Psychology now is not like it was in 2018

“A device in the shape of a small boy.”

The Jacquet-Droz automata were created between 1768 and 1774 and are still functional today. They are the remote ancestors of modern computers.

Creepy and fascinating.

Psychology now is not like it was in 2018

“A device in the shape of a small boy.”

The Jacquet-Droz automata were created between 1768 and 1774 and are still functional today. They are the remote ancestors of modern computers.

Creepy and fascinating.

Flat

Nick Timiraos had a good article in the WSJ overnight and it has changed my mind on the bond market impact of tariffs. The article is here. There are two ways you can look at the bond market impact of tariffs.

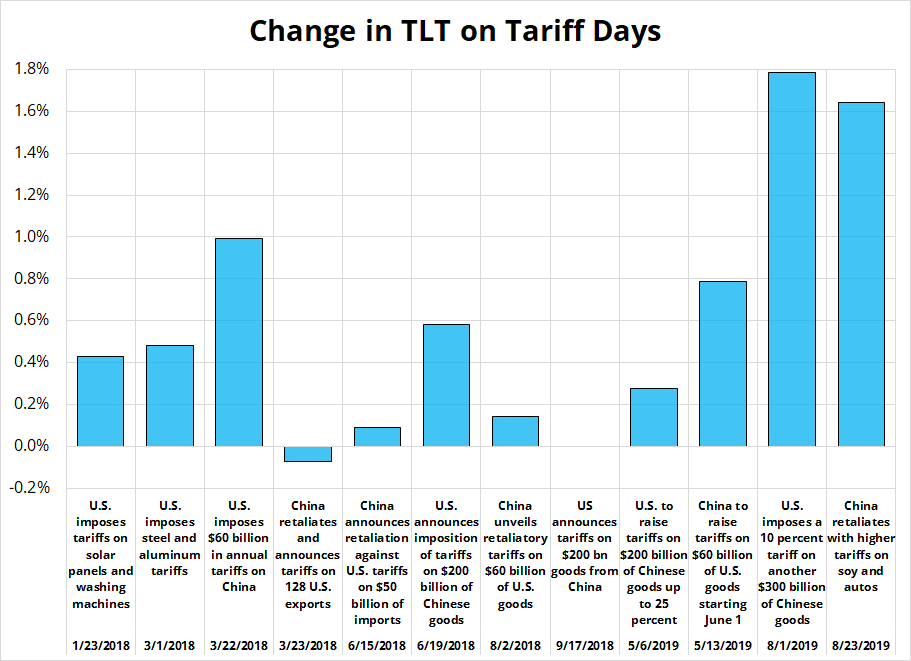

One: Look at recent history. Almost every tariff announcement in 2018 and 2019 saw bonds rally. This is a pretty good starting point for what bonds might do now. The equity-negative fear factor was larger than any inflation worries on those announcements and you could argue that’s the case today, too. I have argued that in am/FX and on the podcast with Alf in recent weeks.

Tariffs create a one-time price change that could be viewed as similar to a tax hike. It’s a step higher in the price level, but not really “inflation” per se. It also creates a negative confidence shock as foreign retaliation and risk of escalation can freeze investment in export-focused industries. Obviously, Smoot-Hawley is the textbook manifestation of a confidence shock as tariff increases (and about 20 other factors) led to a collapse in confidence and a deflationary spiral.

So that was my view. Tariffs are bullish bonds because the Fed will look through them and the economic confidence damage is greater than any one-time price level change. Until I read the Timiraos article. It changed my mind to: Two: Psychology has changed and tariffs will be inflationary. I think the key point is that inflation is a psychological phenomenon. Companies didn’t even have “raise prices more than 2%” on their list of options between 2008 and 2020. Then, the restaurants in my town realized that they could raise the price of the salmon from $17 to $22 to $31 and people would just keep on buying. An extra $9 in Uber fees and such? No problem. I’ll take two and have one for lunch tomorrow.

