked the demographic pressures on labor market tightness. The large-scale monetary easing since 2013, together with post-COVID-19 global inflation, has finally pushed inflation into positive territory. Wages are now rising, and labor shortages have become one of our most pressing economic issues.”

Nothing much to chew on from a monetary policy point of view, but some mildly interesting data points.

Final Thoughts

- One-year inflation swaps are an OK predictor of inflation but do poorly in regime shifts like 2008 and 2020.

https://www.federalreserve.gov/econres/feds/files/2023061pap.pdf

- My EURGBP and EURAUD views are getting stale. I will remove the EURAUD short hedge sub 1.80 (if we get there) and look to sell the next rally in EURGBP to get to flat. Probably makes sense to take profit on long corn positions in the next 48 hours too as the oversold condition has been relieved.

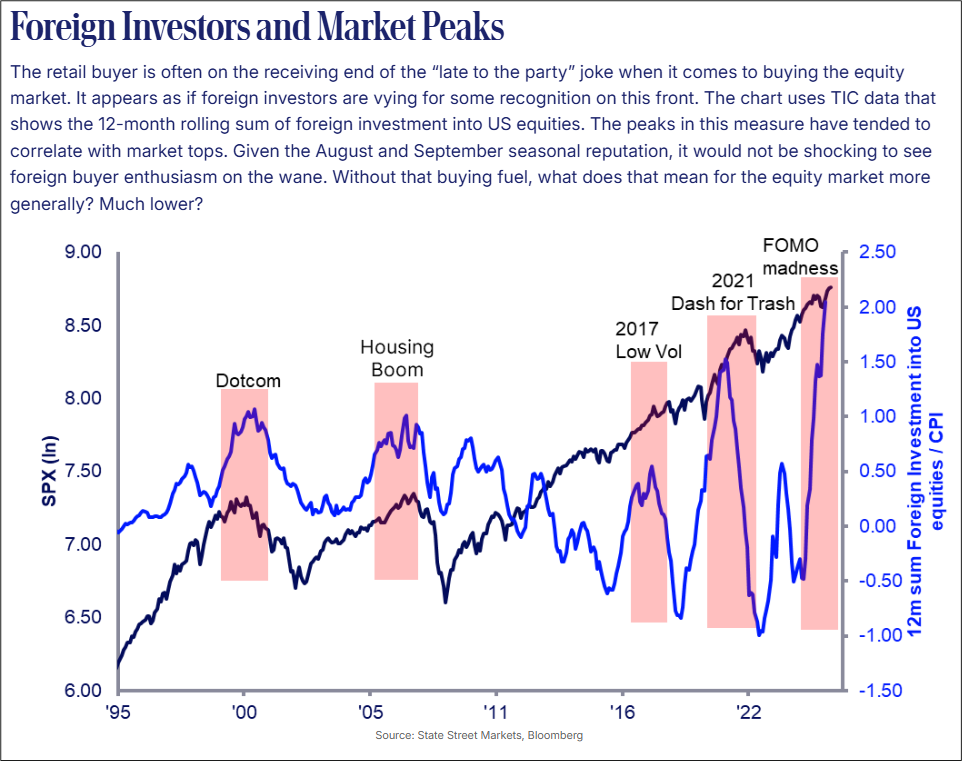

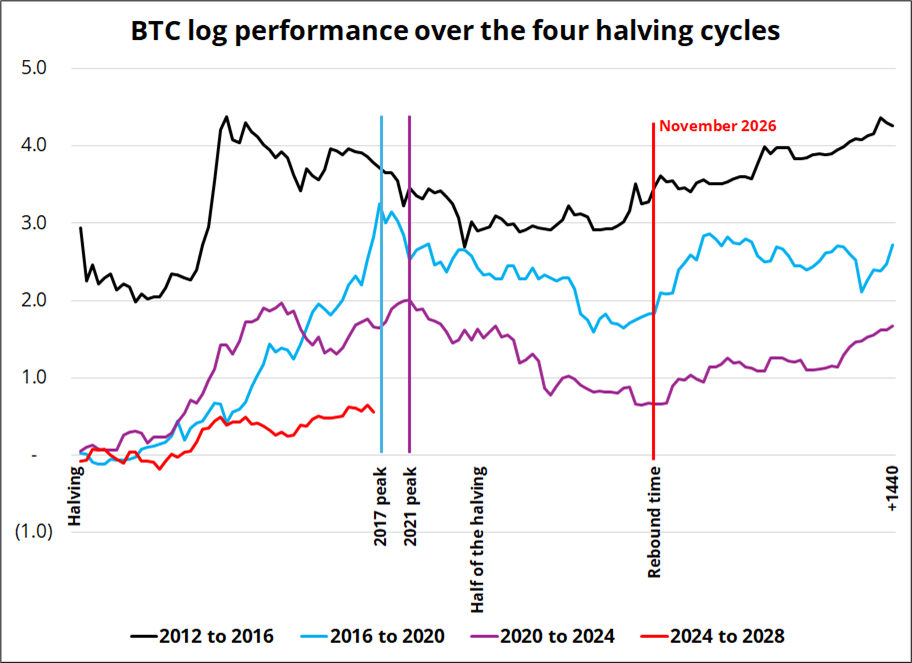

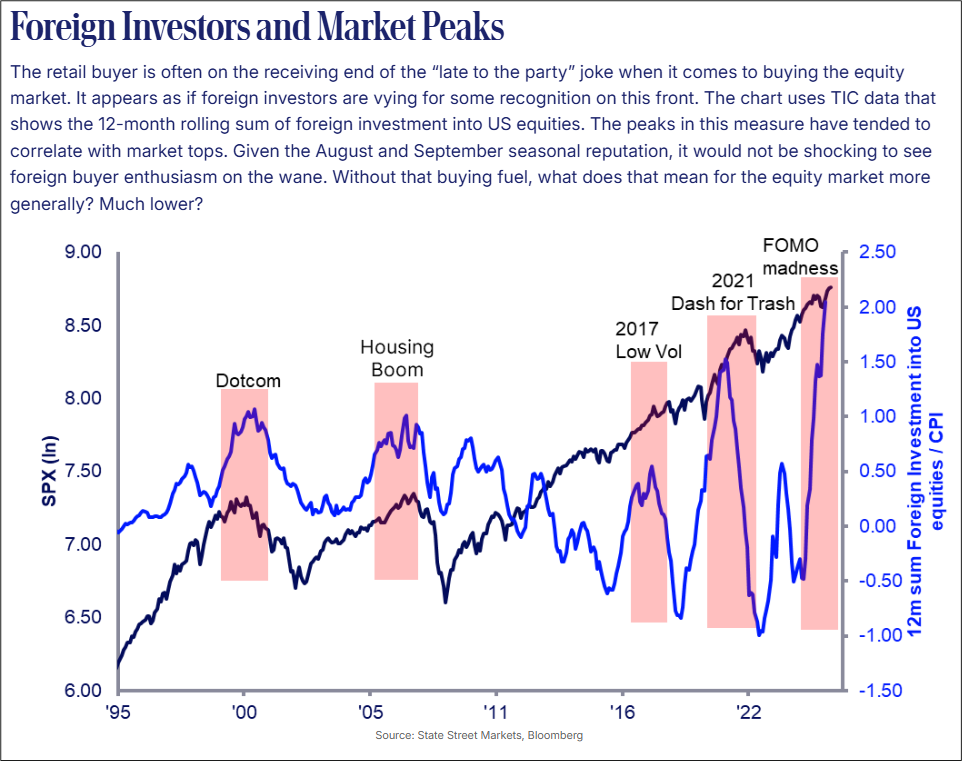

- In case you needed more reasons to worry about the techno-utopia trade. First chart from State Street, second and third ones are mine.

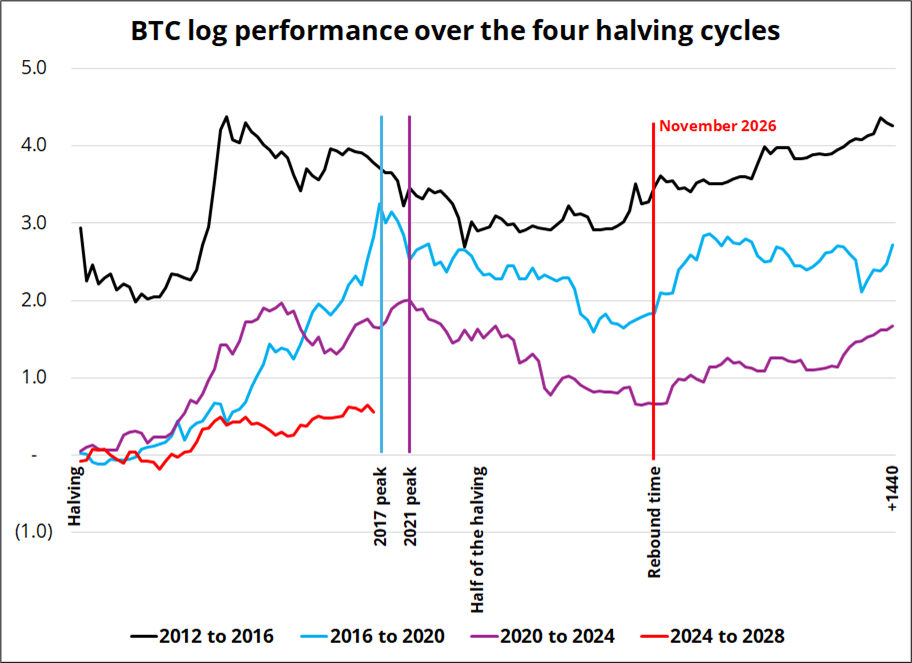

Tom Lee may end up as the Cathie Wood of the Crypto DAT bubblette as his team goes all-in near the peak of the narrative cycle and tries to pump it up with cray cray price targets.