Even if they lost the most price sensitive 15% of their customers, the 82% menu price increase more than made up for it. This is the concept of Price over Volume or PoV that Sam Rines made famous in 2023. Companies now understand that they increase profits by sacrificing some volume to juice margins. Here’s Timiraos:

The last time Trump was president and imposed tariffs on trading partners, expectations of future inflation were low and firmly anchored—or set in dry cement. The public had little experience with inflation, and that made businesses more hesitant to pass along price increases from tariffs.

“They didn’t know how much business they would be losing” if they raised prices, said Hammack.

But several years of high inflation triggered by the pandemic and a policy response that showered the economy with ultralow interest rates and fiscal stimulus have raised questions over whether the Fed could be as relaxed about an increase in prices. If the cement is wet, expectations of higher inflation in the future could sustain higher price growth.

Because corporate management teams have been passing through higher costs, they have the experience of raising prices that they lacked five years ago. Even domestic producers that aren’t hit by tariffs could use higher import prices as an excuse for raising their own prices.

Sure, the dollar can strengthen to partially offset the inflation, but the nefarious aspect of scaled tariffs could be that they stoke inflationary expectations by putting a floor under prices, changing corporate pricing psychology, and creating a world where consumers know prices are going to stair step up, up, up as the tariff vise tightens. This could lead to front-loading, panic buying of tariffed goods, and all the usual inflationary demons that run around in central bankers’ nightmares.

The market is underprepared for a weekend tariff announcement because of the fool me once situation as USDCAD has been in this range for 40 days and 40 nights and people are sick and tired of buying topside and then seeing it bleed to zero. Today we are seeing the usual USD buying for corporate month end and that is pushing the USD a bit out of whack vs. rate differentials.

Corporates are not going to be underhedged going into a potential weekend tariff announcement and the flow is not conditional on macro. They just buy the dollars at whatever price, no matter what’s going on. Corporate USD buying ends between 10am and 11am today.

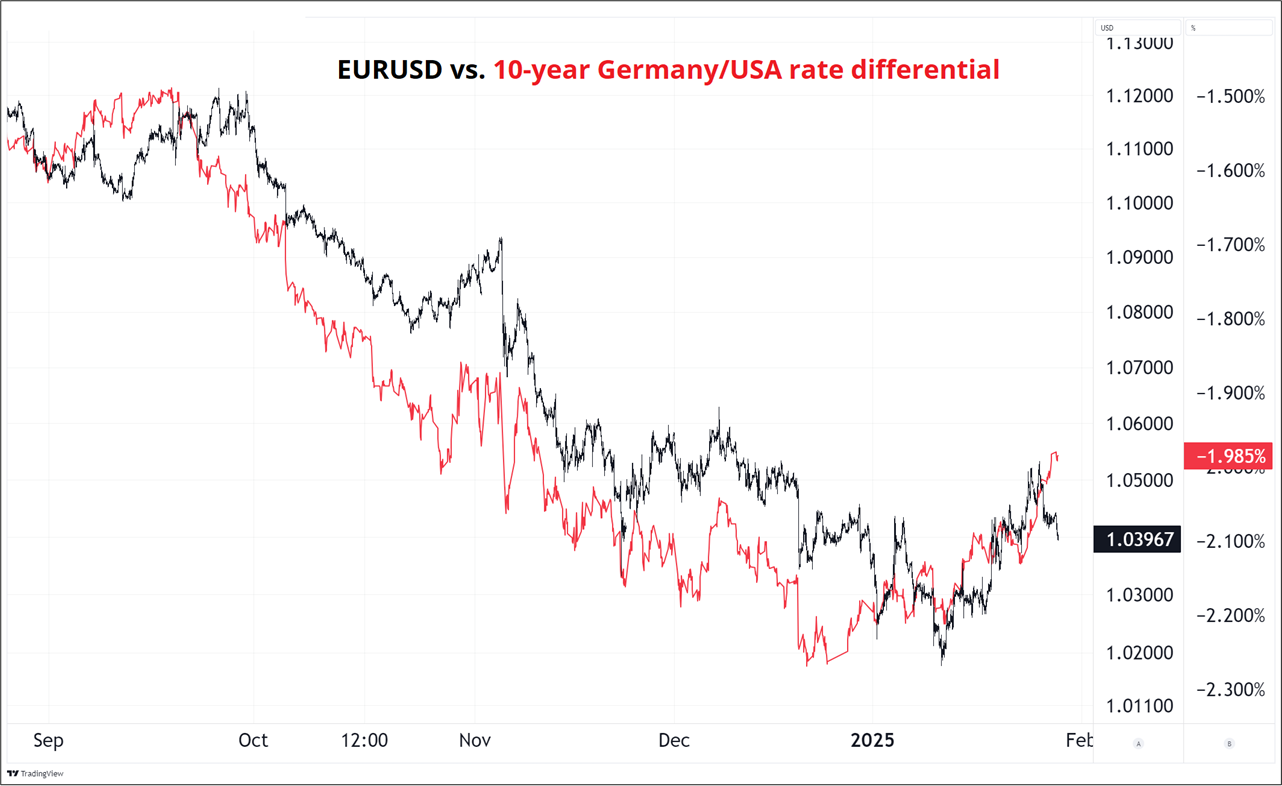

Here you can see the modest decouple as corporates push the USD up and ignore narrowing Germany/US spreads. You could also argue there is a bit of a FOMC or tariff premium getting added, but I do not think that is true. The FOMC opinions in the market are super mixed. Some say hawkish to get in a good spot in case of tariffs and some say dovish because Waller was so unbelievably dovish last time he spoke.

Kalshi has sports betting now. So, for the Super Bowl you can bet $100 to win $77.50 on a regular betting site or bet $100 to win $88.70 on Kalshi. I have often wondered how sports betting vig in the US is the same today as it was when you used to call Frankie the Bull on a landline in 1992. Makes no sense. I have no affiliation or relationship with Kalshi; I just think it’s interesting.

And more good news for bitcoin here.

Have an automatic day.

Some USD longs have burned off while USDCAD has been Max Paine

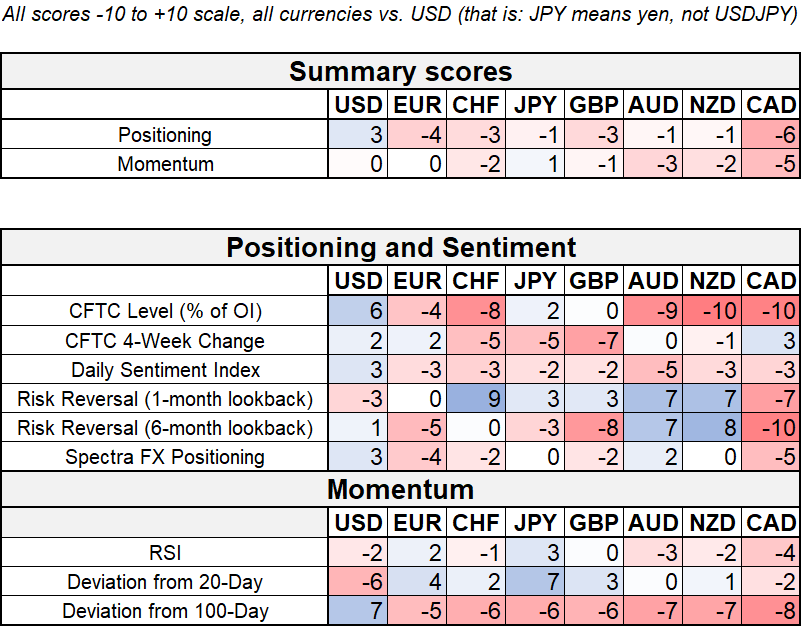

Hi. Welcome to this week’s report. Long USD and short CAD remain the standouts even as some of the excessive USD long positioning has burned off thanks to a lack of clarity on tariffs, a drop in US yields, some questions about the persistence of American Exceptionalism, and theta. We now await the newest deadline, February 1, to see if the tariff threat is real or if it’s a bluff / negotiation tactic.