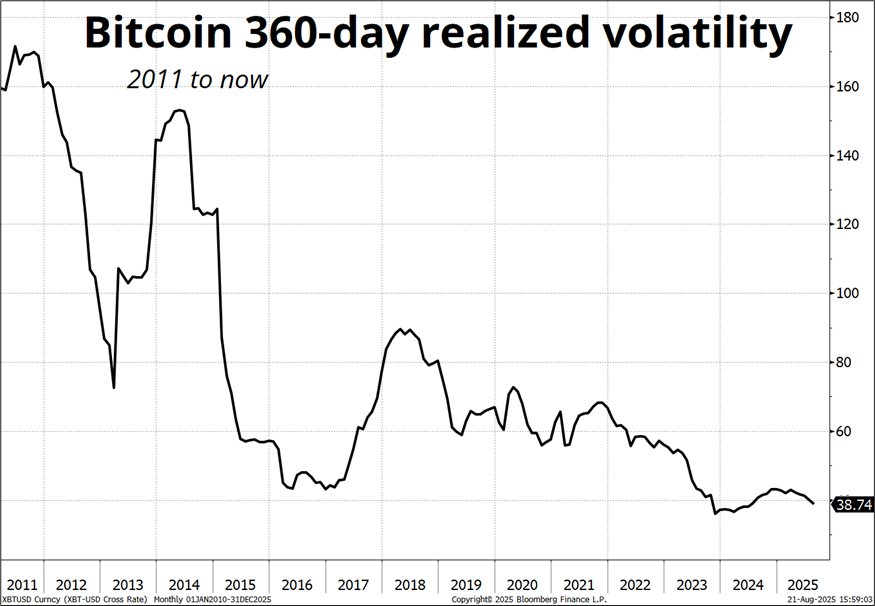

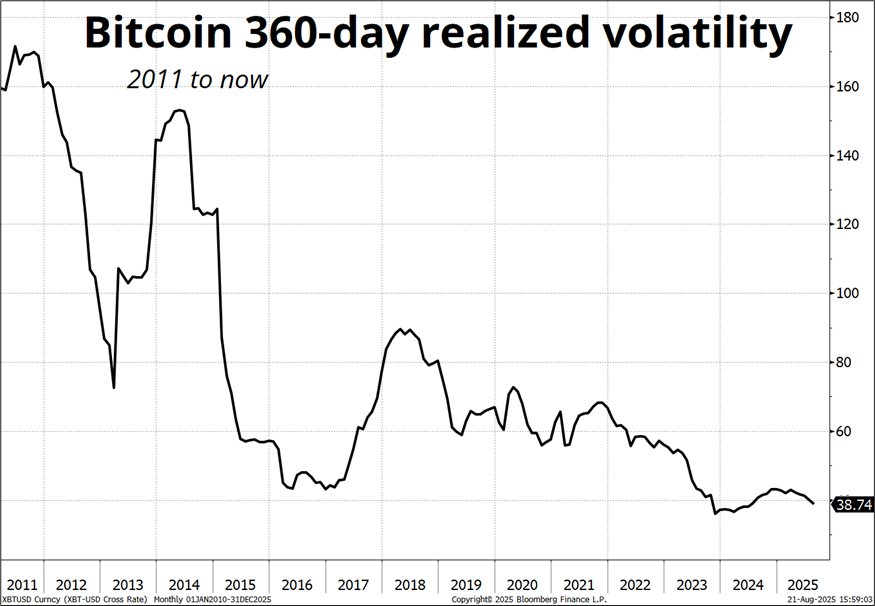

Meanwhile, declining BTC volatility makes the procyclical DAT flywheel a bit less zippy for MSTR and friends.