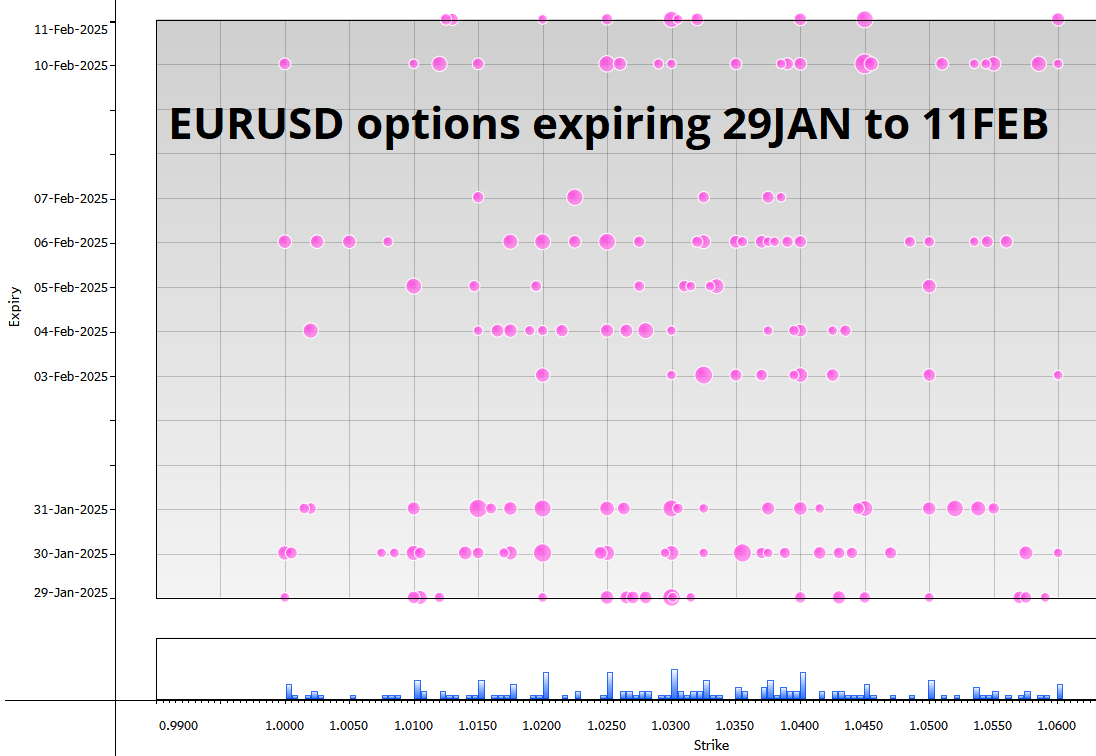

Die hard USD longs are still all-in, but the dabblers have been partially eradicated and a decent amount of downside EURUSD has burned off with the passage of time. Looking at strikes over the next two weeks, you can see there is a big lump of fat circles expiring before the weekend, then less density in the more favorable post-01FEB zone.

The big strikes for after this weekend are concentrated 1.0200/1.0250 and this is probably a good first target for shorts given there’s a few billion EUR of gamma down there and the 2025 low so far is 1.0180.