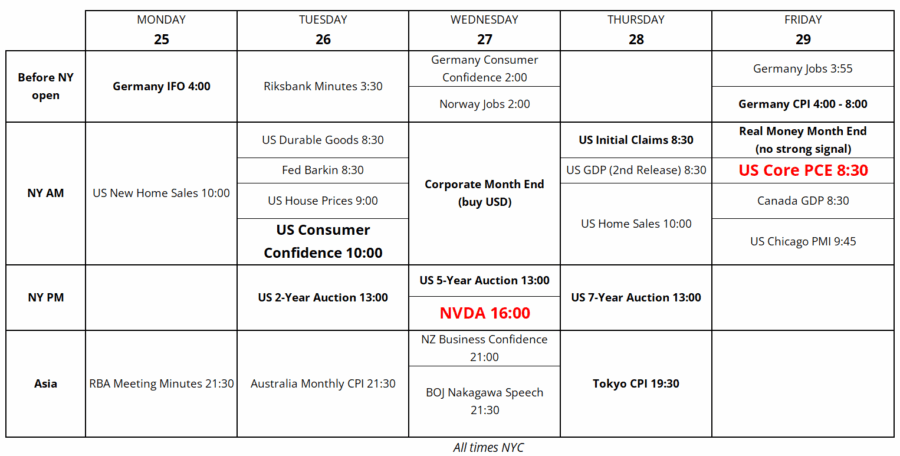

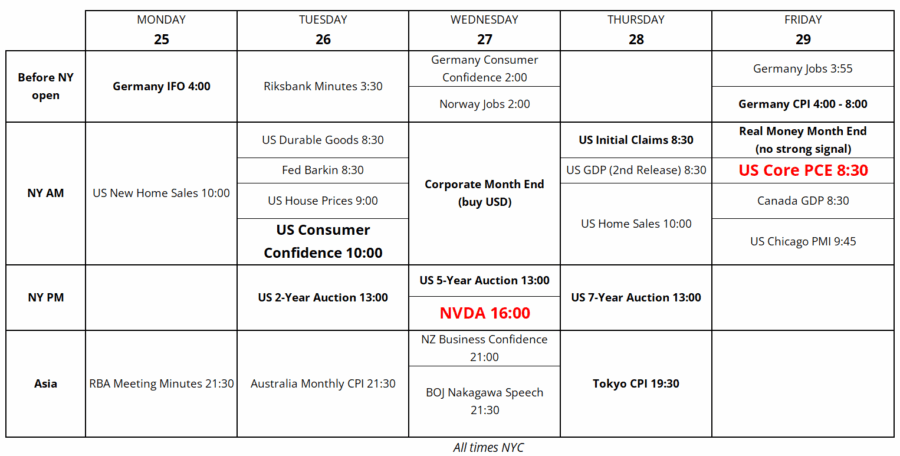

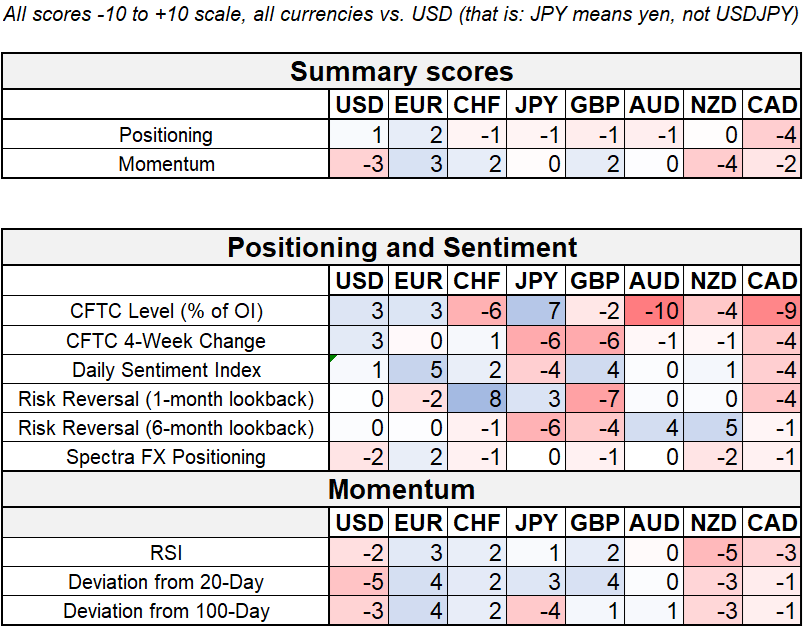