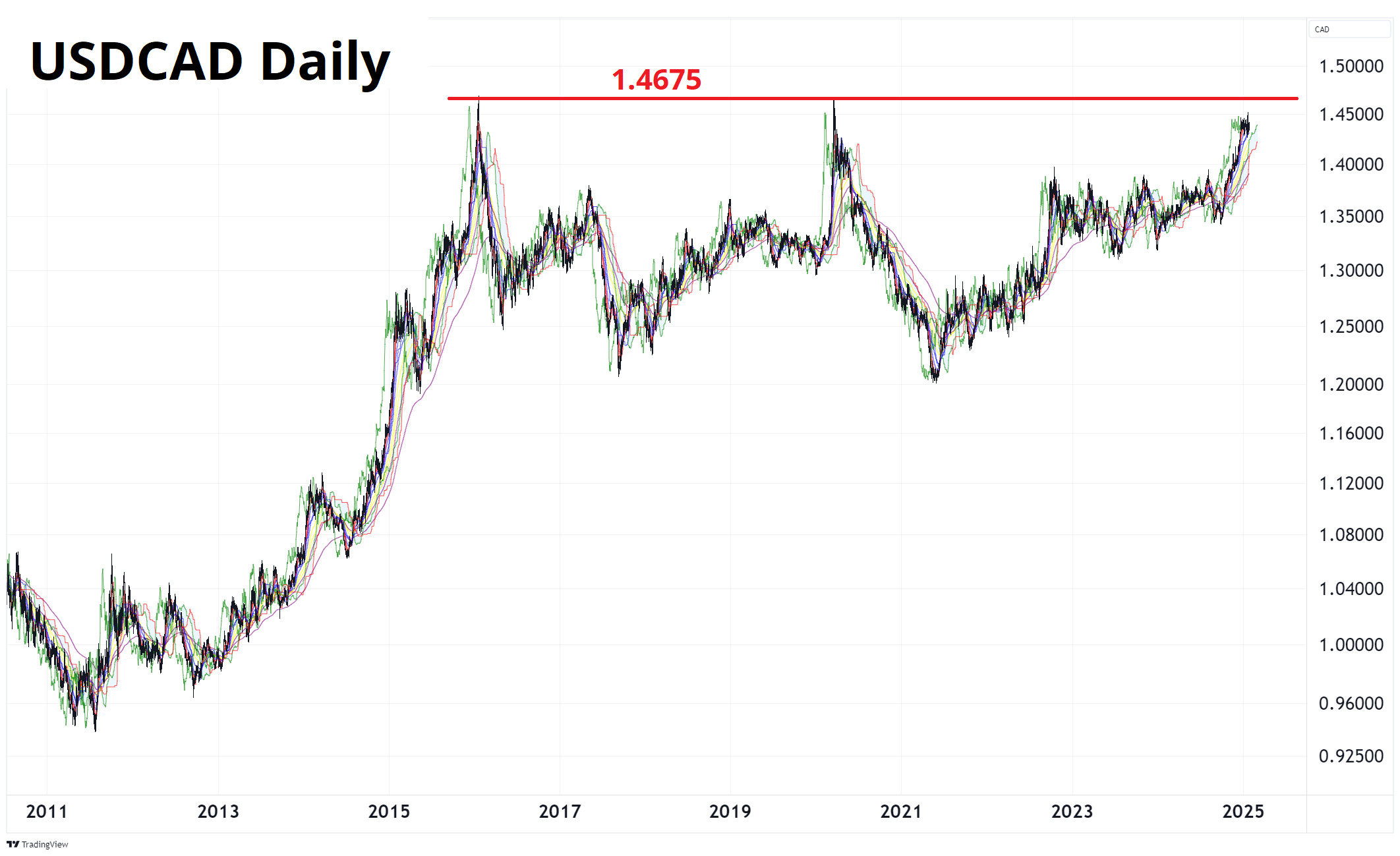

In USDCAD, a similar exercise shows the most plentiful strikes expiring 07FEB at 1.4600/40, 1.4700, and 1.4740. Most estimates for the first wave of tariff impact on USDCAD take us somewhere up in the 1.4700/1.5000 area, above the open air once the 1.4675 double top breaks (see chart).

That chart goes all the way back to 2010. If we zoom in, we see 40 days and 40 nights of range trading and a max pain result for owners of topside USDCAD.

“A device in the shape of a small boy.”

The Jacquet-Droz automata were created between 1768 and 1774 and are still functional today. They are the remote ancestors of modern computers.

Creepy and fascinating.

See video of “The Writer” in action here

HT AdamD