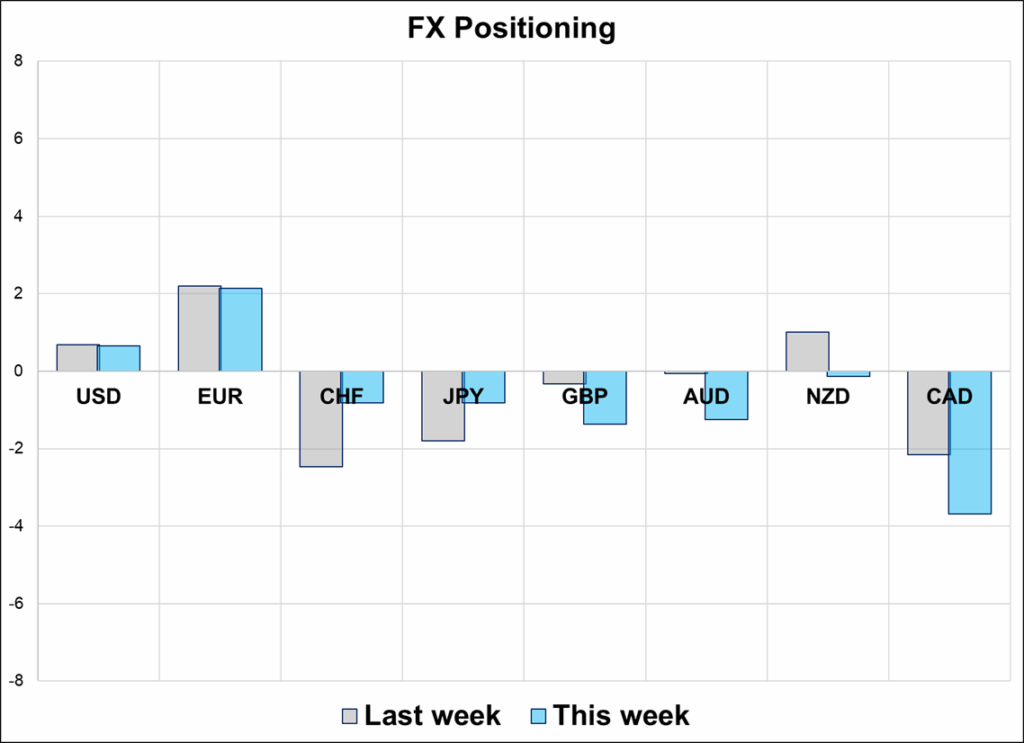

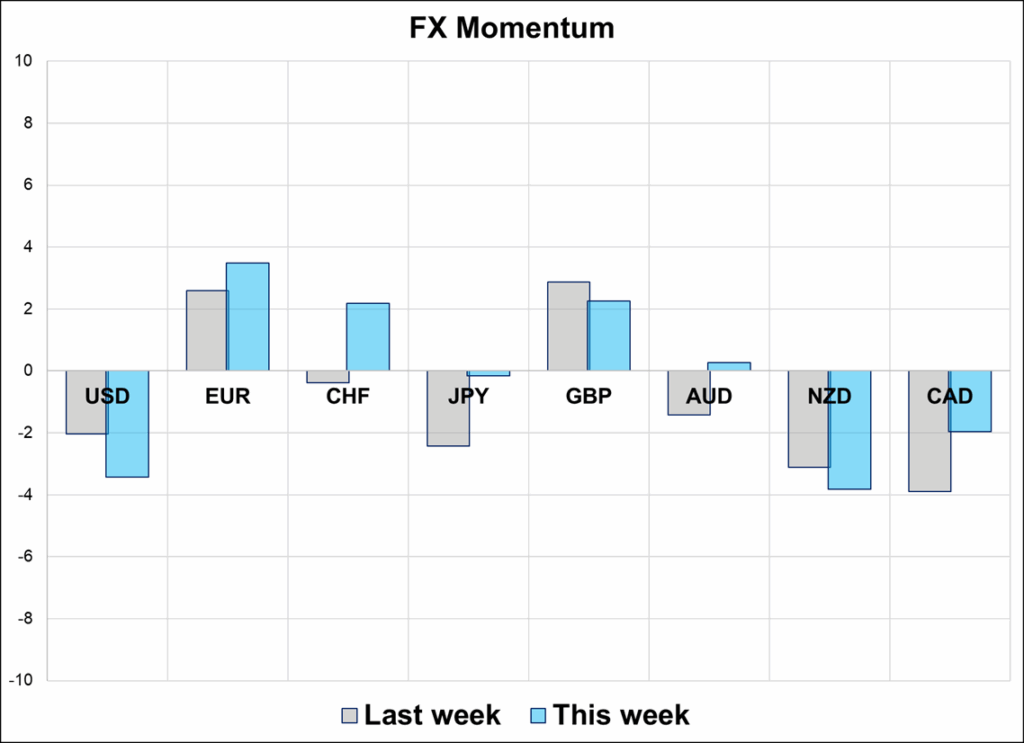

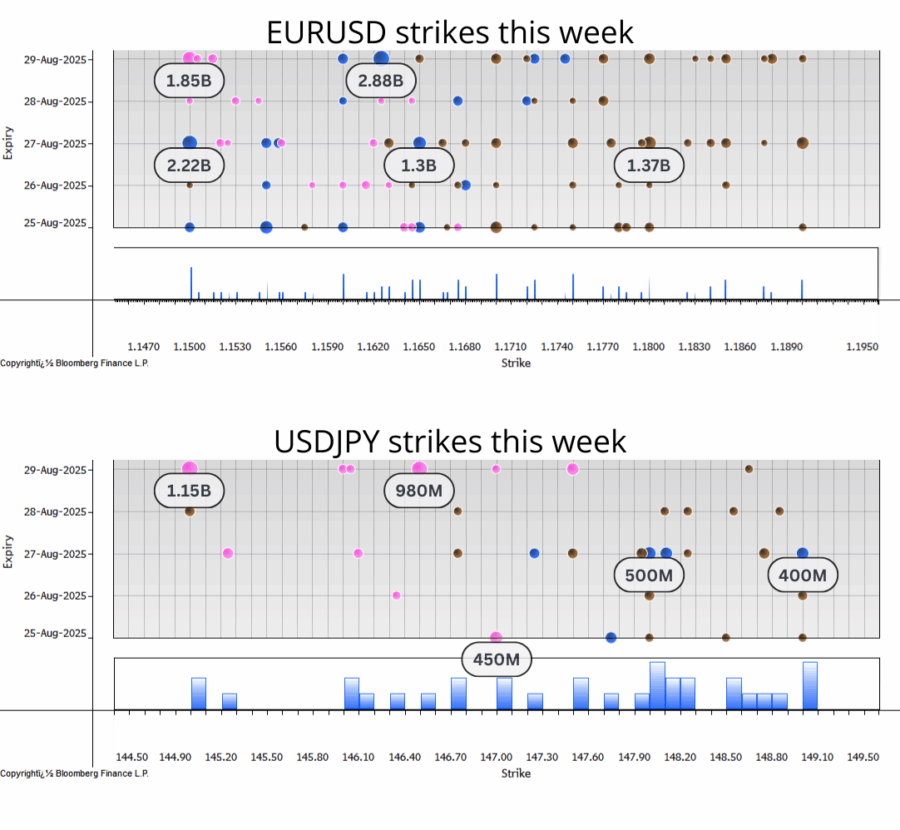

The positioning report, big strikes, and this week’s calendar are below.

Have a spectacular week.

Trading Calendar for the final week of August 2025